Berkshire Hathaway Energy's Uncertain Future

Warren Buffett's concerns about the regulatory climate for the utility industry has negative implications for PacifiCorp and BHE's other subsidiaries.

“Our second and even more severe earnings disappointment last year occurred at BHE. Most of its large electric-utility businesses, as well as its extensive gas pipelines, performed about as expected. But the regulatory climate in a few states has raised the specter of zero profitability or even bankruptcy (an actual outcome at California’s largest utility and a current threat in Hawaii). In such jurisdictions, it is difficult to project both earnings and asset values in what was once regarded as among the most stable industries in America.”

— Warren Buffett, 2023 letter to shareholders 1

Berkshire Hathaway entered the electric utility industry in March 2000 when Warren Buffett acquired a 76% equity interest in MidAmerican Energy.

MidAmerican added several natural gas pipelines and additional electric utilities to its operations over the years, including PacifiCorp in 2005 and NV Energy in 2013, and made significant investments in wind and solar power in an effort to lower carbon emissions. MidAmerican changed its name to Berkshire Hathaway Energy (BHE) in 2014. Berkshire Hathaway currently owns 92% of BHE.2

Since the electric utility industry has characteristics of a natural monopoly, it is very heavily regulated. States have historically permitted utilities to earn reasonable, albeit unspectacular, returns in exchange for providing very large amounts of capital needed to build and maintain critical infrastructure. Regulated returns balance the need to attract investor capital with the goal of providing affordable power to customers.

Utilities are usually owned by investors attracted to the stability and predictability of regulated returns and reliable dividends. However, Berkshire Hathaway is not a typical investor in the utility industry. Rather than running BHE to generate cash for distribution to Berkshire Hathaway, Warren Buffett has sought out opportunities within BHE to reinvest capital. BHE has not paid any cash dividends since Berkshire acquired its initial ownership interest in March 2000 and management does not foresee dividend payments to Berkshire “in the foreseeable future.”3

It is not possible for most utilities to retain all earnings due to limited opportunities for reinvestment. However, since BHE has many energy-related businesses within its conglomerate structure, it has been possible to retain earnings since capital can be deployed between businesses or to purchase additional businesses. However, the premise is that BHE can expect to earn reasonable returns on reinvested capital.

When it comes to the heavy investments required to build new electric generation and transmission capacity, BHE must have a reasonable expectation of regulated returns commensurate with the risk of making the investments.

Warren Buffett’s message in his recent letter to shareholders was that we can no longer assume that the regulatory climate for utilities will be stable, something that he “did not anticipate or even consider” when making decisions in the past. He emphasized that Berkshire can sustain such a “financial surprise” but will not “knowingly throw good money after bad.” In a message that seemed to be directed to regulators as well as shareholders, Mr. Buffett noted that Americans may be “forced to adopt the public-power model” if the industry cannot attract investor capital.

In December 2023, I wrote an article about BHE’s latest investor presentation which provides an overview of a very complicated business, a reality that is evident when reviewing the company’s 2023 10-K which weighs in at 548 pages. The presentation provides a good 30,000 foot view of how the pieces of BHE fit together and I would encourage readers to review my article as well as the presentation itself.

This article focuses exclusively on PacifiCorp which has faced significant adverse outcomes related to wildfire litigation in recent years.

Over the past decade, PacifiCorp has made heavy growth investments, with total capex of $16.5 billion, far in excess of $9.5 billion of depreciation and amortization. While BHE does not pay distributions to Berkshire Hathaway, BHE regularly receives distributions from its business units. PacifiCorp has paid $4.3 billion of dividends to BHE over the past decade. Due to wildfire litigation, PacifiCorp will not pay dividends to BHE “over the next several years.”4

PacifiCorp deserves our scrutiny since the outcome of the litigation, along with changes in the overall regulatory climate, will influence Warren Buffett’s view on whether BHE remains an enterprise that can profitably reinvest all of its free cash flow, as it has throughout Berkshire Hathaway’s ownership. If this is no longer the case in the future, BHE could start paying dividends to Berkshire Hathaway. This would increase the amount of cash that Berkshire Hathaway will have to redeploy. The burden of having to redeploy part or all of BHE’s free cash flow could add to the pressures on Berkshire Hathaway to eventually pay dividends to shareholders.

Overview

PacifiCorp serves 2.1 million retail electric customers in Utah, Oregon, Wyoming, Washington, Idaho, and California. The company operates under the trade name of Rocky Mountain Power in Utah, Wyoming, and Idaho and Pacific Power in Oregon, Washington, and California. In terms of Gigawatt-hours, 46% of PacifiCorp’s business is in Utah and 25% is in Oregon. Very little power is sold in California.

In 2023, retail sales accounted for 95% of electricity sold, with 31% sold to residential customers. PacifiCorp generated 71% of its total energy requirements, with the balance purchased under short and long-term contracts. Coal was used to generate 34% of energy the company sold. Through ownership interests in mines, PacifiCorp sourced 18% of its total coal requirements in 2023, with the balance purchased under short and long-term contracts from suppliers.

The following exhibit shows PacifiCorp’s service area, the location of its generation facilities, and the primary transmission lines:

PacifiCorp has significantly reduced its reliance on coal-fired generating capacity. Management aspires to reach “net zero” greenhouse gas emissions by 2050, with a 50% reduction in emissions by 2030 compared to a 2005 baseline. Of PacifiCorp’s twenty-two coal units, fifteen are expected to be taken out of service by 2030.5

PacifiCorp has invested in new wind capacity in recent years. The majority of the company’s wind facilities are located in Wyoming, as we can see from the exhibit above. To efficiently transport energy from where it is generated to customers, it is necessary to build new transmission capacity.

PacifiCorp’s Energy Gateway initiative is a plan to build approximately 2,300 miles of new high-voltage transmission lines with a total estimated investment of $12.7 billion, of which $4.8 billion has already been spent. As of November 2023, PacifiCorp has placed 575 miles of this project in service at a cost of approximately $2.3 billion. The exhibit below shows the current status of the Energy Gateway project:

In total, PacifiCorp currently has 17,100 miles of high-voltage transmission lines in service across ten states and 66,300 miles of distribution lines to end customers. The Energy Gateway project is an integral component of PacifiCorp’s aspirations to achieve “net zero” greenhouse gas emissions which has required and will continue to require very large capital expenditures. These investments have been made based on the expectation of a reasonable rate of return in a stable regulatory environment.

