Progressive vs. GEICO: 2023 Results

Both companies posted underwriting profits last year but Progressive grew rapidly while GEICO lost market share.

“Our insurance business performed exceptionally well last year, setting records in sales, float and underwriting profits. Property-casualty insurance (‘P/C’) provides the core of Berkshire’s well-being and growth. We have been in the business for 57 years and despite our nearly 5,000-fold increase in volume – from $17 million to $83 billion – we have much room to grow.”

— Warren Buffett’s 2023 letter to shareholders

GEICO posted a record pre-tax underwriting profit of $3.6 billion in 2023. Earned premiums reached a record high of $39.6 billion and the combined ratio was 90.7% which represents the best underwriting performance since 2007. GEICO provided over half of Berkshire Hathaway’s underwriting profits, contributing to a banner year for the insurance business. As Warren Buffett wrote in his 2023 letter to shareholders, insurance was a bright spot that offset weak results in the railroad and utility groups.

If we look at GEICO’s performance in isolation, the results seem strong and highlight the insurer’s longstanding competitive advantages. GEICO has always been a highly efficient operator and its expenses have declined to record low levels relative to earned premiums. The loss ratio is returning to acceptable levels in line with the company’s long-term record. However, not all of the news is positive. GEICO’s policies-in-force declined by 9.8% in 2023 which followed a decline of 8.9% in 2022. GEICO achieved record profitability in 2023 but its market share is shrinking.

Progressive has long been GEICO’s most important competitor. In 2023, Progressive reported a pre-tax underwriting profit of $3 billion. Earned premiums reached a record of $58.7 billion and the combined ratio was 94.9%. Although Progressive posted a less favorable combined ratio in 2023 compared to GEICO, the company achieved this result while policies-in-force grew by 8.5% which followed growth of 3.3% in 2022. Progressive’s results since the pandemic have been stronger and more consistent compared to GEICO, resulting in impressive market share gains.

Berkshire Hathaway shareholders have been concerned about the railroad and utility groups due to weak earnings and concerns expressed by Warren Buffett in his letter to shareholders. In contrast, GEICO’s results have been widely celebrated. As I will explain in upcoming articles, I am less concerned about the rail and utility businesses compared to many Berkshire shareholders. However, I have concerns about GEICO’s performance that have not been widely discussed in the financial media.

This article provides a summary of 2023 underwriting results for Progressive and GEICO followed by my concerns about GEICO’s competitive position. One year is not sufficient for drawing long term conclusions, so I also present some longer-term comparisons. Since my primary focus in this article is to examine market share trends, I focus on underwriting operations and do not discuss investment results.

This article is the continuation of a series covering GEICO, Progressive, and their ongoing rivalry. The list below is a good representation of my recent thoughts on the industry. For new readers, I highly recommend reviewing my December 2022 profile of Progressive which provides a great deal of background information that this article builds on. All of the articles are free to read.

Auto Insurance Competitive Dynamics, April 6, 2022. This is a general overview of market share trends in the auto insurance industry over the past decade.

The Progressive Corporation, December 22, 2022. This profile examines one of the leading private passenger auto insurers in the United States with a focus on its rivalry with GEICO. This is a 36 page PDF report with an Excel file download.

Progressive vs. GEICO: The Battle Continues, May 5, 2023. Progressive's Q1 2023 results were poorly received. Does GEICO have an opportunity to reverse market share losses while returning to underwriting profitability?

Will Progressive's Growth Strategy Pay Off?, July 15, 2023. The auto insurer continues to add customers but posted disappointing results in the second quarter due to catastrophe losses and inadequate pricing.

Insurance Loss Reserve Estimates, August 23, 2023. The ability to accurately estimate loss reserves is a core competency for any well-run insurance company. Progressive provides a useful case study in loss reserving practices.

GEICO Prioritizes Profits Over Market Share, November 7, 2023. Berkshire Hathaway's auto insurer has returned to consistent profitability in 2023 but at the price of ceding market share that will be costly to regain in the future.

