Introduction

America’s Car-Mart was founded in Rogers, Arkansas in 1981 by Bill Fleeman who converted a Dog ‘N Suds fast food restaurant into a car dealership. From the outset, his business model was to provide financing to “credit-challenged” customers who must have reliable basic transportation. In the early days, the company was known to accept nearly anything of value as a trade-in in lieu of a down payment, including “cows, horses, ostriches, pigs, birds, dogs, a llama and a python.” 1

Car-Mart was profitable in every year of its existence as a private company. In 1999, Mr. Fleeman was suffering from terminal cancer and sold the business to Crown Group for $41 million. Crown Group was a publicly traded holding company that soon divested its other businesses and was renamed America’s Car-Mart.

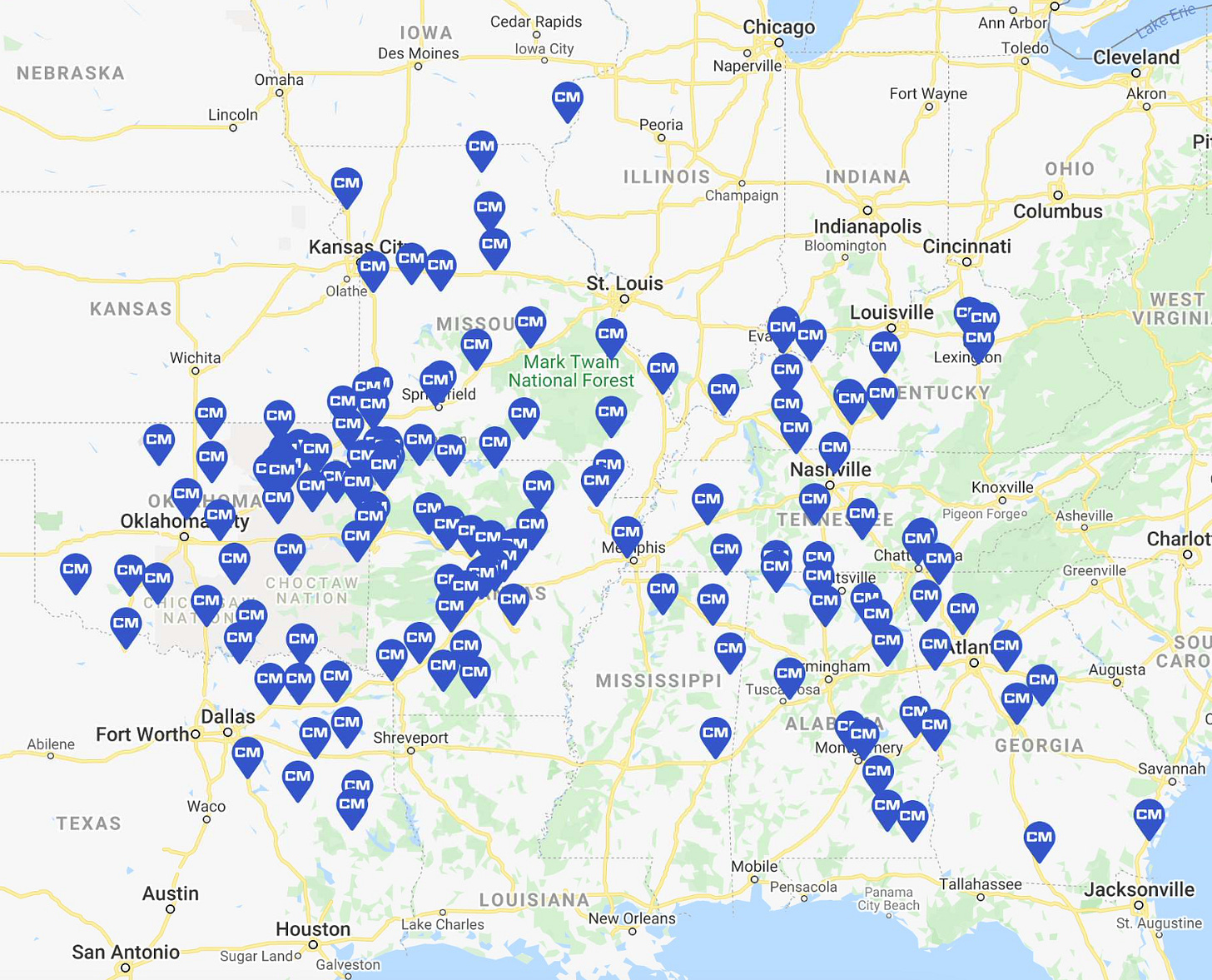

Over the past four decades, Car-Mart has grown from a single location into a network of 154 dealerships concentrated in the south-central United States. Most dealerships are located in small cities with a population of 50,000 or less. Typically, small cities lack the scale needed for widespread public transit and residents must rely almost exclusively on automobiles for essential transportation. 2

Today, Car-Mart’s core value proposition is to “keep you on the road” by providing an assortment of modestly priced used vehicles that can be financed on flexible terms to customers who have impaired credit and limited funds for a down payment.

The majority of Car-Mart customers are unable to obtain traditional auto financing due to very low credit scores. Car-Mart examines a customer’s payroll stubs and overall budget and makes credit decisions using a proprietary process. Since dealership managers are responsible for collections and compensated accordingly, decision making authority at the dealership level is matched with accountability.

Of course, this comes at a cost. Most people would consider Car-Mart’s 16.5% interest rate on a car loan to be ludicrously high, but individuals with limited funds and poor credit who must have transportation to get to work have found Car-Mart’s value proposition compelling, at least compared to their other options. 3

Car-Mart’s high interest rates are necessary due to the high level of defaults that occur when running a business catering to individuals lacking a financial safety net. In the fiscal year that ended on April 30, 2022, net charge-offs were 20.2% of the average principal balance during the year, and this figure is actually quite a bit below the ten year average of 26.4%. Car-Mart’s core demographic benefited from the pandemic-era stimulus programs which helped keep defaults below average.

