Berkshire's Future Depends on Voting Control

Will the culture endure after Warren Buffett's shares are distributed to philanthropy?

Will Berkshire Hathaway be broken up in the future? This has been a perennial debate over the years, and it is nearly certain that there will be agitation for Berkshire to spin off subsidiaries or to break up entirely in the decades to come. Conglomerates are no longer fashionable and there’s never any shortage of financial engineers who claim that the sum-of-the-parts will be more valuable than the whole.

As long as Warren Buffett is on the scene, talk of breaking up Berkshire will remain idle chatter. Mr. Buffett not only has nearly universal respect in the business community, but he has long had effective voting control of the company due to his personal ownership and the loyalty of longtime shareholders. However, it is nearly inevitable that many observers will question the conglomerate structure in the future, especially when the company hits unavoidable rough patches.

Will Berkshire Hathaway exist in its current form twenty years from now in 2042? Answering this question requires an examination of voting control at Berkshire Hathaway, how it has evolved over time, and how it is likely to evolve in the future.

Dual Class Share Structure

Berkshire Hathaway implemented a dual share class structure in May 1996 when the company first issued Class B shares.1 As Warren Buffett explained in his 1995 letter to shareholders, the Class B shares were offered primarily to thwart the creation of unit trusts. Berkshire’s stock traded at around $36,000 in early 1996 and promoters of unit trusts planned to charge hefty fees simply to own Berkshire stock and offer investors the ability to buy shares of the unit trust with small sums. Mr. Buffett considered this exploitive and correctly believed that availability of the Class B shares would stop the creation of the unit trusts.

Berkshire’s existing shares were renamed Class A shares. The new Class B shares originally had 1/30th of the economic rights of Class A shares and traded in the low four figure range, a price that small investors could afford to buy directly and bypass the expenses of the proposed unit trusts. In 2010, Class B shares split 50-for-1 and now have 1/1500th of the economic rights of a Class A share.2 All further references to Class B shares in this article will be on a split-adjusted basis.

At the time of the 1996 recapitalization, there were three differences between Class A and Class B shares:

Limited voting rights. Although Class B shares have 1/1500th of the economic rights of Class A shares, Class B shares only have 1/10,000th of the voting rights of Class A shares. Most small shareholders do not think very much about voting rights and reduced voting power probably had no impact on the marketability of Class B shares when originally issued. Today, with Class A shares approaching $500,000, the vast majority of individual investors who want to own Berkshire simply have no choice but to buy Class B shares.

Conversion feature. Owners of Class A shares have the ability to convert any number of their shares to Class B at any time with no tax consequences. This is very useful for people who want to create their own stock split for purposes of raising cash or making gifts worth less than a Class A share. Class B shareholders do not have the ability to convert their shares to Class A. The conversion advantage has become more important over the years as Berkshire’s Class A stock price has advanced.

Charitable giving program. Class A shareholders originally had the right to designate charitable contributions made by Berkshire. However, Berkshire’s charitable giving program was discontinued in 2003 amid political controversies related to charitable gifts that threatened to harm certain Berkshire subsidiaries. The charitable giving program was a minor benefit for Class A shareholders and was far less important than voting rights and the conversion feature.

The existence of the conversion feature has generally caused the price of the Class B shares to trade at roughly 1/1500th of the price of Class A shares over the years. If Class B shares ever trade at a meaningful premium to 1/1500th of the price of Class A shares, an arbitrage opportunity will exist. Investors would be able to purchase Class A shares, immediately convert them to Class B shares and profit from the premium.3

When Class B shares were created in 1996, they accounted for a very small portion of Berkshire’s market capitalization and an even smaller portion of voting control. However, over the past quarter century, the number of Class A shares has shrunk dramatically primarily due to conversion into Class B shares. As of December 31, 2021, Class B shares accounted for 58.2 percent of Berkshire’s economic value. However, Class B shares only carry 17.3 percent of Berkshire’s voting power. This shift in economic interest and voting control has not been widely covered in the media but has important implications for the company’s future.

