Warren Buffett's Canvas

The painting continues to evolve as Warren Buffett celebrates his 93rd birthday.

“I mean, Berkshire, you know, in a crazy way, I look at Berkshire as a painting. You know, and it’s unlimited in size. It’s got an ever-expanding canvas and I get to paint what I want. And if somebody wants to paint something else, then I’ll get a smaller little thing and I’ll paint away.”

On August 30, 1995, Warren Buffett celebrated his sixty-fifth birthday. By all accounts, he had accomplished all of the business goals that he set out for himself as a young man. As the owner of 442,236 shares of Berkshire Hathaway, Mr. Buffett’s ownership interest was worth an astounding $11.2 billion and he had overwhelming control of the company with over forty percent of the vote.1

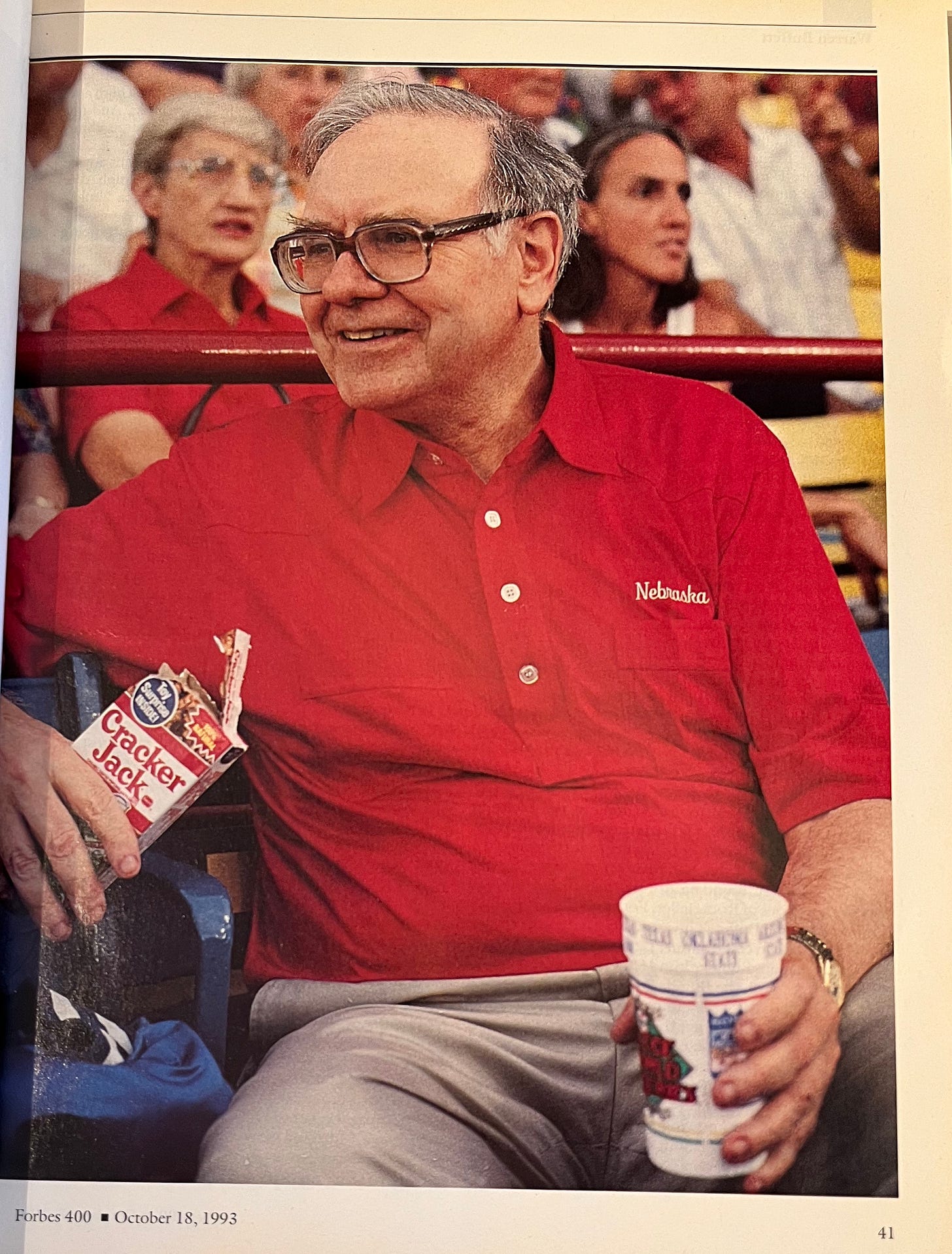

As he entered what’s known as “old age”, Mr. Buffett had been on the Forbes 400 list for over a dozen years and had been a billionaire for a decade. In October 1993, with a stake in Berkshire Hathaway worth $8.3 billion, he found himself at the very top of the Forbes 400. If Warren Buffett had retired and sailed off into the sunset in the mid-1990s, his place in American business history would have been very secure.

But what would “sailing into the sunset” mean for a man like Warren Buffett?

Giving up his role at Berkshire Hathaway would not have brought about happiness but misery. Mr. Buffett knew that his painting was unfinished and he had no desire to do anything other than continue to paint. Taking away his paintbrush at some random age made no sense to him and he vowed to work indefinitely. Given his incredible three decade record at Berkshire, what shareholder in their right mind would object?

