Will Berkshire Hathaway Pay a Dividend?

Investors have been debating the dividend question for decades. So far, shareholders have been well served by Warren Buffett's reluctance to send out dividend checks.

A Perennial Topic …

Fifteen years ago, two days before Berkshire Hathaway’s 2008 annual report was released, I published an article asking whether the company should pay a dividend. I was against it at the time, concluding my thoughts as follows:

The reality is that someday Berkshire will pay a dividend. However, in my view, that day has not come yet. The current economic climate and the more reasonable valuations available in both public and private companies makes it an ideal time for Buffett to have as much cash on hand as possible. Buffett’s reputation alone is a huge asset particularly when it comes to the purchase of private family held companies that care about the long term stability of businesses built over a lifetime. Many times, there is only one person to call to achieve liquidity while also ensuring stability for your company.

When the phone rings in Omaha, I want Buffett to have as large of a checkbook as possible under current conditions.

Two years later, I returned to this topic in response to a Barron’s article speculating that Berkshire could start paying dividends. I was skeptical and reiterated many of my previous arguments, but I also said that eventually dividends are likely to be paid. I hoped that this would not occur while Warren Buffett remained in charge.

Five years later, in early 2016, I wrote an article about what Berkshire Hathaway might look like in 2026. Among other things, I was optimistic that the company’s market capitalization might exceed $1 trillion by 2026 especially if all earnings are retained over the ten year period.1 This article appeared after Berkshire put in place a very limited repurchase program, hamstrung by a stringent limitation on the price-to-book value that could be paid. I was skeptical that repurchases of significant size would be possible with this stringent limitation in place:

Berkshire’s current repurchase limit of 120 percent of book value would have to be increased substantially in order to make repurchases of any significant size possible. Since 120 percent of book value is far below any reasonable assessment of Berkshire’s intrinsic value, it follows that Mr. Buffett and the board of directors would have to agree to increase the repurchase limit in order to return material amounts of cash to shareholders.

Two years later, in 2018, the repurchase program changed to permit repurchases without a price-to-book value limitation. Since then, Berkshire has returned $72.9 billion to shareholders who sold their stock back to the company.2

Berkshire has started to return meaningful amounts of cash to shareholders through repurchases, albeit only at stock prices that are below intrinsic value, “conservatively determined.” A repurchase program returns cash to shareholders who voluntarily decide to part with their shares either on the open market or, more rarely, in private transactions directly with Berkshire. Continuing shareholders have not received any cash and have not borne any tax consequences from holding the stock.

“Conservatively Determined”

Berkshire Hathaway’s policy allows for repurchases without any limitation provided that Warren Buffett considers the price to be below Berkshire’s intrinsic value “conservatively determined” and the company’s cash balance will not drop below $30 billion as a result of the repurchase. Far from being boilerplate language, I believe that Mr. Buffett takes this extremely seriously, as I discussed earlier this week in more detail in Berkshire Hathaway at $600,000.

On Saturday morning, we will learn how many shares Berkshire repurchased during the fourth quarter of 2023. We will also get a more recent share count, sometime in mid-February, from which we can deduce whether additional repurchases were made over the first several weeks of 2024.

Berkshire’s stock price has continued to hit records this week, making the title of my article on Monday obsolete. As of this morning, Berkshire’s Class A shares were trading above $632,000 and Class B shares briefly hit $420, which perhaps will attract Elon Musk’s attention.3 To be serious, the stock has sharply rallied in recent weeks.

On Monday, I wrote that shares were probably in a “zone of reasonableness” but that I would not be surprised if repurchase activity slows or stops entirely, at least for the time being, because of the words “conservatively determined” in the repurchase policy. A slowdown or halt of repurchases seems even more likely at the current stock price. Obviously, prices gyrate all the time and it is possible that repurchases could continue even at the current quote, but I doubt it.

Deploying Cash

In my 2016 article, I wrote about the options for deploying cash:

Berkshire Hathaway has a “high class” problem: The powerful cash generation capability of the company tends to snowball which makes the task of deploying cash flow more difficult over time. Berkshire had over $61 billion of cash equivalents at the end of 2015, excluding cash held in the railroad, utility, and financial products groups. Operating cash flow has averaged over $30 billion during the past three years. Berkshire can deploy cash in any of the following ways:

Cash can be reinvested within the same operating company in which it is generated.

Cash can be reallocated between operating companies.

New partially or wholly-owned subsidiaries can be acquired.

Marketable securities can be purchased.