Class A Equivalent Shares

Berkshire has historically referred to “Class A equivalent” shares outstanding in its news releases and financial statements. This metric is calculated by taking the total number of Class A shares outstanding and then adding the total number of Class B shares outstanding divided by 1,500:

Class A Equivalents = A Shares Outstanding + (B Shares Outstanding / 1500)

For example, on December 31, 2021, there were 617,113 Class A shares outstanding, and 1,290,474,503 Class B shares outstanding. Here is the calculation for the number of Class A Equivalents outstanding as of December 31, 2021:

Class A Equivalents = 617,113 + (1,290,474,503 / 1500)

Class A Equivalents = 617,113 + 860,316.34, Rounded to 860,316

Class A Equivalents = 1,477,449From this calculation, we can see that 58.2 percent of the economic interest of Berkshire Hathaway is represented by Class B shares, while 41.8 percent is represented by Class A shares. The following chart shows the total number of Class A equivalent shares outstanding since December 31, 1996:

The use of Class A equivalent share count is convenient for analysis involving the economic rights of shareholders, and by examining the number of Class A equivalents over time, we can see the effect of significant acquisitions involving share issuance as well as the major repurchase activity that has taken place in recent years. However, looking only at Class A equivalents obscures major changes that have taken place with respect to Berkshire’s voting control.

History of Voting Control

It is useful to examine a couple of charts to see how voting control at Berkshire has evolved over time. The first chart, shown below, displays Berkshire Hathaway’s economic interest by share class. The information is taken from Berkshire’s annual 10-K reports and the economic interest percentages are calculated for each year in the manner described above:

As we would expect, the economic interest of the Class B shares was initially very small at the time they were first issued in 1996. Over the years, Class A shareholders converted their shares to Class B shares to facilitate gifts or to make smaller liquidations. When this occurs, Class A shares permanently cease to exist, and new Class B shares come into existence. In 2015, the economic value of Class B shares exceeded the economic value of Class A shares for the first time and this trend has continued since then.

However, the picture is very different when we look at voting control by share class. Since Class B shares only have 1/10,000th of the voting rights of Class A shares, voting power of the Class B shareholders as a group is greatly diminished relative to economic rights The following exhibit shows how we can calculate voting power by share class:

Class A shares have one vote while Class B shares have 1/10,000th of a vote.

For example, on December 31, 2021, there were 617,113 Class A shares outstanding, and 1,290,474,503 Class B shares outstanding. Here is the calculation of voting control:

Class A Share Votes: 617,113

Class B Shares: 1,290,474,503 / 10,000 = 129,047.45 rounded to 129,047 votes.

Total Votes: 617,113 + 129,047 = 746,160

Class A Voting Power = 617,113 / 746,160 = 82.7%

Class B Voting Power = 129,047 / 746,160 = 17.3%

By using this same calculation for every year since 1996, we can see how voting control at Berkshire has evolved over time:

We can see that the voting power of Class B shareholders, as a group, has increased over the years, but nowhere as fast as the economic interest of Class B shareholders. This is obviously going to be the case since each Class B share has an economic interest of 1/1500th of a Class A share but only 1/10,000th of the voting power. Even though Class B shareholders currently represent 58.2 percent of the economic interest of Berkshire, they only control 17.3 percent of the vote.

There is nothing nefarious about this state of affairs since it was all clearly disclosed at the time the Class B shares were created in 1996. Everyone who purchased those shares at the initial offering or have purchased shares since then should have known about the diminished voting control of B shares relative to their economic interest. Class A shareholders are in firm control of Berkshire Hathaway today as a result.

Warren Buffett’s Ownership and Voting Control

Starting in 2006, Mr. Buffett began giving away large amounts of Berkshire Hathaway stock to charities. Prior to giving away shares, Mr. Buffett has converted his Class A shares to Class B shares which itself is responsible for a significant portion of the increase in the percentage interest of Class B shareholders in Berkshire over time, as displayed in the Economic Interest by Share Class chart above.

The structure of Berkshire’s share classes has kept Warren Buffett in firm control of Berkshire Hathaway over the past quarter-century. By converting his Class A shares to Class B shares prior to giving them away, Mr. Buffett permanently removed a significant percentage of Berkshire’s Class A shares from circulation and increased the number of Class B shares outstanding. Since Class B shares have diminished voting rights, this had the effect of preserving the majority of Mr. Buffett’s voting control even as his percentage ownership of Berkshire declined over the years:

At the date of Berkshire’s proxy statement issued on March 15, 2021, Mr. Buffett controlled 248,734 Class A shares and 10,188 Class B shares. This represented 16.2 percent of the economic value of Berkshire Hathaway, but commanded 32.1 percent of the voting power. Mr. Buffett’s voting power has declined over the years, but very modestly. He controlled 34.8 percent of the vote in 1996, only slightly more than the 32.1 percent he controls today.

