Human intuition can only go so far. The truths that seem self-evident at first glance often represent intellectual traps. Perhaps no trap is easier to fall into than the notion that financial markets are easy to beat because they exhibit “crazy” behavior. Of course, nothing is further from the truth. Markets can seem crazy but still prove very difficult to beat. Ask any value investor operating over the past decade.

The case for passive investing is now widely accepted and indexing is extremely popular both for institutions and individual investors. Even Warren Buffett has made the case for passive investing, going so far as to recommend the S&P 500 as the primary investment vehicle for the assets his wife will eventually inherit:

“My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers.” 1

The fact that such a recommendation comes from Warren Buffett might be surprising given that the compounded annual gain in Berkshire Hathaway stock from 1964 to 2021 was a breathtaking 20.1%, far better than the 10.5% compounded annual gain posted by the Standard & Poor’s 500 over the same period.2

Mr. Buffett has been critical of academic theories of efficient markets for decades. In 1984, he published The Superinvestors of Graham and Doddsville which documents the records of several value investors following the intellectual framework created by Benjamin Graham. Obviously, Mr. Buffett has never given up active investing, nor does he think it is impossible to beat the market. However, investors in active funds, in the aggregate, are burdened by fees that are much higher than passive approaches.

The rise of passive investing is the topic of Robin Wigglesworth’s recent book, Trillions: How a Band of Wall Street Renegades Invented the Index Fund and Changed Finance Forever.

The book offers a sweeping account of the intellectual origins of passive investing dating back to the story of Louis Bachelier, a French mathematician who lived from 1870 to 1946, dying in obscurity before his treatise, The Theory of Speculation, was discovered during the 1950s, initially by academics at the University of Chicago. Bachelier was the first to demonstrate that security prices appeared to follow a “random walk” in the short run.

In 1950, Harry Markowitz decided to focus his PhD research on the stock market which was considered a “grubby” subject for serious academic work in the field of economics. Markowitz believed that diversification across a large number of securities made an overall portfolio less risky and that investors should really only care about the performance of their portfolio, not individual securities within the portfolio. Markowitz later met William Sharpe, an economist working on a PhD at UCLA who developed the capital asset pricing model which academics began to use to value securities. Eugene Fama’s 1965 PhD thesis built on the work of Markowitz and Sharpe to come up with the efficient market hypothesis, also known as the random walk theory.

As Mr. Wigglesworth notes, these academic theories “practically became a religion” at the University of Chicago and soon spread throughout academia. Those of us who studied economics and finance in the decades that followed can hardly forget the valuation formulas based on these theories. Those who are not already familiar with academic finance will find the high level descriptions in this book sufficient to follow the rest of the story.

Whatever the practical shortcomings of academic finance during the 1950s and 1960s, no one can deny the effect it had on the money management industry. In 1960, Edward Renshaw, a University of California economist, wrote a paper making a case for an unmanaged investment company that would track an index such as the Dow Jones Industrial Average. This paper elicited a strong reaction. In the May/June issue of the Financial Analysts Journal, John B. Armstrong made a convincing argument in The Case for Mutual Fund Management. Aside from citing the outperformance of selected funds over three decades, Mr. Armstrong noted that a market tracking index fund would not be practical.

Would it surprise you to learn that “John B. Armstrong” was the pen name for none other than John C. Bogle, the founder of The Vanguard Group and the man who a would make the first index fund available to individual investors in 1976?

Mr. Bogle was not a believer in passive investing during the 1960s when he was quickly ascending the ranks at Wellington Management Company. In 1967, Mr. Bogle led the merger of Wellington with Thorndike, Doran, Paine & Lewis, a firm that bought into the go-go style of active investing popular in the late 1960s. The merger ended in tears with the bear markets of the early 1970s and a management dispute led Mr. Bogle to form The Vanguard Group in 1974, initially to handle administrative functions for the Wellington Funds.

