Burlington Northern Santa Fe — 2023 Results

Warren Buffett is concerned about the performance of Berkshire's railroad

“Though BNSF carries more freight and spends more on capital expenditures than any of the five other major North American railroads, its profit margins have slipped relative to all five since our purchase. I believe that our vast service territory is second to none and that therefore our margin comparisons can and should improve.”

— Warren Buffett, 2023 letter to shareholders

Patience Has Limits

Private equity firms have a reputation, often well deserved, for loading up companies with debt and forcing changes designed to boost short term results regardless of longer term consequences. After a few years of improved metrics, the business is sold to its next owner or taken public and capital is recycled into new restructurings.

This is the polar opposite of Berkshire Hathaway’s “own forever” mindset. Warren Buffett has built his reputation as a patient owner focused on long-term results. He has no desire to “dress up” a business in the short run only to have it falter five or ten years from now. Berkshire stays away from trendy approaches to management and sticks with what has worked for decades. Managers are not asked to implement quick fixes to “make the numbers” this quarter or this year.

But Warren Buffett’s patience is not unlimited and, when it comes to numbers, he is not likely to miss very much. He is known to monitor the operations of Berkshire’s subsidiaries very closely and it would not be surprising if he regularly scrutinizes the weekly carload report published by Burlington Northern Santa Fe, the railroad that Berkshire acquired in February 2010. It has not escaped Mr. Buffett’s attention that BNSF has been underperforming its peers in recent years.