Market Share Update

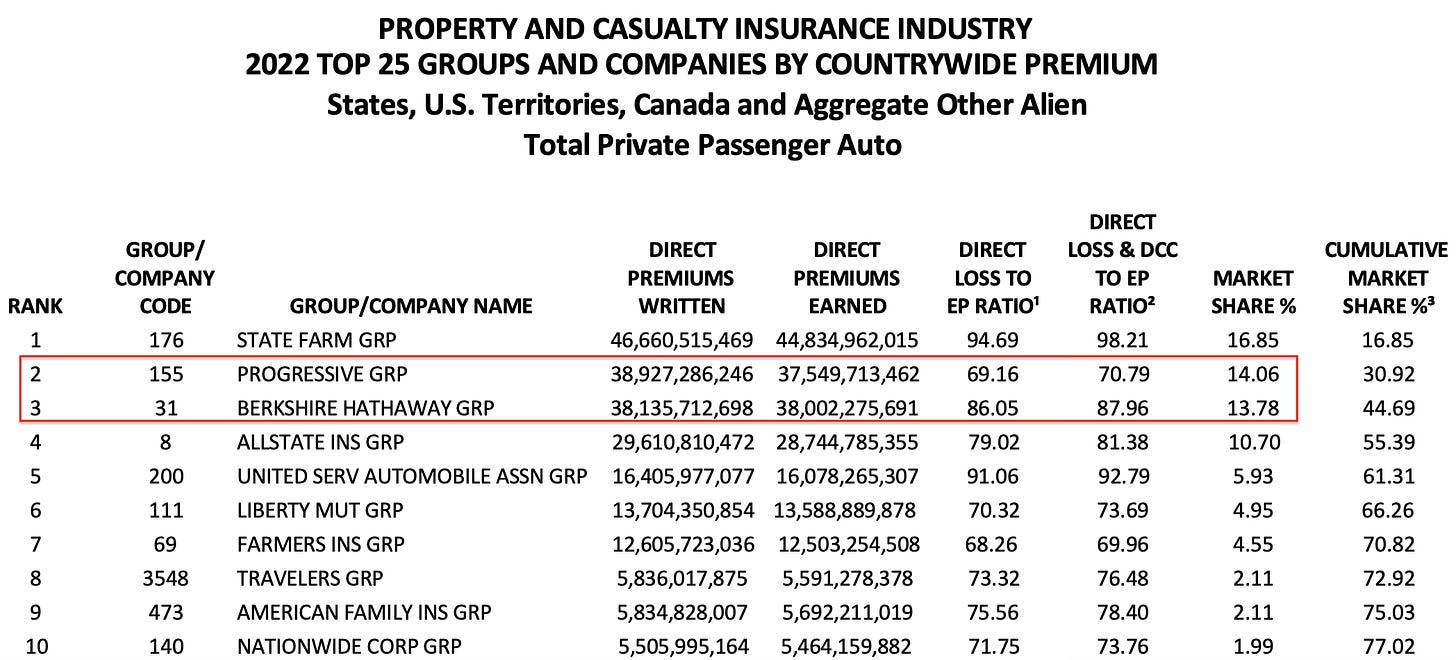

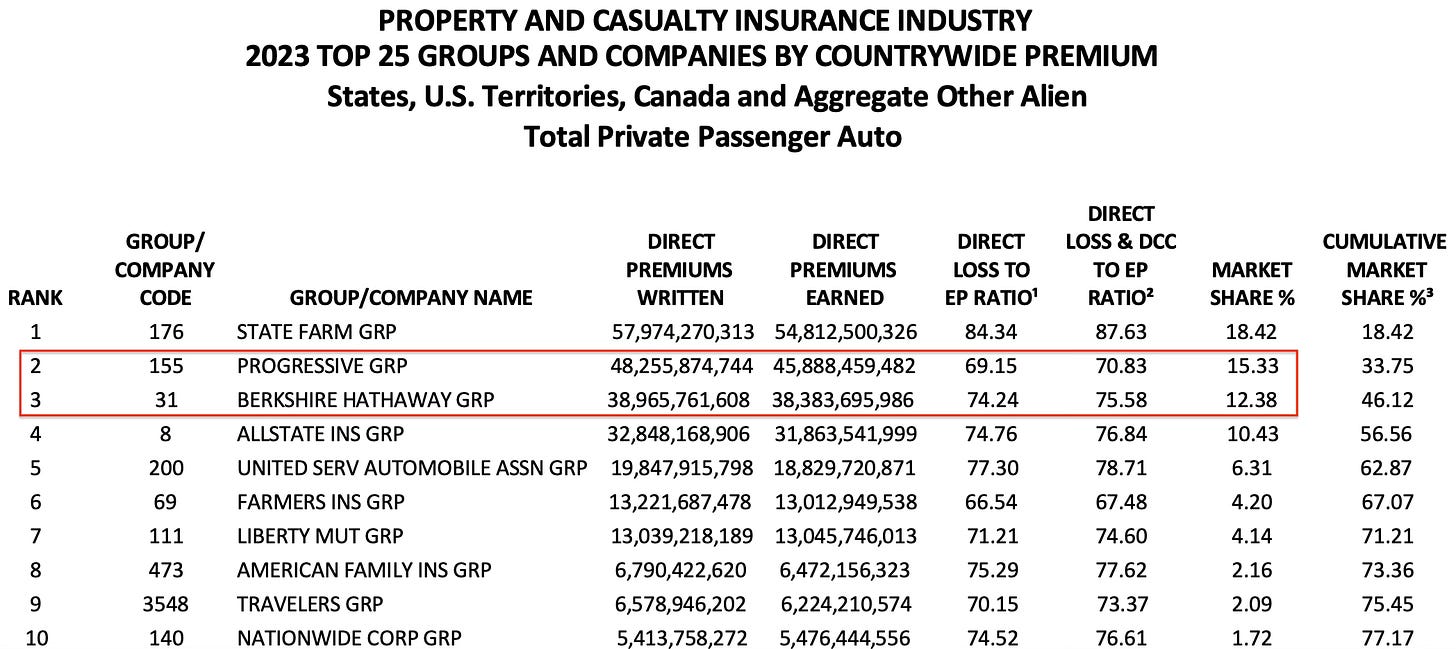

Shortly before I finished writing this article, the National Association of Insurance Commissioners released 2023 market share data for property/casualty insurers. I monitor this report every year, so I’ve added this section to briefly discuss the data.

The following exhibits show market share data for 2022 and 2023 for the top ten private passenger automobile insurers in the United States. Please note that the NAIC reports statutory accounting figures based on data submitted by insurers to state regulators. These figures differ slightly from GAAP accounting figures presented in SEC filings which are the sources I have used elsewhere in this article.

These market share changes are very significant:

GEICO’s market share fell from 13.78% to 12.38%.

Progressive’s market share rose from 14.06% to 15.33%.

State Farm’s market share rose from 16.85% to 18.42%.

It was already clear that GEICO lost market share in 2023 based on data in the Berkshire Hathaway and Progressive annual reports. Now we have official statistics compiled by an industry association. I will discuss market share issues in more detail later in this article but it is worth highlighting such major shifts at the outset.

Progressive’s 2023 Results

For the sake of brevity, this section focuses primarily on Progressive’s 2023 underwriting results. My December 2022 profile of Progressive contains far more details on long-term underwriting and investing results, loss estimation accuracy, and capital allocation.

