Warren Buffett's 2023 Letter to Shareholders

Charlie Munger — The Architect of Berkshire Hathaway

Berkshire Hathaway released 2023 results today along with Warren Buffett’s letter to shareholders. I always recommend reviewing Berkshire’s results before reading the opinions of others. Warren Buffett’s letter needs no introduction or interpretation. It is always well written and straight forward. This year is no exception.

Press Release

Warren Buffett’s 2023 letter to shareholders

Berkshire Hathaway’s 2023 annual report

This article contains my thoughts on Mr. Buffett’s letter. I plan to spend the rest of the weekend reviewing the annual report cover-to-cover. I will write much more about Berkshire’s 2023 results over the next few days.

Topics covered in this article:

Although Warren Buffett does not mention the Pilot lawsuit in his letter, I include an observation about the settled price of $2.6 billion for the remaining 20% of the business, acquired in January 2024, and note that the $13 billion implied valuation is substantially below the $19.8 billion valuation when Berkshire purchased a 41.4% interest for $8.2 billion in January 2023. It looks like the settlement of the lawsuit was favorable for Berkshire.

Permanent Holdings of Marketable Securities

Occidental Petroleum and the Japanese trading companies gain the status of holdings that Berkshire expects to maintain “indefinitely.”

A Tribute to Charlie Munger

Warren Buffett’s preceded his letter with a great tribute to Charlie Munger who he credits with being the true architect of Berkshire Hathaway’s success. It takes a man with unusual self-confidence to attribute the success of his life’s work to another man, one who, on paper, served in a lesser role. But this is hardly surprising for those of us who have followed Berkshire Hathaway for decades. From my first annual meeting in 2000 up to Charlie Munger’s final interview just two weeks prior to his death, it was clear to me that he was a major reason for the success of the company.

Mr. Buffett’s tribute includes some details that I have not read elsewhere, including that he regarded Mr. Munger partly as an “older brother” and partly as a “loving father.” In this way, he puts Mr. Munger on the same pedestal as his own father and Benjamin Graham, the other two men who most influenced his life. With an age gap of under seven years, the comparison to a father-son relationship was surprising.

Starting in the late 1960s, Warren Buffett and Charlie Munger were business partners in various ventures, most significantly in Blue Chip Stamps. It was only in the late 1970s that Mr. Munger assumed his official role at Berkshire Hathaway as Vice Chairman. Mr. Buffett’s tribute states that he and Mr. Munger never expected that Mr. Munger would own a single share of Berkshire stock. All of Mr. Munger’s early advice in the 1960s regarding the architecture of Berkshire Hathaway was given in a totally unofficial capacity, simply due to their friendship.

Warren Buffett has been far more than a “general contractor” implementing Charlie Munger’s architecture. The truth is that both men brought unique attributes to the company and the result is what Mr. Munger often called a Lollapalooza.

For a more extended discussion of Charlie Munger’s influence at Berkshire, I suggest reading Warren Buffett’s fiftieth anniversary letter to shareholders published in 2015. Their sixty-four year friendship and business partnership is a perfect example of a seamless web of deserved trust that occurs very rarely in business and in life.

A Letter to Bertie

Warren Buffett disdains vapid shareholder communications prepared by public relations officials “serving up optimism and syrupy mush.” How does he avoid writing such a letter while not drowning readers in minutia that might only interest a small subset of shareholders? He does so by thinking of writing a letter to his sister, Bertie, who “understands many accounting terms” but “is not ready for a CPA exam.”1

Those of us who write about financial topics have much to learn from Mr. Buffett’s simple approach. It is difficult to write about complicated topics in a way that is simple but not simplistic. In years past, Mr. Buffett’s letters were longer and more detailed, and it seems like he has made a concerted effort to focus only on what he considers to be the most important elements of Berkshire’s results in the letter. Some readers will want more, but some sort of balance is obviously necessary.

Perhaps in the future, Greg Abel and Ajit Jain will have an opportunity to present a more comprehensive narrative of Berkshire’s results in their areas of responsibility. In Berkshire’s 2022 annual report, the appendix included a two page letter from Greg Abel that I found interesting and useful. The subject was related to the environmental impact of BHE, BNSF, and Berkshire’s other subsidiaries, but perhaps the topics could be expanded in the future. A letter by Ajit Jain could do the same for insurance.

Of course, we have management’s discussion and analysis the 10-K itself which is useful for many of us, but in my opinion, it would be beneficial for shareholders to hear from Berkshire’s Vice Chairmen directly in writing once a year.

