GEICO Prioritizes Profits Over Market Share

Berkshire Hathaway's auto insurer has returned to consistent profitability in 2023 but at the price of ceding market share that will be costly to regain in the future.

You glance at your phone on the commute to work one day and notice an email from your auto insurer. Your semi-annual premium has increased again, but this time it is a shocker. For the first time ever, the premium has a comma in it! As the thought of a six month premium over $1,000 sinks in, you start to consider whether the insurer that you’ve been with for many years is still offering the best deal.

Auto insurance is typically a “sticky” product. Once enrolled in a policy, most people rarely think about their coverage or the premium as long as there are no dramatic changes. If your semi-annual premium increases from $925 to $940, are you really going to spend an hour or two researching other options to possibly save the cost of having lunch at Chipotle? Probably not, but if the premium increases from $925 to $1,015, that’s a different story, especially since there’s a comma in the new premium! People tend to psychologically anchor on large round numbers.

As the average annual auto premium rocketed above $2,000 recently, consumers have been willing to consider alternatives. Auto insurers have been in a position where they must figure out how to retain customers while covering rapidly escalating costs. Since customer acquisition costs are significant, insurers do not want to risk losing profitable customers over rate increases. However, this has to be balanced against the need to avoid a flood of red ink as the cost of repairs to vehicles and humans escalate.

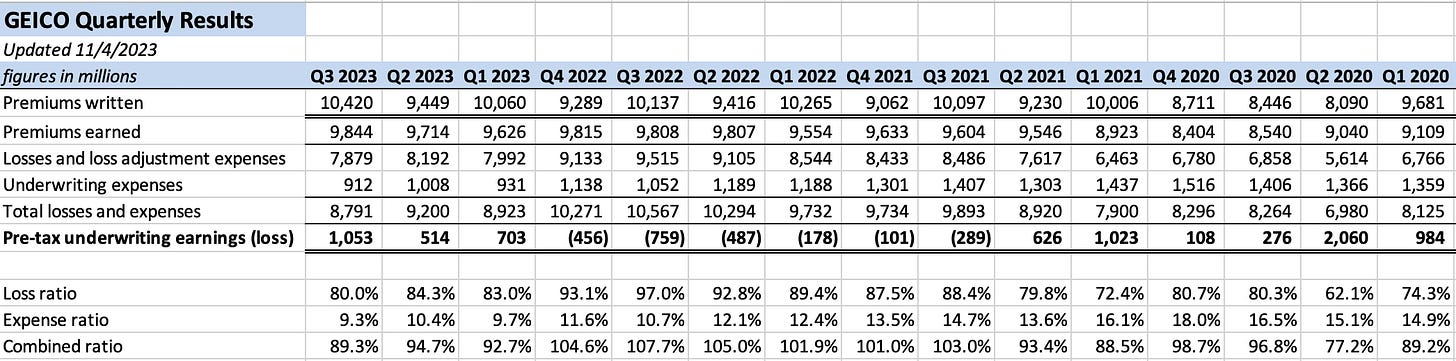

GEICO posted dramatically improved results for the third quarter of 2023. If we compare third quarter and year-to-date results to last year, there is no doubt that management has succeeded in stopping the flow of red ink that was brought about by higher than anticipated inflation. The following exhibit from Berkshire Hathaway’s third quarter report is a good summary of the year-over-year comparison:

While premiums earned were essentially flat for the third quarter and the first nine months of the year, GEICO swung from an underwriting loss to a profit. This was driven by improvements in both the loss ratio and the expense ratio resulting in a combined ratio of 89.3% for the third quarter of 2023 compared to 107.7% for the third quarter of 2022. The same trend is apparent for the first nine months of the year.

Taking a longer view, we can see that GEICO has posted underwriting profits for three consecutive quarters. This follows underwriting losses over six consecutive quarters. As a point of trivia, the underwriting profits from Q1 2023 to Q3 2023 exactly offset the underwriting losses from Q3 2021 to Q4 2022.

The following exhibit shows GEICO’s quarterly results since Q1 2020:

Before popping the champagne, shareholders should focus on some unpleasant aspects of GEICO’s recent results. The relatively flat trend in premiums written and earned mask dramatic shifts in the composition of GEICO’s business, as management disclosed in the quarterly report:

“Premiums written increased $283 million (2.8%) in the third quarter and were substantially unchanged in the first nine months of 2023 compared to 2022. Premiums written in 2023 reflected rate increases during the past 12 months that produced higher average premiums per auto policy (16.8%) and a 2.3 million decrease (12.7%) in policies-in-force over that period. GEICO significantly reduced advertising in 2023 and 2022 which contributed to the reduction in policies-in-force. Premiums earned were substantially unchanged in the third quarter and first nine months of 2023 compared to 2022.”

We can see that GEICO has been very aggressive on pricing over the past twelve months, pushing through higher premiums per policy of 16.8%, but this has come at the cost of losing 2.3 million policies, representing a steep 12.7% decline.

