The Digest #196

Daniel Kahneman (1934 — 2024), Biglari Holdings, Classical education, Sports gambling, Ackman on Disney's proxy war, Lessons from Paul Graham, Dunbar's number, and more ...

Daniel Kahneman (1934 — 2024)

Human beings are not always rational economic actors. Ivory tower economists find it useful to assume that people are rational because this facilitates creating models bolstered by mathematics. Mathematics provides the aura of scientific precision in a field that is predominantly driven by psychology. Daniel Kahneman, who died on March 27 at the age of ninety, insisted on applying his insights as a psychologist to the world of economics. Unfortunately, most investors have ignored his findings.

In The Benefits of Zooming Out, I briefly described prospect theory, a model of economic behavior that Daniel Kahneman and Amos Tversky published in 1979. Their fundamental insight was that human beings view gains and losses asymmetrically. The pleasure we get from a gain of a certain amount is more than offset by a loss of that same amount. In my article, I presented an exhibit showing recent daily changes in $SPY, an exchange traded fund that tracks the movements of the S&P 500:

Does anyone reading this in April 2024 recall these five trading days that took place nearly two years ago? It was big news at the time and long forgotten history today.

Consider two investors: Investor A watches quotes many times a day and is intimately aware of every tick. Investor B checks in once a week. Prospect theory tells us that Investor A would have accumulated a significant emotional deficit over the five days even though the end result was nearly flat.

Why?

The gains over the first three days would have provided Investor A with emotional gains, but the 3.6% loss on the fourth day would have generated negative emotions that far outweigh the pleasure of the first three days. This effect would have been accentuated by the smaller loss on the final day. The sequence of events also matters and the final experience was negative. Investor A ends the week feeling rotten.

In contrast, Investor B never checks quotes during the week and only looks at his account on Friday evening. Investor B would have noted a small week-over-week decline and may not have felt great about it, but his emotional state would be far more stable than Investor A who was glued to market fluctuations all week.

The more often we check quotes, the more likely we are to see a negative number.