Mr. Wigglesworth does an excellent job of giving credit where it is due to the many industry players who preceded Jack Bogle in efforts to implement passive investment strategies during the 1960s and early 1970s. These accounts are well written and readers who are interested in the details will enjoy the early chapters of the book exploring those events. However, I have always been fascinated by Mr. Bogle’s almost religious fervor to bring indexing to individual investors after he was converted to the cause in the mid-1970s, so that is the story I choose to emphasize.

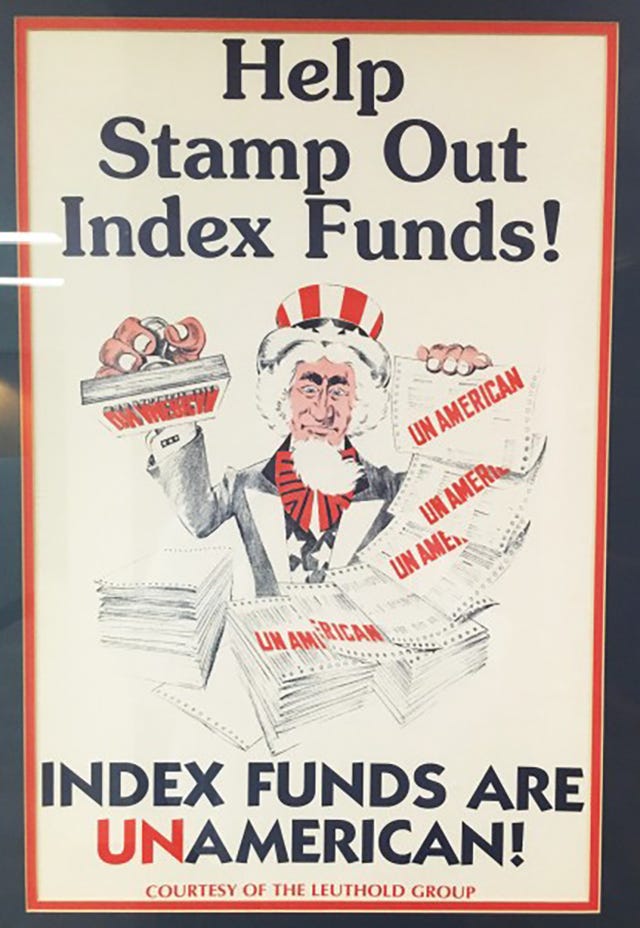

Prior to Vanguard’s introduction of the First Index Investment Trust in 1976, individuals had no practical way to invest passively. But individual investors were hardly beating a path to Vanguard’s door initially. The fund raised only $11 million during its initial underwriting and was ridiculed as settling for mediocrity. Even more ludicrously, the idea of indexing was attacked as “un-American”. 3

The Vanguard fund did its job of matching the S&P 500, but growth of assets proceeded at a snail’s pace. One reason investors might have been reluctant to invest in an index fund at that time was because of the existence of “sales loads”. It might seem ridiculous to today’s investor used to zero commissions, but mutual funds would routinely charge hefty fees as a price of admission. Loads of 8% were not uncommon. Vanguard’s fund carried a load of about 6% which might have been lower than average but still a huge impediment for a fund that did not promise to deliver market-beating performance.

In 1977, Mr. Bogle convinced Vanguard’s board to switch to a no-load structure but even then growth was slow, and the fund only crossed $100 million in assets at the end of 1981 after being merged into another $58 million fund.

Jack Bogle’s life was one of dogged perseverance, as readers of his memoir, Enough: True Measures of Money, Business, and Life get a sense of very quickly. Despite suffering from a heart condition for most of his adult life, Mr. Bogle continued to lead Vanguard as chief executive until his heart finally gave out in 1995 and he had to be hospitalized for over three months before finally receiving a donated heart in February 1996.

When Mr. Bogle returned to the office several months later, he tried to reassert his authority and was eventually pushed out by Jack Brennan, his handpicked successor, who was not keen on the idea of relinquishing his role. After several contentious years serving as Chairman, Mr. Bogle was finally forced to retire in 1999. Although he remained on Vanguard’s campus running the Bogle Financial Markets Research Center, the bad blood never dissipated.