In July 2023, I wrote an article questioning whether Progressive’s aggressive growth strategy would pay off. When the company reported results for June, the stock took a dive that left it down over 20% from its record high posted in April. The proximate cause of the decline in the stock price was lower than expected earnings for the second quarter, but there were longer-term concerns about strategy.

Progressive has long maintained an underwriting profit margin target of 4%, which is equivalent to a 96% combined ratio. Management seeks to grow policies-in-force and premium volume as quickly as possible consistent with achieving a 96% combined ratio. At the end of June 2023, policies-in-force had grown by 11.6% over the prior year but the combined ratio for the first half of the year was 99.7%, well above the target.

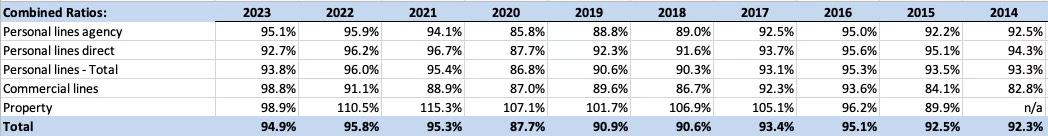

The exhibit below shows Progressive’s combined ratios by segment over the past decade. In this article, my primary focus is on the personal lines business which accounted for 78.8% of earned premiums in 2023.

As I discussed at length in August 2023, Progressive’s target causes underwriters to price policies such that the expected lifetime combined ratio of a policy is 96%. Management course-corrects during the year if the company-wide year-to-date combined ratio is off target. During the earnings call on August 2, it was clear that management planned to take corrective actions.

The following exhibit shows Progressive’s underwriting results on a monthly basis for 2023 as well as for January 2024. We can see that the loss ratio came down rapidly as the second half progressed, from a peak of 88.9% in June to 69.6% in December.