Part of PacifiCorp’s transmission and distribution system is located in areas prone to wildfires. As I will discuss later in this article, wildfire litigation will play a key role in determining whether the remaining investment in Energy Gateway can be justified. I believe that Warren Buffett was referring to this project, among others, when he brought up the question of whether future investments will be desirable or not. That was a clear message to regulators and politicians. If the country’s “net zero” goals are to be met with the help of Berkshire’s capital, a reasonable return will be required.

Recent Results

BHE’s subsidiaries, including PacifiCorp, are organized as legal entities separate and distinct from BHE itself and each subsidiary issues its own debt to the public which is secured by properties owned by each subsidiary. This requires BHE to file detailed financial statements for its debt-issuing subsidiaries. As a result, we can analyze PacifiCorp’s results and overall financial condition as a separate and distinct entity.

The following exhibit shows PacifiCorp’s operating results over the past decade:

Since PacifiCorp’s cost of fuel and energy has historically been recovered from retail customers through regulated rates, management believes that utility margin is a useful indicator of underlying profitability. While there can be delays between a change in costs and approval of new regulated rates, the utility margin has been quite stable over the years at between 62% and 66.5%, as we can see in the exhibit.

Top line revenue growth has been minimal in recent years and so has utility margin in dollar terms. Operating income has been pressured by rising depreciation charges on a growing investment in infrastructure and, over the past two years, due to wildfire losses which will be discussed in the next section. Interest charges have increased due to rising debt levels, partially offset by lower interest rates.

Despite lower operating income in 2022 compared to 2014, PacifiCorp managed to post record-high net income thanks to considerable tax benefits associated with production tax credits (PTCs) earned by wind-powered generating facilities.

The Federal government has offered PTCs to provide an incentive for utilities to invest in wind power and this is precisely what PacifiCorp has done. PTCs for 2023, 2022, and 2021 were $180 million, $185 million, and $164 million, respectively. Since 2020, PacifiCorp has benefited from a negative income tax rate thanks to PTCs.

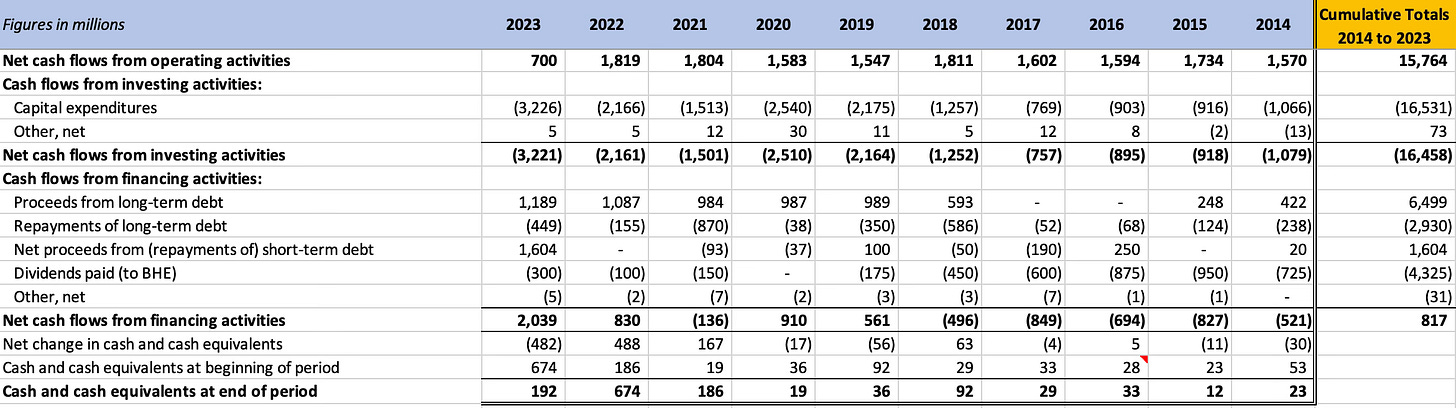

It is useful to examine how PacifiCorp has deployed cash flows from operations over the past decade. The following exhibit shows data from cash flow statements starting with net cash flows from operations for each year along with cumulative totals:

Over the past decade, PacifiCorp generated $15.8 billion of cash from operations and raised $5.2 billion from net issuance of debt. During this period, PacifiCorp used $4.3 billion to pay dividends to BHE and spent $16.5 billion on capital expenditures. While there are other moving parts in the cash flow statement, these are the major elements worthy of discussion. It is notable that the $16.5 billion of capex far exceeds the $9.5 billion of depreciation and amortization charges over the past decade. This is due to the effect of inflation making replacement of existing infrastructure more expensive over time as well as expansion initiatives such as Energy Gateway.

PacifiCorp could have almost fully funded its capex over the past decade with cash flows from operations, but BHE directed PacifiCorp pay $4.3 billion of dividends. This was made possible by increased indebtedness, but debt to total capitalization only increased modestly, from 48% to 55% over the period. Existing loan indentures require debt to total capitalization to remain below 65%. PacifiCorp’s debt is investment grade.

This high level overview of recent results shows a historically stable underlying business model, with utility margin varying relatively little over time. While rising depreciation and interest charges have pressured profits, PacifiCorp more than offset these impacts through 2022 due to large PTCs offered by the Federal government as an incentive for installing new wind power capacity. PacifiCorp has distributed significant cash to BHE while also investing heavily in capex by taking on additional debt, although not at levels that impair the investment grade credit rating.

Of course, we can see that the situation changed significantly in 2023 with wildfire losses of a magnitude sufficient to more than erase PacifiCorp’s underlying business profitability for the year. If this represented a true one-time event, BHE would likely take the blow, implement the necessary grid hardening initiatives, and carry on with its longstanding business strategy that includes heavy investment in new projects such as Energy Gateway. However, Warren Buffett’s letter made it clear that this may not be a one-time event. As a result, we need to take a close look at wildfire litigation losses and the impact of these events on the regulatory climate.