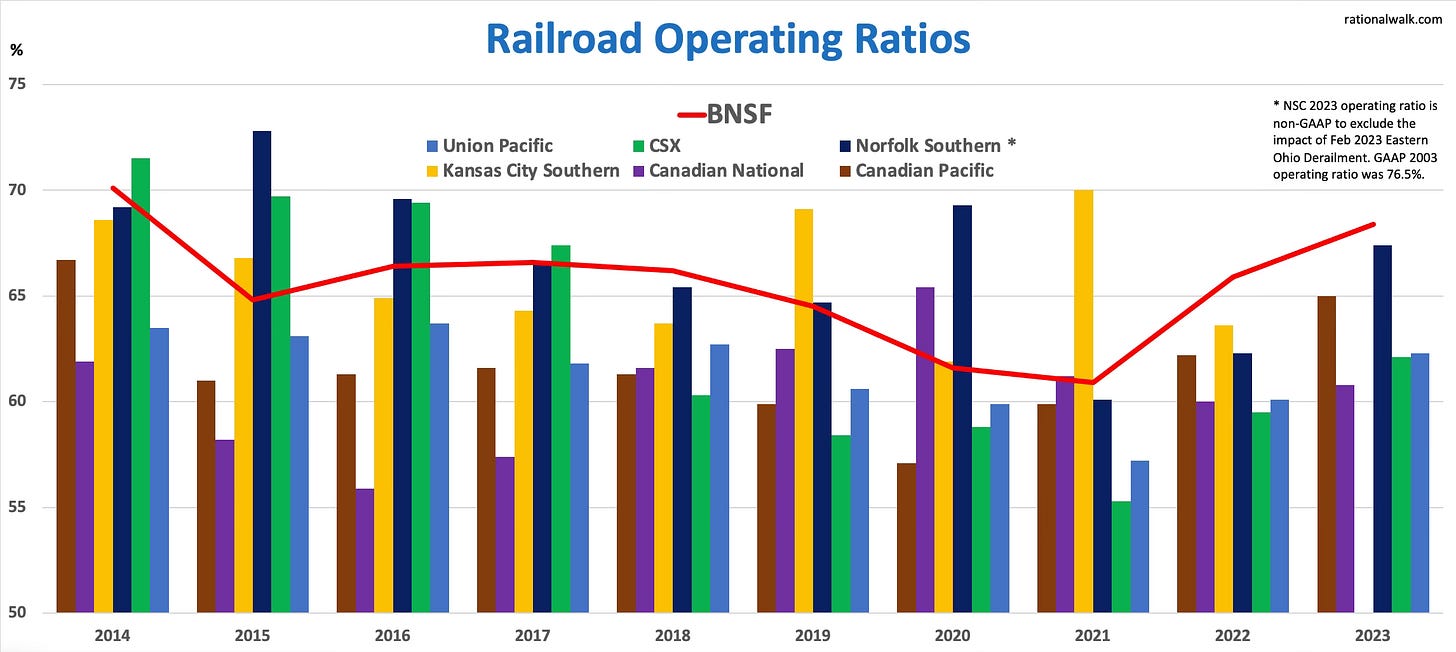

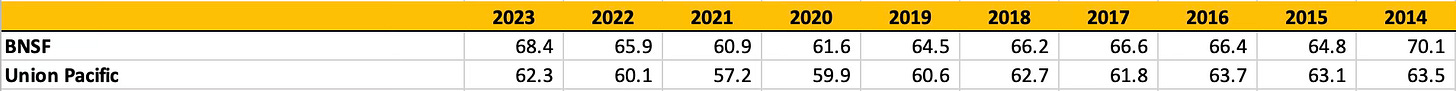

The following exhibit shows the operating ratio for the major North American railroads over the past decade. A railroad’s operating ratio is the ratio of its railroad operating expenses to railroad operating revenues. A lower operating ratio signals greater efficiency, reflected in higher profit margins.

The exhibit displays BNSF’s operating ratio as a red line while the other Class 1 railroads are represented in the bar chart. We can see that BNSF’s operating ratio has been on the high side over the past decade and, over the past two years, has exceeded the operating ratio of all other Class 1 North American railroads.1 When we look at the comparison between BNSF and Union Pacific, its closest competitor, it shows that BNSF’s operating ratio has been higher for every year displayed in the exhibit.

Why has BNSF underperformed relative to its peers?

This is a subject of much debate, but many point to the adoption of precision scheduled railroading (PSR) by competing railroads. PSR is an approach created by Hunter Harrison who had a long and very successful career in the railroad industry that I wrote about at length in a book review of his biography. Harrison died in 2017 but continues to influence the industry through his numerous protégés, including Jim Vena, the current CEO of Union Pacific.

Warren Buffett’s quote, presented at the beginning of this article, is part of a section of his annual letter about the railroad industry and BNSF. Mr. Buffett notes that rail is essential for the economy and will always require very large capital investments. He alludes to political risks for railroads including the possibility that union wages could continue to grow faster than reported inflation. While he is obviously proud of the railroad’s role in the American economy, Mr. Buffett clearly wants BNSF to at least perform in line with its peers. This seems quite reasonable.

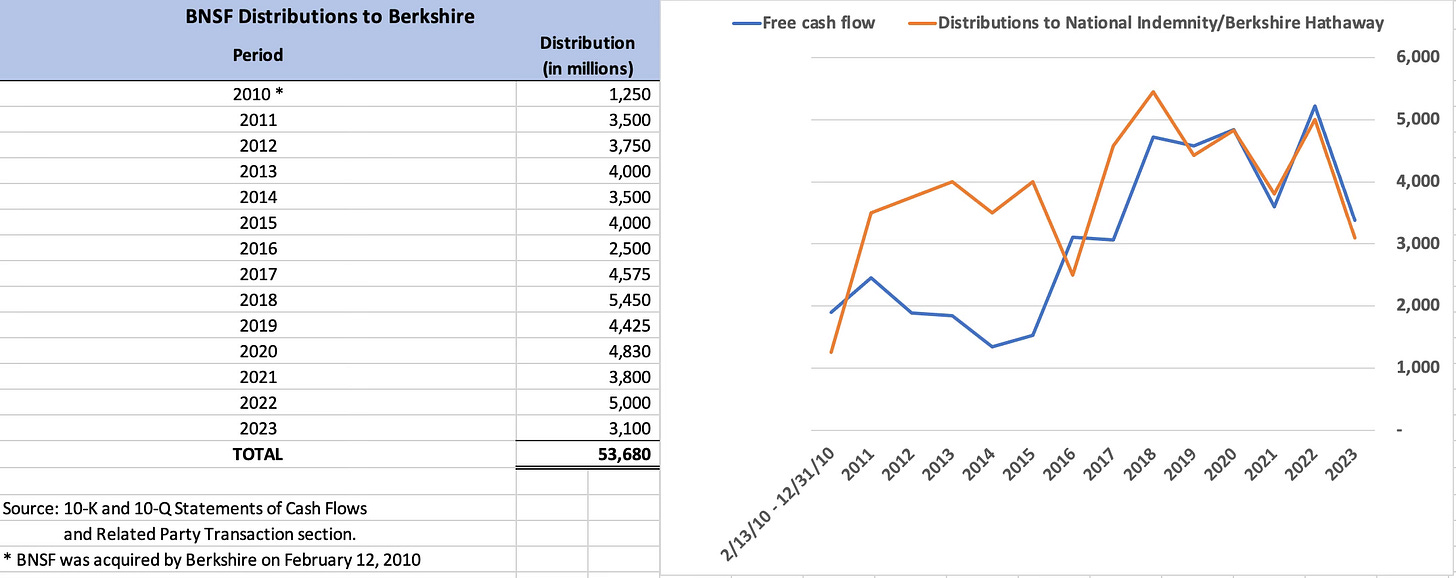

BNSF is one of Berkshire’s most important subsidiaries and has been something of a “cash cow” since it was purchased in 2010. Many shareholders seem to be under the impression that BNSF is a place where Berkshire can invest its free cash flow from its other business operations. Actually, the opposite has been true. Berkshire receives cash distributions from BNSF and must find a place to reinvest that cash elsewhere.2

