Berkshire Hathaway's Q3 2023 Results — Overview

A high level overview of third quarter results and year-to-date repurchase activity

Overview

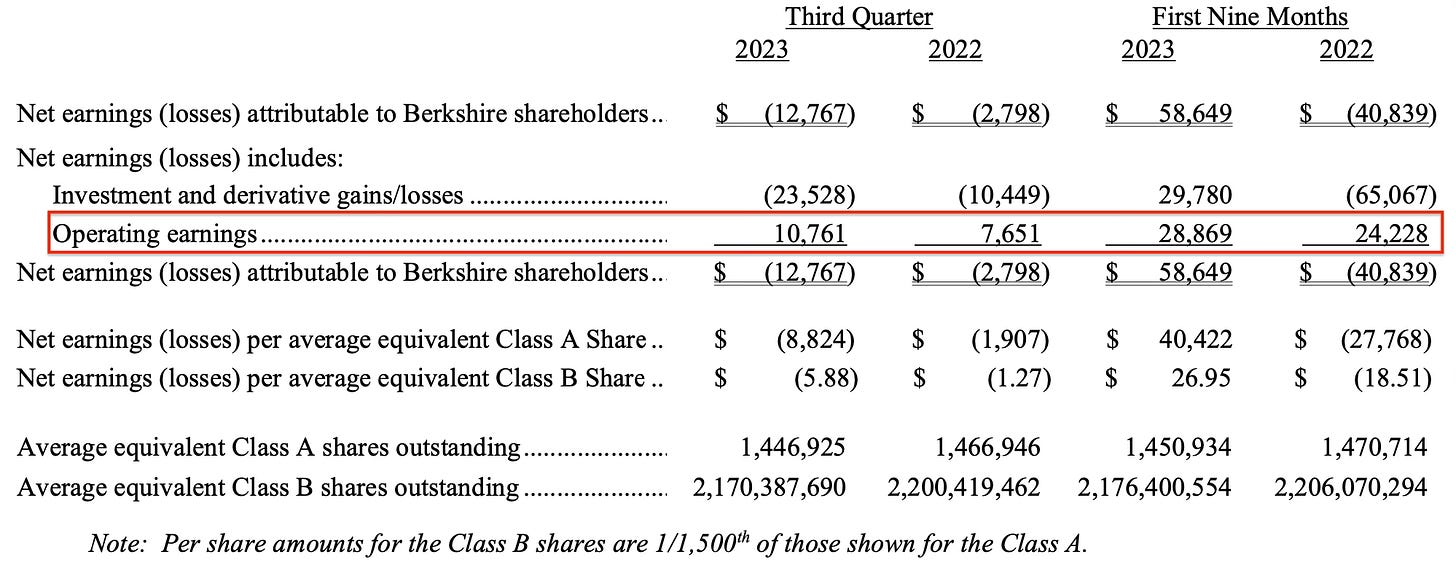

Berkshire Hathaway reported a net loss of $12.8 billion for the third quarter of 2023. Since 2018, accounting rules have required unrealized gains and losses in Berkshire’s portfolio of equity securities to be included in net income. Due to the large size of the equity portfolio, which was valued at $318.6 billion at the end of the third quarter, small percentage changes in quoted market values can easily dominate Berkshire’s reported net income, obscuring the results of the company’s operating businesses.1

Berkshire reported after-tax operating earnings of $10.8 billion for the quarter, up from $7.7 billion for the third quarter of 2022. For the first nine months of 2023, after-tax operating earnings came in at $28.9 billion, up from $24.2 billion for the first nine months of 2022. Berkshire defines operating earnings as net earnings exclusive of investment and derivative gains and losses.