Wildfire Mitigation

Western states have experienced numerous wildfires in recent years driven by drought conditions and the buildup of combustible vegetation in forests. The encroachment of homes and other infrastructure in heavily forested lands has increased the risk to people and property. Electric utilities are often blamed for fires allegedly caused by transmission and distribution lines using bare wire conductors which can ignite vegetation in close proximity to the lines. Climate change could potentially increase the frequency and severity of drought conditions and exacerbate wildfire risks.

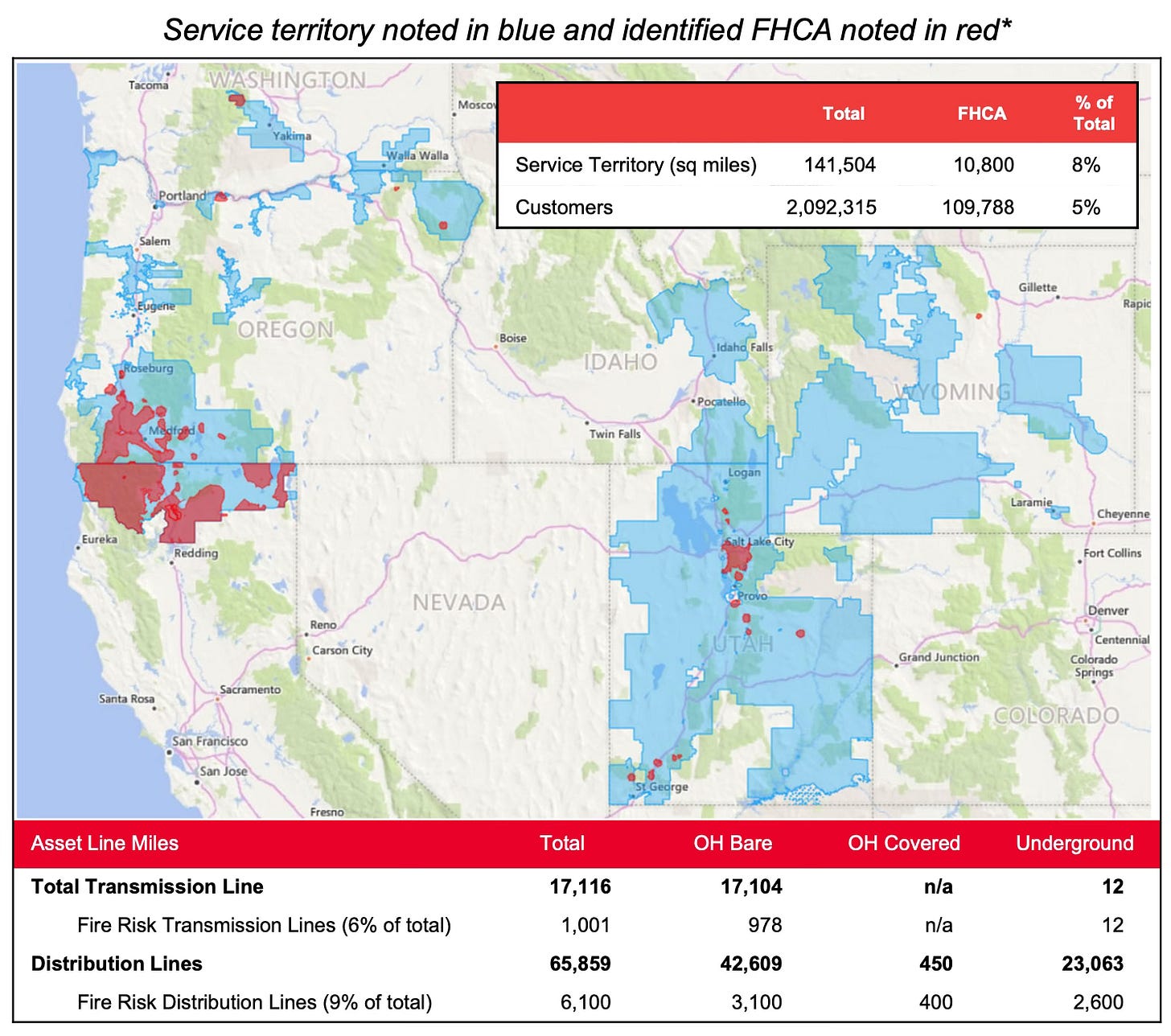

PacifiCorp and other utilities have developed wildfire mitigation plans to reduce the risk of wildfires in the ~8% of its territory believed to be in “fire high consequence areas.” Approximately 6,100 miles of distribution lines and 1,000 miles of transmission lines are affected. The following exhibit shows PacifiCorp’s service territory in blue and highlights the high risk fire regions in red.

Fire risks can be mitigated by moving power lines underground but this is not an inexpensive proposition. For lines that remain above ground, the goal is to reduce the risk of sparks. Overhead lines that currently use bare conductors can be rebuilt to use covered conductors. Electro-mechanical relays can be replaced with microprocessor relays to provide PacifiCorp with faster detection of faults which allows management to shut off power transmission in a timely manner. PacifiCorp currently operates 454 weather stations and has improved its ability to forecast local conditions.

