Warren Buffett on Berkshire’s Valuation

Warren Buffett has typically avoided commenting on Berkshire's stock price, but he has provided some clues that are worth considering.

“I believe the chance of any event causing Berkshire to experience financial problems is essentially zero. We will always be prepared for the thousand-year flood; in fact, if it occurs we will be selling life jackets to the unprepared. Berkshire played an important role as a ‘first responder’ during the 2008-2009 meltdown, and we have since more than doubled the strength of our balance sheet and our earnings potential. Your company is the Gibraltar of American business and will remain so.”

— Warren Buffett, 2014 letter to shareholders

When I read Warren Buffett’s letter to shareholders a decade ago, the passage reproduced above struck me as particularly important. Mr. Buffett is not one prone to exaggeration, particularly when it comes to setting expectations for the performance of Berkshire Hathaway. He has always been more likely to throw cold water on unrealistic expectations. Yet in his 2014 letter, we are assured that the chance of Berkshire experiencing “financial problems is essentially zero.”

Of course, Mr. Buffett was not saying that Berkshire Hathaway’s stock price will never decline. Berkshire’s stock has declined substantially on many occasions and will decline substantially at times in the future. The point was not that the stock price is impermeable to decline but that the underlying business model is highly resistant to permanent impairment. That’s quite a strong statement!

The usual caveats apply. No company can possibly be immune to the effects of global thermonuclear war and there are certain large-scale natural disasters, such as a massive earthquake in the Pacific Northwest or a supervolcano eruption that carry systemic risks far beyond any insurance liability Berkshire would incur. The risk of terrible things happening in the world, whether caused by humans or by nature, can never be eliminated. Mr. Buffett was only saying that Berkshire is as well positioned as any company can be.

Even if we accept Mr. Buffett’s view regarding the robustness of Berkshire’s business model, this will not prevent many shareholders from worrying about Berkshire’s stock. This has been particularly evident in recent months as some level of optimism has crept into the stock price. While giddy optimism has been the prevailing sentiment in most large and mega-cap stocks in recent years, Berkshire’s valuation has typically remained on the sober side and has often veered off into deep pessimism.

What guidance has Warren Buffett provided regarding investing in Berkshire’s stock?

Let’s return to Mr. Buffett’s 2014 letter to shareholders. The letter was written in early 2015, shortly before the fiftieth anniversary of Mr. Buffett taking control of Berkshire Hathaway. In a section of the letter outlining his expectations for the next fifty years at Berkshire, Mr. Buffett made some striking statements regarding investing in the company. Most importantly, he wrote that “the chance of permanent capital loss for patient Berkshire shareholders is as low as can be found among single-company investments.” He was confident that Berkshire’s per-share intrinsic value is “almost certain” to advance over time.

However, this optimism came with a crucial caveat:

“This cheery prediction comes, however, with an important caution: If an investor’s entry point into Berkshire stock is unusually high – at a price, say, approaching double book value, which Berkshire shares have occasionally reached – it may well be many years before the investor can realize a profit. In other words, a sound investment can morph into a rash speculation if it is bought at an elevated price. Berkshire is not exempt from this truth.” [Emphasis Added]

Here we are given a very specific figure that Mr. Buffett characterized as elevated, a level at which a buyer might not realize a profit for “many years.” The specific figure was double book value. At that price, a buyer might have to wait for a lengthy period of time before realizing any profits at all, much less achieving attractive returns. The implication is that Berkshire Hathaway stock would resemble a “rash speculation” if purchased at such a high valuation, especially if the investor’s time horizon is short.

Let’s apply this idea to Berkshire Hathaway in early 2015. At the time Mr. Buffett’s letter was published on February 28, 2015, the Class A shares had last traded at $221,180. Book value as of December 31, 2014 stood at $146,186 per Class A share. Therefore, the price-to-book ratio at the time Mr. Buffett published the letter was 1.51x book value. Double book value would have been $292,272 per Class A share.

