Berkshire Hathaway Energy

Selected highlights from the 2023 EEI Financial Conference

Introduction

Berkshire Hathaway Energy (BHE) is one of Berkshire Hathaway’s most important subsidiaries. It has several unique characteristics:

BHE is one of the few Berkshire subsidiaries that is permitted to retain all of its free cash flow to pursue its own investment opportunities rather than sending the cash to Omaha for Warren Buffett to deploy elsewhere.

BHE is an issuer of debt which is not guaranteed by Berkshire Hathaway. As a result, BHE submits its own financial statements to the SEC which provide a great deal of information not included in Berkshire Hathaway’s filings.1

Greg Abel served as CEO of BHE for a decade prior to being named Vice Chairman of non-insurance operations at Berkshire Hathaway in January 2018. In 1992, Mr. Abel joined one of the predecessor entities that combined into BHE, so he has deep roots in the energy business. Mr. Abel is currently designated to eventually succeed Warren Buffett as CEO of Berkshire Hathaway.2

There have been several occasions when Berkshire Hathaway purchased ownership interests in BHE which provides a valuation of the energy business from the perspective of Warren Buffett himself. As of June 30, 2022, the last date of such a transaction, we could infer a valuation of $88.8 billion for BHE.3

Most Berkshire shareholders are acquainted with BHE mainly through descriptions of the business in Warren Buffett’s shareholder letters and information contained within Berkshire’s financial reports. The 2022 annual report’s discussion of BHE consumed just three pages which provides only a very high level overview of the business.

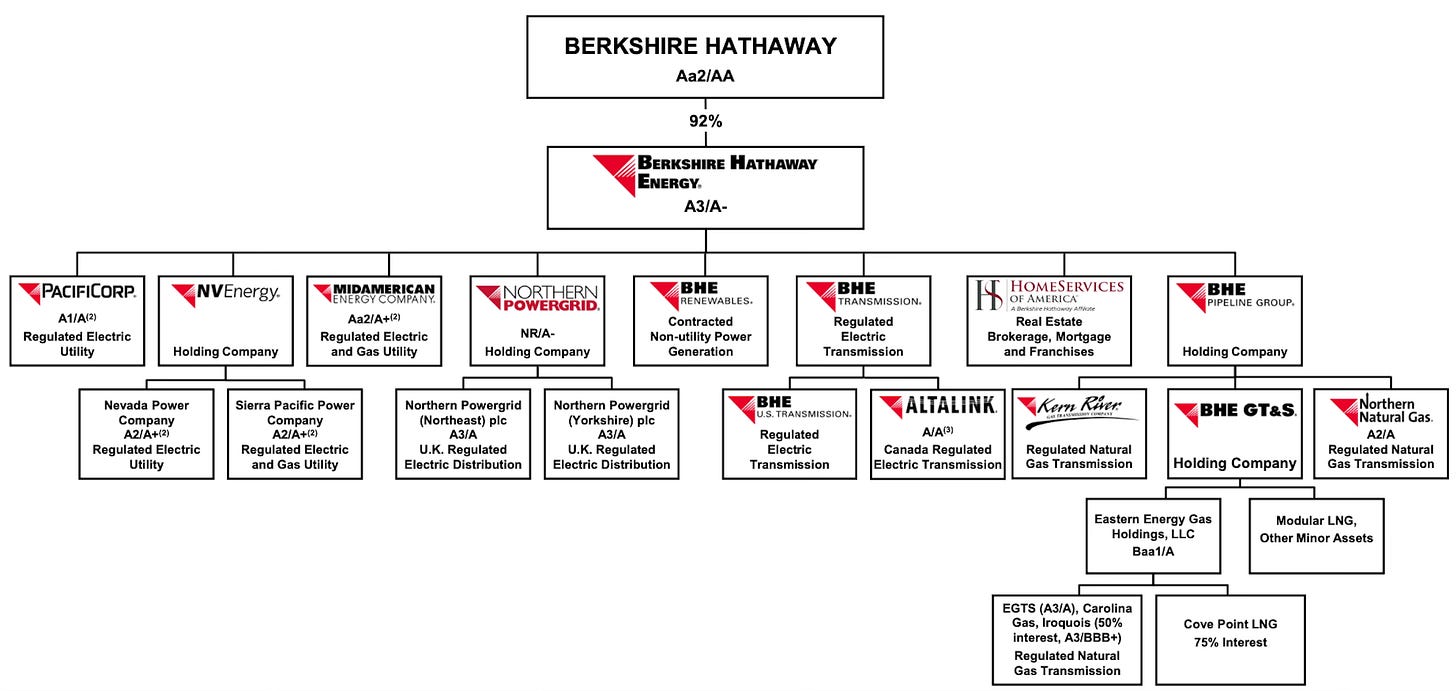

Abridged treatment of subsidiaries is inevitable in a conglomerate like Berkshire. As a result, in most cases, the operations of Berkshire subsidiaries are relatively opaque. But in BHE’s case, we not only have additional information to review but we can go from sipping from a water fountain to gulping from a firehose. This is because BHE is itself a conglomeration of eight direct subsidiaries, and several subsidiaries have their own subsidiaries, as we can see in the exhibit below (click on the image for a larger view):

When I refer to a firehose, I am not exaggerating. BHE’s consolidated 10-K for 2022 is 569 pages long, more than four times the length of Berkshire Hathaway’s 10-K!

I think it is fair to say that a very small percentage of Berkshire shareholders review BHE’s results in much detail, if at all, and prefer to rely on the condensed summaries in Berkshire’s filings. For the most part, this is what I do myself. I do not review BHE’s 10-Qs unless I am looking for something in particular, and while I do review BHE’s 10-Ks, I cannot claim that I am scrutinizing every page in the filing.

Fortunately, shareholders do not need to review the 10-Qs or 10-Ks to get a good sense of what BHE is all about because management prepares detailed presentations that are made public twice a year. The investor relations website archives slide decks for presentations at the Fixed Income Investor Conference and the EEI Conference.4

The 2023 EEI Conference took place in November. I reviewed BHE’s presentation and found several of the slides interesting. In this article, I’ll discuss a small sample of the slides included in the deck focusing on the following areas:

This article should not be considered anything like a comprehensive study of Berkshire’s energy operations, but rather my subjective assessment of what is particularly interesting in the presentation and worth sharing in a reasonably concise format. I have chosen to focus on longer-term capital allocation, decarbonization, and wildfire risks rather than recent operational results. Readers who are interested in more details are encouraged to peruse the entire ninety-two page presentation.