Cash can be returned to shareholders via dividends, repurchases, or both.

Many of Berkshire’s businesses generate significant free cash flow that cannot be reinvested at attractive incremental returns on capital and it has been difficult to find acquisitions. Warren Buffett has not been tempted by recent higher yields on bonds and I suspect that he does not find the stock market, as a whole, to be attractive.

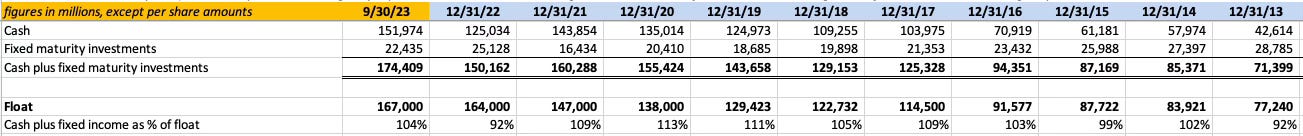

As of September 30, 2023, Berkshire had $152 billion of cash and short-term treasuries, excluding cash held in the railroad and utilities segments. However, Berkshire only held $22.4 billion of fixed maturity investments. The total of cash and fixed maturity investments was $174.4 billion. Typically, Berkshire has held cash and fixed maturity investments roughly equivalent to insurance policyholder float. The following exhibit shows this relationship over the past decade:

Berkshire’s insurance subsidiaries have far more capital than required by regulatory authorities, so there is no reason to necessarily believe that cash and fixed maturity investments must be equivalent to float, but it is notable that this relationship has existed for quite some time which calls into question whether Berkshire really has as much excess cash as a $152 billion cash/t-bill balance might indicate.

Does a Dividend Make Sense?

Let’s assume that Berkshire’s stock price remains at current levels during 2024 and that this results in repurchase activity slowing down dramatically or stopping entirely. If this is the case, should Berkshire institute a regular or special dividend to distribute some of its existing cash/t-bill balance or to distribute this year’s free cash flow?

Ten years ago, there was a vote taken on a shareholder proposal which Warren Buffett discussed in his 2014 letter to shareholders. Although the vote was not officially recorded because the sponsoring shareholder failed to show up at the meeting, Berkshire still announced the results. By a margin of 89-to-1, Class A shareholders were opposed to a dividend. The margin of opposition among Class B shareholders was 47-to-1. The shareholder base has changed over the past decade, but I suspect most shareholders, of both classes, would still prefer reinvestment of earnings.

I am personally fine with Berkshire’s current cash/t-bill balance, particularly given the fact that the company is now earning in excess of 5% on this balance and it does not seem terribly far out of line with historical trends relative to float. I am also fine with free cash flow for 2024 being retained if Berkshire cannot repurchase stock at a “conservative” discount to intrinsic value. This additional cash would also earn a mid-single digit return this year, assuming that the Federal Reserve does not cut rates more than the markets currently expect. It would also provide optionality for Warren Buffett should opportunities arise later this year.

At some point in the future, however, Berkshire is very likely to pay dividends and they could be substantial. Berkshire’s stock price, in the long run, is as likely to trade above intrinsic value as it is to trade at a conservative discount. We could have many years when repurchases would destroy value while other opportunities to deploy cash are absent. A dividend would be necessary under such circumstances.

I would be quite surprised to see a dividend announcement in tomorrow’s letter to shareholders. I would not welcome the tax bill this would generate.

But while a dividend would not be great news from my perspective, the market might disagree. When Meta announced that it would start paying a dividend, the stock price surged. I’ve argued that anyone can turn Berkshire into an “income stock” but the reality is that many investors hate to sell shares and love dividend checks.

One day, Berkshire Hathaway will be a favorite “widow and orphan” dividend paying stock, but I’m still hoping this is many years from now.

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Individuals associated with The Rational Walk own shares of Berkshire Hathaway.

Berkshire’s market capitalization hit $900 billion this week.

Of course, these shareholders did not know that Berkshire was on the other side of the trade, but they voluntarily sold shares and Berkshire happened to be the buyer.

My sense is that a dividend is highly unlikely during Warren’s lifetime: he doesn’t need the money, and a dividend would result in unnecessary taxes, which would reduce the amount ultimately intended to go to charities. My further sense is that Berkshire, with Warren’s planning, has several things up its sleeve that would be superior to a dividend. Top of the list would be the distribution of appreciated securities, like Coke or Amex, to shareholders, which would transfer the related deferred tax to shareholders, who would have the choice to hold or sell.