Accounting Distortions

In 2018, a new accounting rule went into effect that requires changes in the value of equity securities during an accounting period to be recognized in net earnings. Prior to 2018, only realized gains and losses were recognized in net earnings while unrealized gains and losses were recognized in other comprehensive income.

Warren Buffett devotes some space in his letter to criticizing this change, something that I discussed a few years ago in Berkshire’s Hathaway’s Distorted Quarterly Results. Ever since this accounting change went into effect, Berkshire’s net income, which is widely reported in the financial media, has become useless as a means of conveying underlying business results. Berkshire prefers to focus on operating earnings:

“The primary difference between the mandated figures and the ones Berkshire prefers is that we exclude unrealized capital gains or losses that at times can exceed $5 billion a day. Ironically, our preference was pretty much the rule until 2018, when the ‘improvement’ was mandated. Galileo’s experience, several centuries ago, should have taught us not to mess with mandates from on high. But, at Berkshire, we can be stubborn.”

But this does not mean that shareholders should ignore the long-term changes in the prices of equity securities. While short-term gyrations in stock prices produce crazy swings in net income, long-term capital gains are very important at Berkshire:

“Make no mistake about the significance of capital gains: I expect them to be a very important component of Berkshire’s value accretion during the decades ahead. Why else would we commit huge dollar amounts of your money (and Bertie’s) to marketable equities just as I have been doing with my own funds throughout my investing lifetime?”

When the new rules first went into effect in 2018, there was a great deal of confusion because most mainstream financial media articles did not explain the change adequately, if at all. In recent years, many articles have begun to report operating earnings in addition to net income, but there is still much confusion every quarter.

Current rules are so misleading that they seem destined to be changed at some point in the future, but there is no way to know when this might occur. In the meantime, shareholders should focus mostly on operating earnings while monitoring the business results of Berkshire’s large holdings of marketable equity securities. Berkshire runs a highly concentrated portfolio, with Apple being the most important holding, by far.

Dealing with Rascals

As Warren Buffett has often said, you cannot make a good deal with a bad person.

“In 1863, Hugh McCulloch, the first Comptroller of the United States, sent a letter to all national banks. His instructions included this warning: ‘Never deal with a rascal under the expectation that you can prevent him from cheating you.’ Many bankers who thought they could ‘manage’ the rascal problem have learned the wisdom of Mr. McCulloch’s advice – and I have as well. People are not that easy to read. Sincerity and empathy can easily be faked. That is as true now as it was in 1863.”

Although he never mentions the controversy surrounding Pilot that culminated in a lawsuit last year, I somehow suspect that Mr. Buffett might have been thinking of the Haslam family when he wrote this section of the letter, although I could be wrong!

I wrote about the lawsuit in November and, after many twists and turns, it was finally settled in January 2024. I have yet to read Berkshire’s 2023 annual report from cover-to-cover but I did scan the report to find that the purchase price for the remaining 20% of the business was $2.6 billion, implying a valuation of Pilot of $13 billion. This is substantially below the $19.8 billion valuation when Berkshire purchased a 41.4% interest for $8.2 billion in January 2023.

I think it is fair to conclude that Berkshire’s countersuit was strong enough to induce the Haslam family to settle on terms much closer to Berkshire’s figures than on what they originally sought in the lawsuit. Berkshire’s countersuit included some very disturbing details about the incentive structure put in place at Pilot. The settlement means that we are unlikely to ever learn the full details of what took place.

Warren Buffett likes to criticize by category and praise individually, so perhaps that is what he was doing with this quote. The more general point is that people are very complicated and trust, which requires years to build, can be destroyed quickly. This seems to be what happened with Berkshire’s association with the Haslam family. It will be interesting to see whether there are any questions regarding the lawsuit at the annual meeting and if Mr. Buffett chooses to discuss the matter in more detail.

Limited Investment Opportunities

With Berkshire’s net worth under generally accepted accounting principles reaching $561 billion at the end of 2023, far in excess of any other American business, it has become impossible to grow extremely rapidly.

“There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others. Some we can value; some we can’t. And, if we can, they have to be attractively priced. Outside the U.S., there are essentially no candidates that are meaningful options for capital deployment at Berkshire. All in all, we have no possibility of eye-popping performance.”