Business Overview

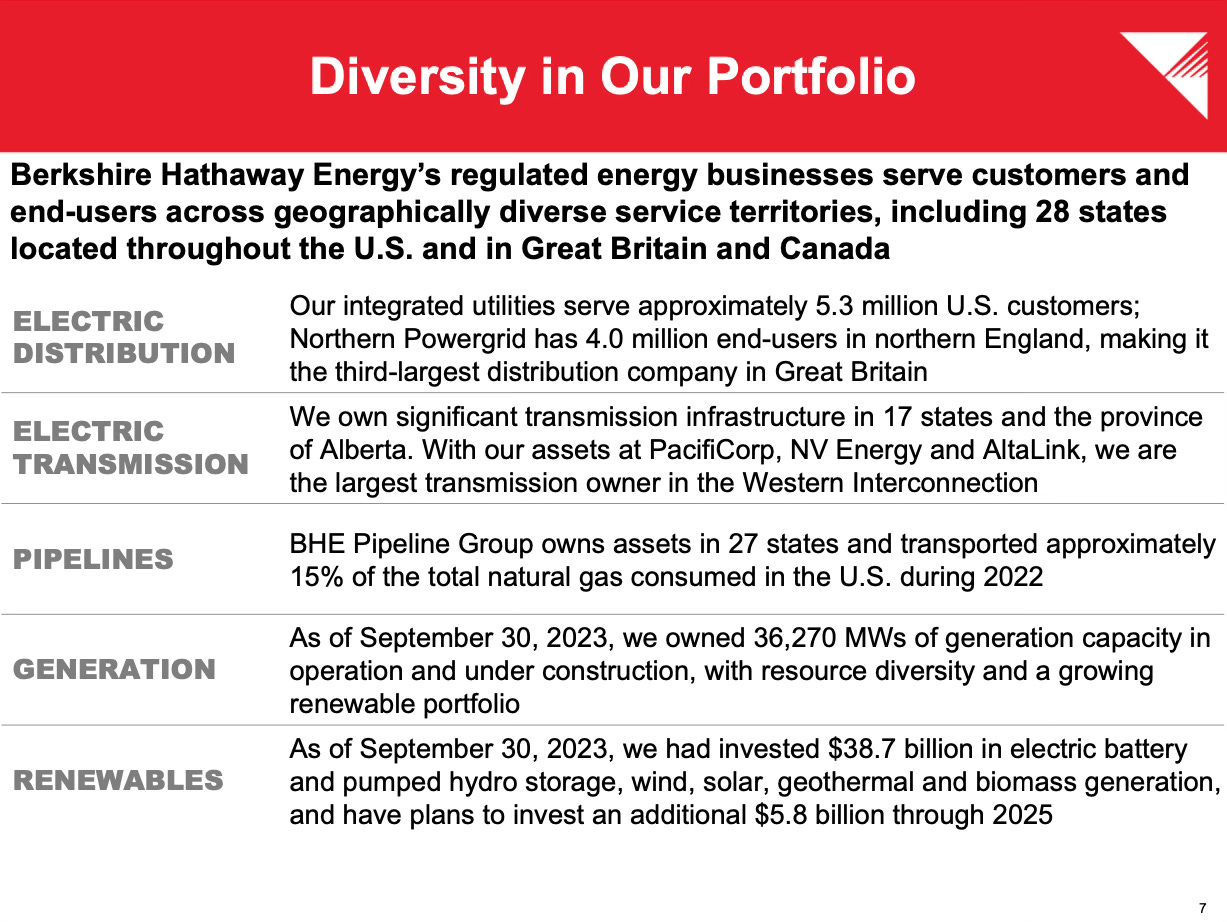

Berkshire Hathaway currently owns 92% of BHE, with the remaining minority interest owned by family members and related or affiliated entities of the late Walter Scott, Jr. Mr. Scott was a longtime friend of Warren Buffett who served on the board of Berkshire Hathaway from 1988 until his death in 2021. BHE’s operations are extensive:

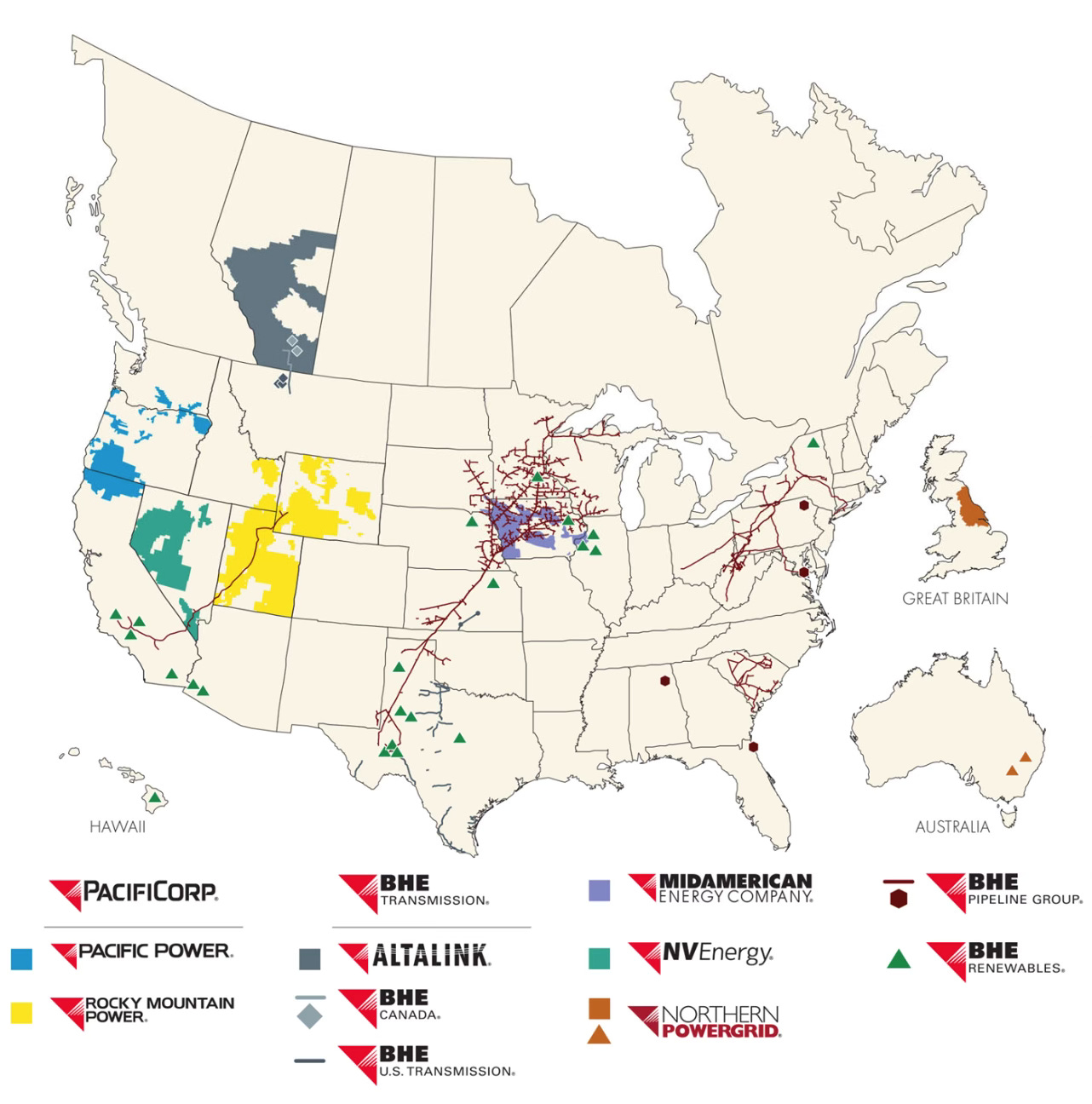

The following map shows the overall footprint of BHE’s operations:

BHE benefits in many ways from Berkshire’s ownership. In addition to access to capital when needed, BHE draws from Berkshire’s reputation when it comes to making deals. Unlike most energy companies, BHE is able to reinvest its free cash flow since Berkshire does not demand dividends. As a result, BHE is able to retain more dollars of earnings than any other American electric utility. From a regulatory standpoint, a stable owner willing and able to reinvest in the system is welcome.

Capital Allocation Plans

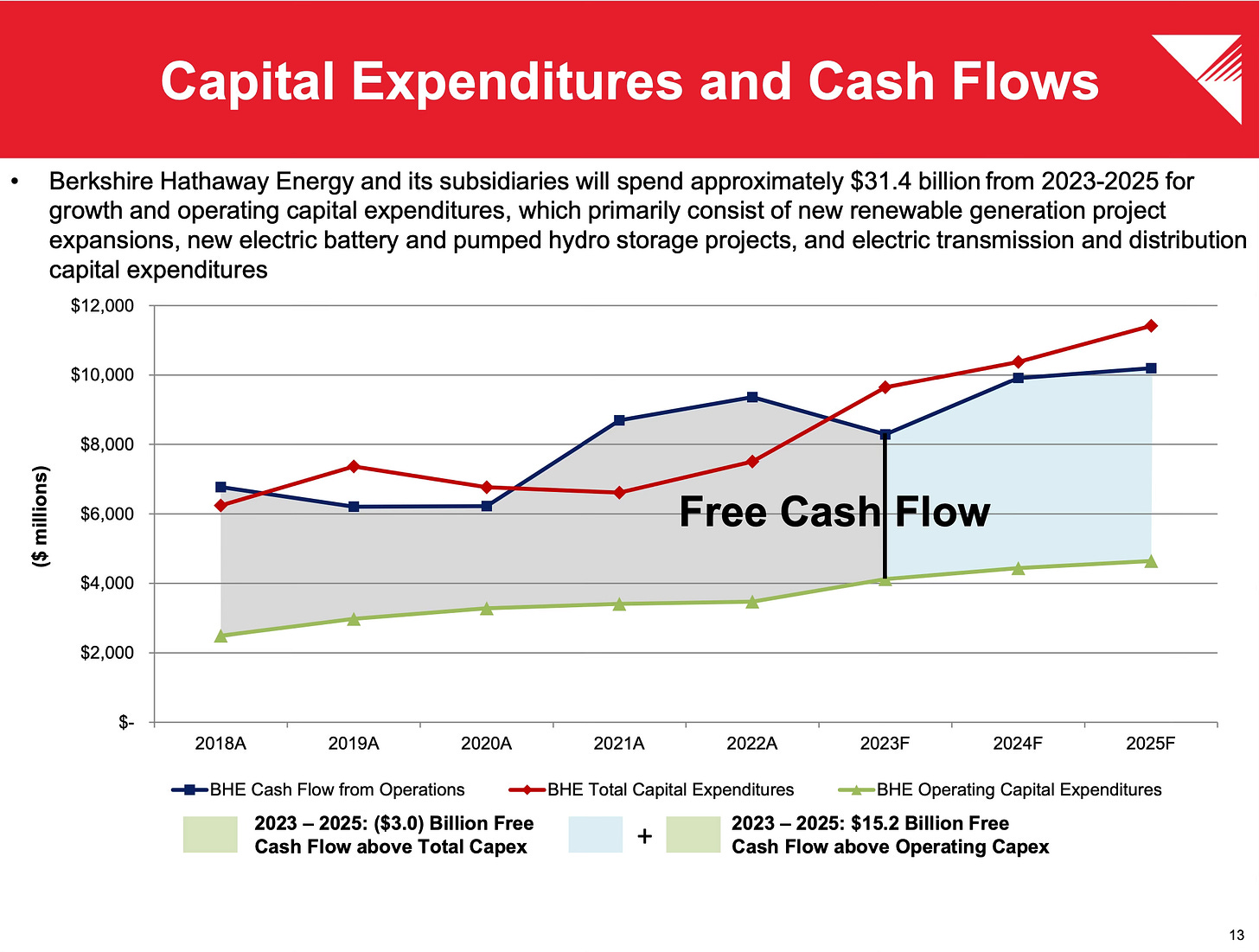

Providing safe and reliable energy to customers is a very capital intensive activity. Management provided a useful graph illustrating BHE’s free cash flow and capital expenditures over the past five years along with forecasts for the next two years:

The blue line shows BHE’s cash flows from operations and the green line shows operating capital expenditures, which can be regarded as expenditures required to maintain existing operations. The area between the blue and green lines represents free cash flow. The dark red line represents total capital expenditures, with the area between the red and green lines indicating what we can interpret as “growth” capex.

We can see that BHE plans to invest $3 billion in excess of free cash flow in total capex over the next three years. Total capex from 2023 to 2025 is expected to be $31.4 billion consisting primarily of renewable generation and storage projects as well as ongoing investments in the electric transmission and distribution grid.