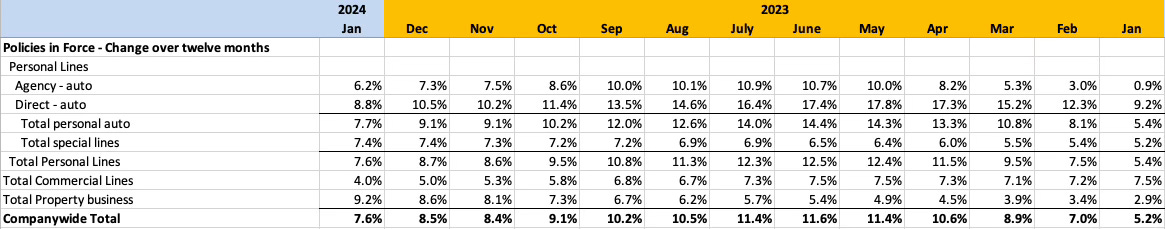

Improved profitability came at a cost. Growth in policies-in-force slowed dramatically in the second half of the year as Progressive took actions to better align premiums with claims experience. The vast majority of growth in policies for 2023 was posted during the first five months of the year, as we can see in the exhibit below:

The trend becomes clearer as we look at the change in policies-in-force over a trailing twelve month period, as seen in the exhibit below. Year-over-year growth peaked at 11.6% in June before falling to 8.5% in December and 7.6% in January.

Progressive posted unfavorable prior year loss development of $1.1 billion in 2023 compared to favorable loss development of $86.3 million in 2022. It is important to note that prior years development, whether favorable or unfavorable, affects the current year’s loss ratio. Progressive’s 2023 combined ratio of 94.9% includes the effect of this unusually large amount of unfavorable loss development.

Automobile insurance is “short-tail” because claims, particularly for physical damage, are reported quickly. Progressive’s loss estimation accuracy has generally been good but rapidly rising inflation in 2022 clearly caused estimated loss reserves to be insufficient. Underestimating the ultimate cost of claims also caused Progressive to underprice policies early in the year, resulting in an elevated loss ratio during the first half. Management’s discussion of 2023 results on February 27 was very useful in terms of understanding the problems facing the company and the corrective actions taken.

In addition to lowering the loss ratio in the second half of the year, Progressive reduced the expense ratio from a peak of 21.1% in March to 16.3% in December. Part of the reduction in the expense ratio was due to cutting advertising costs from $2,032.5 million in 2022 to 1,599.7 million in 2023. This decision also had the effect of slowing down growth in policies-in-force in the second half of the year.

In the earnings call on February 27, management expressed confidence in their rate strategy and seemed optimistic about gaining market share in 2024. Competitors are still raising their rates and management believes that this will cause more comparison shopping that could result in share gains. While management is open to increasing advertising spending, they are not eager to bring the expense ratio up to the 20% level that has been typical in past years unless they believe that more aggressive advertising will attract business consistent with the 96% combined ratio target.

In July 2023, I asked whether Progressive’s growth strategy would pay off. The verdict appears to be that it has paid off due to management’s course corrections in the second half of the year.

Gaining 1.27% of incremental market share in the brutally competitive private passenger auto insurance market while maintaining a combined ratio below 96% has to count as a major victory. Market participants seem to agree with my assessment. Progressive’s market capitalization now exceeds $111 billion, close to a record high which dwarfs shareholders’ equity of $20.3 billion as of December 31, 2023.

GEICO’s 2023 Results

As a subsidiary of Berkshire Hathaway, GEICO provides relatively little information to shareholders. This is particularly glaring when compared to the abundance of data provided by Progressive. As a result, Berkshire shareholders who wish to understand GEICO will find it useful to follow Progressive closely. While it would be useful to see results for GEICO every month and to hear directly from management, the company wishes to limit data that could be useful to Progressive and other competitors.

Let’s begin by looking at results on an annual basis over the past five years:

GEICO almost always operates with a combined ratio under 100% and acts as a source of stability in Berkshire’s insurance group, offsetting occasional losses in reinsurance.

In 2022, policies-in-force declined by 8.9% and average premiums per policy increased by 10.5%. GEICO posted an underwriting loss due to the effects of insufficient premium rates and skyrocketing inflation. The loss ratio shot up to an extremely elevated 93.1% which could not be fully offset by a declining expense ratio.

In 2023, policies-in-force declined by 9.8% and average premiums per policy increased by 16.8%. The loss ratio returned to an acceptable level consistent with recent years. This improvement was thanks to the impact of higher average premiums per policy as well as increased favorable development of prior accident years claims estimates.

In 2023, GEICO recorded favorable development of $1.5 billion in contrast with Progressive’s unfavorable development of $1.1 billion.

