The High Cost of Poverty

Politicians and economists seem baffled as inflation hammers the poor

A recent Wall Street Journal poll found that 83% of respondents describe the state of the economy as “poor or not so good”, with 35% “not satisfied at all” with their personal financial situation. The poll of over a thousand Americans is designed to capture the sentiments of the overall population and has a margin of error of 4%.

With the unemployment rate at 3.6%, it would appear that the labor market is doing well. However, the labor force participation rate, at 62.3%, is still 1.1% below pre-pandemic levels. The disconnect between historically low unemployment and widespread dissatisfaction often appears to baffle economists and politicians.

What’s going on?

One reason for the sour sentiment among consumers is obviously the high rate of inflation. This morning, the Bureau of Labor Statistics reported its May 2022 data for the Consumer Price Index for all urban consumers (CPI-U). The CPI-U rose by 1% in May on a seasonally adjusted basis and has risen by a whopping 8.6% over the past year. The table shown below provides high level summary data by category:

Lower income Americans spend a large proportion of their income on essential consumption such as food, gasoline, and housing. With the cost of groceries posting annual inflation of over ten percent and the cost of gasoline up nearly fifty percent, people of limited economic means are obviously being hammered by inflation. For many of us, paying higher prices for groceries and gasoline is a manageable annoyance. For someone living paycheck to paycheck, it is far more serious.

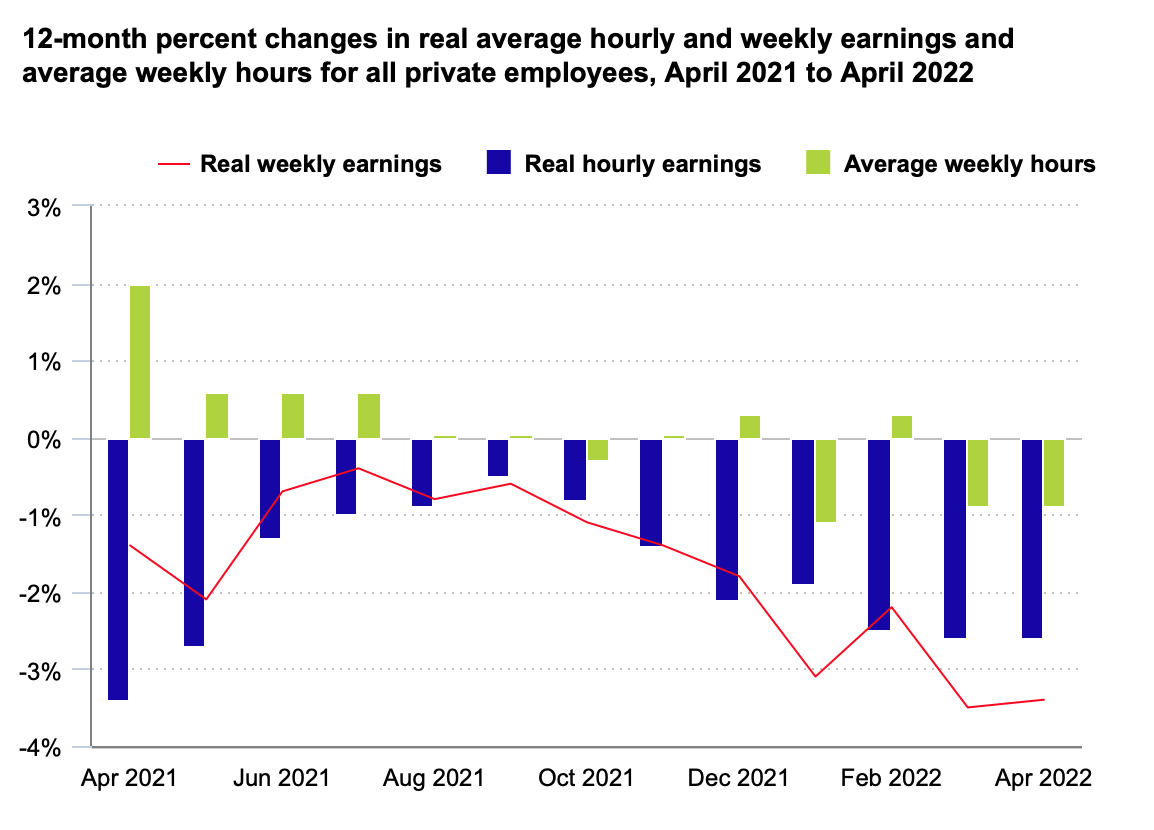

Those of us who follow financial news have been reading about wage pressures over the past year, but this has hardly represented some lollapalooza for wage earners because all of the nominal gains in wages and more have been destroyed by inflation. From April 2021 to April 2022, real wages declined by 2.6% according to the Bureau of Labor Statistics.