Fast forward twenty-eight years. Today, Warren Buffett is celebrating is ninety-third birthday. His ownership of Berkshire Hathaway has dwindled down to a mere 218,237 Class A shares due to very large gifts to philanthropy over the past seventeen years.2 Still, the shares he owns are now worth nearly $120 billion. If Mr. Buffett had never given away any of the shares he owned when he turned sixty-five, he would be worth in excess of $240 billion today, easily qualifying as the world’s richest man.

When Warren Buffett took control of Berkshire Hathaway in May 1965, he was thirty-four years old. Today, nearly half of his tenure at the company has been as a senior citizen. While his record at age sixty-five already secured his spot in the history books, his canvas was still incomplete. As he progressed through years when nearly everyone in his peer group had long since retired, Berkshire Hathaway continued to grow and evolve and today has almost no resemblance to the company that existed in 1995.

A summary of Berkshire’s earnings in 1995 shows the subsidiaries that were considered material enough for separate reporting. For context, at the end of 1995, Berkshire Hathaway shares traded at $32,100 and the company’s market capitalization was $37.8 billion. Shareholders’ equity stood at $17.2 billion and marketable equity securities accounted for $22 billion of Berkshire’s $29.9 billion of assets.

If you have studied Berkshire’s reports in recent years, you will notice the absence of many subsidiaries that warranted separate reporting in 1995. In the vast majority of cases, this is simply because businesses like See’s Candies and Scott Fetzer have dwindled in importance relative to the size of Berkshire Hathaway. Of course, there are some sobering reminders of the changing world as well. Isn’t it amazing that World Book encyclopedia was big enough to move the needle in 1995? Buffalo News, once one of Berkshire’s crown jewels, was finally sold in 2020 after years of decline.

We can draw many lessons from the history of Berkshire Hathaway over the past three decades, but perhaps the overriding lesson is that the canvas was not only unfinished in 1995 but subject to revision. Many of the great artists of the distant past painted over their canvases as they developed different ideas for how to best capture a scene.

“And occasionally I, well, not so occasionally, but I see things in the painting, you know, I think, ‘Well, I should’ve done that differently.’ And I go back and paint it over. And it’s satisfying. And who knows why human beings react in that manner.”

For the most part, the Berkshire Hathaway canvas has been one that expands over time and is rarely repainted. The crown jewels of Berkshire Hathaway in 1995 were different from the crown jewels of 2023 because so many new gems have been added.

Berkshire’s insurance operations were launched in 1967 and insurance was already an important part of Berkshire in 1995. However, GEICO did not become a wholly owned subsidiary until 1996 and General Re was not purchased until 1998. Berkshire announced its initial investment in MidAmerican Energy in 1999 which was the genesis for what has grown into Berkshire Hathaway Energy. Burlington Northern Santa Fe was not acquired until February 2010. The number of acquisitions is far too long to list. Berkshire is a company that has been radically transformed since 1995.

If Warren Buffett had retired in his mid-sixties, Berkshire would certainly have continued to evolve under the leadership of his successors, but how likely is it that the company would resemble today’s behemoth with a market capitalization of nearly $800 billion? Although Berkshire has started to return significant capital to shareholders in the form of repurchases, it is remarkable how much capital has been profitably reinvested over the decades.

From the standpoint of August 1995, it would have been impossible to envision how much the painting would change, as we can see from this breakdown of Berkshire’s operating earnings for 2021 and 2022.

Berkshire’s results are reported every quarter and Warren Buffett’s letters appear annually. Since I have been following Berkshire since 1995, I have seen the business evolve. From time to time, I have looked at the company’s evolution over a decade, such as in this article in 2012, and at other times I have attempted to forecast what Berkshire would look like in another decade, such as in this article written in 2016. On a year to year basis, the changes in the painting are subtle. Looking at progress over a decade is like stepping back from a painting in a gallery. By stepping back, we can more clearly see the overall effect intended by the artist.

Almost no one in 1995 thought that Warren Buffett would still be painting nearly thirty years later. While shareholders were happy to see him continue, most probably thought that he would work for another five or ten years. Concerns over succession planning have existed for my entire twenty-three year history as a shareholder.

Yet the painting continues to evolve and Mr. Buffett shows no signs of slowing down other than handing over day-to-day operational responsibilities to Berkshire’s Vice Chairmen a few years ago. He’s still handling almost all of the company’s capital allocation, a formidable task given Berkshire’s current size. Berkshire is likely to continue returning capital to shareholders via repurchases in the years to come, but I suspect that if Mr. Buffett keeps at it for several years, the painting will continue to evolve. The evolution will be subtle from year to year but could be striking in a decade.

The painting remains incomplete, the canvas is still on the easel, and hopefully this state of affairs will continue for many years to come!

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com

According to Berkshire Hathaway’s 1995 proxy, Warren Buffett controlled the voting interest in 479,222 shares. Of these shares, he owned 442,236 outright and an additional 36,986 shares were owned by his wife. This accounted for 40.7% of the voting control of Berkshire. Note that these shares are what we call Class A shares today. The Class B shares were first issued in 1996 at which time the original share class was renamed as Class A. Berkshire’s shares closed at $25,400 on August 30, 1995 according to Yahoo! Finance.

Great stuff as usual

A wonderful read. Thank you!