A buyer of one Class A share at the closing price of $221,180 on February 27, 2015 would have realized an annualized return of 13.4% over the subsequent decade based on Berkshire’s Class A stock’s closing price of $775,000 on February 28, 2025. What if Berkshire’s stock had traded at double book value a decade ago rather than 1.51x book value? In that scenario, a buyer would have paid $292,372 for one share. Then the annualized return over the past decade would have been 10.2% rather than 13.4%.

Over a ten year period, a buyer at double book value would have still realized a decent return despite paying a fancy multiple at the outset. However, there would have been many occasions over the first five years where the returns would have been flat or negative, as we can see from the chart below:

There would have been a very limited margin of safety for a buyer of Berkshire at twice book value in early 2015, even over a period of several years. In the very long run, paying a high multiple would have worked out since Berkshire’s intrinsic value advanced steadily over the period. But we should note that the current multiple of price-to-book stands at 1.72x today. This happy scenario would have been more muted if Berkshire’s price-to-book ratio had not expanded and remained at 1.51x at the end of the decade.

In his 2014 letter to shareholders, Mr. Buffett offered “no assurance” that any purchase of Berkshire stock would produce positive returns regardless of the entry price if the investor’s time horizon was only one or two years. This is because movements in the stock market over short periods can heavily influence the price of any stock, including Berkshire. The “voting machine” can overwhelm any advance of intrinsic value over such a short period of time.

If one or two years is too short of a time horizon, what is an acceptable time horizon?

Mr. Buffett recommended that Berkshire shares should only be purchased if the expected holding period is at least five years. In other words, he defined the “short-term” as anything less than five years! For most market participants, one year might qualify as “long-term” and five years seems like an eternity. However, the reality is that five years really should be the minimum time horizon for the purchase of any stock.

If twice book value is “too high” of a price to pay, what is a more reasonable price to pay?

In the 2014 letter, Mr. Buffett wrote the following:

“Purchases of Berkshire that investors make at a price modestly above the level at which the company would repurchase its shares, however, should produce gains within a reasonable period of time. Berkshire’s directors will only authorize repurchases at a price they believe to be well below intrinsic value. (In our view, that is an essential criterion for repurchases that is often ignored by other managements.)” [Emphasis Added]

At the time, Berkshire’s policy allowed for repurchases at 1.2x book value, a level at which Berkshire’s stock almost never traded. In 2018, Berkshire amended its policy to allow repurchases at any level at which Warren Buffett and Charlie Munger believed that shares were trading below a conservative estimate of Berkshire’s intrinsic value. Berkshire soon ramped up its repurchase program significantly.

The relaxation of Berkshire’s repurchase policy was accompanied by Mr. Buffett no longer emphasizing book value in communications with shareholders, which he explained in some detail in his 2018 letter to shareholders. The reason behind the change was that he believed that book value was losing its relevance as an understated indicator of intrinsic value as more of Berkshire’s value derived from operating subsidiaries versus marketable securities. In addition, large-scale repurchases of Berkshire stock would increasingly distort book value over longer periods of time.

In light of the 2018 change de-emphasizing book value, should we still take Mr. Buffett’s comments in his 2014 letter to shareholders into account when considering Berkshire’s valuation? I think that the answer is still a qualified yes. It is not as if book value was relevant in 2017 and became instantly irrelevant in 2018. My view is that book value will gradually lose its relevance, not that it became irrelevant immediately.

Regardless of one’s view of book value, we can look at the prices at which Berkshire has been repurchasing stock recently. Mr. Buffett clearly stated that purchases of the stock “modestly above” where the company repurchases shares should “produce gains within a reasonable period of time.” He did not say that it would be prudent to relax the minimum five year holding period, but in my opinion, purchasing modestly above where Berkshire repurchases shares is likely to result in gains within a few years.

