Costco's Director Compensation

Charlie Munger's service on Costco's board makes the retailer's director compensation approach a potential model for Berkshire Hathaway in the future.

“Costco is a different kind of place. It's one of the most admirable capitalistic institutions in the world. And its CEO, Jim Sinegal, is one of the most admirable retailers to ever live on this planet. Costco will continue making huge contributions to society. It has a frantic desire to serve customers a little better every year. When other companies find ways to save money, they turn it into profit. Sinegal passes it on to customers. It's almost a religious duty. He's sacrificing short-term profits for long-term success. More of you should look at Costco.”

— Charlie Munger, 2011 Wesco Financial Annual Meeting

Introduction

Berkshire Hathaway has a unique board of directors with significant skin in the game. Directors serve on the board for minimal cash compensation and receive no equity awards of any kind.1 When there is a vacancy on the board, candidates are expected to have a meaningful ownership interest in the company along with sufficient business acumen. This combination should provide strong incentives for board members to fulfill their duties without receiving meaningful compensation for their service.

While I believe that the board displays the characteristics that I have described, the other important factor attracting members is the opportunity to interact with Warren Buffett and Charlie Munger. Although it is not likely the primary consideration, a director on Berkshire’s board automatically gains massive prestige because they have been selected by two of the world’s most successful businessmen.

In the future, it is certain that Berkshire’s board will change significantly. Voting control of the company will change as Warren Buffett’s super-voting Class A shares are converted to Class B shares and distributed to philanthropy in the decade following his death. In addition, without Mr. Buffett and Mr. Munger’s presence, the prestige that comes with board membership will inevitably be diminished.

If we fast-forward twenty years to 2043, what will Berkshire Hathaway’s board look like and how will members be compensated? The culture and history of the company strongly suggests that Berkshire’s board will continue to be far better than the boards of average American companies. However, Berkshire will lack a shareholder with Mr. Buffett’s enormous economic stake and voting power.

How can Berkshire avoid the pitfalls that afflict typical corporate boards? Given Charlie Munger’s service on Costco’s board since 1997, it is worthwhile to examine how Costco approaches director compensation. Mr. Munger is not a current member of the board’s compensation committee but he most likely approves of the overall compensation strategy. With an ownership interest of over $100 million in Costco, Mr. Munger certainly has a strong alignment of incentives with Costco shareholders.2

Let’s take a look at Costco’s latest proxy statement to see how directors are compensated and whether the company’s approach could be a model for Berkshire’s director compensation in the future.

Board Ownership

It is important to consider the ownership interest of board members before we look at compensation practices. Ownership matters both in absolute and relative terms. Ideally, a director will not only hold millions of dollars of stock but the ownership interest should comprise a significant percentage of the director’s net worth.

