Berkshire Hathaway HomeServices

The real estate brokerage industry will change due to a settlement in a key lawsuit. Berkshire Hathaway HomeServices was not a party to the agreement but its business model will still be affected.

The National Association of Realtors (NAR) recently announced a settlement to resolve litigation related to brokerage commissions. The agreement, reached on March 15, has the potential to significantly change how commissions are set in ways that will upend the industry’s longstanding business model.

In recent years, there has been pressure on the typical 5-6% commission that comes out of the pockets of sellers at closing. However, the practice of the seller setting the compensation for the buy-side agent was never disrupted. Sellers could offer less than the traditional 3% commission to the buy-side agent using the multiple listing service (MLS) database, but agents could opt to steer their buyers away from such properties.1

In addition to paying $418 million over four years, the NAR agreed to implement new rules to prohibit offers of buy-side compensation on the MLS. But in a victory for the industry, the settlement does not prevent realtors from communicating offers of buy-side compensation outside of the MLS system, such as on their own listing websites, marketing materials at open houses, or through conversations with buy-side agents.

The NAR also agreed to implement a new rule that would require agents to enter into written agreements with their buyers. This change will go into effect in July. The reform will eliminate ambiguity regarding how a buyer’s agent will be compensated for their time. In the past, buyers would often be oblivious to the compensation their agent stands to receive from a completed transaction. In the future, buyers will have to agree to provide their agents with some level of compensation. This does not prevent buyers from seeking to recover such costs from sellers as part of negotiations, but the ability to do so will depend on the competitive dynamics of local markets.

Berkshire Hathaway HomeServices, a subsidiary of Berkshire Hathaway Energy (BHE), did not participate in the NAR settlement.

The lawsuit, usually referred to as the Sitzer-Burnett case, was certified as a class action in April 2022. On October 31, 2023, a jury found that the plaintiffs had proved damages of $1.8 billion. BHE has estimated that total damages could be up to $5.4 billion, but management cannot currently estimate the costs and no losses have been accrued at this point. In addition to the Sitzer-Burnett case, HomeServices is currently defending against ten other antitrust cases.2

Let’s take a look at Berkshire’s HomeServices subsidiary, focusing on its business model and financial history over the past decade. BHE does not provide much data regarding HomeServices, but there is enough to understand its scale, how it operates, and its contribution to Berkshire Hathaway’s bottom line.

Berkshire Hathaway’s 2023 Results

In recent weeks, I published a series of articles about Berkshire Hathaway’s 2023 annual report:

Business Model

HomeServices is one of the largest residential real estate brokerages in the United States. Although most revenue derives from commissions on the value of homes sold, HomeServices also offers other services including mortgage origination services, title search and closing services, home warranties, and relocation services. The business is seasonal because many families choose to move during the late spring and summer months to avoid disruption caused by relocating in the middle of a school year.

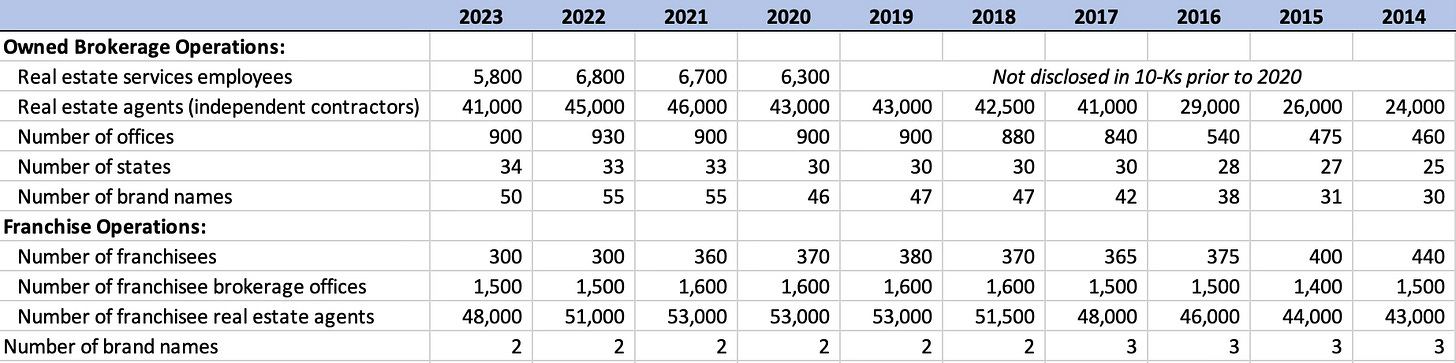

The company directly operates brokerages through a network of nine hundred offices operating in thirty-four states under fifty brand names. Approximately 41,000 real estate agents operate as independent contractors and there were 5,800 employees at the end of 2023. Realtors earn commissions from sales activity they generate rather than through fixed salaries. As a result, agent compensation is a variable cost sensitive to the volume of transaction activity rather than a fixed cost.

