The Digest #185

Capital Allocation, Progressive's strategy, Reading plans, Damodaran's free courses, Looking back at Alibaba's IPO, Chris Davis, Outsider CEOs, Shareholder activists, Oprah, and more ...

Capital Allocation

Anyone who is interested in Berkshire Hathaway should read Jacob McDonough’s book, Capital Allocation: The Financials of a New England Textile Mill. The book covers Berkshire’s history from 1955 to 1985. By providing a decade of history prior to Warren Buffett assuming control in 1965, we can see how Berkshire performed as a textile company before it was transformed over the subsequent two decades. Jacob recently announced that he has made a PDF of the book available for free.

Here is an excerpt from a review of the book that I published in 2020:

Jacob McDonough’s book attempts to analyze Berkshire from 1955 to 1985 through the eyes of an investor who was examining financial statements during those years.

As McDonough states at the outset, he wrote the book for practitioners who are interested in analyzing the financial statements of Berkshire Hathaway during its early years in an attempt to study what Buffett saw at the time and how he transformed the business. The book emphasizes the numbers from Berkshire’s financial statements along with McDonough’s analysis of the sources and uses of cash flow. Extensive notes demonstrate that McDonough obtained and studied all of Berkshire’s early financial statements. These documents pre-date the SEC’s Edgar system and are not widely available on the internet.

For many Berkshire shareholders, this might be the first time that they have had the opportunity to examine Berkshire’s early financial statements.

I highly encourage everyone to check out the PDF of the book or, better yet, to purchase a printed copy. My full review is available below:

In the video below, Jacob McDonough discusses his book with Geoff Gannon and Andrew Kuhn on a Focused Compounding podcast:

Articles

Reading Plans, January 15, 2024. I published this article earlier this week. It provides a description of three sets of books I recently purchased along with my future reading plans. “The Great Books cast a formidable shadow but most of them were meant to be read by a wide audience. Reading plans make it easier to get started.” (The Rational Walk)

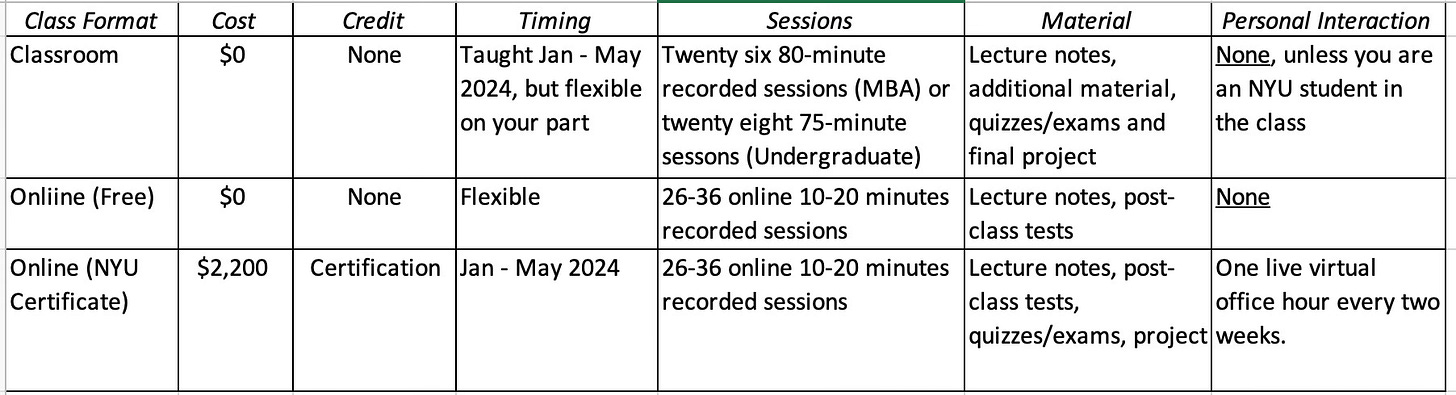

The School Bell Rings: Time for Class by Aswath Damodaran, January 11, 2024. Every year, Professor Damodaran generously makes his classes available for free. This is a great opportunity for students of limited means to gain knowledge that normally costs thousands of dollars. He offers the classes in three formats, as shown in the following exhibit appearing in his article. I also recommend Professor Damodaran’s second data update article for 2024. (Musings on Markets)