Since the acquisition, BNSF has sent a total of $53.7 billion to Omaha for Mr. Buffett to allocate elsewhere, as shown in the following exhibit.3 In the early years, BNSF distributions to Berkshire exceeded free cash flow, funded by the addition of debt.4 In recent years, distributions have approximated free cash flow.

There is no reason to believe that Berkshire’s approach to BNSF’s free cash flow will change in the future. BNSF does have massive capital spending requirements, but those requirements are met with cash flow from operations. After deducting capex, BNSF sends its free cash flow to Berkshire which reinvests it elsewhere in the conglomerate. If BNSF underperforms relative to its peers, even by a significant margin, it will still be able to fund the maintenance of its network but dividends to Berkshire will be impaired, giving Mr. Buffett less cash to redeploy elsewhere.

In 2022, I wrote detailed profiles of both BNSF and Union Pacific. Given the existence of the profiles, I will only briefly discuss the longer term history in this article, instead focusing mostly on 2023 results and concluding with thoughts on the performance of BNSF since it was purchased in 2010 relative to the acquisition cost.

Burlington Northern Santa Fe, August 25, 2022. A review of Berkshire Hathaway's twelve years of ownership. PDF and Excel downloads available.

Union Pacific Corporation, September 26, 2022. Operating efficiency gains and aggressive repurchases have delivered attractive returns to shareholders over the past decade. Will these trends continue? PDF and Excel downloads available.

2023 Results and Ten Year History

Berkshire Hathaway reports information for BNSF, but the railroad files its own more detailed financial reports because it is an issuer of debt that is not guaranteed by Berkshire. BNSF is a wholly owned subsidiary of Berkshire Hathaway. Prior to September 30, 2023, BNSF was owned by National Indemnity, one of Berkshire’s insurance subsidiaries, but ownership was transferred to Berkshire on that date.5