While job loss can lead to failure to pay installment loans as scheduled, it is also common for Car-Mart customers to simply stop paying if their car breaks down. For this reason, the company has incentives to sell vehicles that management believes can last at least as long as the typical term of a loan, which is currently 42.9 months.

Traditional auto retailing, especially in the used vehicle market, is focused on the initial sales transaction. But given the ongoing payment relationship with customers, Car-Mart must take a longer-term view to be successful. Selling a clunker that immediately breaks down is counterproductive since it will likely result in the customer ceasing payments and the repossession of impaired inventory.

Car-Mart is a relatively simple business that has performed well over many decades through a variety of economic environments. In this article, we will take a look at the company’s business model and unit economics and then drill down into its operating track record with a focus on how financing has represented a major advantage. Finally, we will look at the company’s balance sheet with a focus on how it funds installment loans and how repurchases have played an important role in recent years.

Business Model

In the fiscal year that ended on April 30, 2022, Car-Mart sold a total of 60,595 vehicles through 154 dealerships. During the year, the typical dealership sold 399 vehicles at an average retail sales price of $16,649, posting a gross profit of $6,550 per vehicle. During the fiscal year, the average customer down payment was 7% and the average total collections per active customer per month was $513. At yearend, Car-Mart’s active customer count was 95,107.

Dealerships typically maintain inventory of 20 to 90 vehicles depending on the size of the lot and the time of year. Most vehicles are between five and twelve years old and have 70,000 to 150,000 miles on the odometer. Typically, inventory is purchased for between $4,000 and $12,000. The overriding goal is to source affordable vehicles that require minimal reconditioning and are capable of serving as reliable basic transportation for several years.

Before discussing the financial results for the company, taking a look at the unit economics is very helpful when it comes to understanding how the business model works. The following exhibit was provided in the company’s most recent investor presentation for the third quarter of fiscal 2022:

We can quickly see that gross margin on the sale of the vehicle and interest income are both essential components for overall profitability. As we can expect from Car-Mart’s target demographic, credit losses represent the company’s most significant expense. Because of this, the company’s core competency, aside from sourcing reliable used vehicles, involves making intelligent decisions regarding creditworthiness of customers and keeping on top of collections.