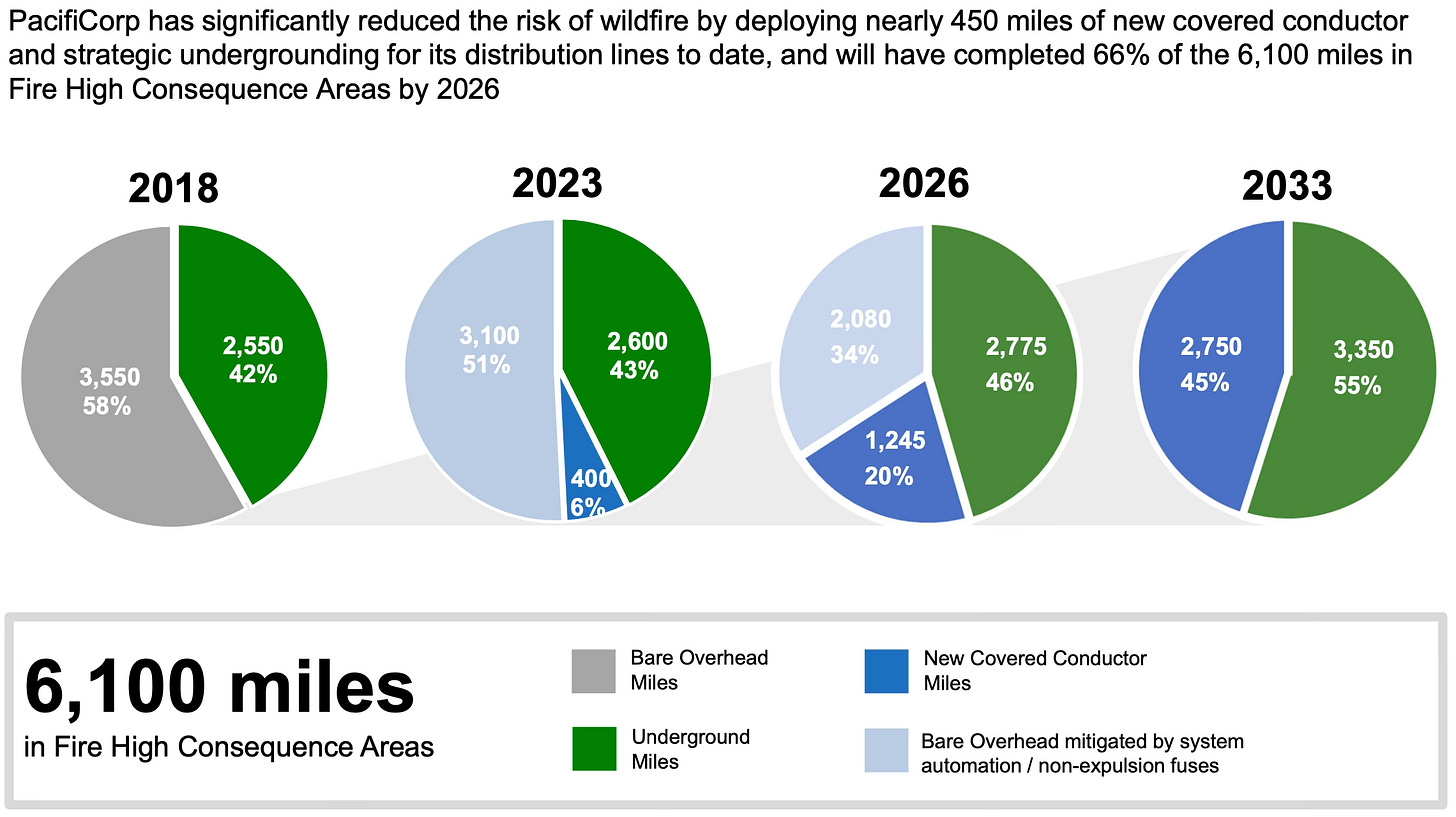

PacifiCorp has made significant progress hardening its infrastructure in recent years and has plans to do much more over the next decade. By 2033, all 6,100 miles of lines in high risk areas will either be moved underground or will be converted to covered conductors, with all bare overhead lines eliminated from the system.

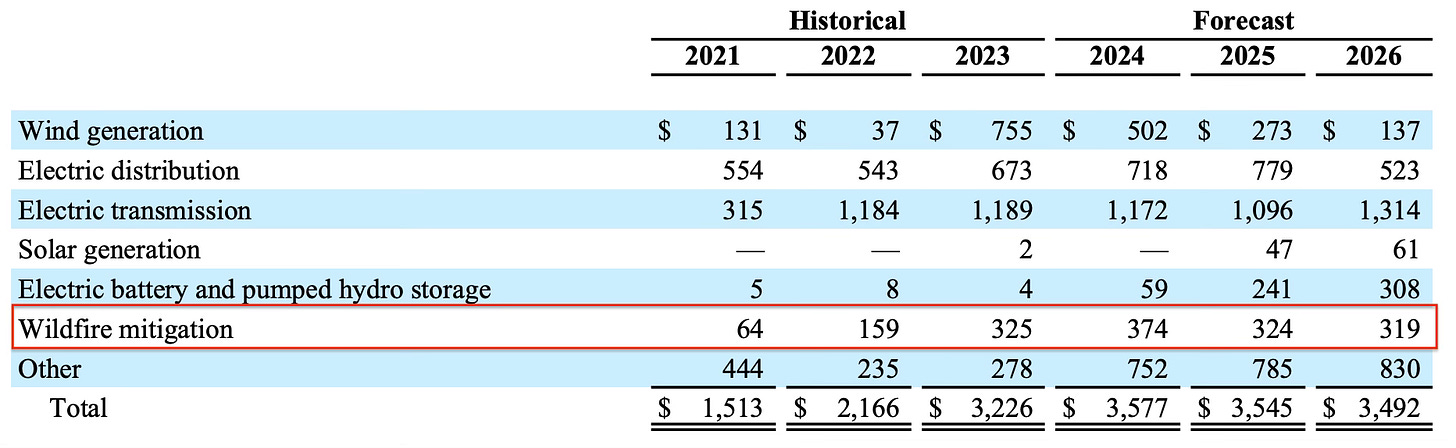

These improvements are expensive. The following exhibit shows the components of PacifiCorp’s capital expenditures over the past three years as well as planned outlays over the next three years. The cumulative cost of wildfire mitigation for 2024, 2025, and 2026 is projected to exceed $1 billion.

PacifiCorp will attempt to recover the cost of wildfire mitigation efforts over time through higher regulated rates, but we cannot know for certain that regulators will permit recovery of these costs.6 But regardless of whether wildfire mitigation costs can be recovered through rates, PacifiCorp must harden its physical infrastructure in fire prone regions and has made clear commitments to do so.