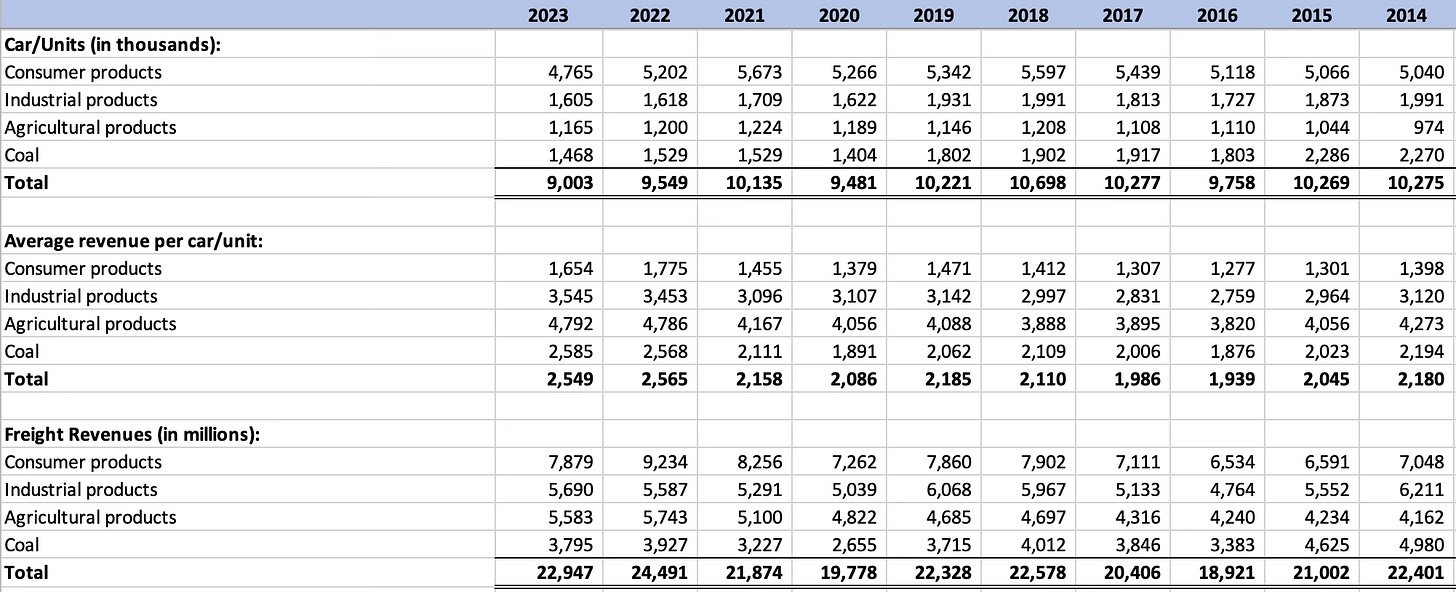

BNSF reported net income of $5,087 million in 2023, a decline of 14.4% from $5,946 million in 2022. Freight revenues declined by 6.3% in 2023 due to a 5.7% decline in car/units transported as well as a 0.6% decline in average revenues per car/unit. The decline in net income exceeded the revenue decline because operating expenses were only cut by 4.7%. The failure to cut operating expenses as fast as the revenue decline resulted in the operating ratio rising from 65.9% in 2022 to 68.4% in 2023.

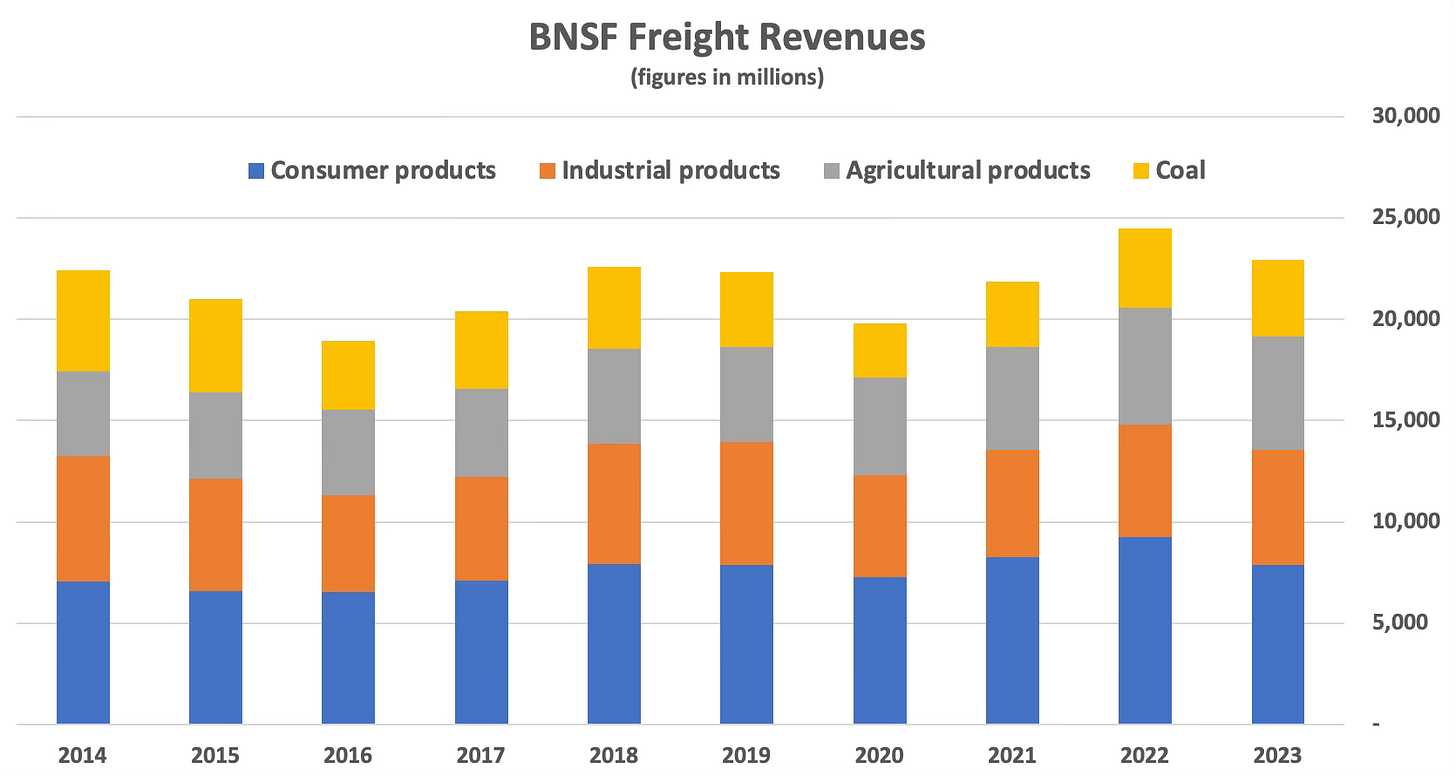

The following exhibit shows freight revenues by category over the past decade:

Freight revenue is a function of physical volumes shipped, reported as car/units, and the average revenue per car/unit. Over the past decade, volumes shipped by BNSF has declined while average revenue per car/unit has increased. The exhibit below shows the record of the past decade:

Management provided the following brief narrative in the 10-K regarding the cause of the across-the-board decline in volumes, replicated below in full:

Consumer Products volumes decreased due to lower west coast imports, the loss of an intermodal customer, and competition from lower spot rates in the trucking market which has impacted domestic intermodal demand, partially offset by an increase in automotive volume from higher vehicle production.

Industrial Products volumes decreased primarily due to lower demand for chemicals and plastics, minerals, paper, and lumber, partially offset by increased shipments of steel and aggregates from infrastructure demand.

Agricultural Products volumes decreased primarily due to lower grain exports, partially offset by higher volumes of domestic grains and feedstocks and renewable diesel.

Coal volumes decreased primarily due to moderating demand as a result of lower natural gas prices.

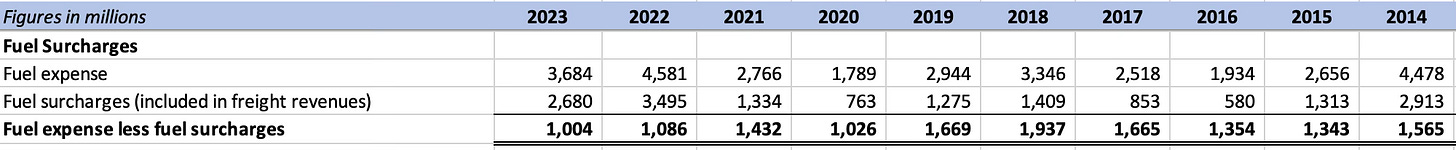

The decline in average revenue per car/unit was attributed primarily to lower fuel surcharge revenue. Since fuel prices declined in 2023, fuel surcharge revenue declined. Fuel surcharge revenue really represents a partial offset to fuel expenses. BNSF’s fuel surcharge revenue compared to fuel expense is shown below for the past decade:

Compensation rose by 4.3% in 2023 due to increased headcount, wage inflation, and the addition of employee costs related to Montana Rail Link.6 Fuel expenses were lower due to lower fuel prices, lower volumes, and improved fuel efficiency. Purchased services were lower primarily due to the sale of the brokerage operations of BNSF Logistics, partially offset by general inflation. The exhibits below show the categories of operating expenses over the past decade and the operating ratio:

BNSF’s physical volumes have actually declined over the past decade, as measured by car/units shipped, from 10.3 million in 2014 to 9 million in 2023. Average revenue per car/unit has increased from $2,180 in 2014 to $2,549 in 2023. The net result is that freight revenues have been nearly flat over a decade, rising from $22.4 billion in 2014 to $22.9 billion in 2023. We should note that these are nominal figures. In real terms, BNSF has experienced a significant revenue decline over the past decade.

For the first several years of the decade, management was able to reduce expenses to more than offset the revenue decline, resulting in the operating ratio declining from 70.1% in 2014 to a low of 60.9% in 2021. However, over the past two years, expense controls have deteriorated resulting in the operating ratio rising to 68.4% in 2023.

Union Pacific Comparison

BNSF competes with Union Pacific in the western two-thirds of the United States. When Warren Buffett says that BNSF’s margin comparisons should improve in the future, I believe his primary benchmark is Union Pacific since it is BNSF’s most direct competitor. It seems reasonable to expect BNSF to strive for sustaining profitability at least on par with Union Pacific over the long run.

While this article does not include a detailed analysis of Union Pacific’s results, it is appropriate to take a brief look at 2023 performance as well as the longer term record.

Union Pacific reported net income of $6,379 million in 2023, a decline of 8.8% from $6,998 million in 2022. Freight revenues declined by 2.5% in 2023 due to a 0.7% decline in car/units transported and as a 1.9% decline in average revenues per car/unit. The decline in net income exceeded the revenue as operating expenses increased by 0.5%. The operating ratio increased to 62.3% in 2023 from 60.1% in 2022.