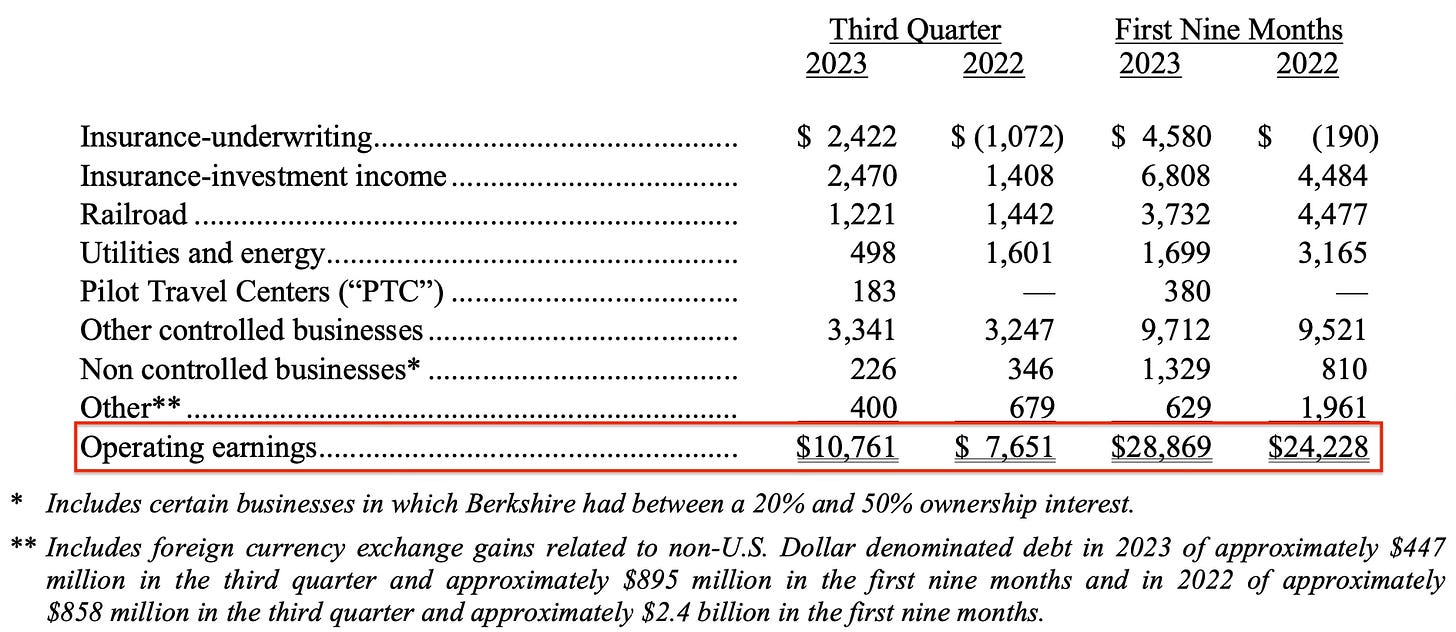

Berkshire provides a useful breakdown of after-tax operating earnings in the press release so we can understand the sources of earnings at a “30,000 foot” level. While it is important to review the company’s third quarter 10-Q report to delve into the details, the table below allows us to spot major trends in operating earnings:

Berkshire’s insurance group posted dramatically improved underwriting results in 2023 while investment income increased due to higher interest rates. Burlington Northern Santa Fe’s results have deteriorated in 2023 primarily due to lower freight volume. In the utility and energy group, Berkshire’s results have been under pressure primarily due to wildfire litigation. Results at the company’s vast array of controlled businesses have been a mixed bag, with results in aggregate showing only a modest improvement, both in the third quarter and for the first nine months of the year.2