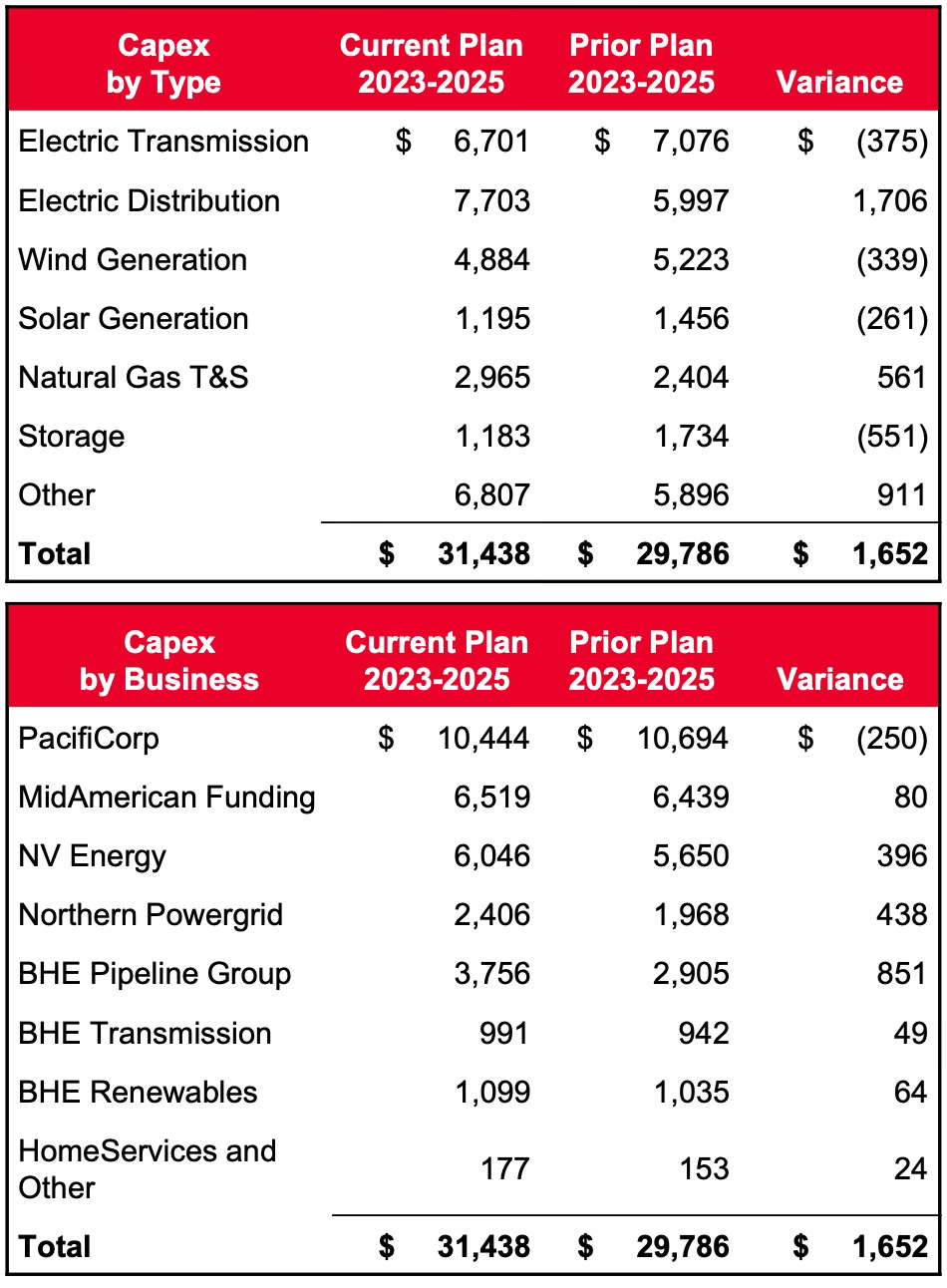

The $31.4 billion in total capex from 2023 to 2025 is broken down on another slide, both in terms of the type of capex and between the eight business units:

BHE is making major investments to shift toward renewable energy sources. This commitment shows up most obviously in the wind and solar line items in the exhibit above, but the larger expense will be to improve the transmission and distribution system to ensure that renewable energy can be moved from sites where it is generated to where there is customer demand. As a result, we see large investments in transmission and distribution in the exhibit. In total, solar and wind generation combined with improvements in the transmission and distribution system accounts for $20.5 billion, or 65% of the capital spending plan for 2023 to 2025.