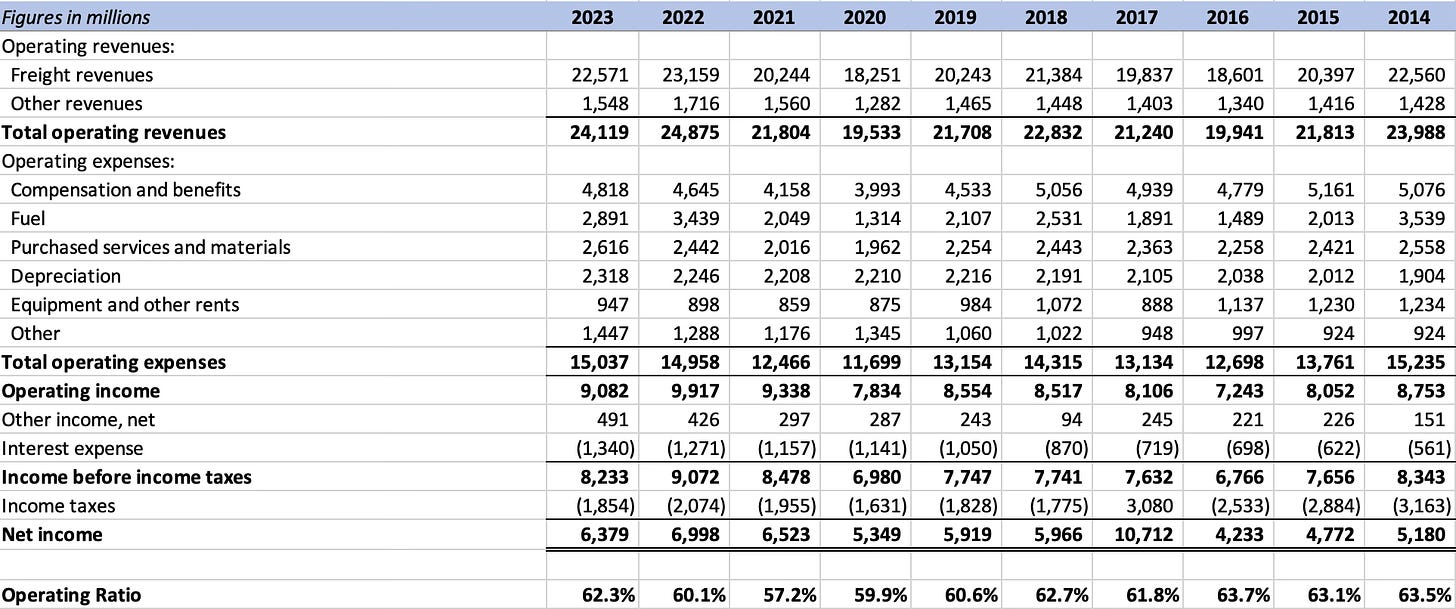

The exhibit below shows Union Pacific’s results over the past decade:

Union Pacific’s top line in 2023 was barely higher than in 2014 which mirrors BNSF’s experience over the decade. However, Union Pacific has consistently delivered a lower operating ratio, as we can see in the exhibit below, as well as in the chart at the beginning of this article comparing the Class 1 railroad operating ratios.

BNSF narrowed the operating ratio gap with Union Pacific between 2014 and 2021 as both railroads operated more efficiently, reaching a low of 60.9% for BNSF and 57.2% for Union Pacific in 2021. However, the gap has widened over the past two years.

This gap in efficiency adds up over a long period of time.

From 2014 to 2023, BNSF reported a cumulative total of $227.7 billion of operating revenues and $77.2 billion of operating income.

From 2014 to 2023, Union Pacific reported a cumulative total of $221.9 billion of operating revenues and $85.4 billion of operating income.

As Warren Buffett points out in his annual letter, BNSF carries more freight than Union Pacific and spends more on capex. He believes that BNSF’s “vast service territory is second to none” and it seems like management should be striving to match Union Pacific’s results, at a minimum. Operating efficiency is always important, but is even more critical in an industry experiencing very little revenue growth even in nominal terms. When we dig into the numbers, especially compared to Union Pacific, it is clear why Warren Buffett is not particularly happy with recent results.