There is nothing nefarious about Mr. Buffett’s retention of voting control over time. Every Class B shareholder knew about, or should have known about, the diminished voting power of the share class. Mr. Buffett’s conversion from Class A shares to Class B shares took advantage of a privilege that was also available to any other shareholder. His use of this privilege is not surprising. To the extent that Mr. Buffett would give away shares, it is perfectly logical to first convert them to Class B shares to avoid giving away more voting power than necessary.

As Mr. Buffett noted in a letter on June 23, 2021, he has now given away half of the Berkshire Hathaway shares he owned in 2006. In doing so, he has given up a significant portion of his percentage economic interest in the company, but has nevertheless retained most of his voting control.

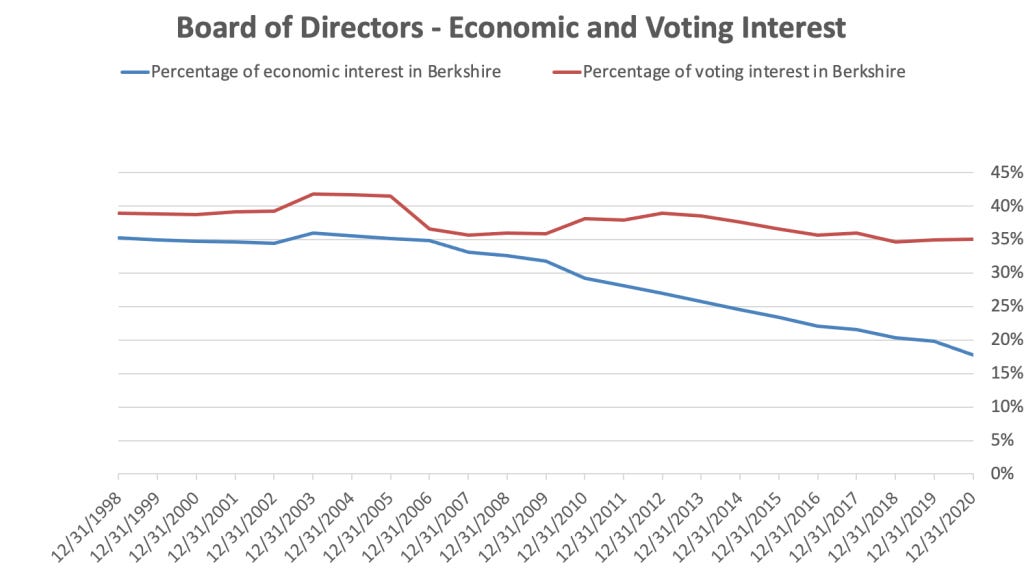

It should be noted that with 32.1 percent of the vote at Berkshire, Mr. Buffett does not have majority control. However, members of the Board of Directors own additional interests in Berkshire. As is the case with Mr. Buffett himself, the board has maintained much of its voting control over the years. The chart below shows the economic interest and voting power of the board since 1996. Note that the figures in this chart include Mr. Buffett’s ownership interest.

As of the date of Berkshire’s last proxy statement on March 15, 2021, the board accounted for 17.9 percent of Berkshire’s economic value and had 35.3 percent of the company’s voting power. This is short of controlling 50.1 percent of the vote, but Mr. Buffett and the board clearly have effective control of the company given the large number of Berkshire shareholders with longstanding personal loyalty to Mr. Buffett. It is inconceivable that Mr. Buffett could lose effective control of Berkshire Hathaway during his lifetime even as his charitable gifts continue in the coming years.

Future Control of Berkshire Hathaway

What can we conclude regarding control of Berkshire Hathaway in the future?

First, we can safely conclude that control of Berkshire is very likely to remain with Class A shareholders for the foreseeable future. Warren Buffett is 91 years old and could very well run the company for several more years. Of course, Mr. Buffett is ultimately mortal, and he has provided information in Berkshire’s Owner’s Manual regarding the disposition of his shares following his death:

On my death, Berkshire’s ownership picture will change but not in a disruptive way: None of my stock will have to be sold to take care of the cash bequests I have made or for taxes. Other assets of mine will take care of these requirements. All Berkshire shares will be left to foundations that will likely receive the stock in roughly equal installments over a dozen or so years.

