The Digest #180

Berkshire Hathaway Energy, John Neff and Peter Lynch on investing, Charlie Munger on parenting, Damodaran on key person risk, Microsoft's IPO, Howard Marks and Annie Duke discuss risk, and more ...

Berkshire Hathaway Energy

The United Nations Climate Change Conference, usually referred to as COP28, is currently underway in Dubai. The event website proudly proclaims that there will be 285 press conferences, 152 global climate action events, 366 side events, and 195 exhibits before the thirteen day conference ends on December 12.

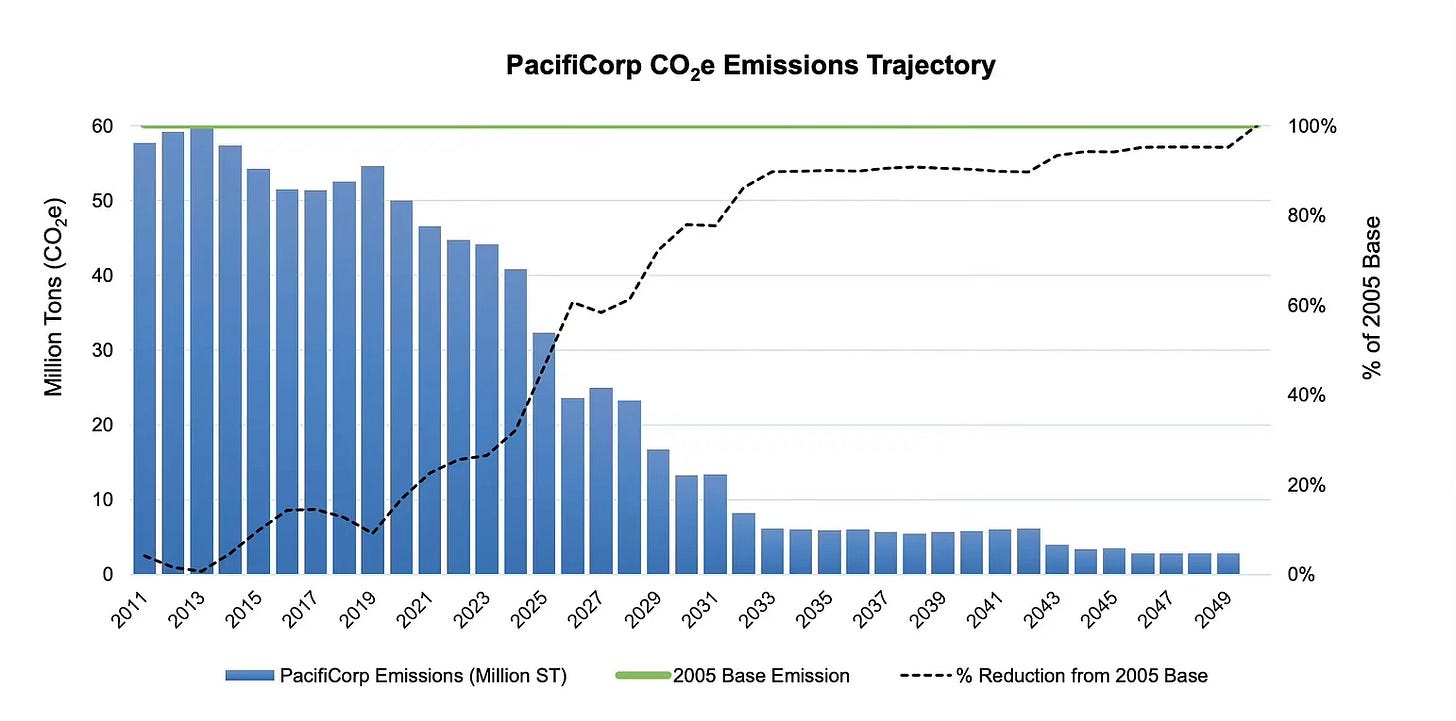

Large multinational events such as COP28 attract much more media attention than the quiet progress on decarbonization taking place at companies such as Berkshire Hathaway Energy (BHE). Last week, I reviewed a recent BHE presentation and shared several highlights with subscribers. The decarbonization initiatives are impressive, with “net zero” expected by 2050. Much progress has already been made.