BNSF’s Results Since Acquisition

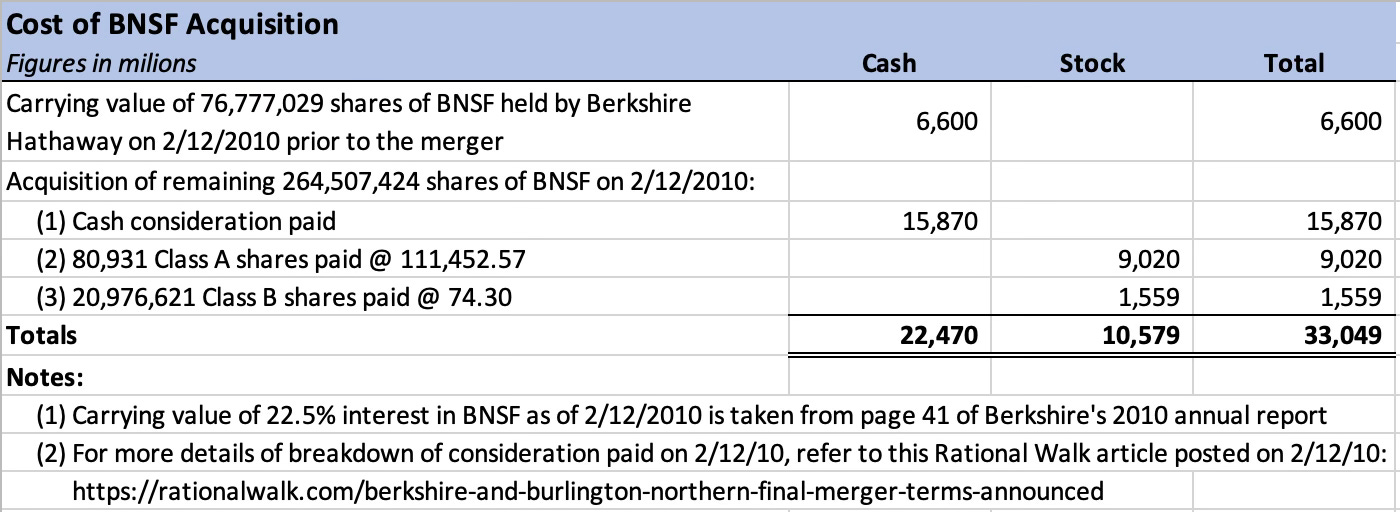

Recent results at BNSF have been disappointing but it is important to put the situation in context. Let’s start with looking at the cost of the acquisition:

Berkshire paid a total of $22.5 billion in cash plus $10.6 billion in Berkshire stock in exchange for full ownership of the railroad. Here are some cumulative statistics for BNSF from the date of the acquisition on February 12, 2010 to December 31, 2023:

Operating revenues: $305.2 billion

Operating income: $99.2 billion

Net income: $68.2 billion

Cash flows from operations: $95 billion

Depreciation and amortization: $30.6 billion

Capital expenditures: $51.5 billion

Free cash flow: $43.4 billion

Distributions from BNSF to Berkshire: $53.7 billion7

Railroads require massive capital expenditures to maintain existing tracks and related infrastructure. Since existing property and equipment is recorded at historical cost, depreciation charges fall well short of maintenance capex. We can see this very clearly in the figures presented above. The result is that net income overstates economic earnings for railroads. We should focus on free cash flow, not net income, when we consider BNSF’s true level of cash profitability.

Berkshire has now received cash distributions of $53.7 billion compared to the $33 billion purchase price. However, we should remember that Berkshire did not pay all cash for BNSF. 80,931 Class A shares and 20,976,621 Class B shares were issued to BNSF’s owners and this was valued at $10.6 billion on February 12, 2010. The value of those shares at today’s prices would be $57.8 billion. In effect, existing shareholders of Berkshire “sold” part of their interest in the business in exchange for BNSF.

Would Berkshire have been better off not acquiring BNSF in 2010? In my opinion, the railroad is an important asset for Berkshire that provides a stream of cash flow to headquarters that is independent of insurance results. In combination with the broadly diversified manufacturing, service, and retailing (MSR) group, these cash flows allow Berkshire to assume risks in the insurance business that should be more than covered by cash flows from the railroad and the MSR groups in any given year.

It is easy to lament the issuance of shares of Berkshire at a low valuation in early 2010 and I believe that Berkshire should have been much more aggressive with share repurchases in the years following the financial crisis. However, all things considered, I am glad that Berkshire owns BNSF today, even at current levels of profitability.

Conclusion

“A century from now, BNSF will continue to be a major asset of the country and of Berkshire. You can count on that.”

— Warren Buffett, 2023 letter to shareholders

Warren Buffett is known as a patient owner but he did not get to his current position in business by accepting inferior long-term results from Berkshire’s subsidiaries. His letter to shareholders extols BNSF’s network and sends the message that he sees no reason why BNSF’s operating ratio should not be in line with its peers.

If BNSF had matched Union Pacific’s 62.3% operating ratio in 2023, BNSF’s operating income would have been $9 billion rather than $7.4 billion. This would have brought an additional ~$1.2 billion to the bottom line and it’s nearly certain that management would have distributed this cash to Omaha for Mr. Buffett to redeploy elsewhere. This is obviously a meaningful number, even for a company as large as Berkshire, when we consider the cumulative effect over the next decade.