Wildfire Lawsuits

PacifiCorp has been blamed for sparking wildfires in September 2020 in Oregon and Northern California that burned over 500,000 acres and over 2,000 structures, and a fire in July 2022 in Northern California that burned over 60,000 acres and damaged or destroyed nearly 200 structures. Several injuries and fatalities were caused by the fires. The cause of the wildfires remain under investigation.

BHE’s 10-K goes into great detail regarding each of the individual lawsuits that have been filed and their current status in the legal system.7 PacifiCorp also maintains an up-to-date summary of wildfire litigation developments. The ultimate legal liability facing PacifiCorp is unknown and will not be known for many years. However, the total amount sought related to the 2020 wildfires is approximately $8 billion and this figure excludes any doubling or trebling of damages that could be awarded if PacifiCorp is found guilty of recklessness, gross negligence, or malice.

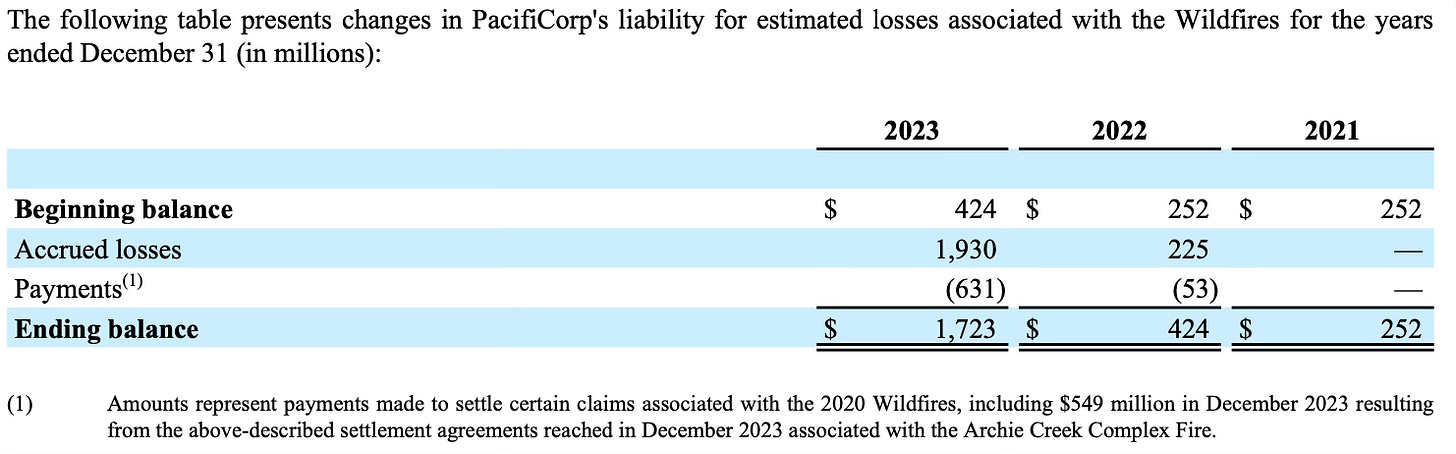

Management increased its accrual for wildfire losses by $1,930 million in 2023 which brings its cumulative estimated probable losses to $2,407 million. As of December 31, 2023, PacifiCorp has paid $684 million in settlements associated with the 2020 wildfires. Between January 1 and February 23, 2024, PacifiCorp entered into settlements totaling $51 million. As of December 31, 2023, PacifiCorp expects that $499 million of its remaining liabilities will be covered by insurance recoveries.8

The following exhibit shows the evolution of PacifiCorp’s fire liabilities since 2021:

Despite the apparent precision of these figures, they are only educated guesses at this point. BHE includes the following language in the 10-K, typical of legal disclaimers in security filings, but to be taken quite seriously under the circumstances:

“It is reasonably possible PacifiCorp will incur material additional losses beyond the amounts accrued for the Wildfires that could have a material adverse effect on PacifiCorp's financial condition. PacifiCorp is currently unable to reasonably estimate a specific range of possible additional losses that could be incurred due to the number of properties and parties involved, including claimants in the class to the James case, the variation in the types of properties and damages and the ultimate outcome of legal actions.”

The bottom line is that we simply do not know the extent of PacifiCorp’s ultimate fire liabilities at this time. Even if PacifiCorp’s transmission lines were partially or even entirely to blame, it is very hard to believe that management acted in a “reckless”manner consistent with “gross negligence” or that there was any “malice” involved that could justify double or treble damages, but this cannot be excluded as a possibility in the current legal environment. Treble damages on the total amount of $8 billion sought in all lawsuits might be regarded as the worst possible scenario, and such an outcome would obviously be ruinous for PacifiCorp’s equity and debt holders.

Capital Structure

PacifiCorp is a wholly owned subsidiary of BHE. PacifiCorp is a separate and distinct legal entity which issues its own debt secured by its properties. While BHE has no obligation to satisfy the demands of PacifiCorp’s creditors, it should be noted that in the event of “any default due to the bankruptcy, insolvency, or reorganization of a significant subsidiary, all of BHE’s debt will become immediately due.”9

This section provides an overview of PacifiCorp’s capital structure in order to better understand the risk of its equity being impaired or wiped out due to fire litigation costs. At the end of the section, I’ll briefly discuss BHE’s debt given the provision that it would become “immediately due” in the event of PacifiCorp’s bankruptcy.