Aside from food and energy, there is the cost of housing. A glance at the table above shows that the BLS estimates that shelter costs have increased by just 5.5% over the past twelve months. The BLS uses a complex methodology to estimate changes in shelter costs which centers on the concept of owners’ equivalent rent. However, actual rents charged by landlords have hit record highs in several cities and increased by 18% over two years ending in March.

Those of us who were able to secure mortgage rates under 3% during 2021, either through an initial purchase of property or refinancing, benefit from a large part of our housing costs being fixed. In my case, 54% of my monthly cash outflow for housing is the mortgage payment, 29% is the HOA fee, and 17% represents property taxes.

I was recently notified that my HOA fee will increase by 8% in a few months, and I suspect that my property tax will increase by ~10% in 2023. Assuming these increases occur, my monthly cash outflow for housing will increase by ~4% in 2023 because my mortgage payment will remain static for the life of the loan. 1

People living in poverty are more likely to rent, and are facing very large increases across the country. But even those who have been able to purchase housing can face far more adverse outcomes in certain circumstances. The Washington Post reported this week that owners of mobile homes are facing ruinous increases in ground rent in several locations throughout the country.

“Mobile” is somewhat of a misnomer because it can cost thousands of dollars to move a mobile home to a different park, if it is possible to move it at all. Most mobile home owners do not own the land underneath their homes. Even if they own their mobile home free and clear, they are subject to rent increases on the ground they occupy. About 20 million Americans live in manufactured housing.

The Washington Post reports that private equity groups have been moving into this space, often using Fannie Mae and Freddie Mac funding:

"When new owners come in, they’re doing infrastructure upgrades, they’re improving the streets and adding amenities, all of which are very important as these communities age,” said Lesli Gooch, chief executive of the Manufactured Housing Institute. “When a community does change hands, often times it’s because of a significant need for improvement and a lack of capital from the existing owners to make such improvements.”

This could very well be true, although several of the individuals interviewed for the article claim that rents went up dramatically as soon as the private equity groups took title. Even if new amenities are introduced, they are obviously unaffordable for many of the people living in these parks.

“In interviews with a dozen mobile home residents around the country, all said their rents had risen this year. Most reported increases of 10 to 25 percent, although some said monthly payments had doubled or tripled. Their options were increasingly limited, too: Many said they had bought trailers after being priced out of apartments, homes and condominiums and were now unsure of where to go next. They had used up their savings or taken on high-interest loans to buy manufactured homes with little resale value. Some were considering moving into motels, crashing with friends or living in their cars until they could find a more permanent arrangement.”

The ground rents in places like Los Angeles have increased to levels that one might think includes actual housing rather than just a plot of land to park a mobile home:

“Christy Andrews thought she was making a sound investment when she scooped up a mobile home for $5,000 in Torrance, Calif., six years ago. But now she says it was a big mistake. Her lot rent — the monthly fee she pays for the plot of land where her trailer is parked — has nearly doubled, to $1,700, in the six years she has lived at Knolls Manor and now takes up nearly all of the $1,900 a month she receives in Social Security disability checks.”

Of course, the cost of apartments or rental homes in coastal regions like Los Angeles are even more costly. Some private equity firms find that it makes sense to convert mobile home parks into more lucrative developments such as condominiums.

