Berkshire Hathaway Annual Meeting Questions

Five questions on my mind as the 2024 annual meeting approaches

Berkshire Hathaway will hold its 2024 Annual Shareholders Meeting on Saturday, May 4 at 4:00 pm in Omaha. The real action will start hours earlier when the doors of the CHI Health Center Arena open at 7:00 am and thousands of shareholders rush in to secure their seats. Events related to the annual meeting begin on Friday and continue through the end of the weekend. In addition to events sponsored by Berkshire, there are numerous other gatherings such as the Markel Omaha Brunch.1

The highlight for many shareholders will be the question and answer session that begins at 9:15 am. Since Berkshire does not hold quarterly earnings calls, this is the only opportunity to ask Warren Buffett and Greg Abel questions about the company. During the morning session, Ajit Jain will also be on stage.

This will be the first annual meeting since Charlie Munger died. His presence on stage simply cannot be replaced. He is certain to be honored in some way during the meeting, perhaps in the movie that precedes the Q&A session.

The Q&A session lasts for close to five hours. Questions will alternate between shareholders at the meeting and Becky Quick who curates questions submitted to berkshirequestions@cnbc.com. The Q&A will be webcast for those of us who are not going to Omaha. I expect that there will be time for at least fifty questions.

I plan to submit one or two questions to Becky Quick. This article is a listing of five questions that I am considering for submission. Although the chance of having a question selected is very low, I have found in the past that well written questions can sometimes attract attention. My questions appear in bold italics and I have provided some additional commentary and context below each question.

Berkshire Hathaway Energy

The Berkshire Hathaway Energy 10-K includes the following risk factor: “In the event of default due to the bankruptcy, insolvency, or reorganization of a significant subsidiary, all of BHE's debt will become immediately due.” Given Mr. Buffett’s concerns about the long-term stability of the regulatory and legal climate expressed in the annual letter, should shareholders be concerned about problems at one of BHE’s subsidiaries causing contagion for BHE as a whole?

I brought up the question of contagion in Berkshire Hathaway Energy’s Uncertain Future. PacifiCorp is a wholly owned subsidiary of BHE. PacifiCorp is a separate and distinct legal entity which issues its own debt secured by its properties. While BHE has no obligation to satisfy the demands of PacifiCorp’s creditors, I noted with some concern that in the event of “any default due to the bankruptcy, insolvency, or reorganization of a significant subsidiary, all of BHE’s debt will become immediately due.”2

BHE has no legal obligation to inject capital into PacifiCorp to satisfy legal liabilities or for any other purpose and it is very likely that BHE would be able to renegotiate its $13.1 billion of senior debt rather than having to actually pay it off, although perhaps at higher interest rates. Given this situation, I wonder whether BHE might elect to bail out PacifiCorp, if needed, to avoid triggering any covenants related to BHE senior debt or possibly for reputational reasons.

Just as BHE has no obligation to inject capital into PacifiCorp, Berkshire Hathaway has no obligation to inject capital into BHE. However, Berkshire Hathaway has been permitting BHE to retain all of its earnings and has never taken a distribution from BHE. Although not part of my question, it will be interesting to see whether Berkshire continues this policy or begins to take distributions from BHE in the future.

Berkshire Hathaway’s 2023 Results

I’ve published a series of eight articles about Berkshire Hathaway’s 2023 results:

My goal has been to provide coverage not typically found in the mainstream financial media which is often confused about Berkshire and misunderstands its results.

Skin in the Game

Berkshire’s proxy states that “any recommended candidate [for the board] should own Berkshire stock that has represented a substantial portion of the candidate’s investment portfolio for at least three years.” Is there a numeric threshold that must be satisfied, or does Mr. Buffett and the board approach this on a case by case basis? Should shareholders be confident that current members of the board all own Berkshire stock that is a substantial portion of the director’s net worth?