GEICO was more conservative with loss estimates in 2022. Effectively, GEICO’s combined ratio in 2022 was elevated due to this conservatism while Progressive’s combined ratio was suppressed. This effect reversed in 2023 as actual loss experience in 2022 became clear and each company adjusted their reserves accordingly.

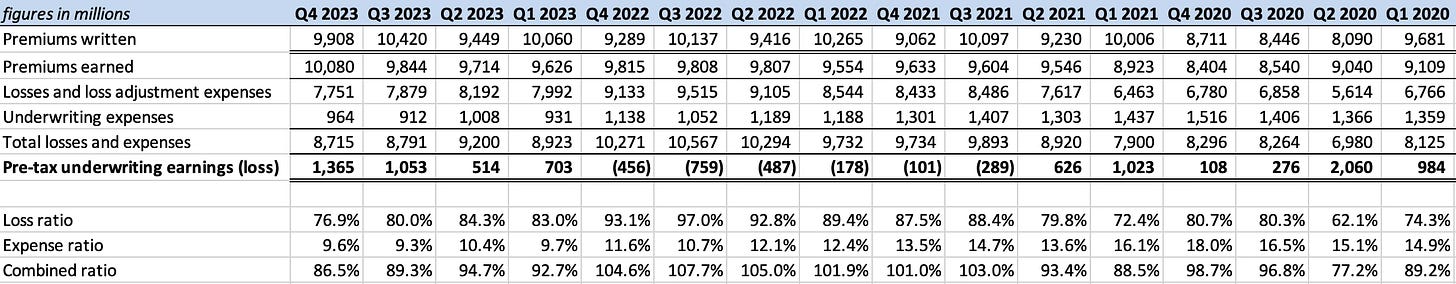

Let’s turn our attention to GEICO’s results on a quarterly basis since 2020:

In the early months of the pandemic, GEICO’s loss ratio plummeted due to fewer miles driven, but rebates to policyholders had the effect of reducing earned premiums later in the year. The loss ratio began to deteriorate during the second half of 2021 and peaked at 97% in the third quarter of 2022. A declining expense ratio, partly driven by a reduction in advertising, could not offset the rising loss ratio and the result was six consecutive quarters of underwriting losses. Starting in the first quarter of 2023, GEICO returned to underwriting profits as the loss and expense ratio both declined.