Transmission Investments

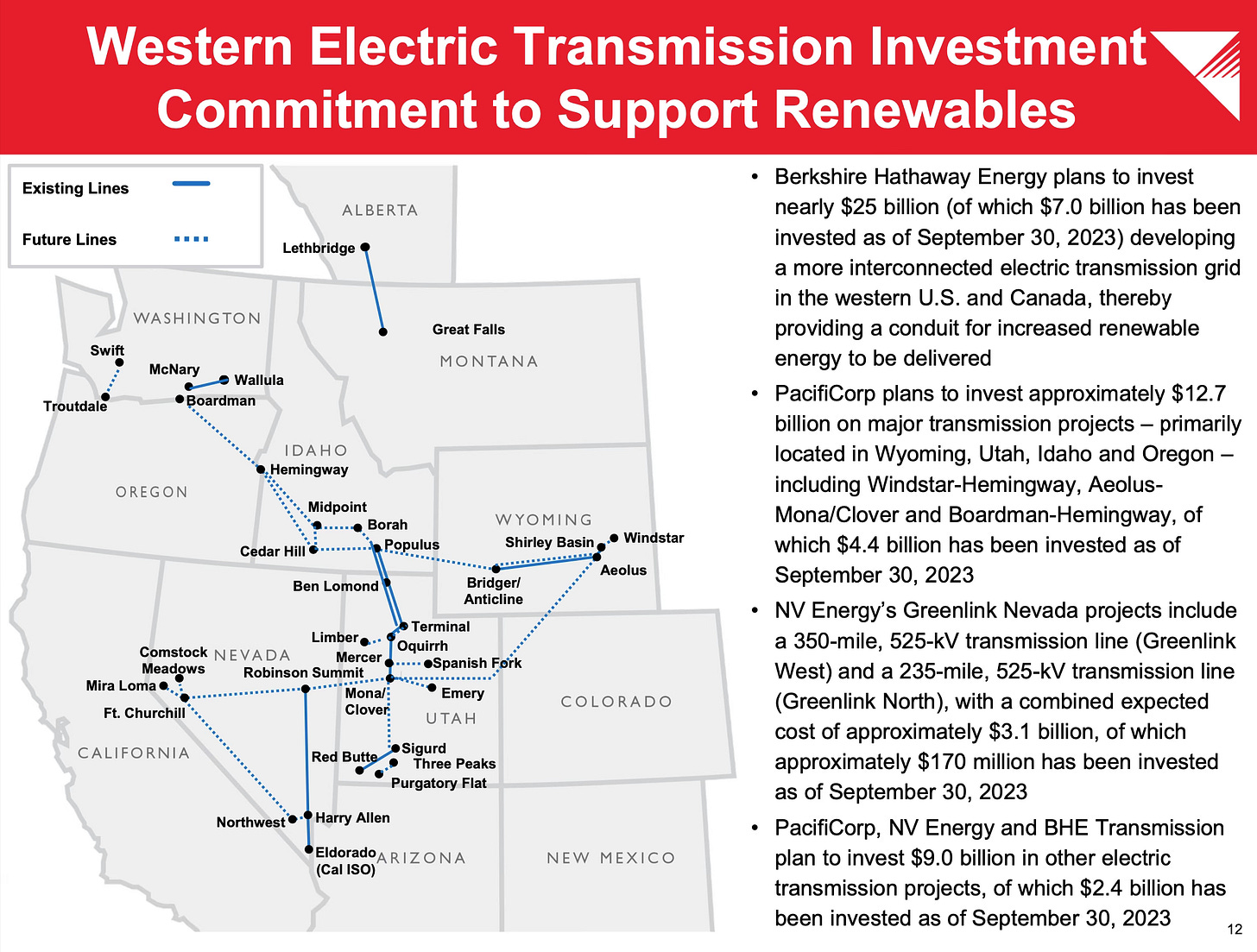

PacifiCorp and NV Energy are part of the Western Interconnection which connects fourteen western states, two Canadian provinces, and part of Mexico. At the end of 2022, PacifiCorp’s system included 17,100 miles of transmission lines in ten states, 65,300 miles of distribution lines, and 900 substations. The slide below shows BHE’s western transmission system as it currently exists along with plans for future lines:

Additional slides in the PacifiCorp and NV Energy business updates provide details on the specific projects pictured on the map. In recent years, there have been many news articles, such as this S&P Global article published in early 2023, regarding potential reliability issues with the western interconnection:

"There's going to be huge increases in the situational awareness that grid operators will have and a much higher volume of transactions than we see in the [real-time] EIM," said Stefan Bird, president and CEO of PacifiCorp's Pacific Power division.

At the same time, PacifiCorp is adding new resources and transmission to decarbonize its system and handle "surprise events" such as heat waves and wildfires, Bird said.

The utility is advancing its strategy presented in September 2021 to add about 10,000 MW of new resources by the end of this decade, mostly in the form of energy storage, renewables, energy efficiency and natural gas generation converted from coal.

It is apparent that significant investment will be required to improve the overall grid as the country moves from coal fired power plants to renewable sources. BHE is clearly in a position where it has ample capital to play a constructive role when it comes to improving the grid.

Decarbonization Initiatives

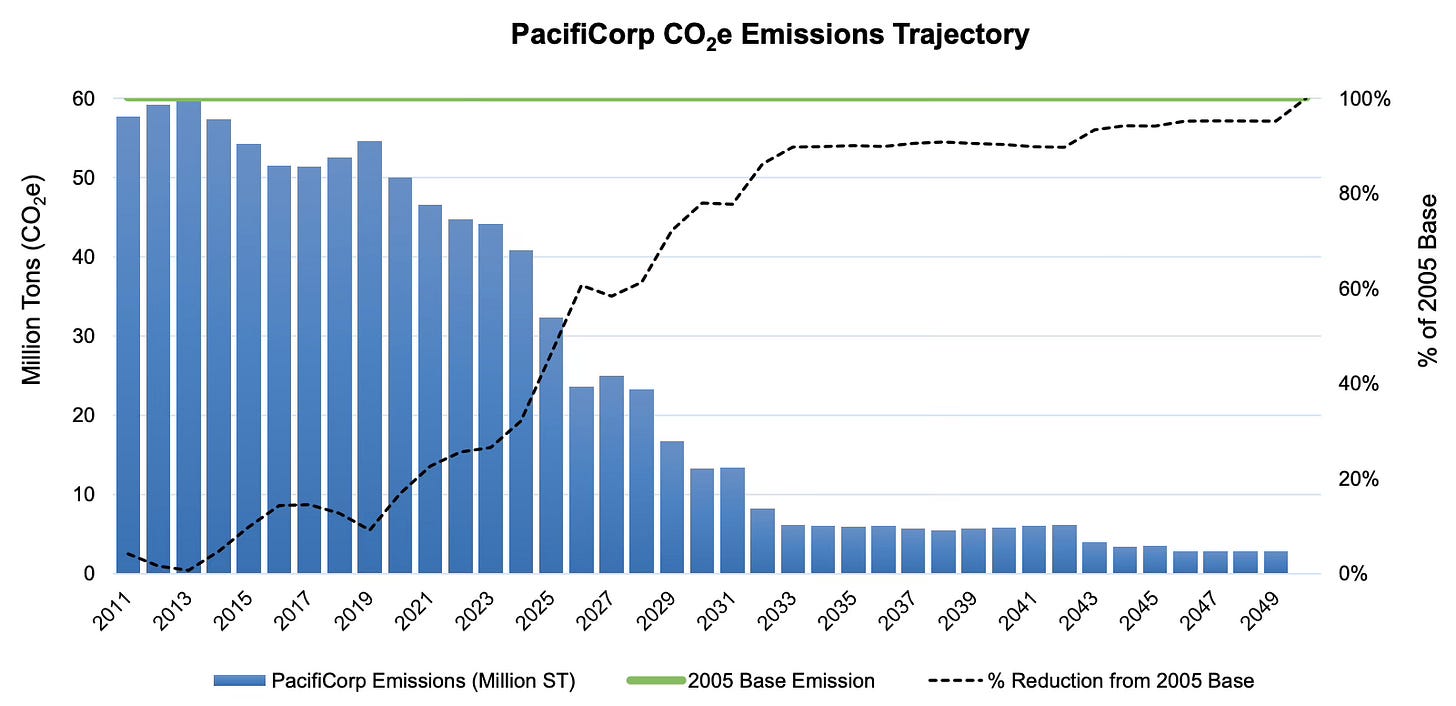

BHE has ambitious plans for decarbonization, with a goal of achieving “net zero” greenhouse gas emissions by 2050. Management stresses that this must be done “in a manner our customers can afford, our regulators will allow, and technology advances support.” To achieve this objective, all coal units will be retired by 2049 and all natural gas units will be retired by 2050. By 2030, management expects to achieve a 50% reduction in CO2 emissions compared to a 2005 baseline.

