Progressive is Firing on All Cylinders

The auto insurer resumed aggressive growth in the first quarter of 2024 while reporting a very strong combined ratio.

At the start of 2023, Progressive ramped up its growth strategy. Policies-in-force grew by 7.9% between January and May but growth came at the cost of a rising combined ratio which reached 104.9% in June. This caused management to dial back on growth for the rest of 2023. Policies-in-force increased by 0.6% between June and December as the combined ratio improved considerably, reaching 83.4% in December.

I covered Progressive’s problems during the first half of 2023 in Will Progressive’s Growth Strategy Pay Off?, published on July 15, and I discussed the company’s results for the full year in Progressive vs. GEICO: 2023 Results, published on March 5.

The balance between market share gains and achieving acceptable profitability is an age-old challenge in the insurance industry, and this has been particularly apparent over the past several years in auto insurance. Despite some hiccups, Progressive has successfully achieved market share gains and strong profitability in the recent hard insurance market and, at least so far, has won the competitive battle against GEICO.

Since Progressive reports summary financial data on a monthly basis, we have the ability to track its results more frequently than for most companies. With Progressive’s March results released last week, we are in a position to see how the company’s growth strategy has performed so far this year.

Management has decided to resume aggressive growth. Policies-in-force grew by 3.9% in the first quarter. More impressively, the combined ratio for the quarter was 86.1%, nearly ten points below management’s target of 96%. This profitability was delivered despite a rising expense ratio, likely due to an increase in advertising expenses.

In normal times, auto insurance is a “sticky” product because there is some hassle involved in changing carriers. But auto insurance has been a major pain point for consumers over the past year, with costs up 22.2% according to the March CPI report. With the average annual cost of auto insurance coming in at over $2,300, a typical consumer might see their semi-annual premium increase by $250 or more. This is more than enough to prompt most people to do some comparison shopping. Insurers that have ramped up advertising spending are likely to take share based on higher consumer awareness, provided that they are also competitive on pricing.

Let’s take a brief look at Progressive’s recent monthly results and consider how GEICO might have fared in the first quarter. Berkshire Hathaway will release first quarter results on the morning of the annual meeting on Saturday, May 4.

Recent Results

The brief discussion that follows is based primarily on Progressive’s monthly financial reports, with a focus on January, February, and March. Progressive’s 10-Q will be filed on Monday, May 6 and the first quarter earnings call will be on Tuesday, May 7. The company’s monthly releases are not substitutes for the more detailed information found in 10-Q and 10-K reports but they do provide a useful early preview.

I find it most interesting to track policies-in-force on a monthly basis. The figures reported represent the number of insurance contracts outstanding at the end of each month. In contrast to other metrics that involve estimation of losses, policies-in-force should be known with precision on the reporting date.

If policies-in-force grow faster than the addressable market, Progressive’s share will increase, but this is only a good thing if growth generates underwriting profits over the expected lifetime of the policy. New business is less profitable than seasoned business for reasons that management discussed in an investor presentation last year.