All collections are serviced by company employees at the dealership level. Customers are given a variety of options for making payment and traditionally a high percentage make payments in person at the dealership. 77% of payments are due either weekly or bi-weekly, usually coinciding with a customer’s payday.

When a customer fails to make timely payments, the dealership immediately initiates contact with the customer and tries to avoid repossessing vehicles. However, the company does not make major loan modifications aside from small adjustments to payment dates to account for a shift in a customer’s payday or due to temporary difficulties such as minor auto repairs.

Since repairs can be a major reason for delinquencies, Car-Mart offers various service contracts that most customers choose to purchase with their vehicles. In addition, a payment protection plan is available to discharge the remaining debt of customers who are still making payments in the event that their vehicle is stolen or destroyed. Car-Mart does not service vehicles in-house and typically contracts with service centers at labor rates negotiated in advance.

As of April 30, 2022, 3% of customer accounts were more than thirty days overdue. Car-Mart strives to resolve delinquent accounts quickly, either through minor loan modifications or repossession of vehicles. On average, accounts are approximately 73 days overdue at the time they are charged off.

Car-Mart operates in a decentralized manner with accountability at the dealership level for financial results. However, certain functions are centralized, such as establishing standards for extension of credit and procurement of inventory.

Pandemic Effects

In order to better understand Car-Mart’s recent financial history, we need to take a brief detour to consider the effects of the COVID-19 pandemic on the company over the past two years. To a certain degree, the pandemic has skewed the results of most businesses, but it has had an even greater effect on companies that cater to individuals at the lower end of the socioeconomic spectrum, and the used car market in particular has faced unprecedented conditions over the past year.

As we have seen, Car-Mart’s customers have financial lives with almost no margin of safety. With low credit scores and minimal savings, most customers are living paycheck-to-paycheck in normal times. The loss of a job or some other financial setback can immediately push such customers into default.

At the outset of the pandemic, most observers expected the economy to fall into a deep depression and assumed that lower income consumers would face imminent ruin. However, the federal government quickly approved stimulus programs that boosted the financial condition of most Americans:

In addition to stimulus payments, from July to December of 2021, a refundable child credit of $250-300 per child was available on a monthly basis via direct-deposit. The combination of the stimulus program and the monthly child credit had the effect of dramatically increasing the savings rate in 2020 and 2021, as we can see below:

Obviously, the effect of these programs had the effect of stabilizing the financial situation for Car-Mart’s target demographic making it possible for new customers to make larger down payments, afford larger monthly payments, and purchase better vehicles. Existing customers were able to continue making payments leading to charge-offs declining during the pandemic.

Unfortunately, the news is not all good. The government’s response to the pandemic has also increased inflation dramatically, and few categories have seen more inflation than the price of used vehicles, as we can see from the exhibit below:

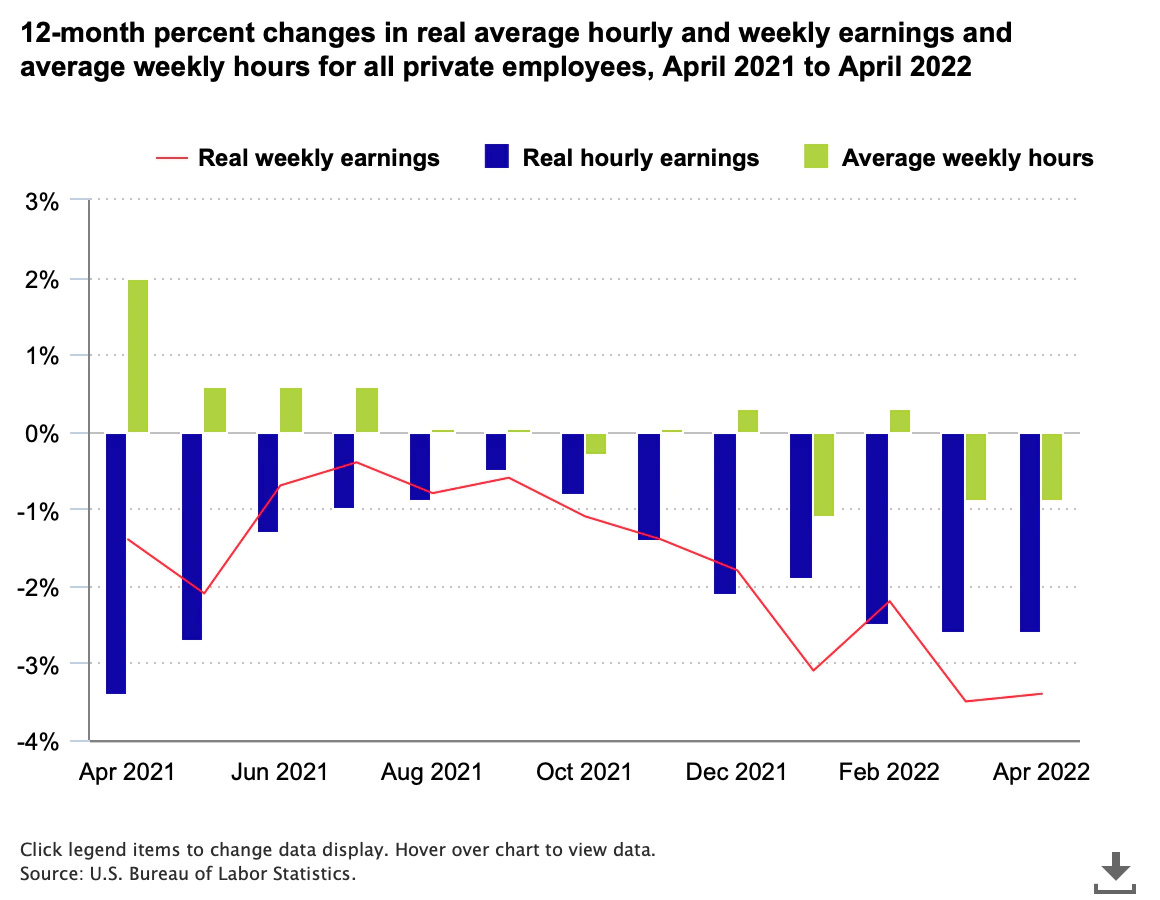

As the price of used cars increase, Car-Mart has been put in a position of needing to acquire acceptable inventory at reasonable prices and finding a way to make vehicles affordable for its target market. On the one hand, customers have more of a financial cushion than they had in the past due to stimulus programs, but on the other hand wages have failed to keep up with consumer price inflation:

It is best to think of the pandemic-era stimulus as akin to a sugar high. Consumers received a temporary infusion that stabilized their financial lives, but inflation threatens to take a major permanent toll on finances once the sugar high wears off. It is remarkable that the economy currently has an unemployment rate of just 3.6% while 83% of respondents in a recent Wall Street Journal poll characterize the economy as “poor” or “not so good”. It doesn’t take a big leap to assume that Car-Mart’s typical customer is not feeling very confident about the economy.

What does this mean for Car-Mart’s business model? The most obvious impact is that the company must charge dramatically higher prices for vehicles because the cost of its inventory has skyrocketed:

The reality is worse than the chart indicates. While the average retail sales price for fiscal 2022 as a whole was $16,649, the average sales price in the fourth quarter of the fiscal year shot up to $17,860. Two years ago, the average sales price was just $11,793.

How can Car-Mart keep vehicles affordable for a target market that might still have some savings from the stimulus programs but faces declining real wages in an inflationary environment? There are only a few options:

Lower the interest rate.

Accept lower gross margins on vehicle sales.

Lengthen the term of the installment contracts.

Lowering the interest rate charged to customers in an inflationary environment with increasing funding costs seems like a bad idea, and Car-Mart has not pursued that approach. However, management has accepted lower gross margins and has significantly lengthened the terms of installment contracts. Both actions have implications that must be considered as we review the company’s financial history.