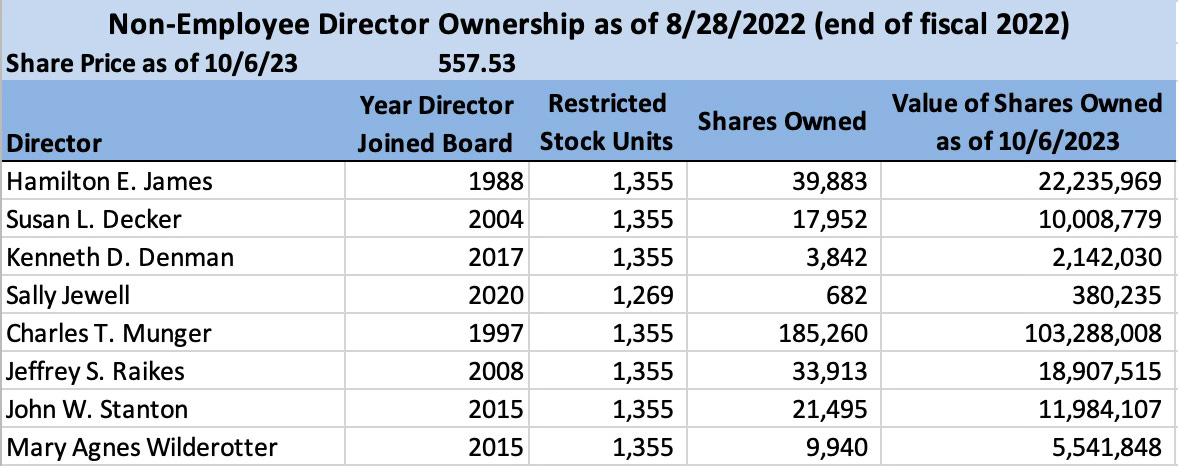

The following exhibit shows ownership of restricted stock units and shares directly owned by non-employee directors at the end of Costco’s fiscal 2022 as of August 28, 2022. Costco’s proxy statement for fiscal 2023 has not been released.

Costco mandates that all directors must own and retain shares worth at least $1 million based on the value at the time of acquisition of shares. However, this requirement only applies to directors who have served for at least five years. All directors have satisfied the $1 million requirement except for Sally Jewell who has not been on the board for five years.

With the exception of Ms. Jewell, each director has what I would consider to be a substantial interest in the company in absolute terms. We are not in a position to know whether these holdings represent a significant portion of the net worth of directors except to the extent that we draw inferences from the director biographies in the proxy and publicly available information about their careers. My overall impression is that the Costco board has significant skin in the game.

Board Compensation

Costco’s board is compensated on par with other large companies with total director compensation exceeding $300,000 for each non-executive director in fiscal 2022. As of July 2022, the board set the annual cash retainer to $37,000 in addition to travel expenses related to their duties. In fiscal 2022, each director received a grant of 561 restricted stock units (RSUs) which were valued at $266,369 on the date of the grant in October 2021. The exhibit below is taken directly from the 2022 proxy.

Stock awards vest by one-third annually beginning on the first anniversary of the date of the grant. Directors receive accelerated vesting upon retirement based on length of service. Directors with between five and ten of service at retirement receive 50% accelerated vesting while those with more than ten years of service are fully vested.

Referring back to the stock ownership exhibit, as shares vest, they move from the RSU column to the Shares Owned column and begin to count toward the $1 million minimum holding requirement. We can see by the size of the RSU grants that it would be possible for a director to join the Costco board and accumulate the $1 million minimum entirely through RSU grants without purchasing any stock directly.

Alignment of Incentives

In my opinion, it is not ideal to allow satisfaction of the share ownership requirement entirely through vesting of restricted stock because this means that directors could join with minimal or no prior share ownership and satisfy the requirement entirely through compensation as directors. However, this criticism is mitigated by the fact that directors are receiving only a modest cash retainer and no additional perquisites. As a point of reference, the cash retainers for non-executive directors at Wal-Mart and Target are $100,000 and $120,000 per year, respectively.3

One major benefit of setting the cash retainer at a relatively low level is that few directors will be attracted to serve on the board as a form of a retirement or late-career sinecure. It is not uncommon in corporate America to see directors with little skin in the game serving on several boards which, in aggregate, provides for a significant income. Costco’s $37,000 cash retainer is unlikely to make a serious dent in the income needs of directors seeking to use board membership primarily as a means of supplementing their income.

From a psychological perspective, I think that there is a difference between being given RSUs as compensation and purchasing stock directly with one’s own cash. However, in the case of Costco, the fact that directors are receiving modest cash compensation probably leads members to regard the RSUs they receive as far more than mere lottery tickets.

Of the eight non-executive directors, five have stock holdings of over $10 million. Those with under $10 million have served for less than a decade. This level of ownership would be psychologically meaningful for anyone with a net worth less than several hundred million dollars. Serving alongside Charlie Munger, who owns over $100 million of Costco stock, no doubts adds to the board’s owner-oriented mentality.

A Potential Model for Berkshire Hathaway?

It is useful to consider Berkshire’s board compensation in two parts. First, what is the level of compensation that will likely be necessary to attract and retain directors in the future? Second, how should board compensation be divided between a cash retainer and restricted stock?

While I would be happy to be proven wrong, it just seems unrealistic to think that director pay will remain at current microscopic levels far into the future. It seems far more likely that the level of pay will eventually approach the norm for similarly sized companies. In today’s world, that generally means total compensation in the $250,000 to $350,000 range. It would be reasonable for Berkshire to pay somewhat below the norm, perhaps in the $200,000 range, especially if board members continue to have large holdings and the overall ethos of the company remains intact.