It is often the case that apostles for a cause end up being a bit too rigid over time. Such was the case with Mr. Bogle’s initial reaction to Exchange Traded Funds (ETFs), an innovation that he initially wanted Vanguard to have no part in. Mr. Wigglesworth outlines the major differences between ETFs and traditional mutual funds, including the tax and liquidity advantages of ETFs. As the ETF industry matured, a proliferation of offerings emerged that allowed investors to pick almost any conceivable sector or sub-sector of the market rather than just the S&P 500.

Mr. Bogle did not consider these ETF innovations to be positive for individual investors. After all, mutual funds already provide daily liquidity. Why would individuals need to be able to jump in and out of ETFs during the day? This trading mindset bothered him and so did the idea of selecting ETFs that attempted to track specific sectors. If the idea of passive investing is that one cannot reliably beat the market by identifying individual stocks, why would individual investors be able to beat the overall market by identifying sectors of the market and buying narrowly targeted ETFs that invest in those sectors?

Vanguard eventually moved into the ETF market despite Mr. Bogle’s objections. His role as an investor advocate and elder statesman did not preclude Vanguard from realizing that ETFs were in high demand and responding to that demand. Mr. Wigglesworth devotes several later chapters to the rise of ETFs in general, with specific focus on BlackRock’s offerings. The competitive dynamics of the industry in the pivotal decade of the ‘00s are extensively documented.

The final chapters of the book cover the implications of the rapid rise of passive investing over the past decade. According to a recent article, passive vehicles accounted for 54% of the $11.6 trillion U.S. domestic equity fund market, although passive assets are still only about one-sixth of the total market cap of the U.S. stock market. With this level of market penetration, what are the implications for market efficiency and corporate governance?

We should never lose sight of the fact that capital markets exist to allocate scarce resources. The only way in which this can happen is when market participants analyze investment opportunities and allocate capital to the best possible use, at implied prospective returns commensurate with risk. If the market comes to be dominated by passive strategies, who will do the hard work required to price securities?

The concern is a valid one, but the profit motive is itself a self-correcting force. If passive investing so dominates the field that major inefficiencies begin to appear, there will never be a shortage of sophisticated active market participants eager to jump at the chance for profit. Human nature is such that a certain segment of the population will always strive to beat the market, no matter how unlikely it might be to achieve the objective.

Another concern is that firms controlling the passive investment assets of millions of investors will begin to use their voting power to pressure companies in ways that do not necessarily align with maximizing shareholder value.

The Environmental, Social, and Governance (ESG) movement has already attempted to influence companies to take actions that they claim to be for the common good. BlackRock’s Chairman and CEO Larry Fink has become extremely vocal on ESG issues. To what extent should firms managing trillions of dollars of capital in mostly passive strategies use their voting power for goals that are not directly related to maximizing shareholder value for the underlying owners of the assets?

The passive investing revolution has been a boon for institutions and individual investors who have come to realize that they are unlikely to beat market averages. Pioneers of this revolution such as Jack Bogle should be credited with improving the financial outcomes of millions of people, but the passive approach has reached levels that the early advocates could have hardly imagined. As this seemingly inexorable trend continues in the years to come, market efficiency and governance concerns that seem manageable today could very well become much more serious issues.

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Warren Buffett’s 2013 letter to shareholders. Since all of Mr. Buffett’s Berkshire stock is going to various charitable foundations, his bequests are in the form of cash that would have to be invested by a trustee. Why didn’t Mr. Buffett recommend Berkshire Hathaway stock rather than the S&P 500? I suspect a big part of it has to do with not wanting to appear to “talk up” Berkshire’s stock. Also, Mr. Buffett’s wife will obviously inherit far more money than she needs and optimizing investment performance is hardly something the trustee will need to be worried about. The S&P 500 works well in this scenario.

Warren Buffett’s 2021 letter to shareholders.