Berkshire should still have “somewhat better prospects” compared to most large companies in the United States, which I believe refers to opportunities to grow the intrinsic value of its existing operations over time. Much more importantly, Mr. Buffett believes this can be done on a favorable risk-adjusted basis:

“With that focus, and with our present mix of businesses, Berkshire should do a bit better than the average American corporation and, more important, should also operate with materially less risk of permanent loss of capital. Anything beyond ‘slightly better,’ though, is wishful thinking. This modest aspiration wasn’t the case when Bertie went all-in on Berkshire [in 1980]– but it is now.”

Longtime readers of Warren Buffett’s letters know that he has been warning of an imminent slowdown due to limited opportunities for decades. However, Berkshire is now firmly in the top ten public companies by market capitalization and I think it is undeniable that it takes far more to move the needle at Berkshire than ever before.

For those of us who have a very large investment in Berkshire relative to our net worths, the fact that Mr. Buffett is laser focused on risk is reassuring.

History has proven the company’s resilience through multiple crises. While the market price of Berkshire’s shares have plummeted many times in the past, and surely will plummet again at some point in the future, Mr. Buffett states that he always seeks to avoid inflicting “permanent financial damage … on Bertie or any of the individuals who have entrusted us with their savings.”

The implicit message is that Warren Buffett takes the stewardship of our capital as shareholders as seriously as the stewardship of his sister’s capital. If almost any other CEO of public company wrote this, I would dismiss it as mere bloviating, but Mr. Buffett has a six decade record that backs up this understanding.

How many CEOs regard their company’s capital as the savings of actual people?

Permanent Holdings of Marketable Securities

Given the paucity of investment opportunities, it is logical that Berkshire should favor holding the shares of excellent businesses that it has already acquired. After discussing Berkshire’s long-held investments in Coca-Cola and American Express, Mr. Buffett writes about Berkshire’s yearend 27.8% stake in Occidental Petroleum shares.2 Just as he said during last year’s annual meeting, Berkshire has no plans to acquire or manage Occidental and has confidence in Vicki Hollub’s leadership.

I was a bit surprised to see the five Japanese trading companies placed into a similar category of quasi-permanent holdings. Berkshire had an unrealized gain of $8 billion from these investments at yearend with the majority of the position funded by cheap Yen debt. Mr. Buffett praised Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo for having policies that are more shareholder-friendly than common practices in the United States. The CEOs are less aggressive about their own compensation and have rational capital allocation policies. Berkshire has pledged to keep its holdings of each company below 10% but these relationships could produce other opportunities:

“An additional benefit for Berkshire is the possibility that our investment may lead to opportunities for us to partner around the world with five large, well-managed and well-respected companies. Their interests are far more broad than ours. And, on their side, the Japanese CEOs have the comfort of knowing that Berkshire will always possess huge liquid resources that can be instantly available for such partnerships, whatever their size may be.”

The prospect of Berkshire providing funding for a large deal managed by one of the Japanese companies is quite enticing. Berkshire clearly has the cash to facilitate a deal of any conceivable size and, if the deal is in Japan, Berkshire has the balance sheet to issue much more cheap Yen debt which, so far, has been “very well received.”

Berkshire has partnered with other companies to do deals in the past, and this has not always produced great results. For example, we no longer read much about the potential for future partnerships with 3G Capital, Berkshire’s partner in KraftHeinz. Does Berkshire have enough internal knowledge to evaluate deals brought to the company by Japanese partners? Time will tell, but there is a great deal of risk aversion at Berkshire which seems like a healthy thing, especially for potential deals abroad.

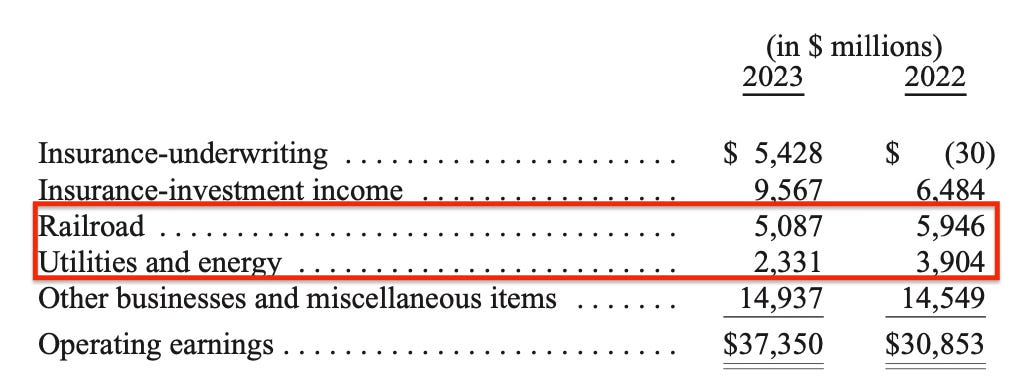

Weak Results at BNSF and BHE

I plan to review the results of BNSF and BHE in detail later this weekend and when these companies release their own annual reports early next week. Warren Buffett highlighted their weak performance in the letter because he had expressed optimism about their results at the 2023 annual meeting. Instead, both businesses posted much weaker operating results than in 2022:

Many Berkshire shareholders have been concerned about BNSF’s underperformance relative to the other major U.S. Class 1 railroads in recent years. I mentioned this problem in my August 2022 report on BNSF.3 Warren Buffett has been very patient with BNSF’s elevated operating ratio for many years, but it seems like his patience is starting to wear thin. After noting how important rail is to the American economy, how capital intensive the industry is, and the amount of hard work it takes to keep the trains moving, Mr. Buffett comments on BNSF’s poor recent performance:

“Though BNSF carries more freight and spends more on capital expenditures than any of the five other major North American railroads, its profit margins have slipped relative to all five since our purchase. I believe that our vast service territory is second to none and that therefore our margin comparisons can and should improve.”

Precision scheduled railroading (PSR), a management approach introduced by the late Hunter Harrison, has been relentlessly pursued by BNSF’s competitors over the past decade. However, political risks have increased, with PSR being blamed for accidents and poor working conditions. Berkshire is not likely to push for implementation of PSR, but I get the sense that the clock is ticking on management to improve results.

Mr. Buffett is more worried about BHE, citing a “severe earnings disappointment” in 2023 and going into detail on the political risks facing western utilities due to fires and other climate-related risks. As he has many times before, Mr. Buffett discussed the deal between states and public utilities that has been a stable business model for over a century. In exchange for utilities providing very large amounts of capital, the regulators promise these companies a fair return on their investment.

BHE has continued to invest heavily but the pact with certain states has been broken:

“Now, the fixed-but-satisfactory- return pact has been broken in a few states, and investors are becoming apprehensive that such ruptures may spread. Climate change adds to their worries. Underground transmission may be required but who, a few decades ago, wanted to pay the staggering costs for such construction?”

Underground relocation of electric lines is extremely expensive, as I discussed in an article on BHE in December. If required to mitigate wildfire risk, utilities will be justified in expecting a reasonable rate of return on the investment but will that return be forthcoming? Can BHE trust the word of politicians and regulators?

Perhaps not.

“Whatever the case at Berkshire, the final result for the utility industry may be ominous: Certain utilities might no longer attract the savings of American citizens and will be forced to adopt the public-power model. Nebraska made this choice in the 1930s and there are many public-power operations throughout the country. Eventually, voters, taxpayers and users will decide which model they prefer.

When the dust settles, America’s power needs and the consequent capital expenditure will be staggering. I did not anticipate or even consider the adverse developments in regulatory returns and, along with Berkshire’s two partners at BHE, I made a costly mistake in not doing so.”

The idea that a public-power operation could handle wildfire risk better than BHE and other companies seems unlikely to me, but that is a path that Mr. Buffett is obviously concerned about. If this occurs, BHE’s value could be significantly impaired.

BHE’s filings are long and complicated, with regulatory and legal language that is not easy to read, but I plan to study the company’s annual report next week in detail.