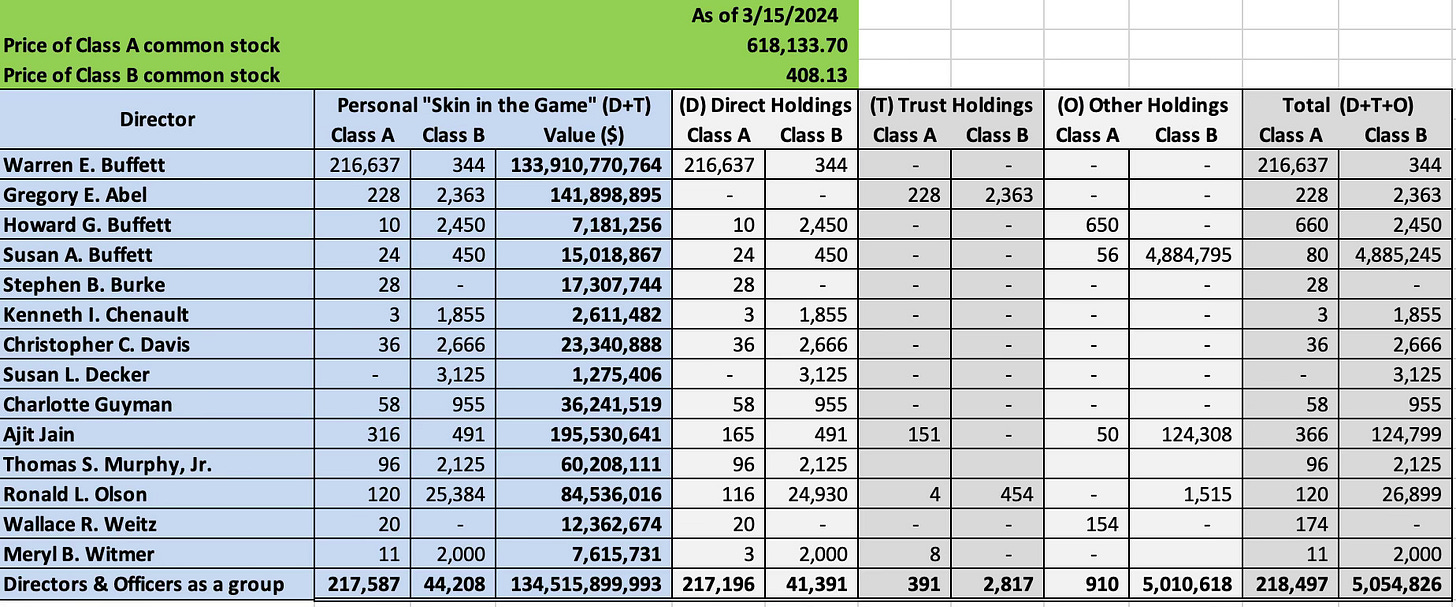

I’ve written several articles about “skin in the game” at Berkshire. My most recent comments are in an article about Berkshire’s 2024 proxy. While Berkshire’s board, in aggregate, clearly has a major economic interest in the business, it is not necessarily clear that every director has a stake that is a “substantial portion” of net worth.

I will refrain from singling out directors, but will note that a holding measured in the single digit millions might seem large in absolute terms but could still be a small holding relative to the director’s net worth if he or she spent many decades in high level executive positions. Here is the exhibit that I presented in my recent article:

Future CEO Compensation

Berkshire’s proxy states the following: “… neither the profitability of Berkshire nor the market value of its stock are to be considered in the compensation of any executive officer. Under the Committee’s compensation policy, Berkshire never intends to use Berkshire stock in compensating employees.”

The wording about not using stock as compensation is stronger than in past years. Last year’s proxy stated: “Berkshire does not grant stock options to executive officers” but did not use the word “never.”

If future CEOs will not be compensated based on the profitability or the market value of Berkshire and if stock is not to be used as compensation, what kind of pay structure will be used to tie long-term performance with pay?

I noted the change in language in my recent article on the 2024 proxy statement. It might seem like splitting hairs, but I don’t think that the inclusion of the word “never” should be brushed aside without further explanation.

I have no issue with the $20 million in cash compensation paid to Ajit Jain and Greg Abel in 2023 because I trust Warren Buffett’s judgment when it comes to evaluating performance and setting the pay of his top executives. However, it is notable that all of this pay was base salary and the pay was identical for both Vice Chairmen.

In the future, it is not at all clear how the board will approach compensating the CEO. Presumably Warren Buffett has privately given guidance to the board on this matter. He may or may not be willing to share his thinking in response to this question.