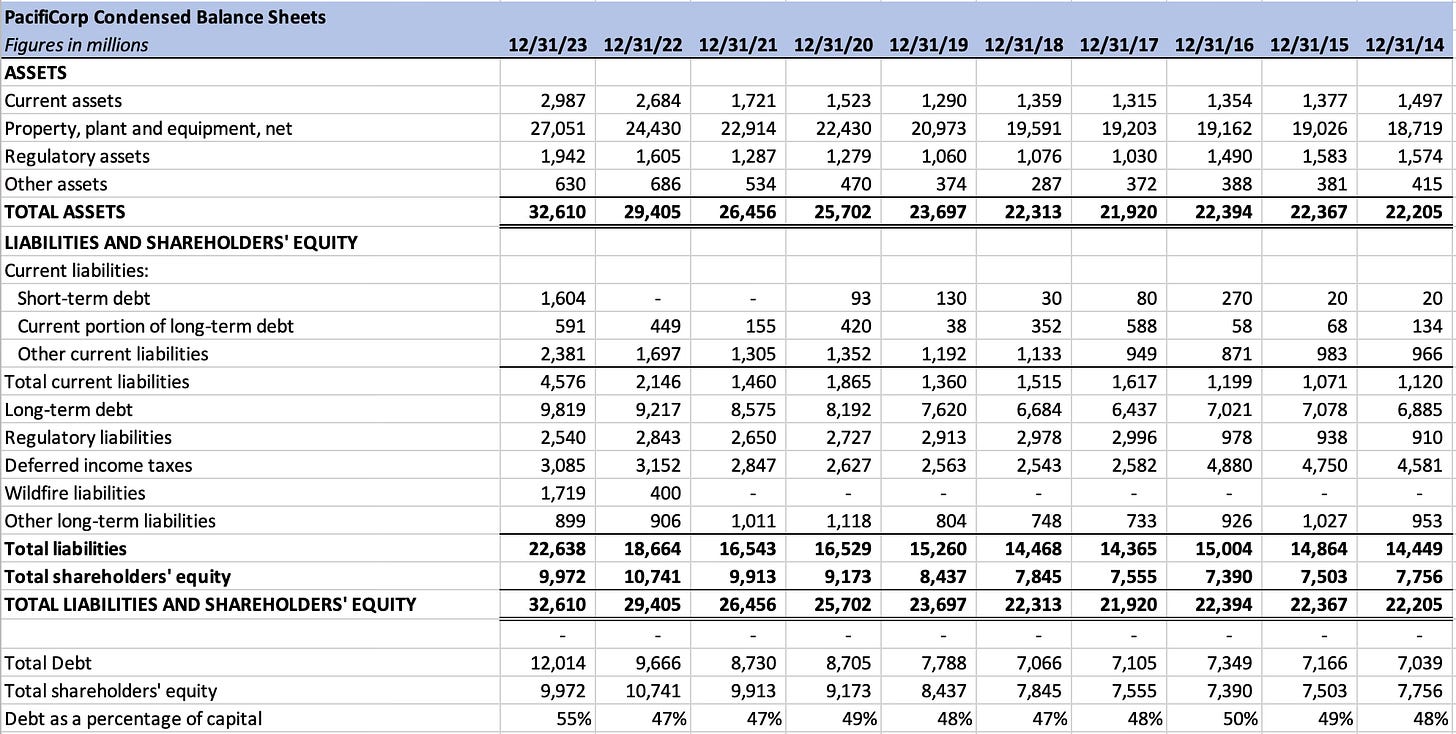

In the following exhibit, I have condensed PacifiCorp’s balance sheets to display key data required to assess the financial stability of the company:

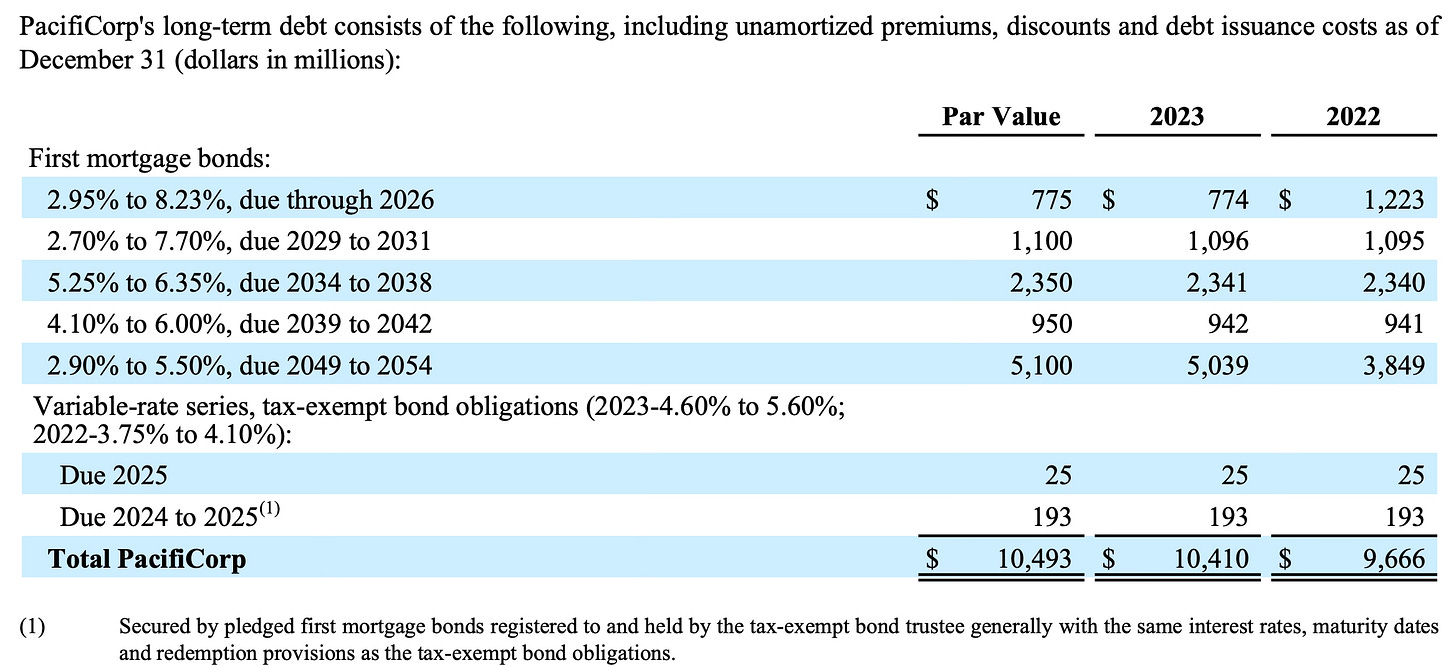

As of December 31, 2023, PacifiCorp had shareholders’ equity of nearly $10 billion and total debt of $12 billion. The following exhibit shows the breakdown of the company’s long-term debt, including the current portion of long-term debt:

In January 2024, PacifiCorp issued a total of $3.8 billion of first mortgage bonds comprised of $500 million of 5.1% bonds due in 2029, $700 million of 5.3% bonds due in 2031, $1.1 billion of 5.45% bonds due in 2034, and $1.5 billion of 5.8% bonds due in 2055. With the proceeds, PacifiCorp paid off its $1.6 billion of short-term debt shown in the balance sheet as of December 31, 2023. Following this debt issuance, there is no remaining regulatory authority to issue additional long-term debt.10

PacifiCorp continues to maintain an investment grade credit rating and, based on its recent bond issuance, the lawsuits have not spooked bond investors. It is likely that one reason for this is BHE’s commitment to allow PacifiCorp to retain all of its free cash flow for “several years” by not paying dividends to BHE, although I find nothing in the company’s filings that would prohibit such distributions, aside from loan indentures that require PacifiCorp’s debt to not exceed 65% of total capitalization.

PacifiCorp’s management believes that $1.7 billion is the probable liability, but the maximum amount sought is $8 billion and damages could be doubled or trebled. With $10 billion of shareholders’ equity, there is an obvious limit to absorb liabilities on the upper end of the theoretical range without the debt becoming impaired.

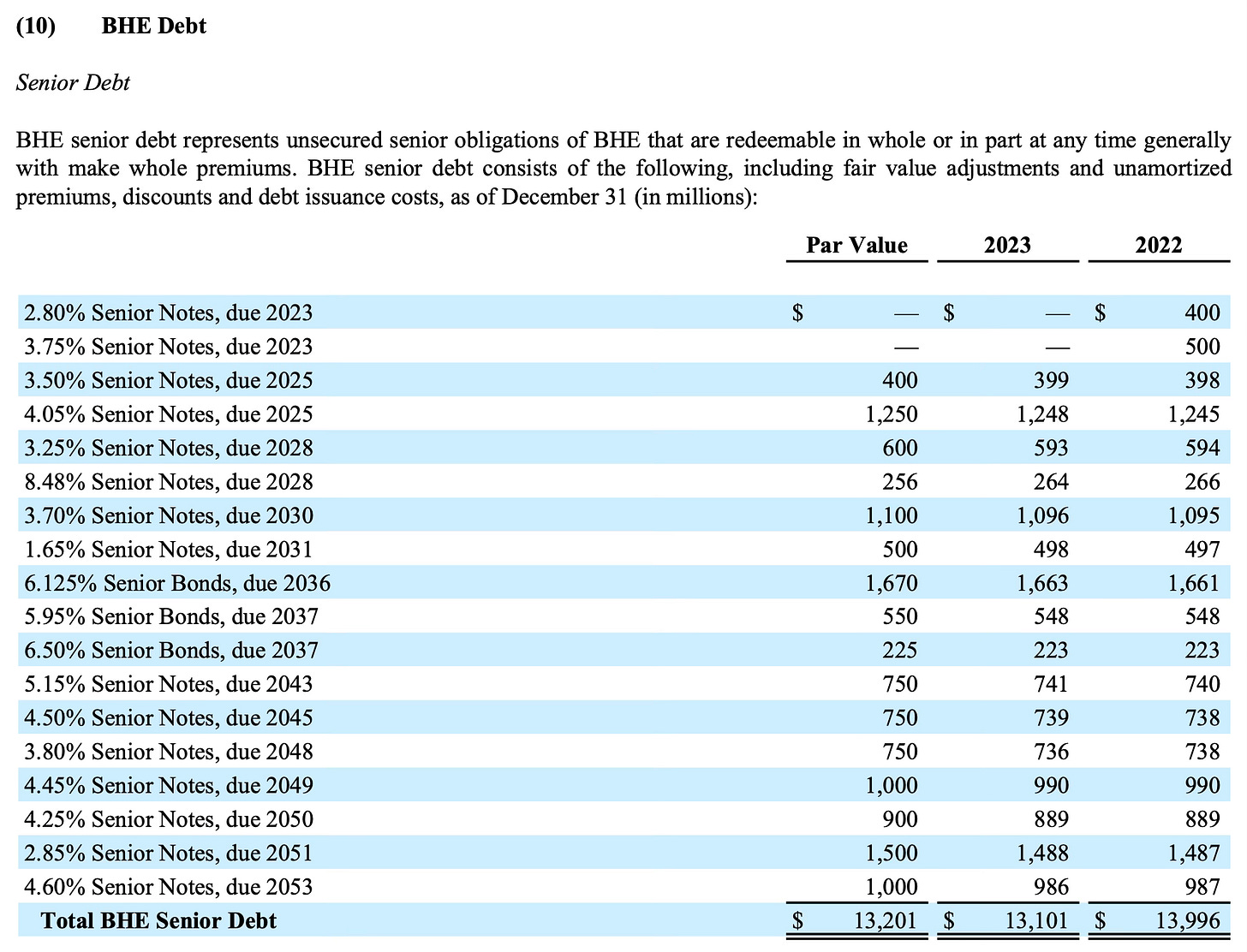

If a worst case scenario occurs, BHE might choose to inject cash into PacifiCorp even though it is not legally required to do so. As I noted at the beginning of this section, BHE’s debt could become due in the event of bankruptcy or reorganization. BHE’s senior debt is listed in the exhibit below.

Prior to delving into the details of BHE’s very long 10-K, I was under the impression that PacifiCorp was sufficiently “sandboxed” and that the worst case scenario for BHE would be to lose the $10 billion of equity capital invested in PacifiCorp, “handing over the keys” to the debt holders in a restructuring. I was not aware of a potential trigger causing BHE’s debt to become due if PacifiCorp falters. This increases the probability that BHE might choose to inject cash into PacifiCorp, although it is by no means inevitable that this would occur. However, it is a possibility worth taking seriously.

Berkshire Hathaway does not guarantee debt issued by BHE or its subsidiaries and is under no obligation to come to the aid of BHE or PacifiCorp. BHE has never paid dividends to Berkshire and this is expected to continue to be the case. It seems highly unlikely that Berkshire Hathaway would inject cash into BHE for purposes of shoring up PacifiCorp’s finances, but reputational factors might come into play.