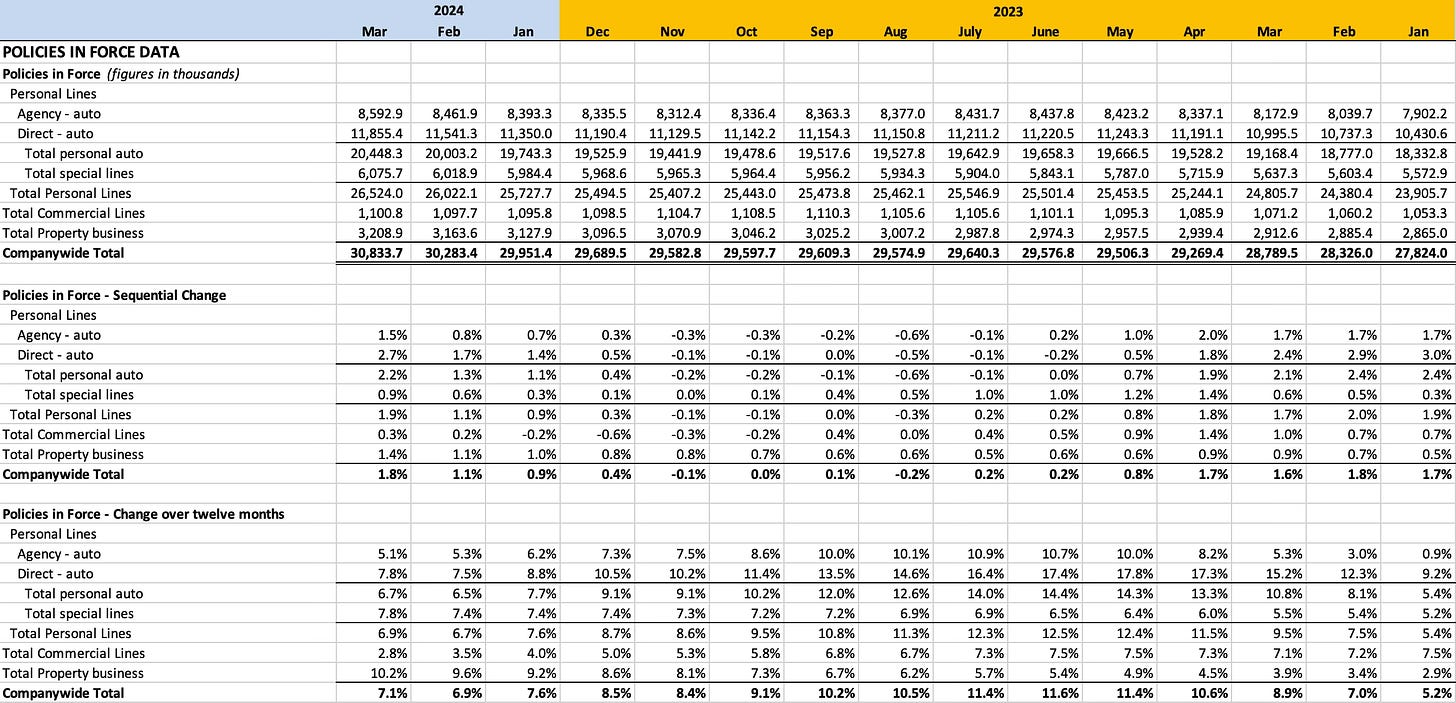

The exhibit below shows Progressive’s policies-in-force by product line since the beginning of 2023 along with monthly sequential and annual percentage changes:

At the end of March, Progressive had a total of 30.8 million policies-in-force, up 7.1% over the past year, and up 3.9% over the past three months. We can see that monthly growth resumed in earnest starting in January after six months of marginal growth.

During the fourth quarter earnings call on February 27, CFO John Sauerland pointed out that growth in policies-in-force depends on new business acquisition but policyholder retention is a stronger driver.

“… If we're looking towards PIF [policies-in-force] growth, new business is one driver, but retention is a far stronger driver of PIF growth. And as Tricia mentioned, we are looking forward to more stable rates this year.

We are feeling very adequate in most environments. So we have already enjoyed retention improvements, and we expect to continue to enjoy retention improvements.

Competitors are certainly in a better place, but are continuing to raise rates as well. So on a competitiveness basis when the renewals come through, we think we're going to be in a good place, and that will help drive policy in force growth as well.”

We are told about policies-in-force on a monthly basis but we do not see “churn” in policyholders. It would be useful to see the number of policies that did not renew along with the number of new policies written, but this is competitive information that management would not want to share. Since new policies are less profitable initially than seasoned business primarily due to acquisition costs, we could expect a higher combined ratio at times when there is more policyholder “churn.”

Based on management’s loss reserve estimates, growth during the first quarter was achieved with excellent profitability, as we can see in the exhibit below which shows premiums earned and the components of the combined ratio since January 2023:

The figures highlighted in yellow show the monthly combined ratio for the first three months of the year. The combined ratio for the quarter was 86.1%, nearly ten percent below management’s target 96% combined ratio. We can also see that the expense ratio has crept up from 16.3% in December to 18.7% in March. It is likely that higher advertising costs were incurred during the first quarter to acquire new customers. The loss ratio has declined meaningfully compared to levels that prevailed during 2023, the result of the industry-wide trend toward higher premiums.

Assuming that management is confident in their loss estimates for the first quarter, the low combined ratio is likely to result in even more aggressive advertising spending as the year progresses. Management’s goal is to grow as fast as possible consistent with achieving a 96% combined ratio. There is plenty of room to further increase ad spending and management may decide to compete more aggressively on pricing.

GEICO’s Q1 Results?

We will have to wait until May 4 for GEICO’s results which will be reported within Berkshire Hathaway’s first quarter 10-Q. My concerns regarding GEICO will not surprise longtime readers. I wrote the following last month:

It will be interesting to see how quickly GEICO increases advertising spending and whether market share follows. Following Progressive’s monthly results can provide an advance clue regarding overall industry conditions. GEICO has important cost advantages that should provide underwriting profits on a consistent basis in the years ahead but the competition with Progressive is certain to be brutal.

With the rising pricing environment, I expect GEICO will post strong results in terms of the combined ratio, continuing the positive trajectory evident in quarterly results during 2023. However, in my opinion the more important metric will be policies-in-force. In 2022, GEICO’s policies-in-force declined by 8.9% and this was followed by a decline of 9.8% in 2023. Significant market share has been lost, much of it to Progressive, as GEICO’s management focused on restoring profitability.

With GEICO reporting a combined ratio of 86.5% in Q4, perhaps management felt more comfortable competing for new business over the past three months. We will find out three weeks from today.

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Long Berkshire Hathaway. No position in Progressive.

Great update! Your past commentary on GEICO's lost share is interesting. BRK is well known to ramp up underwriting after a hurricane has hit and others are scaling back. It appears that PGR has used BRK's playbook on BRK over the past 1 - 2 years. It will be interesting how/where BRK tries to recapture the lost share from. Particularly in an environment where PGR is back in growth mode. Granted, there are many weaker players in this space. GEICO has definitely fixed its CR, but it has come at a big cost.