BNSF Ownership

On September 30, 2023, ownership of BNSF was transferred from National Indemnity to Berkshire Hathaway, making BNSF a direct subsidiary of Berkshire. Prior to September 30, 2023, BNSF’s cash distributions were paid to National Indemnity. Now they will be paid directly to Berkshire.

Presumably, National Indemnity is overcapitalized and there is no regulatory need for the railroad to be owned by the insurance company. Were there any other reasons to shift ownership? I have read some speculation that it would be easier to spin off BNSF in the future now that it is a direct subsidiary of Berkshire, but assume that this is not on the table given Warren Buffett’s comments in the latest shareholder letter which stated: “A century from now, BNSF will continue to be a major asset of the country and of Berkshire.”

I am on the fence regarding submitting this question because I am certain that Warren Buffett will throw cold water on the idea of a BNSF spin-off, now or in the future. I am not necessarily in favor of such a spin-off, but the thought did cross my mind when I read about moving the ownership to Berkshire from National Indemnity.

It is likely that BNSF simply was not needed within the insurance business in terms of regulatory capital. Therefore, it is a good practice to remove the railroad from the insurance business, thereby putting it outside the reach of policyholder claims.

Dividend and Repurchase Policy

Berkshire’s policy is to only repurchase stock when it is available below intrinsic value, conservatively determined. From 2018 to 2023, Berkshire used $75 billion to repurchase stock. Shareholders have historically been against dividends and repurchases below intrinsic value make a great deal of sense since ongoing owners bear no tax consequences, aside from the 1% repurchase tax.

If Berkshire trades at or above intrinsic value in the future and management builds up cash balances that cannot be redeployed internally or used for buying back stock, will dividends make sense? Would it be appropriate for Berkshire to adopt a policy of paying out special dividends when this circumstance occurs, or will regular dividends be initiated? If a regular dividend is initiated, would that potentially reduce flexibility since most companies hesitate to cut or eliminate regular dividends once they are instituted?

I brought up the dividend question in a recent article. I am personally opposed to a dividend as long as repurchases are possible below intrinsic value and, since I trust Warren Buffett’s judgment, I have no worries about recent repurchases. In the future, the board and the CEO will need to make this decision. Presumably, Mr. Buffett has given guidance in private to the board regarding how he thinks about intrinsic value. He is not likely to share this in a public setting, but perhaps he will shed some light on whether regular or special dividends represent his preferred policy in the future if the stock trades above intrinsic value and there’s too much cash on the balance sheet.

Once instituted, a regular dividend usually becomes sacrosanct and takes on meaning for many investors beyond the cash paid out. Cutting or eliminating a dividend, or even failing to increase it every year, can be a “signal” of supposed problems. In reality, it might make good sense to stop paying dividends if the stock declines below intrinsic value and can be repurchased. Regular dividends could tie the hands of future managements in a way that special dividends do not.

Perhaps a combination of a small regular dividend and irregular larger special dividends will become the preferred policy. There is some evidence to support this approach. Costco pays a very small regular dividend and has, on several occasions, paid large special dividends. Charlie Munger served on Costco’s board for decades and no doubt had an influence on capital allocation. Of course, Costco cannot redeploy cash in the way that Berkshire can, so the situation is not exactly comparable.

What are some of your questions for the Berkshire Hathaway annual meeting? Feel free to discuss what’s on your mind in the comments section!

If you found this article interesting, please click on the ❤️️ button and consider sharing this issue with your friends and colleagues.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Long Berkshire Hathaway

I think your BHE question appears quite strong. I've noticed many times in the past that sometimes Warren (and Charlie, RIP) would answer a part of a question or otherwise grab onto a part of a question to talk about something on their mind. (That happened to me last year.) I think your BHE question is not only very relevant for obvious reasons, but stated in such a way that the chances of a response that gets at the heart of your query would be appear to be on the higher side.

Another topic I'm curious about is the impact of coming changes in the wake of the lawsuit against the National Association of Realtors, HomeServices of America, and others. HomeServices of course is a BHE subsidiary. With future changes in the fee structure for Realtors a certainty, I wonder what this does for the the profitability of BRK's real estate brokerages? I know the compay can't talk about pending litigation, but at ~17% of BHE's 2023 revenue (and closer to 25% for the two prior years) this is a legit question.

Good questions! I would be interested in hearing the rationale for moving BNSF out of National Indemnity.