The Berkshire Beat by Kingswell, January 12, 2024. Kingswell begins a slow read of the new edition of Poor Charlie’s Almanack starting with this issue. I am still waiting for my hard copy of the book but fortunately it is available for free on Stripe’s website. I’d also recommend Kingswell’s recent article on Chris Davis. (Kingswell)

Haslam family sells Berkshire Hathaway remaining 20% of Pilot by Dan Mangan, January 16, 2024. Berkshire Hathaway and the Haslam family reached a settlement that avoided a potentially nasty trial. I wrote about the dispute between Berkshire and Pilot in early November. Unfortunately, the settlement announcement reveals very little about the agreement. We are likely to learn how much Berkshire paid for the remaining 20% of Pilot in late February when Berkshire’s annual report is released. I suspect that we will not learn much beyond the purchase price. (CNBC)

How to Be Successful by Jim O'Shaughnessy, January 10, 2024. Great advice on how to pursue success: “Read, synthesize ideas, try them, abandon those that aren't working, try new ones, read some more. Tell people about your hopes and goals. Listen for good advice; it does exist. But ruthlessly remove the bad advice, the naysayers, the permanent pessimists. Keep your mind wide open to ideas; indeed, read and understand those you might have an aversion to so that you improve your understanding and knowledge.” (Infinite Loops)

Case Study – Alibaba’s Long, Strange Trip by Herb Greenberg, January 17, 2024. A look back at red flags that were apparent to those who actually read the filings prior to Alibaba’s IPO nearly a decade ago. “Alibaba was the Chinese Amazon, only better... as if Alibaba simply did everything better than everybody else. And at its public debut at the New York Stock Exchange, Jack Ma became an instant celebrity.” (On the Street)

The Negative Checklist: Reducing Errors, January 18, 2024. “Joel Tillinghast’s negative checklist inverts the problem. Instead of looking for great companies, great management, and so on, the checklist avoids the worst of the worst of them. Don’t understand the company? Skip it. Horrible management? Nope. Overpriced stock with no sales? Pass. Product with no pricing power or brand loyalty? Not interested.” (Novel Investor)

Podcasts

High Conviction Value Investing with Chris Davis, January 11, 2024. 1 hour, 4 minutes. Video. “Chris has built an outstanding long-term record as a value investor and also serves on the board of both Berkshire Hathaway and the Coca-Cola Company. We discuss his process for analyzing companies and his owner earnings-based approach that led him to companies like Amazon ... We also discuss his biggest lessons from his father and grandfather, both of whom were very successful investors as well, how Charlie Munger changed his life and his thoughts on concentration and position sizing.” (Excess Returns)

Trane Technologies: Hot and Cold, January 10, 2024. 46 minutes. Transcript. Trane provides HVAC systems. “We cover the distribution model and class-leading software behind Trane's evolution, the main differences between commercial and residential HVAC, and how trends like decarbonization and data centers are driving demand.” (Business Breakdowns)

Outsider CEOs: Tom Murphy, A Perpetual Motion Machine for Returns, January 12, 2024. 41 minutes. Video. Geoff Gannon and Andrew Kuhn discuss the career of Tom Murphy based on The Outsiders, by William Thorndike. (Focused Compounding)

Business Lessons from Tom Murphy, April 8, 2022. (The Rational Walk)

Dear Chairman: Benjamin Graham vs. Northern Pipeline, January 16, 2024. 1 hour, 1 minute. Video. This episode begins a series of podcasts covering Dear Chairman, a book about shareholder activism by Jeff Gramm. (Focused Compounding)

Book Review of Dear Chairman, June 18, 2016. (The Rational Walk)

Oprah, January 16, 2024. 1 hour, 9 minutes. There are no biographies of Oprah Winfrey so David Senra transcribed two interviews of Oprah, Young Oprah on Her Life and Career and Oprah on Career, Life, and Leadership, and shares what he learned about a remarkable television personality and businesswoman. (Founders Podcast)

Tiberius, January 11, 2024. 53 minutes. “When [Tiberius] was born in 42 BC, there was little prospect of him ever becoming Emperor of Rome. Firstly, Rome was still a Republic and there had not yet been any Emperor so that had to change and, secondly, when his stepfather Augustus became Emperor there was no precedent for who should succeed him, if anyone. It somehow fell to Tiberius to develop this Roman imperial project and by some accounts he did this well, while to others his reign was marked by cruelty and paranoia inviting comparison with Nero.” (In Our Time)

Tiberius, Emperor of Rome

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.