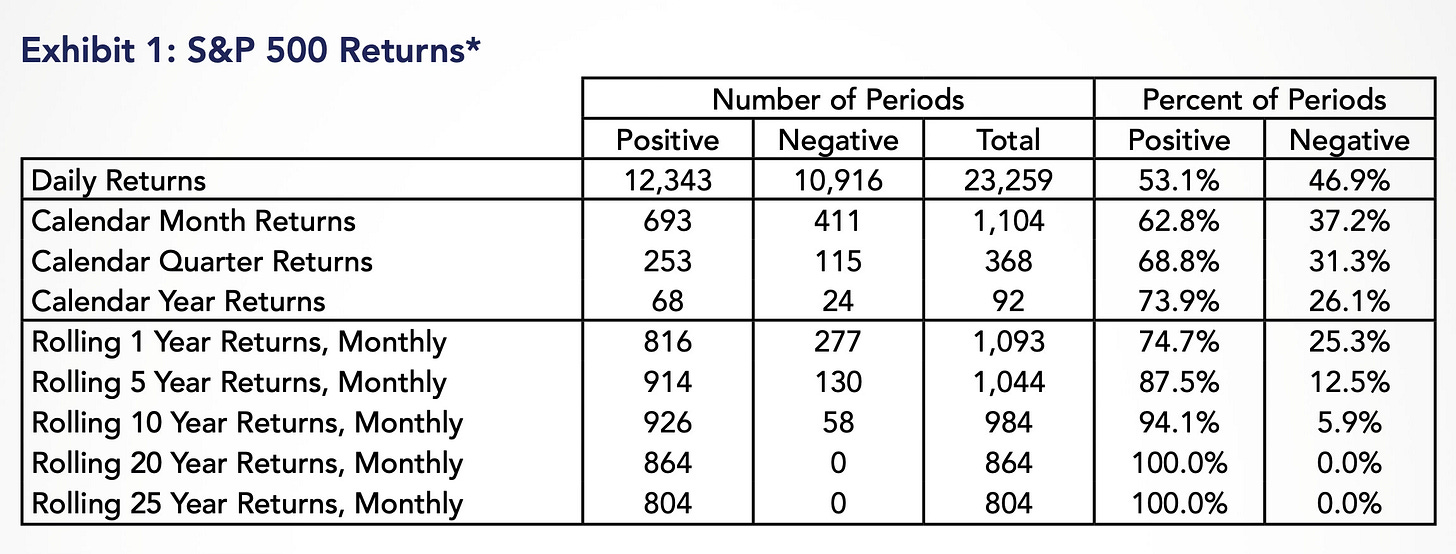

Even though slightly more than half of daily returns are positive, the lived experience on a day-to-day basis is only a little better than a coin flip. The investor who looks at quotes every day will see roughly the same number of days of gains and losses, but the losses will overwhelm his emotions leading to an aggregate emotional deficit. This effect is greatly alleviated by looking at quotes less often. For example, nearly three-quarters of calendar years have provided a positive return.

Investors who do not differentiate between market quotations and intrinsic value are even more susceptible to accumulating a negative emotional deficit if they look at quotes too often. Those of us who anchor to intrinsic value can view quotes with more detachment but we are still not immune from irrational thinking.

The lesson is crystal clear: Investors should ignore quotes on a daily basis.

Watching quotes obsessively is sure to create an aggregate emotional deficit over any length of time. Even worse, this emotional deficit could become overwhelming to the investor and lead to panic selling in a desperate attempt to restore emotional balance.

Daniel Kahneman’s insight, if more widely followed, has the potential to improve the overall happiness of investors by reducing emotional turmoil associated with market fluctuations. Emotional balance is a prerequisite to achieving satisfactory investment results over long periods of time. Unfortunately, today’s society prizes minute-by-minute sensory input of all sorts, with market quotes being just one example.

I recommend the following articles and podcasts for readers interested in learning more about Daniel Kahneman’s life and work:

The Psychologist Who Turned the Investing World on Its Head by Jason Zweig, March 29, 2024. Jason Zweig knew Daniel Kahneman personally and collaborated with him on the first two-thirds of Thinking, Fast and Slow, which was published in 2011 and sold more than 2.6 million copies. “… Danny could rework what we had already done as if it had never existed. Most people hate changing their mind; he liked nothing better, when the evidence justified it. ‘I have no sunk costs,’ he would say.” (WSJ)

Book Review: The Undoing Project, December 15, 2016. Daniel Kahneman and Amos Tversky did not start their careers with the intention of one day upending the field of economics. At the start of their collaboration in the late 1960s, they had been shaped by experiences that were superficially similar but, in fact, quite different. Michael Lewis tells the story of their friendship and collaboration in The Undoing Project: A Friendship That Changed Our Minds. (Rational Walk)

Daniel Kahneman’s Final Exploration of Human Error by Rob Henderson, March 31, 2024. This article is a review of Daniel Kahneman’s final book, published in collaboration with Olivier Sibony, and Cass Sunstein. (Rob Henderson’s Newsletter)

Daniel Kahneman: Putting Your Intuition on Ice, October 2019. 1 hour, 6 minutes. In this 2019 interview, Shane Parrish asked Daniel Kahneman to elaborate of many of his key ideas. “I think changing behavior is extremely difficult. There are a few tips and a few guidelines about how to do that, but anybody who’s very optimistic about changing behavior is just deluded. It’s hard to change other people’s behavior. It’s very hard to change your own. Not simple.” (The Knowledge Project)

Nassim Taleb and Daniel Kahneman discusses Antifragility, February 5, 2013. This is an interesting discussion between Taleb and Kahneman that I’ve seen a few times. I particularly liked Kahneman’s analysis of how the fictional Fat Tony and Nero Tulip of Taleb’s books represent different aspects of the author’s personality. (YouTube)

Articles

Biglari Holdings (BH) - In Defense of Sardar Biglari by Jacob McDonough, March 29, 2024. I looked into Sardar Biglari a decade ago due to his stated goal of emulating Warren Buffett. I came to the conclusion that Biglari was using Buffett’s name in an effort to enrich himself at the expense of shareholders. This article is an interesting counterpoint. The question is whether a steep discount to liquidation value can offset concerns about the integrity, motivation, and incentives of management. I remain very skeptical, but skepticism is obviously the consensus and I found this non-consensus take on Sardar Biglari very interesting. (McDonough Investments)

