The Digest #184

Ed Thorp: A Man for All Markets, Howard Marks on easy money, Active patience, Activist investing, Damodaran's 2024 data update, Michael Ovitz, Live Oak, Red Bull, Capital allocation, and more ...

“Blessed is the man who has ordered his needs to so just a measure that his riches suffice them without worrying him or taking up his time, and without the spending and the gathering breaking into his other pursuits which are quiet, better suited, and more to his heart.”

A Man For All Markets

As Nassim Taleb wrote in the foreword to A Man For All Markets, parts of Edward Thorp’s autobiography read more like a James Bond thriller than the memoir of a mathematician who ventured outside his academic field to beat casinos, both in Las Vegas and on Wall Street. I recently revisited the book and identified ten highlights which I published in a post on X/Twitter and have listed below:

Thorp's early experiences in Las Vegas were crazy. In 1963, he was part of a team of six that pretended not to know each other and sat down at the baccarat tables at the Dunes Casino. He ended up doing so well that the pit boss drugged his coffee! Later, the brakes on his car mysteriously failed. Wild stuff!

Thorp gained an edge in blackjack with a card counting method. He proved the theory through hands-on methods in Reno and published his findings in a book, Beat the Dealer, which is still read by gamblers today.

Roulette was a bigger challenge. To gain an edge, Thorp collaborated with Claude Shannon to build the first wearable computer. It was intended to provide the user with an edge in roulette. The computer was conceived in 1955 and tested in Las Vegas in 1961. Some technical problems prevented serious betting but it was a success and unveiled to the public in 1961.

Thorp turned his attention to a bigger casino: Wall Street. At least on Wall Street, no one would doctor his drinks or mess with his car's braking system. Thorp read Graham and Dodd but also immersed himself in technical analysis. Early forays were not satisfactory but he kept at it and eventually struck gold ...

Common stock warrants proved to be fertile ground for Thorp. He came up with a mathematical model to detect mispricing of warrants relative to the underlying common stock. By purchasing the relatively underpriced security and shorting the relatively overvalued security, he scored profits. Thorp wrote another book, Beat the Market, to explain his strategy.

Thorp came up with the math behind the Black-Scholes model before Black and Scholes who were at least partly inspired by reading Beat the Market. Thorp was, at heart, a mathematician and academic and shared his ideas, perhaps a bit too freely. Otherwise, the Black-Scholes option pricing model might today be known as the Thorp-Black-Scholes model.

Meeting Warren Buffett. Thorp met Warren Buffett in 1969 when a dean at U.C. Irvine asked Warren Buffett to vet Thorp. The dean was receiving a distribution from the liquidation of the Buffett Partnership and wanted to know what Buffett thought of Thorp's warrant strategy. Warren Buffett must have been impressed enough because the dean invested additional funds with Thorp.

Princeton Newport Partners. Thorp remained an academic through the 1970s but his income from investments eventually grew larger than his salary. Princeton Newport was Thorp's investment vehicle and he eventually gave up academia and devoted all his time to investing starting in the early 1980s. From November 1, 1969 through the end of 1988, Princeton Newport returned 19.1% before fees and 15.1% after fees compared to 10.2% for the S&P 500. Importantly, this was accomplished with far lower volatility than the S&P 500.

Thorp and Madoff. In the early 1990s, Thorp was asked to evaluate Bernie Madoff's track record for a client. Thorp was stonewalled by Madoff, but eventually discovered that the returns claimed by Madoff were impossible and that the trades reported by Madoff could not have possibly happened since they exceeded the volume for the market for certain securities. Thorp made it known that Madoff was a fraud but the establishment simply ignored his warnings.

Personal Finance. The book ends with a section on personal finance because Thorp felt strongly that lack of education in this area is a major problem for society. This was an unusual ending to an autobiography, but one that I think can be helpful for many readers.

To learn more about Ed Thorp, I recommend reading my full review of his book:

In 2021, Ed Thorp appeared on the Tim Ferriss show. At nearly ninety, he was clearly in exceptional shape and looked more like a man in his sixties.

Articles

Easy Money by Howard Marks, January 9, 2024. Listen to the memo. “In his latest memo, Howard Marks considers what financial history can teach us about periods of easy money, the impact they have on investor behavior, and what happens when they end. He analyzes macroeconomic trends using insights from Edward Chancellor’s latest book The Price of Time: The Real Story of Interest to argue that we’re unlikely to soon see the return of the permissive investment climate that prevailed in recent decades.” (Oaktree Capital)

I would recommend reading my review of The Lords of Easy Money by Christopher Leonard which documents the Fed's increasingly unconventional monetary policies since the 2007-09 financial crisis.