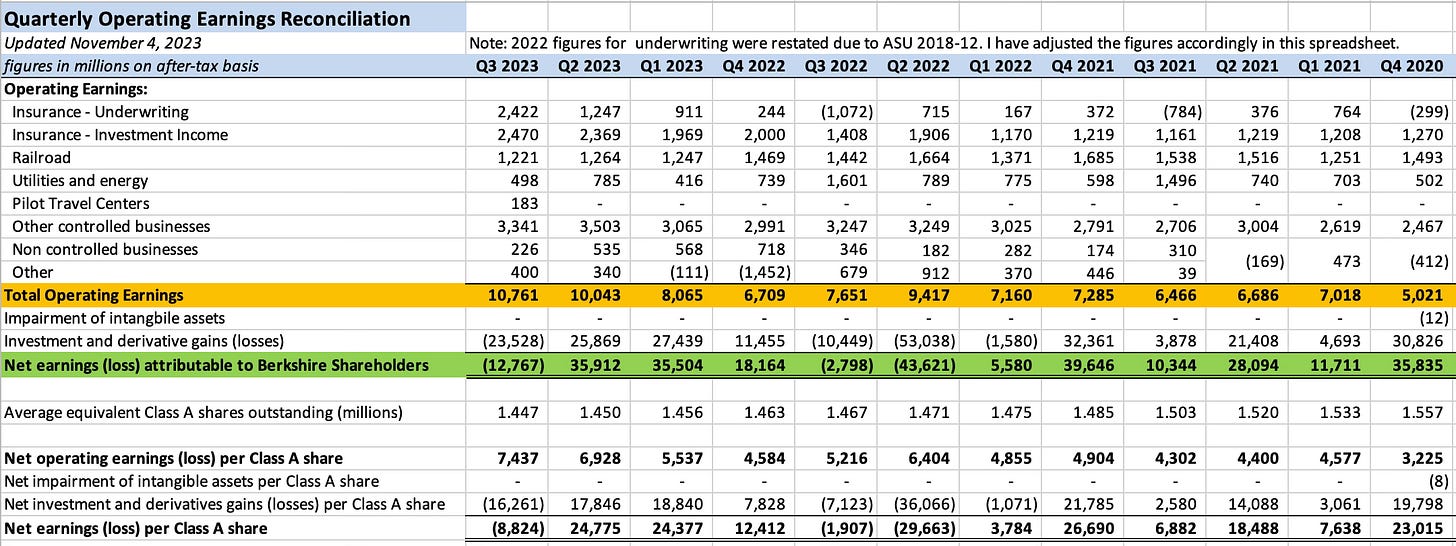

It is useful to look at quarterly results over a longer period of time. The exhibit below shows Berkshire’s earnings over the past twelve quarters.3

Over the trailing twelve quarters, the volatility caused by investment gains and losses develops into a longer-term trend. Over this period, Berkshire reported a cumulative $69.3 billion of investment and derivatives gains while cumulative operating income came in at $92.3 billion. This adds up to net income of $161.6 billion over three years. Berkshire Hathaway is best analyzed over periods of at least three to five years.

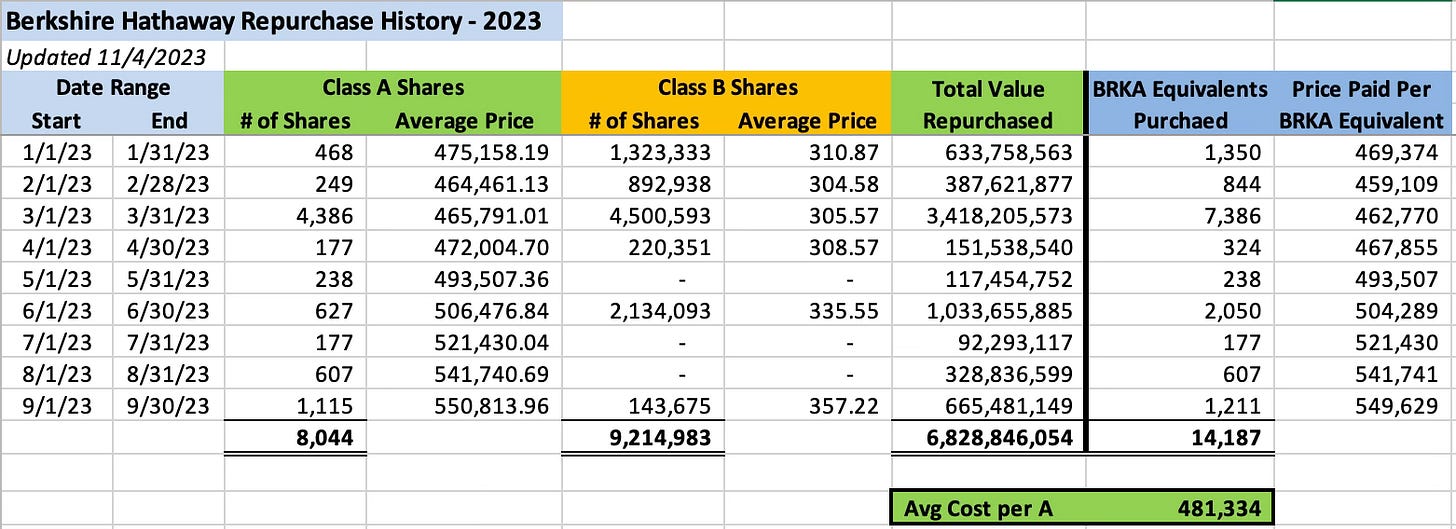

During the third quarter, Berkshire used $1.1 billion to repurchase shares. For the first nine months of the year, Berkshire repurchased 8,044 Class A shares and 9,214,983 Class B shares for a total cost of $6.8 billion. On a Class A equivalent basis, the average cost of the repurchased shares was $481,334 The exhibit below shows the summary of repurchase activity from January to December:

Perhaps unsurprisingly, Warren Buffett dialed down his enthusiasm for repurchases as the stock price advanced, with the dollar amount spent on buybacks declining each quarter. However, it is notable that repurchases continued in the third quarter. The average cost of shares purchased in August and September exceeds the current quote of $534,122 per Class A share. The repurchase program permits Berkshire to repurchase shares any time when Warren Buffett and Charlie Munger “believe that the repurchase price is below Berkshire’s intrinsic value, conservatively determined.”