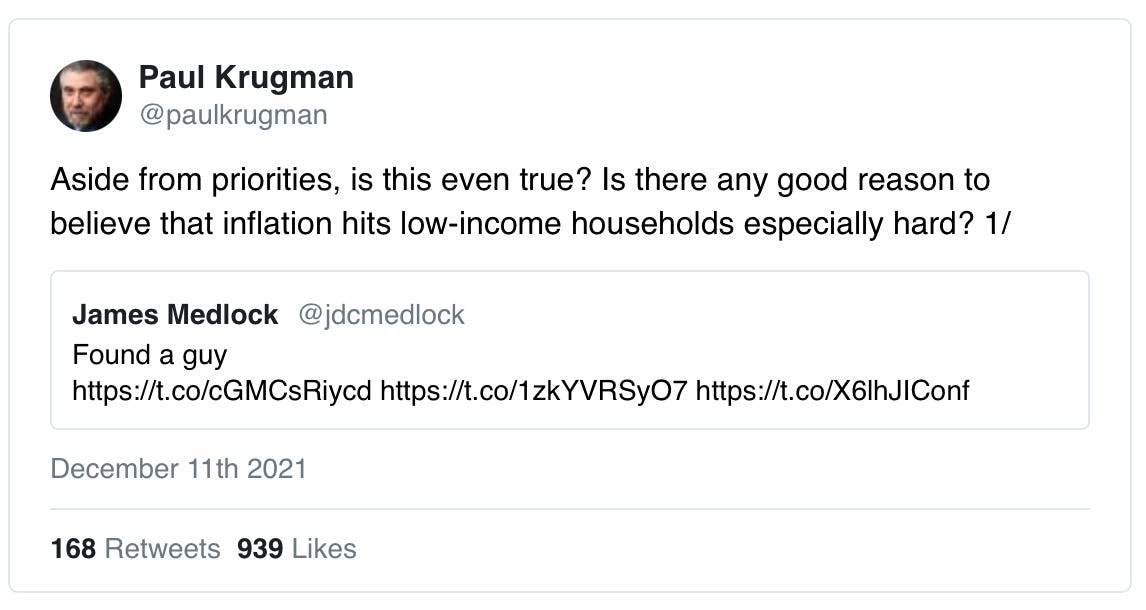

Last year, Paul Krugman, who is the 2008 recipient of the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel, posted a short Twitter thread in which he doesn’t seem to understand how inflation harms the poor. 2

In the thread, he states that inflation redistributes wealth from creditors to debtors which is “not exactly a burden on the bottom half of the income distribution.” It is true that unexpected inflation has the effect of helping debtors as the real value of debt melts away in the face of inflation that was not incorporated into the interest rate.

The mortgage I took out last year at 2.75% is melting away on the books of my creditor in real terms, one reason that my personal housing costs are unlikely to rise by more than mid-single digits annually over the next few years.

But the idea that this effect can be the dominant factor when it comes to people living in poverty just seems out of touch with reality.

If you live in a mobile home park in Los Angeles where the rent has skyrocketed by hundreds of dollars per month while you are also paying over 10% more for food and 50% more to fill up your car than you were just a year ago, those are the salient factors that determine your level of confidence.

Consumer price inflation represents an annoyance for me personally and the same is probably true for most of you reading this. But the situation is much worse for people living in poverty, and it does not seem at all surprising that a large majority of Americans believe the economy is on the wrong track.

Americans are no longer fooled by the money illusion of nominal increases in wages that are woefully inadequate to even cover the official increase in the CPI-U, to say nothing of the larger increases in their personal cost of living which is tilted toward items within the CPI that are rising much faster than the overall average indicates.

As Christopher Leonard documented in great detail in The Lords of Easy Money, which I reviewed earlier this year, the Federal Reserve conducted a huge experiment with the American economy over the past decade. As they say, the chickens have now come home to roost. 3

Not all economists and politicians are totally clueless, and it seems justifiable to wonder whether they really do not understand what’s happening to cause social unrest today, or if they simply don’t want to understand.

I’m reminded of Family Matters, the 1990s sitcom featuring the lovable, yet clumsy and error prone, Steve Urkel who somehow always caused funny catastrophes, invariably followed by the question, “Did I do that”? Of course, the catastrophes caused by the Federal Reserve and the politicians who failed to exert appropriate oversight of the Fed are anything but funny, as a large number of Americans are now realizing.

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Of course, part of the mortgage payment represents principal on an amortizing loan, so the entire payment is not an expense. On the other hand, the capital invested in the property has an opportunity cost that is not represented by monthly cash flow.

h/t to Rudy Havenstein for the Krugman tweet which was included in his recent post, Keynesian Cargo Cult.

Yes, there are certain factors such as the war between Russia and Ukraine that have made matters worse, but it is disingenuous for politicians to blame inflation principally on the war, as some have implied in recent months. Inflation was clearly gaining momentum for months before the war started.

That was excellent. Despite having multiple friends in high school who lived in trailers, I had no idea that trailer parks worked that way. I guess I assumed that whoever owned the mobile home also owned the land beneath it.

the poor rent and resets can occur faster than mortgages. some landlords actually only want 11 month leases so they can skirt any long term lease laws. Or they charge more for the risk of socialist tenant friendly rental laws.