Inside the New Wave of Old-School Education by Julia Steinberg, March 24, 2024. I hope this trend opposing “modern education” gains much more momentum. “Today, more than a million students in the United States, ages five to 18, are receiving a classical education in public or private schools, or at home, Dan Scoggin, co-founder of Great Hearts Academy, a network of public charter schools in the classical education tradition, estimated. That’s nearly two percent of all 55 million students across the country.” (The Free Press)

America Made a Huge Bet on Sports Gambling. The Backlash Is Here by Joshua Robinson, Jared Diamond and Robert O'Connell, March 28, 2024. The constant ads for gambling during sports broadcasts have become increasingly jarring. Sports betting takes the worst aspects of securities trading and greatly amplifies the ill effects. Predictably, it has increased corruption in sports and I’m sure that it will further degrade our society in the coming years. The economically illiterate are most likely to fall victim but even experts in psychology have been financially ruined. (WSJ)

Comments on Disney’s Proxy Battle by Bill Ackman, April 2, 2024. Nelson Peltz is in a close proxy contest with Disney which is opposing his nomination to the board. I’ve found it strange that the ongoing results of proxy voting have been reported in the media. According to Bill Ackman, such leaks are illegal if done to manipulate the final outcome. He’s urging a SEC investigation into the matter. (X/Twitter)

12 Things I Learned from René Girard by Ted Gioia, March 25, 2024. “When Girard writes about ancient Greek tragedy, he seems to be describing Instagram and social media. When he analyzes Flaubert or the Book of Genesis, he somehow explicates the current political situation. By looking at what’s old, he clarifies what’s new.” (The Honest Broker)

The Reddits by Paul Graham, March 2024. “I pushed the Reddits to launch fast. A version one didn't need to be more than a couple hundred lines of code. How could that take more than a week or two to build? And they did launch comparatively fast, about three weeks into the first YC batch.” (PaulGraham.com)

Podcasts

10 Lessons from the Best Writer in Tech: Paul Graham, March 29, 2024. 1 hour. Video. David Perell explains how Paul Graham writes so well. “… How has writing led to Paul Graham's success? I've deconstructed 11 of his best lessons and we're going to go through them one by one. Ultimately, you’ll learn the writing secrets behind this mega-successful investor, how he engages and delights his audience, and how you can, too.” (How I Write)

Chips Are the Future of AI. They’re Also Incredible Vulnerable. March 29, 2024. 45 minutes. Transcript. “In 2017, something really miraculous happened, something that has never before happened in the history of humanity, and that is humanity learned how to make machines think, to turn chips or computers, not into just calculators, but into thinkers. From chips to cognition. And this is a big deal, because that means chips and compute is about to become one of the most valuable commodities in the world. Actually, it will likely become the most valuable commodity in the world.” (Your Undivided Attention)

Robin Dunbar — Optimizing Human Connection, April 2, 2024. 1 hour, 2 minutes. Transcript. “Robin is a biological anthropologist, evolutionary psychologist, and specialist in primate behavior. He is the man behind Dunbar’s number, a theory about the number of stable relationships we can maintain at once. Robin unravels the thread of research that led him to Dunbar’s number and describes how this plays into every single person’s layers of human connection.” (Invest Like the Best)

Dr. Rhonda Patrick: Diet Essentials For Healthy Living, April 2, 2024. 1 hour, 31 minutes. “Shane Parrish sits down with Dr. Rhonda Patrick to explore the intricate world of nutrition and health. Dr. Patrick provides a deep dive into the role micronutrients play in our daily health, detailing how deficiencies and insufficiencies in vitamins, minerals, fatty acids, and amino acids can lead to serious health issues over time.” (The Knowledge Project)

A User’s Guide to Our Emotional Thermostat, April 1, 2024. 1 hour. Transcript. “Can you be too happy? Psychologist Adam Mastroianni talks with EconTalk's Russ Roberts about our emotional control systems, which seem to work at bringing both sadness and happiness back to a steady baseline. Too much happiness is--perhaps surprisingly--not necessarily a good thing. They also explore whether our general level of happiness is really related to events in our lives or connected to something much larger than ourselves.” (Econ Talk)

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Thanks for sharing the article on Biglari Holdings. I love that you were skeptical, remain skeptical, yet were still willing to think through the other side of the argument at the same time and give it a chance. We all could use more of that these days