Berkshire Hathaway is constantly attacked by the so-called “ESG” movement, with vacuous shareholder initiatives presented at every annual meeting. I have to wonder whether these activists have even read BHE’s presentations and other disclosures.

I suspect that many activists do not really care so much about actual progress on decarbonization. They are more focused on using climate change as a political cudgel to attack capitalism. The response of a typical climate change street protestor to a slide such as the one below might be to deface a centuries-old painting, shriek incoherent slogans, chain themselves to a pole, or block traffic.

While virtual signaling global elites conclude the festivities at COP28, in a dress rehearsal for next month’s extravaganza at Davos, it is worth noting that the private sector continues to make progress on decarbonization goals. The full article is available for paid subscribers. A free introduction is available for all readers.

Articles

The Great Conversation by The Rational Walk, December 6, 2023. Last week, I wrote a review of The Great Conversation: The Substance of a Liberal Education by Robert M. Hutchins. This book is the first volume of Great Books of the Western World, a fifty-four book set originally published in 1952. (The Rational Walk)

John Neff, Peter Lynch, Portfolio Turnover and Growth Traps by John Huber, December 5, 2023. I remember reading about John Neff frequently in the 1990s, but he retired in 1995 and fell off the radar for most investors. This article reviews John Neff on Investing, a book that has not been widely discussed recently. (Base Hit Investing)

The Embrace of Agency by Lawrence Yeo, December 2023. “Someone recently asked me when I became a writer. I hadn’t put much thought into that inquiry before, but I felt compelled to address it. After a brief pause, I replied, ‘I became a writer when I told myself that I was a writer.’” (More to That)

Charlie Munger’s Parenting Lessons, December 5, 2023. Charlie Munger wrote about parenting lessons in this article: “My children and grandchildren might not think exactly the way I do, but I hope they can observe my life as an example of how to be successful in their careers and relationships — just as I did with the generations before me.” (CNBC)

Building Moats by Conor Mac and Ironside Research, December 5, 2023. This is an interesting article about identifying the “moats of tomorrow.” (Investment Talk)

Charlie Munger's Outstanding Investor Digest Talks by Adam Mead, December 9, 2023. Links to three OID issues covering Charlie Munger. (Watchlist Investing)

The Difference Makers: Key Person(s) Value! by Aswath Damodaran, December 10, 2023. Key person risk is obvious at small companies but also an issue at large companies such as OpenAI, Tesla, and Berkshire Hathaway. (Musings on Markets)

Podcasts

Annie Duke and Howard Marks, December 6, 2023. 52 minutes. Annie Duke, a former professional poker player and best-selling author, joins Howard Marks to discuss ideas from her book Thinking in Bets and Howard’s memo You Bet! (Oaktree Capital)

Microsoft - 1986 Prospectus, December 8, 2023. 28 minutes. Jacob McDonough analyzes Microsoft’s prospectus released prior to the 1986 IPO. (10-K Podcast)

Celebrating Charlie Munger, December 10, 2023. 2 hours, 11 minutes. Transcript. William Green recalls his interactions with Charlie Munger over the years. He also replays past interviews with Mohnish Pabrai, Tom Gayner, Joel Greenblatt, and Chris Davis regarding what Charlie Munger taught them. (Richer, Wiser, Happier)

The Enduring Legacy of Charlie Munger, December 6, 2023. 53 minutes. Lawrence Cunningham is the author of several books on Berkshire Hathaway and served as editor of The Essays of Warren Buffett: Lessons for Corporate America. (Excess Returns)

Assessing Land Banks: Value Trap or Value Investment?, December 6, 2023. 28 minutes. Video. It is tempting to purchase stock of a company where the market capitalization is demonstrably lower than the value of land on the balance sheet. However, depending on the circumstances, this can be a trap. (Focused Compounding)

Snow, Boulevard de Clichy, Paris, 1886

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Thank you for the mention! Cheers!

Respectfully disagree with your assumption that most activists aren't looking for real progress on decarbonization. Further, PacifiCorp has an abysmal record on this front, has more coal-fired generation than virtually all surrounding utilities and is dragging its heels on transitioning away from coal to clean energy.