To sum up, I am more concerned about problems at PacifiCorp impacting BHE than I was prior to reviewing BHE’s 10-K in detail, but we should keep this in the proper perspective. PacifiCorp has estimated ultimate fire liabilities of $1.7 billion and there is no reason to question the integrity of the managers who have arrived at this estimate. Buyers of PacifiCorp’s long-term debt do not appear to be overly concerned about the worst case scenarios materializing.

Conclusion

“With this model employed by both private and public-power systems, the lights stayed on, even if population growth or industrial demand exceeded expectations. The ‘margin of safety’ approach seemed sensible to regulators, investors and the public. Now, the fixed-but-satisfactory- return pact has been broken in a few states, and investors are becoming apprehensive that such ruptures may spread. Climate change adds to their worries. Underground transmission may be required but who, a few decades ago, wanted to pay the staggering costs for such construction?”

— Warren Buffett, 2023 letter to shareholders

A modern economy can be crippled by an unreliable electric grid. It is extremely expensive to build and maintain the generation, transmission, and distribution infrastructure required to meet the demands of a growing economy. This task is compounded further by the goal of reaching carbon neutrality by 2050. The capital required to meet these goals will be considerable and, if it is going to come from for-profit companies, there must be an expectation of a reasonable return on investment.

In his recent letter to Berkshire Hathaway shareholders, Warren Buffett made it clear that he is nervous about the longstanding regulatory model in which for-profit companies such as BHE are encouraged to make investments in exchange for regulated rates of return. Regulators and politicians can complain about electric utilities and adopt a “populist” approach but they cannot force companies like Berkshire Hathaway to throw good money after bad.

If private capital flees the electric utility industry, this will not change the fact that infrastructure must be maintained and constructed in the decades to come.

As Mr. Buffett mentioned in his letter, a public-power model is an option that has been used in many states. But does anyone really believe that governments can run an electric utility better than BHE, to say nothing of making the investments needed to achieve carbon neutrality by 2050? The cost of doing so still must be paid and will be borne either by ratepayers or taxpayers no matter how much obfuscation emanates from the political process in the short run. There is no free lunch.

PacifiCorp does very little business in California, but we cannot ignore that state’s policy of “inverse condemnation.” Under this policy, courts have ruled that investor-owned utilities can be liable for wildfire damages without the utility being found negligent and regardless of fault.

I try to steer clear of politics, but this sort of policy is one that I would expect in a banana republic, not one of the richest states in the union. The old saying is that “as goes California, so goes the nation,” so we cannot simply write this off as one more crazy quirk coming out of that state. This type of punitive ideology could easily spread to neighboring Oregon where PacifiCorp sells a quarter of its electricity, and it could spread to Nevada where BHE’s NV Energy subsidiary operates.

Warren Buffett concluded his discussion of BHE as follows:

“When the dust settles, America’s power needs and the consequent capital expenditure will be staggering. I did not anticipate or even consider the adverse developments in regulatory returns and, along with Berkshire’s two partners at BHE, I made a costly mistake in not doing so.”

BHE had shareholders’ equity of $49.7 billion as of December 31, 2023, of which 92% is owned by Berkshire Hathaway. In June 2022, BHE repurchased $870 million of BHE stock held by Greg Abel at an implied valuation of $88.8 billion for BHE, as I wrote about in my coverage of Berkshire Hathaway’s second quarter 2022 report. As a result, many shareholders, myself included, penciled in a valuation in that range for BHE when assessing the intrinsic value of Berkshire Hathaway.

While I am certain that Warren Buffett and Greg Abel entered into that transaction in good faith, with all information known at that time incorporated into the price, it seems likely that the equity value of BHE is lower today than it was in mid-2022.

It is difficult to argue that BHE is not worth less today than it was two years ago given the risk of adverse wildfire litigation at PacifiCorp as well as longer term regulatory risks. This is unfortunate but it is normal for business conditions to change over time even in industries that appear to be stable. Berkshire Hathaway shareholders can at least take solace in the fact that Warren Buffett is not going to knowingly inject cash into the utility business unless he is convinced that it will earn a reasonable return.

I am sure that Mr. Buffett’s message was understood by regulators and politicians, but in today’s environment, I cannot hazard a guess regarding their response.

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Individuals associated with The Rational Walk own shares of Berkshire Hathaway.

Warren Buffett discussed two earnings disappointments at length in his 2023 annual letter. The first disappointment was at Berkshire’s railroad subsidiary, the subject of an article published on March 9: Burlington Northern Santa Fe — 2023 Results. The second earnings disappointment was at Berkshire Hathaway Energy, the subject of this article.

The 8% minority interest is owned by family members of Walter Scott Jr., a longtime friend of Warren Buffett who served on Berkshire Hathaway’s board from 1988 until his death in September 2021. Walter Scott initiated the deal for Berkshire to purchase MidAmerican in 1999 according to Warren Buffett’s account of the transaction in his 1999 annual letter.

Berkshire Hathaway Energy’s 2023 10-K, page 102.

Berkshire Hathaway Energy’s 2023 10-K, page 74.

BHE’s 2023 EEI presentation, page 11.

According to BHE’s 2023 10-K, management has made filings with state regulators to “preserve the ability of PacifiCorp to file for deferred accounting treatment when actual liability costs are more certain” but has not sought to recover costs through rates at this time. Pages 56-58 of the 10-K deal with PacifiCorp’s many actions regarding regulated rates and the recovery of various costs. I claim no expertise when it comes to judging how regulators will react to these filings or if wildfire litigation or mitigation costs will be recoverable. Much seems to depend on the political and legal climate in the coming years.

Berkshire Hathaway Energy’s 2023 10-K, pages 91-99.

Berkshire Hathaway Energy’s 2023 10-K, pages 188-189.

Nice find on the BHE debt trigger!

Given California accounts for such a small portion of electricity sold and a majority of the wildfire risks, how easy would it be for Pacific Corp. to exit its Californian service areas?