HomeServices also operates a franchise network. Approximately 300 franchisees operate out of 1,500 offices under two brand names. At the end of 2023, there were 48,000 real estate agents working with franchisees. HomeServices realizes revenue from the franchise network through franchise fees.3 In exchange, franchisees are permitted to use HomeServices brand names, most notably including the Berkshire Hathaway name. From a franchisee’s perspective, being identified with HomeServices has the potential to attract clients in sufficient volume to justify paying franchise fees.

The following exhibit shows information about HomeServices that I have gathered from the past decade of BHE’s 10-K filings:

As we will see in the next section, the slowdown in transaction activity in the real estate industry over the past two years has resulted in contraction of the business. In response, we can see that HomeServices has reduced its employee headcount and the number of real estate agents engaged in its brokerage operations. Franchisees have also reduced the number of real estate agents. Since real estate agents are independent contractors compensated by commissions, a slowdown in transaction activity will naturally cause the weaker agents to exit the industry.

Recent Results

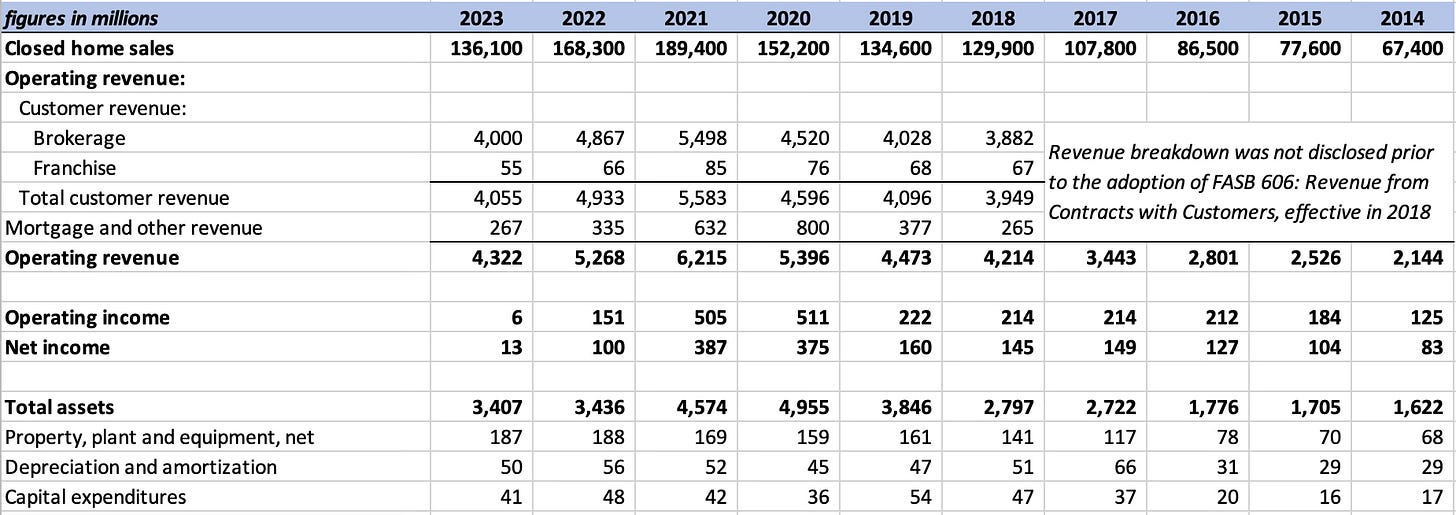

The operations of HomeServices are not discussed in detail in BHE’s filings, but we do have enough information to make a review of the past decade interesting. The following exhibit presents key data points that I identified from 2014 to 2023:

The primary driver of HomeServices revenue is the value of closed home sales which sets the baseline for commission revenues. In 2023, HomeServices closed $136.1 billion of home sales, down 19.1% from 2022. Management attributes the decline to rising interest rates which drove down home sales. In addition to lower commission revenue, all other services, such as mortgage origination and closing services, also decline when home sales decline. These factors caused revenue to decline 18% to $4.3 billion in 2023. Net income plummeted 87% to $13 million.