We know that repurchase activity continued in October because the updated share count appearing on the first page of Berkshire’s third quarter 10-Q. As of October 24, there were 1,444,002 Class A equivalent shares outstanding compared to 1,445,546 shares outstanding as of September 30. This implies repurchases of 1,544 Class A equivalents over the first seventeen trading days of October. Over this period, the average closing price of Class A shares was approximately $522,200 so we can very roughly estimate that $800 million was used for repurchases from October 1 to 24.

Berkshire ended the quarter with $152 billion in cash and treasury bills giving Warren Buffett ample firepower for future investments in securities or business acquisitions.4 In an interview published yesterday, Charlie Munger was optimistic about the odds of a major acquisition taking place while he and Mr. Buffett remain in charge with the caveat that venture capital has made it more difficult to find suitable candidates.

We do not yet have the details of Berkshire’s activity in equity securities in the third quarter since the company’s 13-F is not filed prior to the 10-Q. However, the 10-Q does provide disclosure on Berkshire’s top five holdings. From this disclosure, we can infer that Berkshire sold approximately 10.4% of its Chevron holding during the third quarter.5 Berkshire has sold shares of Chevron for four straight quarters.

Berkshire resumed purchases of Occidental Petroleum shares in October, as I discussed in a recent article, but in aggregate it appears that Berkshire has trimmed exposure to oil and gas in recent months. Perhaps this will change in response to rising geopolitical tensions in the Middle East. Due to Berkshire’s large ownership interest in Occidental, we know of all transactions in the stock within three days. In contrast, Chevron transactions are only reported on a quarterly basis.

Hopefully, this overview of Berkshire’s results provides useful context that is absent in most coverage of the company’s earnings in the mainstream financial media. I will write a more in-depth article about certain aspects of Berkshire’s third quarter results for paid subscribers in the coming days. Paid subscribers can also comment on this article and I will do my best to read and respond to any comments.

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Long Berkshire Hathaway.

As Warren Buffett has stated on many occasions, investors should consider the intrinsic value of Berkshire’s portfolio of marketable securities. However, quarterly swings tell us very little about intrinsic value. The progress of market value over longer periods of time should better approximate changes in intrinsic value. While the quarterly swings in the value of the equity portfolio reflect market sentiment more than intrinsic value changes, in the long run, we should carefully monitor the performance of Berkshire’s equity securities.

Arguably, foreign currency gains and losses should be considered non-operating in nature. However, Berkshire reports foreign currency effects in the “Other” line of operating earnings. In both 2022 and 2023, Berkshire reported substantial foreign currency exchange gains related to non-U.S. Dollar denominated debt, as shown in the exhibit. When Berkshire borrows in foreign currencies, the debt is translated into U.S. Dollars, the company’s functional currency, when results are reported. If the dollar appreciates relative to foreign currencies, the value of the debt expressed in dollars declines. This decline is represented as a foreign exchange gain. Of course, the reverse could also occur. If the dollar declines relative to foreign currencies, Berkshire would record a foreign exchange loss.

Note that Berkshire has changed certain aspects of its operating earnings presentation and an accounting change slightly altered insurance underwriting results for 2022 compared to figures that were originally reported. I have used the restated quarterly figures for 2022 provided in the first, second, and third quarter releases for 2023. The results for the 4th quarter of 2022 remain as originally reported since we do not have specific restated data broken down for that quarter at this point (it should be presented in the press release for 2023 full year results). In my opinion, the change in accounting (ASU 2018-12) is not material from a high level analytical perspective.

Berkshire’s deployable cash for acquisitions is far less than $152 billion for reasons similar to the points I made in an article written in early 2020. Today’s Berkshire’s minimum cash level is set to $30 billion and I also continue to believe that a significant percentage of Berkshire’s cash is essentially a fixed-income substitute. It is notable that the recent increase in longer term interest rates has been insufficient for Mr. Buffett to add to Berkshire’s fixed-maturity investments which are down to $22.4 billion from $25.1 billion at the start of the year.

Berkshire disclosed that it held $18.6 billion of Chevron stock at the end of the quarter. Based on Chevron’s closing price of $168.62 on September 29, we can infer that Berkshire owned ~110,307,200 shares of Chevron at the end of the third quarter compared to 123,120,120 shares at the end of the second quarter, a decrease of ~10.4%.

Thank you. Keep up the good work. Much! appreciated.