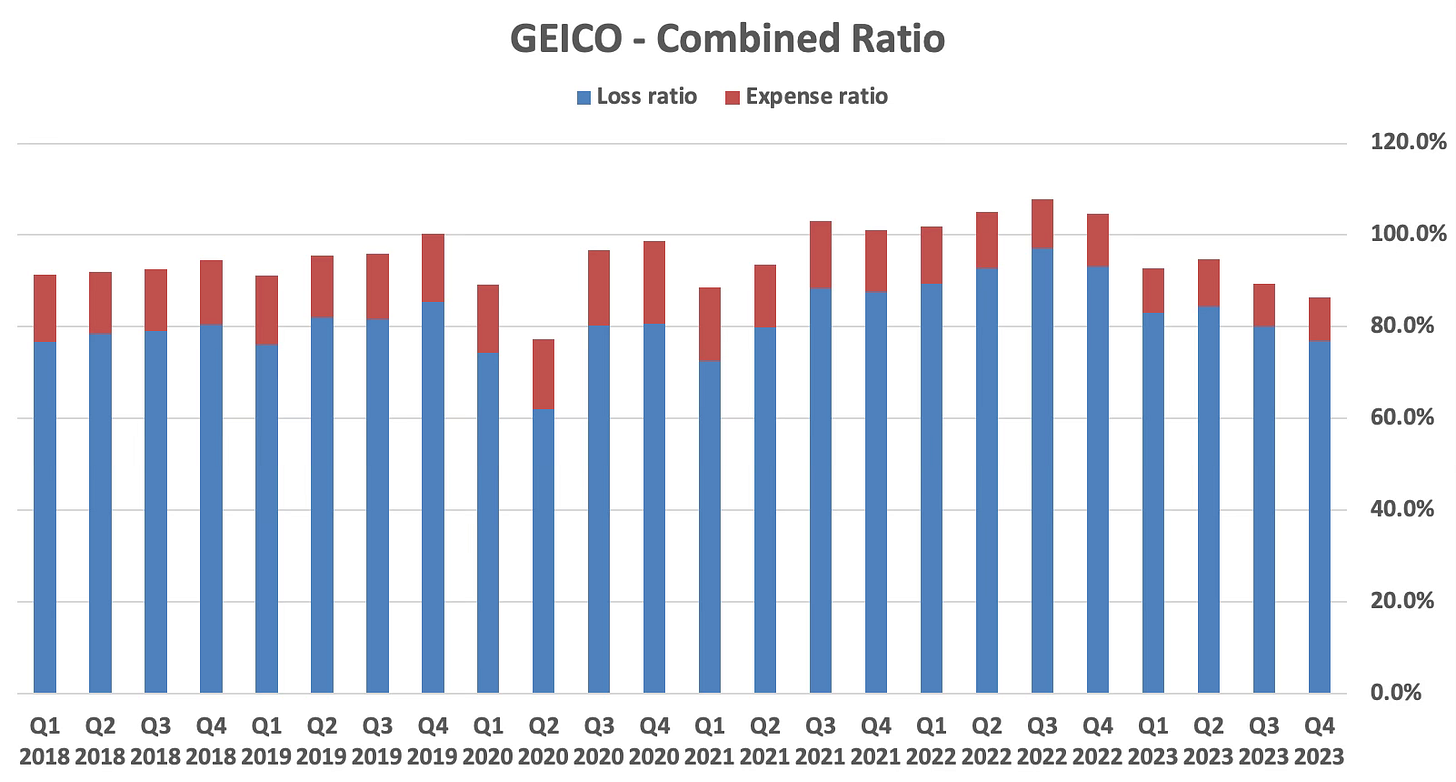

The following exhibit is a visual representation of the combined ratio since 2018:

GEICO’s management clearly took actions to increase premium rates to levels consistent with underwriting profitability, but a major part of the strategy also involved cutting advertising which had the effect of reducing policies-in-force, as noted above. GEICO’s management knew that market share losses would results from the combined effect of higher premiums and less advertising, as I pointed out in my article covering GEICO’s third quarter results. The top priority was to get back to underwriting profitability, even at the cost of shrinking the business.

Growth for the sake of growth can be deadly in the insurance business. Berkshire Hathaway has a long history of being willing to shrink an insurance business if doing so is required to achieve underwriting profitability. To the extent that management’s decision to shrink avoided underwriting losses, these actions would be justified. But if management’s decisions resulted in a loss of business that would have been profitable in the long run, we should question whether it was the right call to make.