The real estate market is cyclical and very sensitive to mortgage rates. The following exhibit shows the average thirty year fixed rate mortgage over the past decade:

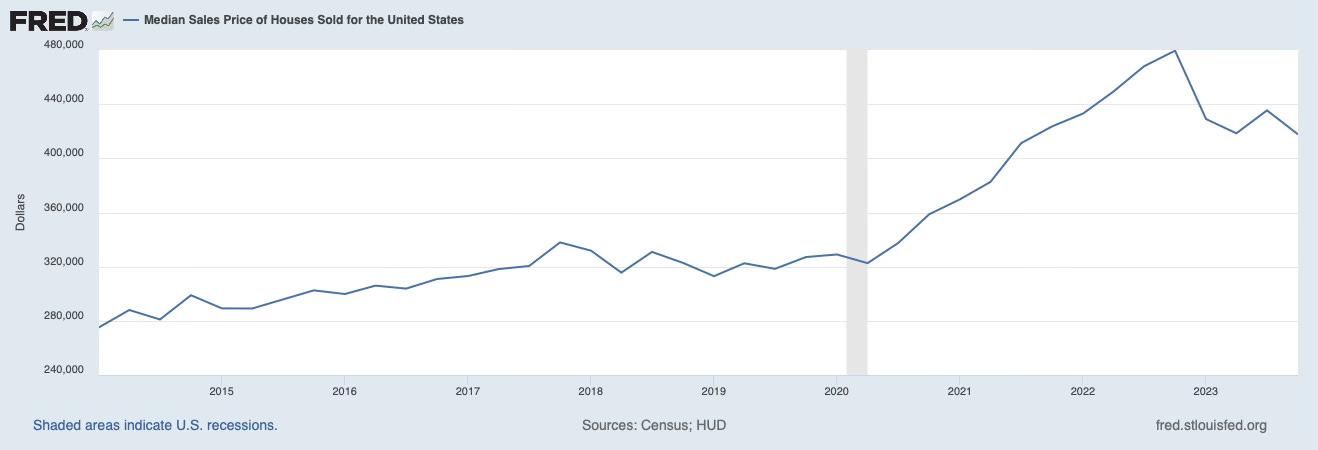

With mortgage rates rising from multi-generational lows below 3% to exceed 7% at times during 2023, transaction volume was certain to decline. Americans with low mortgage rates have been understandably hesitant to sell their homes resulting in limited inventory levels. This shortage of available homes for sale has limited the decline of median home prices which remain elevated:

A buyer of a $500,000 home taking out a $400,000 thirty year fixed rate loan would face a monthly payment of $2,661 with a 7% rate compared to $1,686 with a 3% rate. That is quite a difference and it makes home ownership far less affordable. Deteriorating affordability and low inventory have suppressed closed transaction volume, resulting in lower revenue for HomeServices and other real estate brokers.

Taking a longer view, closed home sales volume in 2023 was similar to 2019 levels and HomeServices revenues were not much different between those two years. However, net income was $13 million in 2023 compared to $160 million in 2019. This large difference was not due to loss accruals related to lawsuits. Although management believes that losses are “likely to occur,” they are unable to currently come up with an estimate and no loss has been accrued as of December 31, 2023.

HomeServices management clearly has work to do on the cost structure to restore profitability at current transaction volumes. Doing so in a timely manner is even more necessary given the changes to the business model coming up later this year.

Conclusion

Although HomeServices did not participate in the settlement, its agents will still be affected by changes to the MLS system which is controlled by the NAR.

The MLS is the primary means through which buyers and agents find properties for sale. The lack of information on buy-side commissions in the MLS will impact HomeServices real estate agents like all other agents. Buyers will also start signing agreements with their agents specifying compensation. The fact that HomeServices will pursue their own appeal or settlement of the Sitzer-Burnett case does not change the fact that HomeServices will be impacted by changes to the MLS system.

HomeServices is organized as a legal entity separate and distinct from BHE. As of December 31, 2023, HomeServices had total assets of $3.4 billion, of which $1.6 billion is attributed to goodwill. Long-term debt of $133 million is structured as a variable-rate term loan due in 2026. Potential liquidity is available through short-term credit facilities of $1.1 billion and there was $280 million of cash on the balance sheet.

The NAR settlement was for $418 million, but I do not know of any way to estimate a potential settlement or ultimate legal judgment against HomeServices. It does appear that the company has some liquidity to fund a settlement or to pay out an adverse outcome after an appeal, within limits. I have not read anything leading me to believe that BHE is obligated to infuse cash into HomeServices for its legal exposure.

HomeServices recorded cumulative net income of $1.6 billion over the past decade, so the potential legal liabilities are large in the context of the company’s profitability. My greater concern is that the real estate business model could be permanently impaired by the changes to the MLS system and disruption to the way in which buy-side agents are compensated. Real estate agents will still be needed to sell homes and many buyers will choose to compensate their agents, but some will no doubt bypass realtors on the buy side entirely. Impairment of the business model could result in a write-down of all or part of the $1.6 billion of goodwill on the balance sheet.

BHE is light on information regarding HomeServices, but hopefully this brief article on the data available to the public has shed at least some useful light on the situation.

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Individuals associated with The Rational Walk own shares of Berkshire Hathaway.

For the NAR’s perspective on the settlement, see The Truth About the NAR Settlement Agreement dated March 22, 2024.

Berkshire Hathaway Energy’s 2023 10-K, pages 99 and 190

Berkshire Hathaway HomeServices Franchise Agreement dated 5/28/2013