Active Patience by Ian Cassel, January 3, 2024. “The longer I invest the more I realize you get 1-2 great opportunities every few years. The rest of the time is spent wondering if you will ever get another great opportunity again and convincing yourself to own mediocre opportunities while you wait. Mediocrity is the price you pay for impatience. Great investors develop Active Patience. Active Patience means knowing what you are looking for and doing nothing until you find it.” (MicroCap Club)

Awe, Health, and Fear: 2023 Annual Letter by Brent Beshore, January 2024. PDF. There is a tribute to Charlie Munger toward the end of the letter based on a lunch meeting that took place in 2016. The notes are also available as an X/Twitter post. “Over the next three hours a small group of us entered into a wide-ranging conversation from ecology to architecture to politics, and, of course, business and investing. It was fun to watch how quickly and adeptly he would navigate complex subjects with a shocking amount of frankness, command of facts, and historical context.” (Permanent Equity)

Focused Compounding Fund, LP Issues Open Letter to the Board of Parks! America, Inc, January 9, 2024. I don’t know anything about Parks! America or this situation, but it is interesting to read about Geoff Gannon’s proxy fight for control of the company. I have been following Geoff’s writing for fifteen years and have often shared his articles and podcasts in The Digest. The letter is worth reading as an example of an activist proxy campaign. (Focused Compounding)

I am reminded of my review of Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism by Jeff Gramm, a book all about fights for corporate control.

Active vs. Passive Learning by Morgan Housel, January 2, 2024. Listen to the article. “Without time to passively think and learn, your education stalls between age 18 and 22, most of which likely consisted of active learning. It seems bizarre that as a boss you should give your employees idle time to do things that don’t look like productive work. But so many successful people found their key educational experiences during free time, passively, driven by their own curiosity and wandering minds.” (Collaborative Fund)

Cheap Steaks — and Other Lessons from Warren Buffett by

, January 9, 2024. This article provides highlights and commentary based on an interview of Warren Buffett which took place on March 13, 2007. “I’ve always been fascinated by those few Buffett media appearances that, for whatever reason, slip through the cracks and escape mainstream attention. In this case, it’s particularly interesting to look back and study his comments from this pre-GFC moment when regulatory reform seemed to be our most pressing economic challenge.” (Kingswell)The futility of estimating changes to all-cause mortality from target cancer screening studies by Peter Attia, January 8, 2024. “With the exception of some types of cancer … known to be less aggressive than others, individuals have a much better chance of surviving treatment and extending lifespan when cancer is detected early. Only a few forms of cancer even have widely available screening tests, so while the risks of possible harm should be weighed against the potential benefits for the individual, the best chance of not dying from cancer comes from catching cancer early through screening.” (Peter Attia MD)

Podcasts

Howard Marks: Investing During a Regime Change, January 4, 2024. 49 minutes. This is a podcast of the CFA Society Orlando. “In today’s episode, we cover the various phases of Howard’s career. We then discuss the beginning of his time in high-yield debt and how the shift to a risk-return framework for fiduciaries forever changed the investing profession. We also discussed his famous memos and his important thoughts on the Sea Change we are currently experiencing in markets and much more.” (The Investors First Podcast)

Michael Ovitz — Knowledge Is Power, January 9, 2024. 1 hour, 49 minutes. Transcript “Michael is the legendary talent agent and Co-Founder of CAA or Creative Artists Agency. Michael started CAA in 1975 and over the next 20 years, he built it into the world's most formidable talent agency, changing Hollywood forever. The list of stars he's worked with is endless, from Meryl Streep to Steven Spielberg and David Letterman.” (Invest Like the Best)

Who is Michael Ovitz, January 2019. Transcript. (Founders Podcast)

Live Oak: The Small Business Bank, January 3, 2024. 1 hour, 4 minutes. Transcript. “Live Oak is a bank that received its charter right before the financial crisis. It does not have the 100-year plus histories of many of the banks that we know so well today … This is a new story. And it's a new story with very interesting DNA in terms of how they built up this bank. They targeted specific industries. They targeted the SBA loan program, and they had technology in their DNA.” (Business Breakdowns)

Red Bull's Billionaire Maniac Founder: Dietrich Mateschitz, January 8, 2024. 1 hour, 8 minutes. "It is a must to believe in one's product. If this were just a marketing gimmick, it would never work." (Founders Podcast)

The Warren Buffett Way: Mastering the Art of Capital Allocation, January 8, 2024. 1 hour, 14 minutes. Video. Geoff Gannon and Andrew Kuhn outline the pros and cons of various approaches to capital allocation. (Focused Compounding)

