Berkshire Hathaway Annual Meeting Questions

Voting control in 2050, Repurchase taxes, and Apple's exposure to China

Berkshire Hathaway will hold its 2023 Annual Shareholders Meeting on Saturday, May 6 at 4:30 pm in Omaha. However, the real action will start many hours earlier when the doors of the CHI Health Center Arena open at 7:00 am and thousands of shareholders rush in to compete for prime seats. Events related to Berkshire’s Annual Shareholders Festival begin on Friday and continue through the end of the weekend.

The highlight for many shareholders will be the question and answer session that begins at 9:30 am. Since Berkshire does not hold quarterly calls, the annual meeting is the only opportunity to ask Warren Buffett and Charlie Munger questions about the company. During the morning session, Greg Abel and Ajit Jain will also be available.

The Q&A session lasts for five hours. Questions alternate between shareholders at the meeting and Becky Quick who curates questions submitted by non-attending shareholders. The Q&A will be webcast for those of us who are not going to Omaha. Shareholders may submit questions to berkshirequestions@cnbc.com. There should be time for about sixty questions if the average time per question is five minutes.

I attended Berkshire’s annual meetings almost every year from 2000 to 2011, but I have not attended in many years. Although I never asked a question at a meeting, I have submitted questions to journalists which were selected for the Q&A. I have submitted the following three questions for consideration. The questions appear in bold italics and I have provided some additional commentary and context below each question.

Voting Control in 2050

Berkshire Hathaway’s dual class share structure has served the company well over the past quarter century by allowing Mr. Buffett to retain effective control of the company despite giving over half of his shares to charitable foundations after converting Class A shares to Class B shares with less voting power.

Mr. Buffett has indicated that his estate will convert his remaining Class A shares to Class B in the decade after his death prior to donating the Class B shares to charity.

Does Mr. Buffett have a good sense of who will control the majority of the dwindling number of Class A shares in 2040 or 2050? My concern is that remaining Class A shares are likely to end up in the hands of institutions in the long run making it difficult to retain Berkshire’s unique corporate culture. Recent shareholder proposals make it clear that activists will continue to exert pressure in the years and decades to come.

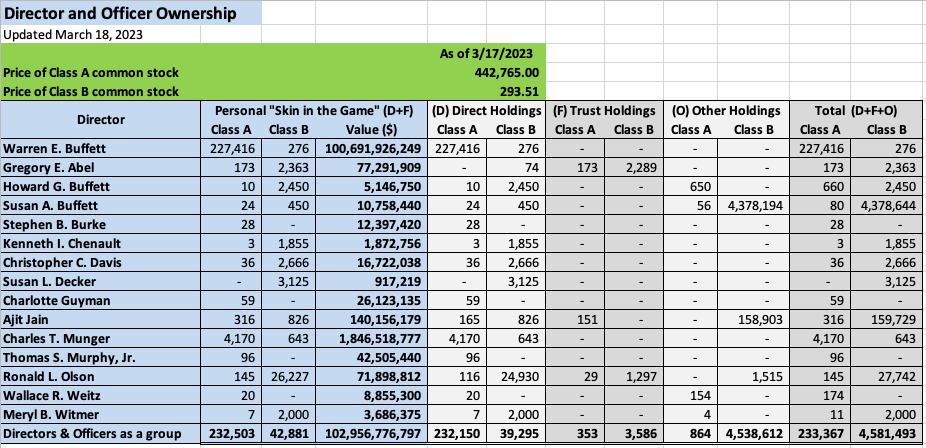

When Berkshire’s 2023 proxy statement was released, I wrote an article commenting on several aspects of the proxy. I am always interested in the amount of “skin in the game” that directors and officers have in any company that I own. I included the following table in the article. The blue region of the table illustrates the importance of Mr. Buffett’s ownership which consists almost entirely of Class A shares.

As of March 8, there were 590,238 Class A shares and 1,298,190,161 Class B shares outstanding. Class A stock has one vote per share while Class B stock has 1/10,000 of a vote. Each Class B share has 1/1,500 of the economic rights of a Class A share.

As I wrote last year, Berkshire’s future will depend on voting control, with Class A shares having a major advantage. Readers interested in the mechanics of Berkshire’s voting control will find that article interesting and, for the sake of brevity, I will not repeat all of the explanations here.

Mr. Buffett controls approximately 15.6% of the economic interest in Berkshire but the concentration of his ownership in Class A shares means that he has approximately 31.6% of the voting interest in the company. Mr. Buffett’s track record and history with the company means that he has effective control even with less than a third of the vote. He commands the loyalty of a very large percentage of shareholders.

I hope that Mr. Buffett lives many more years, but I think we can all agree that his estate will have completed distributing his shares to charity by 2040 or 2050 (Mr. Buffett was born in 1930). This means that Mr. Buffett’s current holdings of 227,416 Class A shares will eventually be converted to 341,124,000 Class B shares with diminished voting rights. A huge percentage of the current Class A share count will therefore exit the scene permanently and those who control the remaining A shares will exercise disproportionate power when it comes to shareholder votes.