This loss of business can be attributed primarily to two factors: (1) The price increases; and (2) dramatically lower advertising. Management disclosed that ad spending was reduced by 54% in the first nine months of 2023. The absence of GEICO’s little gecko from television screens, particularly notable this fall during NFL games, comes at the cost of fewer inquiries for quotes and less overall brand awareness. However, in the short run, lower ad spending has helped profitability.

But how sustainable is this state of affairs? GEICO may want to shrink its business in the short run to improve its mix of customers, in terms of risk, and to contain costs, but we should note that the expense ratio has reached historic lows. As a point of comparison, GEICO’s expense ratio of 9.3% in the third quarter of 2023 was far lower than its 16.5% expense ratio in the third quarter of 2020. The exhibit below shows the expense ratio trend since 2018:

Taking a much longer view, the average expense ratio from 2001 to 2022 was 16.6%, so the figure for the third quarter of 2020 is far closer to “normal” that what we have seen recently. If GEICO’s expense ratio had been 16.6% for the first nine months of 2023, rather than the 9.7% actually posted, the combined ratio would have been 99.1% rather than 92.2%, meaning that underwriting would have been close to break-even.

On a more positive note, the loss ratio of 80% in the third quarter and 82.5% in the first nine months of 2023 is far improved over the comparable periods in 2022. This demonstrates that management has adjusted premiums to the point where they are adequate to pay for inflated claims costs.

If GEICO can stabilize the loss ratio at around 80%, even if the expense ratio rises to 15-16% in the coming quarters, this will result in a combined ratio of close to 96% which is the target that Ajit Jain disclosed at the 2023 annual meeting.

The customers representing the 2.3 million policies in force that GEICO has lost over the past year still need insurance. Where did they go? A significant percentage of them migrated to Progressive. Over the twelve months ending on September 30, 2023, Progressive’s policies-in-force for personal auto rose by 2.1 million, as we can see from the exhibit below (click on the image for a larger view):

The rapid growth in personal auto policies over the past year took place between October 2022 and May 2023. Policies-in-force plateaued in recent months with the count at the end of September falling 0.8% from the peak recorded at the end of May.

How has Progressive been doing from an underwriting profit perspective while gaining this market share over the past year? Let’s take a look at the monthly data:

Over the trailing twelve months, Progressive’s average combined ratio stood at 96.5%, comprised of an average loss ratio of 78.7% and an average expense ratio of 17.8%. Due to Progressive’s business outside of private passenger auto and the company’s agency channel, this isn’t an exact apples-to-apples comparison with GEICO, but it is apparent that Progressive has been able to gain share without bleeding red ink.

I have covered GEICO’s longer-term competition with Progressive many times in the past, most recently in Progressive vs. GEICO: The Battle Continues, which I published in May shortly after the Berkshire Hathaway annual meeting.

Ajit Jain has been candid in his comments regarding Progressive’s lead in telematics, as I discussed in the May article. A better understanding of the true risk of individual drivers makes it possible to match premiums with risk more closely. This can result in smaller premium increases designed to retain low-risk drivers while purposely shedding risky drivers through larger rate increases.

GEICO has a longstanding structural advantage when it comes to its expense ratio even if one assumes a return to more normalized levels of advertising spending. The company’s weakness, as I see it, is that management is forced to act on premiums with less precision which has the effect of turning away customers who are likely to be low risk and profitable over long periods of time. Progressive has been happy to add such customers, and their advantage in telematics means that they can be more discriminating in raising premiums based on actual driver behavior.

At the 2022 annual meeting, Ajit Jain expressed optimism that GEICO would catch up to Progressive in telematics “in the next year or two” which means that results in 2024 could be much improved, both in terms of underwriting profits and growth of policies-in-force. Unfortunately, it is expensive to regain lost customers. Doing so might require higher than normal advertising expenses over the next few years. I will be concerned about GEICO’s long term prospects if the expense ratio does not increase substantially going forward, reflecting a restoration of advertising spending.

Berkshire Hathaway investors have looked to Progressive’s market capitalization, currently approximately $92 billion, as a proxy for GEICO’s value. Given recent trends, I think that this comparison might lead to an aggressive valuation for GEICO. However, catching up to Progressive in telematics and regaining profitable market share could very well make up for lost ground over the next several years.

For more details on the competitive landscape and telematics, I recommend reading my article published in May:

This is the third article in a series that followed Berkshire Hathaway’s third quarter earnings release over the weekend. Previous articles in the series appear below:

I am planning to write one more article on third quarter earnings which will be sent out to subscribers this week. I welcome any comments on this series of articles.

Thanks for subscribing to The Rational Walk!

This article is exclusively for paid subscribers. If you found this article interesting, please click on the ❤️️ button and consider referring a friend to The Rational Walk.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Long Berkshire Hathaway.