Under Berkshire’s ownership of BHE, progress in decarbonization to this point has been achieved by investing $38.7 billion in renewable generation and storage through September 30, 2023 with an additional $5.8 billion of planned spending through 2025. Currently, 47% of owned generation capacity comes from non-carbon sources. Management claims that BHE’s businesses, in aggregate, ranks first among investor owned utilities for clean power generation capacity in operation.

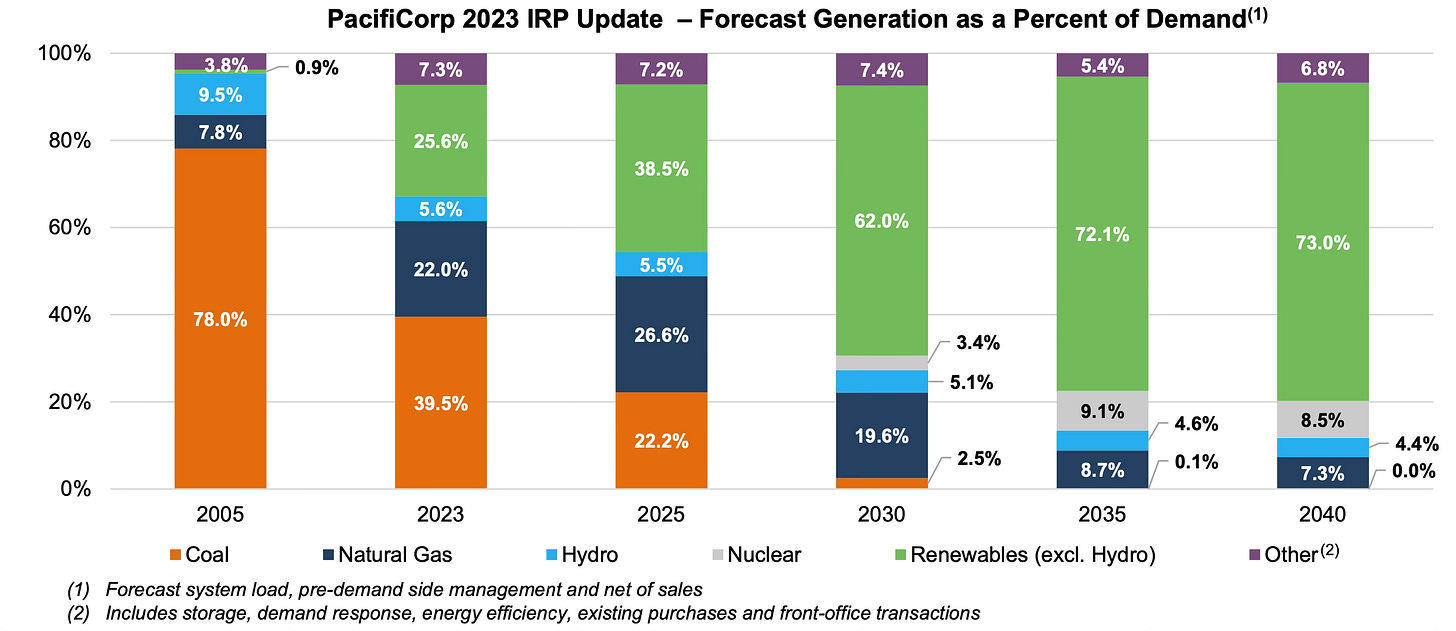

It is important to note that BHE has already made major progress in decarbonization under Berkshire Hathaway’s stewardship. This is important because there is much empty virtue signaling about the environment in corporate America. BHE has actually delivered. As an example of progress made to date, the following chart shows PacifiCorp’s generation profile:

Coal generation will be mostly eliminated from PacifiCorp’s profile by 2030, with natural gas remaining in the mix for a longer period of time. Of course, this will result in a major reduction of CO2 emissions:

Environmental activists might claim that this demonstrable progress has not been fast enough, but management must balance the shift to renewables with the need to build the supporting transmission infrastructure, and to do so in a way that produces reliable and affordable power for customers within a complex regulatory framework. Over the next decade, massive progress is going to occur based on current plans. Similar presentations are provided by management for other BHE subsidiaries.