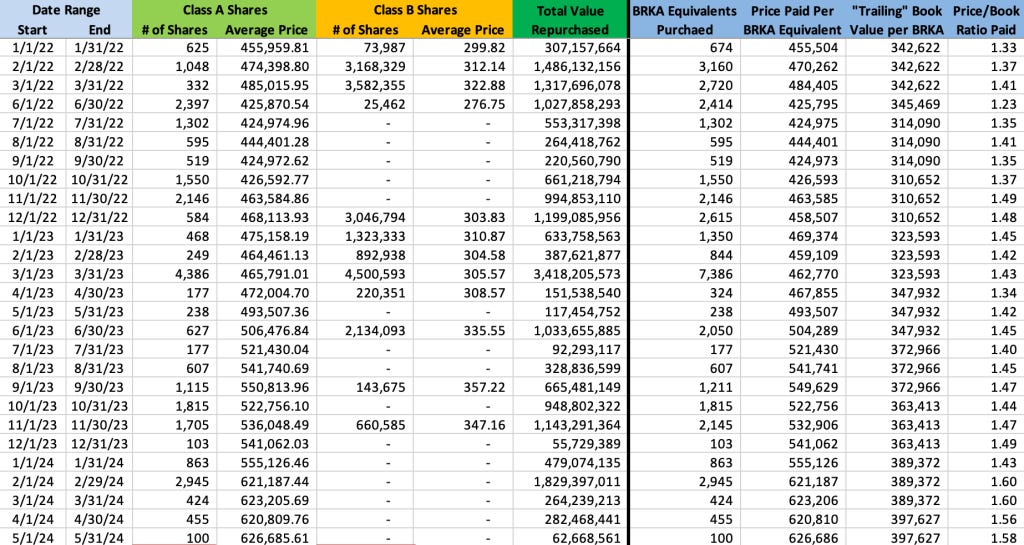

The exhibit below shows Berkshire’s repurchase activity over the past three years:

For each month that Berkshire repurchased stock, the exhibit shows the number of Class A and Class B shares that were purchased, the average price paid, and the total value of the repurchases. In addition, I have calculated the number of Class A equivalents that were purchased (with each Class B share having 1/1500 of the economic rights of one Class A share), the price-to-book ratio of Berkshire’s Class A shares, and the price-to-book ratio paid. Note that the book value used in these calculation is the last publicly known book value at the date of the repurchase and that Mr. Buffett would have had non-public information regarding Berkshire’s ongoing performance during any quarter in which repurchases were made.

From this table, we can see that Mr. Buffett has been price-sensitive in his repurchase activity, but has shown flexibility as well. He has been willing to pay as much as 1.6x trailing book value, but seems far more enthusiastic when he can purchase shares for 1.4x trailing book value or less. Berkshire entirely stopped repurchasing shares starting in June 2024.

Does Mr. Buffett still consider 2x book value to be on the high side?

We can see that repurchases stopped after May 2024 and it seems unlikely that Mr. Buffett is repurchasing shares today at over 1.7x book value. My guess is that he would still consider 2.x book value to be on the high side and a level at which buyers might not realize a return for many years. However, given the fact that Mr. Buffett stopped explicitly referring to book value over five years ago means that we cannot be certain.

Let’s consider Berkshire’s current stock price of $775,000 per Class A share in a little more detail. Given that book value was $451,507 per Class A share as of December 31, 2024, the stock is currently trading at 1.72x book value. The average price-to-book ratio paid for repurchases since 2022 is 1.44x book value which would be approximately $650,000 per Class A share.

In my opinion, Mr. Buffett’s statements in his 2014 letter implies that purchases of Berkshire at or somewhat above $650,000 per Class A share could be expected to produce gains within a “reasonable” period of time. What does “somewhat above” mean? Opinions will vary, but it seems like 1.5x book value would not be much of a stretch, implying a price of $677,000 per Class A share.

Some might suggest that Berkshire was willing to pay 1.6x book value in early 2024 and we should consider that benchmark to be a “reasonable” level for purchase. 1.6x book value would be approximately $722,000 per Class A share today. Since Berkshire will make no repurchases unless the shares are available at less than a conservative estimate of intrinsic value, this position has some level of support.