Progressive vs. GEICO

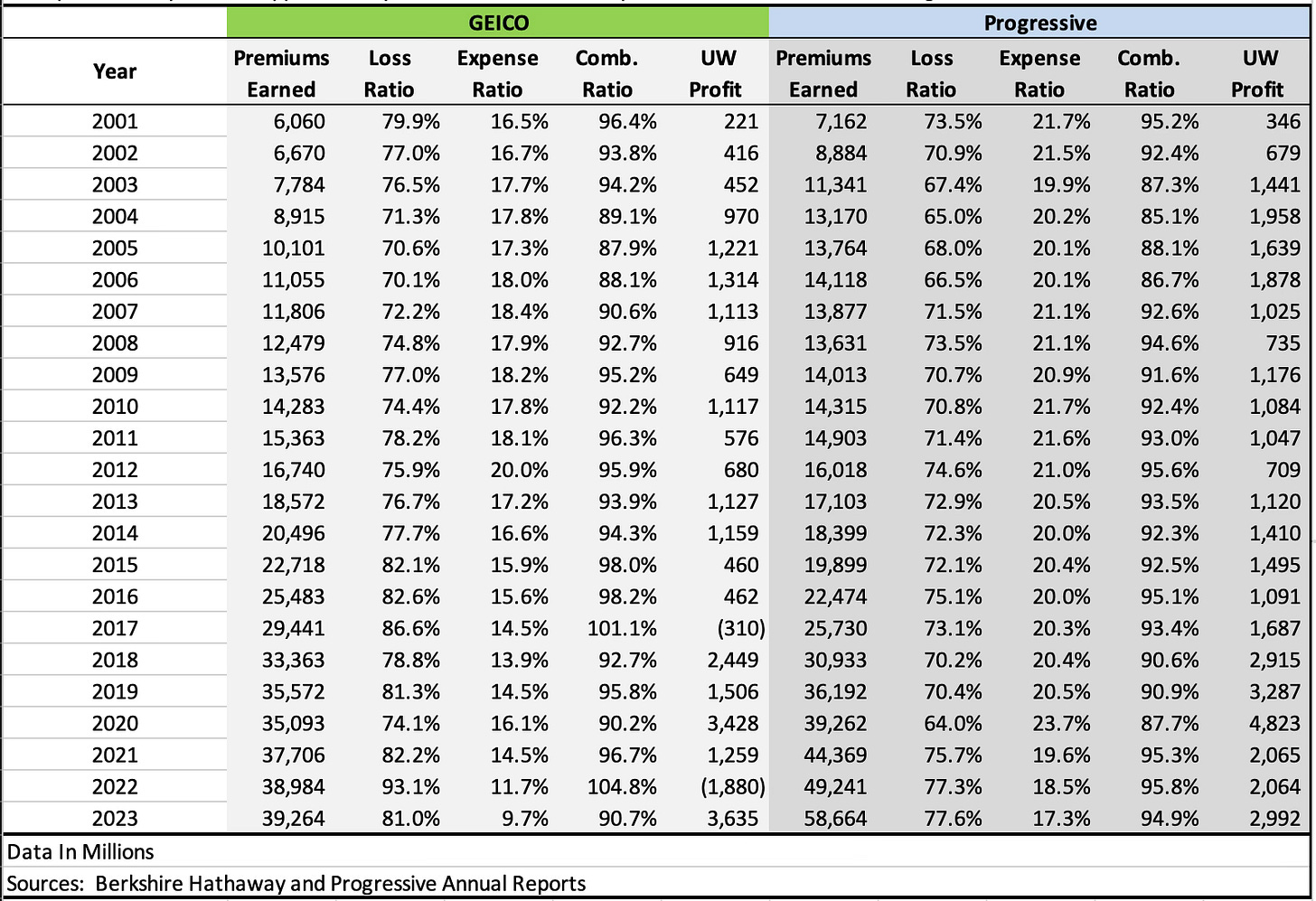

We have seen that Progressive gained market share in 2023 based on data published by the National Association of Insurance Commissioners. It is helpful to take a much longer term view of the competition. The table below shows earned premiums, and profitability metrics for both companies since 2001. Premiums earned for Progressive includes commercial lines and property insurance. Since 2015, Progressive has offered residential property and rental insurance. In 2023, Progressive’s personal lines auto business had earned premiums of $46.2 billion.

We can observe certain long term trends. GEICO has long maintained an advantage as an efficient operator reflected by its far lower expense ratio which has averaged 16.3% over the years in the exhibit compared to 20.5% for Progressive. Progressive has maintained a lower loss ratio which has averaged 71.5% over the years in the exhibit compared to 78% for GEICO. Progressive’s average combined ratio over this period was 92% compared to 94.3% for GEICO.

In the twenty-three years shown in the exhibit, GEICO’s cumulative underwriting profits were $22.9 billion compared to $38.7 billion for Progressive. GEICO posted two years of underwriting losses while Progressive never posted an underwriting loss.