Norfolk Southern’s train derailment in East Palestine, Ohio on February 3, 2023, and the political and legal fallout from the accident, demonstrates the need for railroads to operate safely. One of the criticisms of precision scheduled railroading is that crews shrink and end up being potentially overworked, resulting in safety issues. Obviously, BNSF should not take cost-cutting actions to reduce the operating ratio if doing so results in safety problems, but all railroads operate in a highly regulated environment.

In labor negotiations, BNSF does have a potential liability because it is owned by Berkshire Hathaway, a parent company that obviously has “deep pockets.” It is often convenient for labor leaders to refer to “Warren Buffett’s railroad” as a means of gaining a negotiating advantage.8 There is no reason to accept less favorable labor contracts based on Berkshire’s ownership of the railroad, although this type of political pressure is not likely to ease anytime soon.

Shortly after the release of Berkshire’s annual report, BNSF laid off 360 mechanical workers, according to recent news reports. BNSF denied that the layoffs would impact safety. It’s unlikely that Warren Buffett has personally directed BNSF to take any specific cost cutting actions, but the message of his letter was very clear. It will be interesting to see how the railroad’s operating metrics develop in 2024, especially in comparison with Union Pacific’s results.

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Individuals associated with The Rational Walk own shares of Berkshire Hathaway.

For the chart, I have chosen to use Norfolk Southern’s published non-GAAP operating ratio of 67.4% rather than its GAAP operating ratio of 76.5% because the major adjustment was to exclude the costs associated with the derailment incident in East Palestine, Ohio on February 3, 2023. While the costs borne by Norfolk Southern associated with the derailment are very real, it seems correct to view a derailment of this magnitude as non-recurring. The non-GAAP ratio seems like a better gauge of Norfolk’s Southern’s underlying efficiency.

I was wrong about BNSF being a “destination” for Berkshire’s cash when I wrote in January 2010: Buffett’s Plans for Burlington Northern May Include Rapid Expansion. In my defense, this was a common error. In May 2010, BNSF CEO Matt Rose sounded like he was planning an acceleration of capex: Burlington Northern’s CEO Plans for Accelerated Capex.

BNSF was purchased in February 2010 by National Indemnity, an insurance subsidiary of Berkshire Hathaway. On September 30, 2023, ownership of BNSF was transferred from National Indemnity to Berkshire, making BNSF a direct subsidiary of Berkshire. Prior to September 30, 2023, BNSF’s distributions were to National Indemnity which, presumably, sent these distributions up to Berkshire Hathaway. This formal change in ownership structure does not, in my view, change the underlying economics of the distributions.

The debt is issued by BNSF as is not guaranteed by Berkshire Hathaway. The increase in BNSF’s debt since Berkshire purchased the railroad in 2010 has been modest. Long-term debt as a percentage of total capital was 24% on March 31, 2010, the first balance sheet after the acquisition. The figure stood at 32% as of December 31, 2023. In comparison, Union Pacific had a substantially greater debt burden at 69% of total capital. More information on the capital structure of both railroads can be found in the August 2022 profile of BNSF and the September 2022 profile of Union Pacific.

See footnote 3 for more details. Some observers believe that the ownership change to the parent company might have been done to allow for a future spin-off, since the complexities of untangling the railroad from National Indemnity would simplify the process. I am skeptical that BNSF will be spun off. However, the fact that the cash flow from the railroad is not needed to satisfy insurance regulators is a sign of National Indemnity’s strength. Berkshire’s insurance subsidiaries hold the majority of the company’s marketable securities.

On April 7, 2023, BNSF resumed providing service over a line previously leased to Montana Rail Link. This transaction discussed as a business combination in BNSF’s 10-K was accounted for as a lease termination. The cost of the lease buyout of $2,113 million, appears to have been accounted for in 2021, somewhat confusingly as a component of “Other, net” under operating activities in the statement of cash flows. According to an article published in early 2022, BNSF confirmed that the cash to buy out the lease was included in its 2021 financial statements. According to the 2023 10-K, Note 7, upon approval by the STB in March 2023, the cost of the transaction was reallocated from other assets to property and equipment ($1,571 million), materials and supplies ($11 million), and goodwill ($531 million).

Distributions to Berkshire have exceeded free cash flow due to the addition of BNSF debt in the early years of Berkshire’s ownership of the railroad. See footnote 4 for further details.

Fyi, interesting note by Adam Mead today on BNSF. Check it out...

fyi... https://x.com/SquawkCNBC/status/1786428305253544329