There are six shareholder proposals in this year’s proxy statement and the board has recommended a “no” vote on each proposal. In recent weeks, a number of institutions have submitted filings urging votes in favor of these proposals. I discussed why I consider the proposals misguided in my article covering the proxy. I consider most of the “ESG” concepts currently in vogue to be detrimental to Berkshire’s corporate culture. Furthermore, many of these activists fail to realize that Berkshire’s subsidiaries often have policies along the lines of what they are asking for! They seem to insist on a duplicative layer of bureaucracy at corporate headquarters.

For the duration of Mr. Buffett’s tenure as Chairman and CEO and for several years after his death, control of Berkshire will not be in question. However, the same cannot be said for what the situation will look like in 2040 or 2050.

One reason I proposed a split of the Class A stock last year is because I would like to see as many of these shares stay in the hands of shareholders aligned with the current corporate culture. As time goes on and Mr. Buffett’s shares are converted to Class B and given away, and as other individual investors convert their Class A shares to Class B to facilitate gifts and personal consumption, control of the company seems destined to slip into the hands of institutions. I would like to get a better sense of how Mr. Buffett sees control of Berkshire evolving over the next twenty to thirty years.

Repurchase Taxes

A new law went into effect this year that imposes a 1% tax on net repurchases of stock. President Biden has proposed increasing this tax from 1% to 4%. Since 2011, Berkshire has returned $67.8 billion to shareholders via repurchases with the vast majority of buybacks taking place over the past three years.

Would Mr. Buffett and Mr. Munger please comment on this tax both from a public policy standpoint and in terms of how it might affect Berkshire’s repurchase policies going forward? At what repurchase tax rate would the board tilt away from repurchases toward dividends to return excess capital to shareholders?

Repurchases have been relentlessly vilified by many left wing politicians recently along with their supporters in the media. As I observed in my commentary on Mr. Buffett’s 2022 letter to shareholders, he appears quite annoyed with the rhetoric:

“When you are told that all repurchases are harmful to shareholders or to the country, or particularly beneficial to CEOs, you are listening to either an economic illiterate or a silver-tongued demagogue (characters that are not mutually exclusive).”

The letter did not include more than relatively vague generalities on the subject and it is not clear how the repurchase tax will impact Berkshire’s behavior going forward. As I noted in my coverage of the proxy statement, Berkshire has continued to repurchase shares in 2023 after the 1% tax went into effect. I estimated that $1.9 billion was used to repurchase stock between January 1 and March 8.

In Mr. Buffett’s recent appearance on CNBC, he made a comment that I interpret to mean that $4 billion has been used for repurchases through April 12:

BECKY QUICK: Do you have more or less [cash] now? Where are we? What three and a half months later.

WARREN BUFFETT: Yeah. Well, we laid out, you know, $7 billion plus in terms of Pilot. And we spent $4 billion buying in stocks. That’s $11 billion that’s gone out the door. But we’ll know the figures and, you know, exact. But I think we are probably up on cash and Treasury bills, yeah. [Emphasis Added]

I would expect Mr. Buffett to say that the 1% tax is not having much of an impact on repurchase activity but I am not sure what he would say about the proposed 4% tax. Also, I think that the question could elicit some candid commentary from Mr. Munger regarding his thoughts on the repurchase tax.

The China Question

At the Daily Journal annual meeting, Mr. Munger acknowledged that the Chinese government is worrying all the capitalists in the world while also expressing hope that China and the United States will find a way to get along. However, tensions over Taiwan continue to grow. Mr. Buffett alluded to this risk in his appearance on CNBC in April when asked about his decision to sell Taiwan Semiconductor shares.

Apple represents a very important part of Berkshire’s value. If China invades Taiwan and the U.S. response is commensurate with the sanctions imposed on Russia after its invasion of Ukraine, it is difficult to see how Apple’s business would not be seriously impaired. The situation would be even more serious if the United States enters the war to defend Taiwan, as President Biden has indicated numerous times. Has Mr. Buffett discussed this risk with Tim Cook and, if so, is he confident that Berkshire will not suffer a permanent loss of capital in the event of war between China and Taiwan?

In March, I wrote an article about this topic and I remain extremely concerned about the prospect of war between China and Taiwan. While some people believe that the United States and our allies would not impose sanctions on China commensurate with those imposed on Russia last year, I suspect that the situation will be even more serious. On several occasions, President Biden has directly stated that the United States would intervene to defend Taiwan:

Regardless of one’s views of whether it is appropriate for U.S. troops to intervene in the event of war between Taiwan and China, the economic implications of such an action are clear. When the United States imposed sanctions on Russia, it was necessary for most western companies to divest their interest in Russian subsidiaries and dissolve ties with business partners. Far more serious consequences would exist in the event of a war involving U.S. military forces fighting on behalf of Taiwan.

How would Apple navigate its relationship with Foxconn under such circumstances? I discussed that scenario in my article last month so I will not repeat it here other than to say that I don’t think that Tim Cook would have any way to avoid massive damage to the business. I would like to hear Warren Buffett and Charlie Munger comment on this given the importance of Apple to Berkshire Hathaway.

If you found this article interesting, please click on the ❤️️ button and consider sharing this issue with your friends and colleagues or on social media.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Long Berkshire Hathaway.

Great questions, hoping for at least the first to be addressed. Thanks on behalf of a fellow owner.

Re the first question, I would have rather used 2050 - 2060 vs the prior decade.