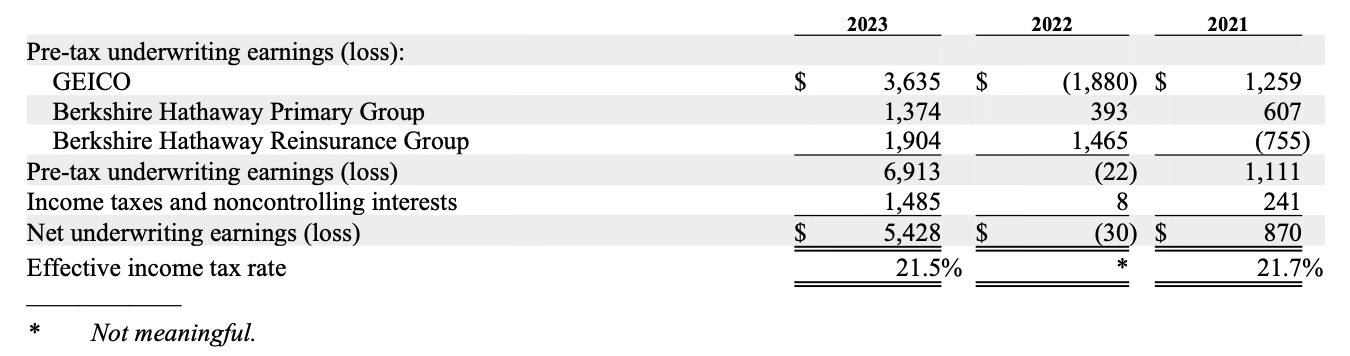

Exceptional Insurance Results

Berkshire’s insurance operations fired on all cylinders with records for sales, float, and underwriting profits. Mr. Buffett might be an optimist in general, but he doesn’t like to see too much optimism in the insurance operations! Surprises tend to be negative, especially in long-tail lines. I have not reviewed insurance results in detail yet, but this exhibit from the report shows why Mr. Buffett is happy with the results:

As usual, Mr. Buffett credits Ajit Jain, who joined Berkshire in 1986, with building up Berkshire’s reinsurance operations along with his team, most of whom are unknown to the press and the public. This is reassuring given that Mr. Jain is now 72 years old. Although Mr. Buffett notes that Berkshire’s long-time managers “regard 65 as just another birthday,” it is good to know that there is a bench of talent in the insurance business if the need arises for new leadership.

Missing Topics!

There are a few topics that were not mentioned in the letter. It is likely that some of these topics will come up at the annual meeting on May 4.

Apple Investment. At the annual meeting last year, my impression was that Warren Buffett thinks of Apple as a permanent holding. Apple is not mentioned in the letter. Berkshire slightly reduced its stake in Apple during the fourth quarter, although it is possible that this reduction was a decision made by Todd Combs or Ted Weschler rather than Warren Buffett.

GEICO Leadership. Although Ajit Jain is mentioned in the letter, there is no mention of Todd Combs who current serves as CEO of GEICO in addition to his role managing part of Berkshire’s portfolio of marketable securities. Mr. Combs has now served as GEICO’s CEO for over four years. Is this position permanent? If so, will he continue to manage investments at Berkshire as well?

Investment Managers. There is no mention of Ted Weschler and Todd Combs who manage at least $34 billion of Berkshire’s investments. Last year, I wrote an article asking whether Berkshire should disclose their performance. Since one or both of these men will take over all of Berkshire’s investments once Warren Buffett is no longer involved, more information would be useful.

Return of Capital. Mr. Buffett does note that Berkshire shareholders own more of investees such as Coca-Cola and American Express because of Berkshire’s stock repurchase program. There’s also a brief mention of Berkshire not “currently” paying dividends. As I wrote yesterday, I do not expect Berkshire to pay dividends anytime soon, so this is not necessarily surprising.

Pilot Lawsuit. As mentioned above, there is no explicit mention of the Pilot lawsuit, although we can make an inference that the settlement was favorable for Berkshire Hathaway based on the cost of the remaining 20% of Pilot that Berkshire purchased in January. It is unlikely that Warren Buffett will comment on the specifics at the annual meeting, although I’m sure he will be asked. Perhaps there is a lesson here for what to avoid in future acquisitions.

Personal Stock Trades. ProPublica published an article in November 2023 regarding alleged personal trades by Mr. Buffett revealed in IRS records that were obtained illegally by their source. As I wrote at the time, I am not concerned with the allegations but it seems likely that a question will come up at the meeting.

Every year, I open the annual letter with a bit of trepidation since there could easily be bad news in the first few sentences regarding Warren Buffett’s health or a decision to retire. Thankfully, we had no such news in today’s letter. Since it is certain that we would be informed of any serious health-related issues that impact Mr. Buffett’s ability to do his job, I consider no news on the subject to be good news.

Hopefully this article was useful for subscribers. I’m now turning my attention to the details of the annual report itself and will publish another article in the near future.

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Individuals associated with The Rational Walk own shares of Berkshire Hathaway.

Roberta “Bertie” Buffett Elliott is briefly profiled on a Northwestern alumni association webpage. As Warren Buffett indicates in the letter, his sister has donated significant sums to philanthropy in addition to growing very rich through her investment in Berkshire Hathaway which made in 1980 when she was 46 years old.

Berkshire increased its stake in Occidental Petroleum in early February.

Thanks, Ravi. Touched on all the important points for me. Well done.

My takeaway from this letter — which may or may not be accurate — is that Mr. Buffett is setting the stage for his successors with his discussions of BHE and BNSF. But, as you point out, he did not mention Todd & Ted. This could be because he doesn’t like to discuss on-going investments (except for permanent holdings)? Not sure if there is another explanation

.