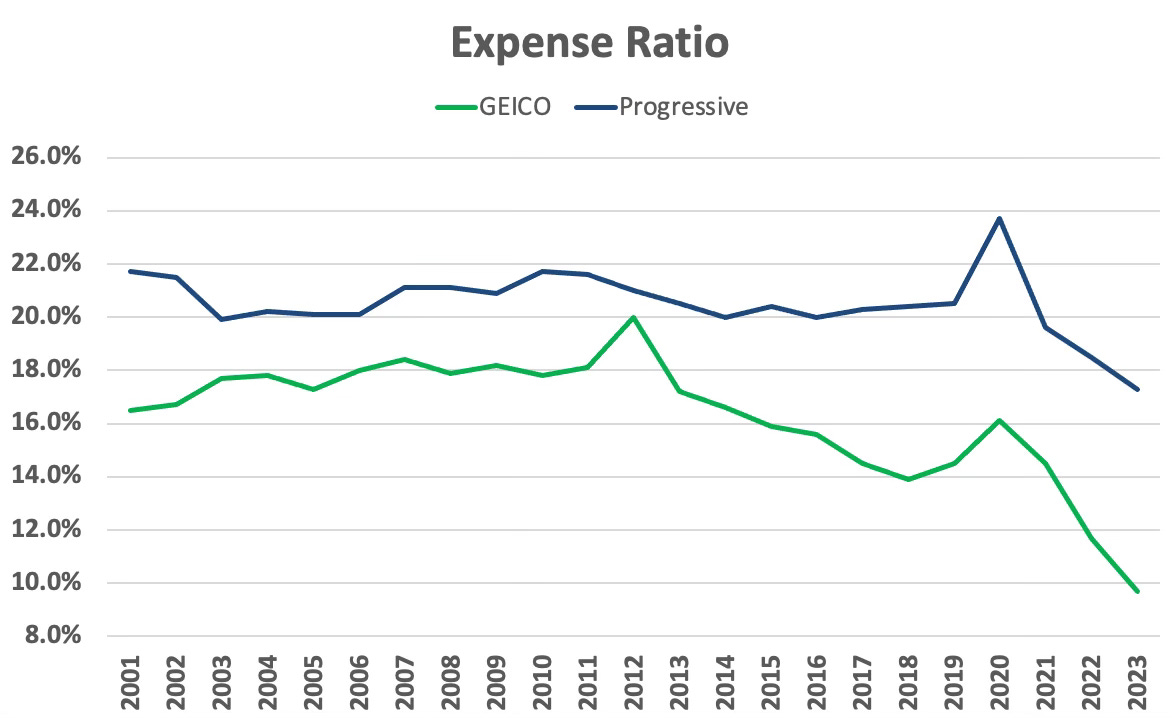

While GEICO’s ability to cut underwriting expenses can be viewed as admirable, this has come at the cost of market share. The exhibit below shows how extreme the expense ratio cut has been relative to the long term record:

It is unrealistic to expect that GEICO’s expense ratio can remain at recent levels going forward, at least not without ceding additional market share to competitors.

In the long run, the expense ratio needs to come back up to permit additional advertising spending. Additionally, GEICO needs to invest in better technology to remain competitive in terms of matching premium rates to driver risk.

If GEICO can maintain a loss ratio in the 80% range, the expense ratio could return to 12-14% while still delivering a combined ratio in the low to mid 90% range.

Progressive has been capable of growth while delivering underwriting profits and Berkshire Hathaway shareholders should expect GEICO’s management to strive to regain lost market share while delivering underwriting profits.

Many Berkshire Hathaway shareholders have looked to Progressive’s market value as a benchmark for what GEICO would be worth as a public company. However, it is clear that an independent GEICO would trade at a lower market value than Progressive under current conditions. This is not to suggest that GEICO will ever be spun off, only to note that in a sum-of-the-parts analysis, Berkshire shareholders can no longer view Progressive’s market cap as a proxy for GEICO’s intrinsic value.

Conclusion

Looking at the headline numbers is not always sufficient when it comes to analyzing a company’s progress. This is certainly true when analyzing GEICO’s performance in 2023. While Berkshire Hathaway shareholders are obviously relieved to see GEICO return to underwriting profitability, we cannot look at this result without considering the steep loss of market share. Progressive was able to add market share in 2023, with a significant amount taken from GEICO, and did so on a profitable basis.

The market for insurance is usually “sticky” because customers do not normally seek out competitive quotes unless premiums are rising rapidly. The churn of the customer base in recent years has occurred because people naturally look for alternatives when their costs are inflating by double digits annually. If we return to a stable premium rate environment, inertia will keep most people from shopping around unless they are prompted by heavy advertising.

Warren Buffett has spoken about his willingness to authorize heavy advertising spending at GEICO when conditions warrant doing so. The litmus test must be that new customers will be profitable over their expected policy lifetime. Hopefully, GEICO is now in a better position to resume advertising with competitive rates and will take back profitable market share from Progressive. However, doing so will not come without increasing advertising spending resulting in a higher expense ratio.

It is worth noting that Progressive’s lead in telematics could be the key factor allowing management to set rates commensurate with risk. Having real time data on the behavior of drivers makes it possible to set rates more appropriately compared to insurers relying primarily on demographic characteristics and driving records. GEICO has made progress in this area, as I noted in my article covering Ajit Jain’s comments at the Berkshire Hathaway’s 2023 annual meeting:

“As he has stated in prior meetings, Mr. Jain acknowledged that GEICO had been slow in adopting telematics. In addition, he noted that the company’s information systems needed significant work with hundreds of systems that don’t talk to each other. Management is working on integrating information systems and making rapid strides in telematics that should lead to better matching of pricing and risk. GEICO is now at the point where about 90% of new business has a telematics input on pricing.”

It will be interesting to see how quickly GEICO increases advertising spending and whether market share follows. Following Progressive’s monthly results can provide an advance clue regarding overall industry conditions. GEICO has important cost advantages that should provide underwriting profits on a consistent basis in the years ahead but the competition with Progressive is certain to be brutal.

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Individuals associated with The Rational Walk own shares of Berkshire Hathaway.

Do you plan on writing a BNSF vs. Union Pacific comparison? Also, do you suspect that the discount of BNSF's enterprise value versus UNP is negatively diverging at the same pace and depth as GEICO versus Progressive? thx!