The Last Ship From Hamburg, January 4, 2024. 48 minutes. “For a 30-year period, from the 1880s to World War I, 2.5 million Jews, fleeing discrimination and violence in their homelands of Eastern Europe, arrived in the United States. Many sailed on steamships from Hamburg. This mass exodus was facilitated by three businessmen whose involvement in the Jewish-American narrative has been largely forgotten.” (History Unplugged)

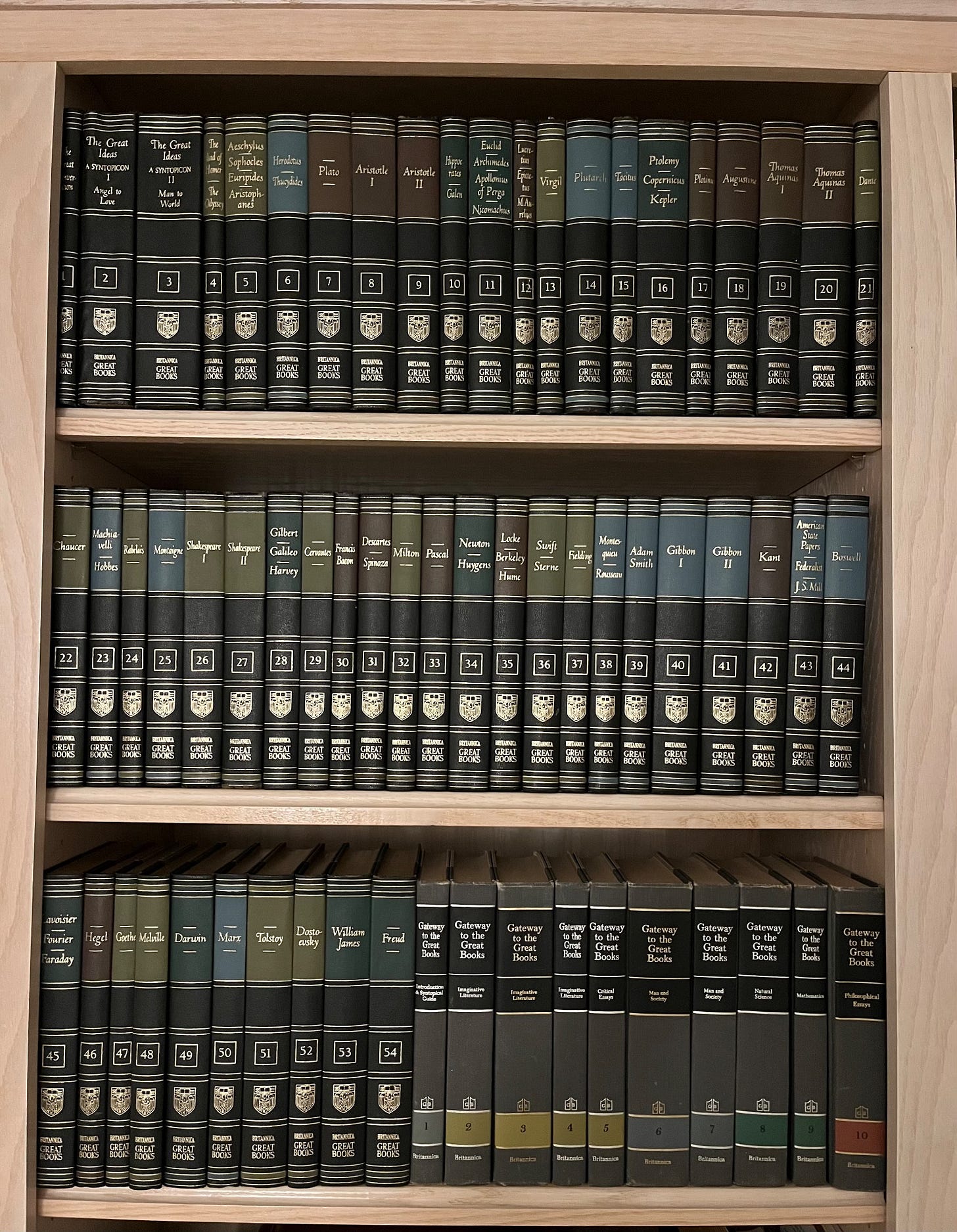

Great Books of the Western World

I recently acquired a vintage set of the Great Books of the Western World. Last month, I wrote an article about the introductory volume which I purchased separately. It is not easy to find these books in good condition. I am fortunate to have a pristine set.

Looking at the entire collection in my bookshelf is quite intimidating. Fortunately, I also have a ten volume set, The Great Ideas Program, which provides reading plans. Based on the recommended pace, completing the suggested readings could take up to six years. I plan to start at the recommended pace later this month.

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.