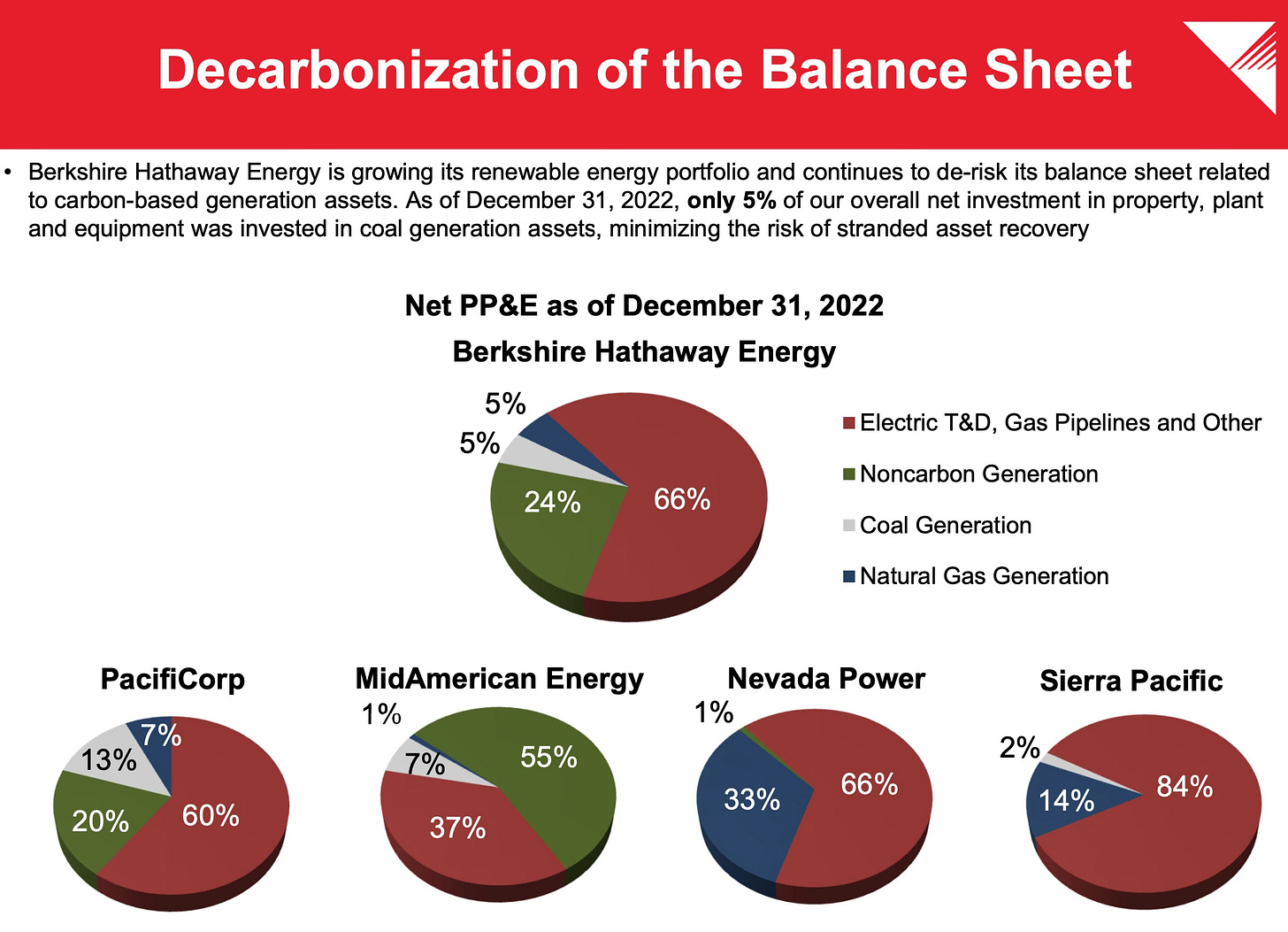

A major concern for Berkshire investors is obviously whether BHE will have stranded assets — plant and equipment that remains sound and useful but must be taken out of service prematurely to meet decarbonization goals. Management presented a useful slide showing that only 5% of BHE’s overall net investment in property, plant and equipment was invested in coal generating assets at the end of 2022:

While net investment in PP&E on the balance sheet does not necessarily reflect the remaining useful life of assets, it is reassuring that write-downs are likely to be minimal, at least with respect to coal. Natural gas accounts for an additional 5% of investments on the balance sheet. However, I suspect that natural gas assets are more secure given the need for grid capacity to supplement the intermittent resources provided by wind and solar, at least until storage solutions are more fully developed.

Wildfire Risk Mitigation

Western states have experienced numerous wildfires in recent years, with many blamed on public utilities which have traditionally relied on overhead power lines, with fire risk mitigated to some extent through policies of clearing trees and vegetation closely adjacent to lines. Although much of the blame has been placed on utilities, poor forestry management and climate change are both contributing factors.

PacifiCorp has provided a summary of wildfire litigation issues on its website and several pages of the EEI presentation were devoted to the subject. As of September 30, 2023, PacifiCorp has accrued cumulative estimated probable losses of $2,405 million, or $1,871 million net of reinsurance. Only $127 million of this reserve has been paid to claimants and there is still much uncertainty regarding PacifiCorp’s ultimate liability.

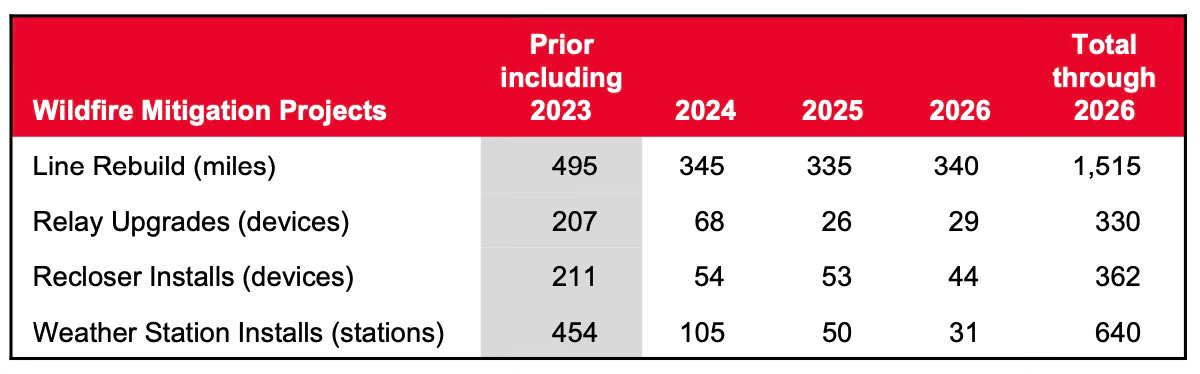

Rather than speculate on the outcome of litigation, it is more productive to focus on what PacifiCorp is doing to mitigate the risk of future wildfires. Through 2023, PacifiCorp has invested $500 million in “asset hardening” and plans to invest an additional $1 billion from 2024 to 2026. Hardening refers to reducing the risk of spark-caused wildfires by rebuilding overhead lines with covered conductors or relocating lines underground, as well as reducing the potential interference of vegetation.

In addition to investments in the robustness of transmission and distribution lines, PacifiCorp is investing in a large number of weather stations to monitor conditions and model the impact to its infrastructure. Pacific Power has increased the number of weather stations from 23 to 272 since 2020 and plans to install an additional 100 stations over the next three years. Rocky Mountain Power now has 182 weather stations, up from 11 in 2020, and plans 75 more over the next three years.

Weather stations permit management to gain better insights into emerging weather patterns that could increase the risk of wildfires. Factors such as temperature, humidity, and wind can combine to significantly increase the risk of a spark causing a major wildfire. As a precaution, utilities may de-energize power lines during periods of extreme risk. Weather stations provide the ability to know when to de-energize lines and, equally important, when not to since doing so has an impact on customers.