Ultimately, we should be cautious above making overly precise judgments regarding intrinsic value. Even Warren Buffett and Charlie Munger did not come up with identical intrinsic value estimates when they discussed the matter privately. At best, we can arrive at a range of values that make purchases reasonable.

Thinking About Berkshire’s Stock Price

The majority of market participants are obsessed about short-term market gyrations. There is no way to predict Berkshire’s stock price over the next week, month, or year. However, those who take a longer-term view can consider several factors when considering the returns they are likely to achieve.

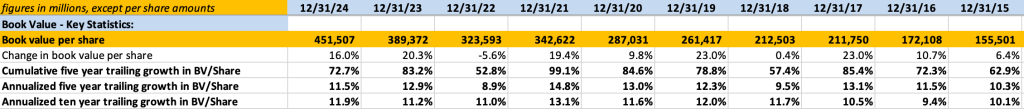

Let’s first consider Berkshire’s historic performance in compounding book value per share. When I wrote about Berkshire’s 2024 results, I included a table showing book value per share over the past decade which is presented again below:

We can see that Berkshire has compounded book value at 11.9% over the past decade, which is a strong performance, perhaps higher than what we can expect in the future. Let’s assume that Berkshire compounds book value per share at 8% over the next five to ten years. If this occurs, we could expect book value per share to be approximately $663,000 in five years and $975,000 in ten years.

Let’s say that Berkshire’s price-to-book value declines from the present 1.72x to 1.5x. If this occurs, assuming 8% annualized growth in book value, we can expect Berkshire’s Class A stock to trade at ~$995,000 in five years and ~$1,463,000 in ten years. Given the current price of $775,000, shareholders could expect annualized returns of 5.1% over the next five years and 6.6% over the next ten years.

In other words, if we assume that growth in book value per share to 8% and the price-to-book ratio will contract to 1.5x, returns for shareholders holding the stock from current levels will be materially below 8%. Of course, there is no law that says that the price-to-book ratio will be 1.5x in the future or that growth of book value per share will be 8%. Those who disagree with these assumptions can substitute their own estimates and arrive at their own implied annual returns for the stock starting at its current price.

The Bottom Line

Berkshire’s stock price is trading at levels not seen in many years, as measured by a multiple to book value. Despite Berkshire de-emphasizing book value as a relevant metric over the past several years, I believe that it still makes sense to follow book value as an understated measure of intrinsic value. If book value progresses at a certain rate in the future, intrinsic value is likely to progress at a similar rate. When we combine this assumption with the guidance provided by Berkshire’s willingness to repurchase stock, we can form conclusions regarding the likely return that shareholders can expect from current levels.

Warren Buffett correctly warned shareholders against buying the stock at particularly elevated levels and explicitly mentioned 2x book value as representing a rich price. We are not anywhere near 2x book value, although the current price is materially above where Berkshire has been willing to repurchase shares. All of this warrants caution for those contemplating investing in the stock. For those who already own the stock, it still seems highly likely that we will achieve positive returns over a five to ten year period. However, anything can happen over the next couple of years. Shareholders who need to sell shares over the next year or two might consider doing so now, but we should keep in mind that the current price-to-book ratio of 1.72x is likely to decline in the coming quarters as book value advances due to retention of earnings.1

This article is NOT investment advice! My purpose is only to help shareholders think about Berkshire’s stock price in a manner that makes sense, with supporting evidence based on Warren Buffett’s statements in his annual letters to shareholders. I would encourage readers to not take the examples of book value growth and future price-to-book ratios in this article too seriously. Instead, consider your own opinions regarding Berkshire’s future and calculate likely future returns based on your assumptions. Then compare the likely returns from Berkshire against other opportunities that you know of, adjusted for risk. Only then can you know whether buying or holding Berkshire at current levels makes sense for you.

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC. The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Individuals associated with The Rational Walk own shares of Berkshire Hathaway.

Note that the assumptions in this article assume continued retention of all earnings. If Berkshire begins to pay a dividend, this will reduce book value growth, but shareholders will have received cash distributions which would have to be added to stock price appreciation to arrive at a total return.