Presumably, Mr. Buffett’s remaining shares will be converted from Class A to Class B shares prior to being given away after his death. This will act to reduce the number of Class A shares outstanding and increase the number of Class B shares, further tilting the percentage ownership in Berkshire toward the Class B stockholders as a group. However, voting control will remain firmly in the hands of the remaining Class A shareholders. When will Class B shareholders, as a group, control over 50 percent of Berkshire’s voting power? Only at the point where Class B shares represent 87 percent of the economic interest, and we are far from that level today.4

During the twelve years after Mr. Buffett’s death, his estate will still control the voting power of his remaining Class A shares until they are converted to Class B shares and given away to the charitable foundations. Obviously, Mr. Buffett has selected executors of his estate who will vote those shares in a manner that he would approve of. Additionally, Berkshire’s next Chairman is likely to be Mr. Buffett’s son, Howard Buffett, who is certain to exert significant influence over the voting interests of other members of the board. Howard Buffett’s influence is also likely to result in Class A shareholders who are not on the board supporting a retention of Berkshire’s current structure.

Conclusion

Voting control at Berkshire Hathaway is likely to remain with the Class A shareholders for the foreseeable future, so it is important to understand how the supply of A shares will change over time and who is likely to control those shares. As Mr. Buffett continues to give away more of his shares during his lifetime, and as his estate gives away the rest of his shares in the twelve years after his death, the supply of Class A shares will continue to decline. However, it is unlikely that Class B shareholders, as a group, will control more than 50 percent of the voting power for decades to come.

Due to the conversion feature discussed previously, it is almost impossible for Class B shares to trade at more than 1/1500th of the price of a Class A share for very long because arbitrage opportunities exist to capitalize on such a premium. However, the opposite is not the case: Class A shares could conceivably trade at a premium to 1500x the price of a Class B share because Class B shares cannot be converted into Class A shares.

As the scarcity of Class A shares increases in the future, it is certainly conceivable that the shares will begin to trade at a premium that reflects enhanced voting power. Currently, there is no question that control of Berkshire resides in the hands of Mr. Buffett and the board. However, a couple of decades from now, the configuration of voting control is more uncertain. Those who own Class A shares will have outsized voting power and anyone who wishes to take control of the company or obtain board seats will likely need Class A shares to do so.

As long as Class A shares are not trading for a significant premium above their economic interests in the company (meaning that the price of a Class A share is not significantly more than 1500x the price of a Class B share), it makes sense for anyone who is interested in making a large purchase to opt for Class A shares.

Of course, very few individual investors are in a position to put nearly a half million dollars into a stock at any given time. However, larger individual investors and institutions should logically opt for Class A shares because they offer the potential of trading at a premium in the distant future due to their greater voting power. Owning Class A shares rather than Class B shares offers the potential for modest additional returns if voting control becomes important while also offering increased ability to vote against a break-up of the company in the future.

Disclosure: Individuals associated with The Rational Walk LLC own Class A and Class B shares of Berkshire Hathaway common stock.

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

The Class B stock split was not driven merely by a desire to lower the stock price. Berkshire was issuing shares as part of the BNSF acquisition and the Class B shares were split to allow more small BNSF shareholders to elect Berkshire stock as compensation rather than cash.

For example, let’s say that the price of a Class A share is $480,000. At that price, Class B shares would be expected to trade at approximately $320, or 1/1500th of the value of a Class A share. If Class B shares were trading at $325, one could purchase a Class A share for $480,000, convert it to 1,500 Class B shares, and immediately sell them at $325 for a total of $487,500, earning a profit of $7,500. The fact that this opportunity exists and will be acted upon will increase the demand for Class A shares. Conversion to Class B will increase the supply of Class B shares and subsequent sales to capitalize on the arbitrage opportunity will create selling pressure. The combined effect acts to drive the relationship between Class A and Class B shares back to the 1:1500 ratio that eliminates the arbitrage opportunity. Class B premiums have been rare over the years.

For the Class B shares to control 50% of Berkshire’s voting power, there must be 10,000x as many Class B shares outstanding as Class A shares. As an example, look at the situation as it stood on 12/31/2021. At that date, there were 1,477,429 Class A equivalents outstanding comprised of 617,133 Class A shares and 1,290,474,503 Class B shares. If instead there were 192,708 Class A shares outstanding and 1,927,080,000 Class B shares outstanding (which would result in the same total number of Class A equivalents as of 12/31/2021), then the Class A and Class B shareholders, as groups, would each control 50% of the voting power.