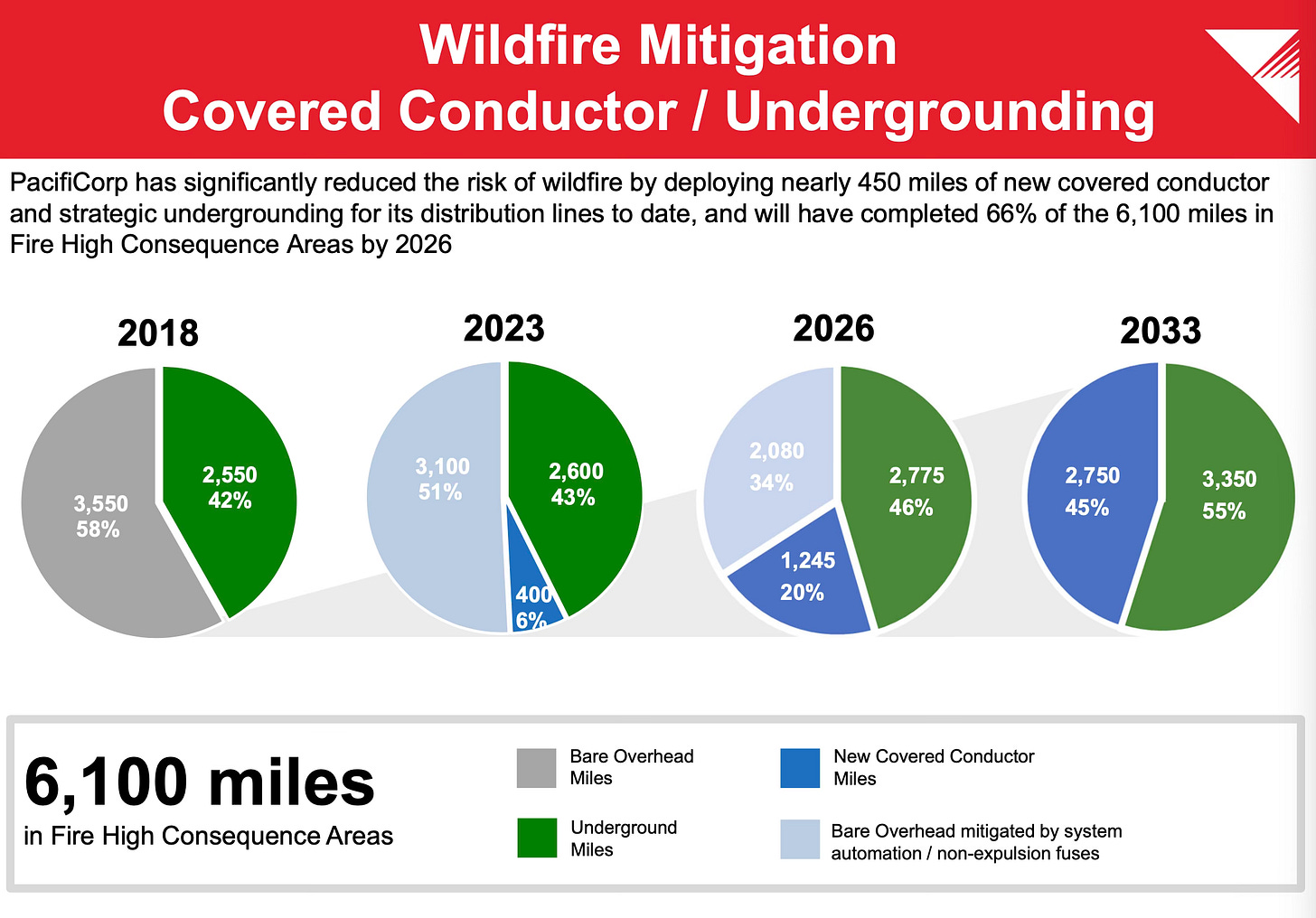

The following exhibit shows that PacifiCorp has already made significant progress hardening the infrastructure in areas that it considers to be at highest risk:

By 2033, bare overhead wires will be eliminated in the highest risk areas with a combination of covered conductors of remaining overhead lines and underground lines. This requires significant capital which BHE has due to lack of dividend requirements up to Berkshire Hathaway. At the subsidiary level, BHE has committed to providing support to PacifiCorp by suspending dividend payments up to BHE.

Additionally, the presentation indicates that access to debt capital markets is possible due to Berkshire Hathaway’s ultimate ownership. However, it is important to understand that Berkshire Hathaway does not guarantee BHE debt. The PacifiCorp unit has total shareholders’ equity of $9,775 million. Based on my reading of the 10-K, I believe that ultimate liability for the wildfires, in a worst case scenario, cannot surpass PacifiCorp’s equity. In other words, I do not believe that BHE or Berkshire Hathaway can be held liable for damages in excess of the equity of PacifiCorp.

The safe and affordable generation, transmission, and distribution of power is essential for society. It is in the interests of public utilities, regulators, legislators, and end-customers for there to be cooperation when it comes to dealing with wildfire risk. Although a deep-pocketed company might seem like an attractive scapegoat, I am hopeful that reason will prevail. BHE certainly seems willing to make investments to make the system safer and hopefully regulators and politicians will recognize this.

Conclusion

As noted at the outset, the main purpose of this article is to alert readers to the existence of information provided by BHE and its subsidiaries that supplement the limited information in Berkshire Hathaway’s financial reports. I found the EEI presentation very interesting and hopefully the highlights in this article have been useful for readers. I plan to continue following BHE in the future and it could be a subject for future articles.

This article is exclusively for paid subscribers. If you found this article interesting, please click on the ❤️️ button and consider referring a friend to The Rational Walk.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Long Berkshire Hathaway.

BHE’s SEC filings can be found at https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001081316. In addition, financial information and investor presentations are available on the BHE website at https://www.brkenergy.com/index.html.

Greg Abel was designated as Warren Buffett’s successor in May 2021 after the company’s annual meeting where Charlie Munger alluded to the plan which was later confirmed by Warren Buffett. I wrote about this development on May 11, 2021: Berkshire’s CEO Succession: A Brief Look at Incentives

In June 2022, BHE purchased Greg Abel’s 1% interest for $870 million, as disclosed in BHE’s Q2 2022 10-Q filing. I wrote about this development when I covered Berkshire Hathaway’s Q2 2022 results in August 2022. The transaction implied a valuation for BHE of $88.8 billion, a premium to BHE’s $51.2 billion of shareholders’ equity as of 6/30/2022.

Normally, I do not consider investor presentations to be a good substitute for reading SEC filings because they typically highlight what management wants investors to know and omit negative information. While BHE’s presentations are not going to provide all the information in the 10-K, I think that the ethos of the company is such that we are not likely to receive a distorted picture of the business, just one that is abridged and more digestible.

Ravi, thank you for a superb contribution to your readership! First rate!

I was looking forward to reading this article. Superb, thank you.