If director pay is to rise to the $200,000 range, the Costco model could be emulated by establishing a low cash retainer of perhaps $20,000 per year with the balance paid in restricted stock that vests over three to five years. Berkshire could also implement a minimum requirement. Given Berkshire’s culture, it would be reasonable to have a minimum ownership requirement that cannot be met exclusively by accumulating restricted stock. It would seem undesirable for Berkshire to have directors who have not built a meaningful position in the company prior to serving on the board.

The following exhibit is from my article covering Berkshire’s 2023 proxy statement:

There are non-executive directors who have served on the board for many years who have accumulated a smaller interest in Berkshire compared to the non-executive directors at Costco. For example, Susan Decker serves on both boards and her ownership of Costco is roughly ten times as large as her ownership of Berkshire.

For some Berkshire shareholders, the idea of granting RSUs to directors might be viewed as heresy. But if I am correct that overall compensation of directors will have to increase in the future, the choice will be between paying all of the compensation in cash versus paying a small cash retainer plus RSUs. If the cash retainer is very small, directors are likely to regard RSUs almost like shareholders who used their own cash to purchase their shares.

One alternative would be to pay a larger cash retainer with no RSUs and then require directors to establish a certain level of ownership on their own. This could fit more closely with the Berkshire ethos and overcome objections from shareholders who dislike the concept of providing any stock-based compensation.

Conclusion

Stepping back from the particulars, the primary way to align the interests of directors with shareholders is for directors to have an economic interest in the company that is far more important than the annual pay received for their service. As an example, consider a director of Costco who owns $10 million of stock. Director compensation represents just over 3% of their interest in the company. Such a director will be far more driven by his or her economic interest than annual director pay.

One of the main requirements for independent directors is the willingness to oversee management and take aggressive action if they observe misguided business strategies or misconduct. Too often, board members just act as rubber stamps for the CEO. Ordinary shareholders should want directors who are willing to raise uncomfortable questions in the boardroom. There is no substitute for ownership as a force for overcoming the natural desire of most people to go along with their peers.

I would be remiss to not mention executive compensation which I have chosen not to discuss in this article. The reason I focused on director pay at Berkshire is that it is unusually low. The same is not true for executive compensation, other than the symbolically small pay received by Warren Buffett and Charlie Munger. Both Ajit Jain and Greg Abel earned annual cash salaries of $16 million in 2022 plus a $3 million cash bonus. Although plenty of top executives earn more, these are large sums. The composition of CEO pay at Berkshire might change in the future to include a stock component but the overall level of pay probably does not need drastic revision.

Further Reading

The following two articles were written approximately a year ago. The first article has a link to a comprehensive profile of Costco which includes much of the content of the second article documenting my first visit to Costco as a new member.

If you found this article interesting, please click on the ❤️️ button and consider referring a friend to The Rational Walk.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Long Berkshire Hathaway.

No position in Costco.

Directors who are employed by Berkshire receive no compensation for serving on the board. Non-management members receive $900 for each in-person meeting and $300 for each meeting over the telephone. Audit committee members receive an additional $1,000 per quarter. Directors receive reimbursement for out-of-pocket expenses to attend director and shareholder meetings. No directors and officer liability insurance is provided to directors. See the 2023 proxy for further details and my article analyzing the proxy.

Charlie Munger controlled 187,180 shares of Costco, including 19,565 on behalf of a charitable foundation that he funded and controls. as of November 11, 2022. With the stock trading at $557.53 as of October 6, 2023, this ownership interest is worth $104.4 million.

Wal-Mart’s 2022 Proxy Statement, Page 39. Target’s 2023 Proxy Statement, Page 30. In Target’s case, directors have the option to forego cash compensation in exchange for additional stock-based compensation.

I wouldn’t be surprised to see Buffett or Munger fund (with some of their BRK.A shares) a special account to provide for director/senior staff RSUs. I believe their have been private pools for bonuses at other companies (CV Starr for AIG for many years), Kierlin at Fastenal, and Munger at DJCO - you wrote about those.