Operating History

Car-Mart’s business model has clearly worked very well for a long period of time. The exhibit below shows the company’s financial results for a sixteen year period which includes the financial crisis and subsequent recession (click on the exhibit to enlarge it):

The company has a record of consistent results and growth. Revenue grew in every year and, until recently, gross margin has consistently hovered in the 40-43% range. In fiscal 2022, the company decided to accept a much lower gross margin in order to keep vehicles more affordable for customers in the midst of rapid used car inflation. Gross margin in fiscal 2022 dropped to 37.4%, far below historical averages.

There is greater variability in the provision for credit losses which is responsible for much of the variation in net margin, yet the company has been profitable in all years. Assisted by a declining share count, net income per share has advanced at a rapid clip.

Over the past two years, the company has been able to improve SG&A costs as a percentage of sales. This metric has typically been in the 17-18% range but dropped to 14.7% for fiscal 2022, as noted in the company’s recent fourth quarter earnings release:

“We also had nice leveraging of SG&A costs as a percentage of sales for both the quarter (at 13.2% compared to 14.5% for the comparable prior year quarter) and full fiscal year (at 14.7% compared to 16.2% for the prior year). This is especially impressive considering the increased costs in the current inflationary environment for most of our expenses, but especially the wage pressures,” said Vickie Judy, CFO. “We are investing in and building for our future to support a growing number of associates and customers.”

If sustained, this improvement in SG&A has the potential to drive significant gains in operating income. Each percentage of sustained improvement in SG&A results in over $10 million of incremental pre-tax income annually.

In every year except 2016, the company has posted an increase in the number of vehicles sold at retail. Average units sold per dealership is a key productivity metric that has trended higher in recent years and now stands just under 400. As previously discussed, the average retail sales price has skyrocketed over the past two years after several years of relative stability.

One of the most important metrics to examine involves the length of the average installment contract term. As discussed earlier, the rapid inflation of used car prices has resulted in a longer originating contact term. A decade ago, the typical contract had a term of just over 29 months, but this has increased to just under 43 months for Fiscal 2022, as shown in the exhibit below:

Increasing the contract term has the effect of lowering payments, but the downside is that the longer the contract, the higher the possibility of eventual default.

The passage of time increases the chances of the vicissitudes of life impacting customers in a negative way. This could involve the loss of a job or family dislocations, but there is also a higher risk of a vehicle breaking down as time goes on.

We need to keep in mind that Car-Mart’s vehicles already have 70,000 to 150,000 miles on the odometer at the time of sale. Over a contract term stretching to nearly four years, we could expect many vehicles to exceed 200,000 miles. Typically, when a vehicle breaks down, the customer will default on the contract and Car-Mart will end up with a repossessed vehicle that is likely to have little salvage value.

It will be important to monitor the average contract length in the future and to determine the effect of a longer term on loan defaults. It seems reasonable to assume that charge-offs as a percentage of loan receivables could trend higher in the coming years, but there would be a time lag involved before vehicles toward the end of their extended installment term begin to break down resulting in defaults.

The following chart from the company’s third quarter fiscal 2022 investor presentation shows that net charge-offs as a percentage of average receivables have trended downward during the pandemic. I would expect that this figure is likely to return to historical levels as pandemic-era stimulus effects wear off and the longer installment terms begin to take a toll on the number of customers who default. (Note that YTD 2021 and YTD 2022 items in the graph cover three quarters of charge-offs. The full year charge-off was 19.3% in 2021 and 20.2% in 2022.)

Now that we have reviewed the key metrics of Car-Mart’s operating history over the past decade, we will turn our attention to the balance sheet and capital allocation.

Balance Sheet

The following exhibit shows Car-Mart’s balance sheet over the past decade. Note that the balance sheet at April 30, 2022 has less granularity because it is derived from condensed summary information appearing in the company’s recent earnings release. The 10-K for fiscal 2022 should be filed with the SEC by late June or early July.

At the end of fiscal 2022, Car-Mart’s debt-to-equity ratio was 0.94 which represents an increase from 0.56 at the end of the prior fiscal year. Historically, Car-Mart has relied on revolving credit facilities carrying variable interest rates, collateralized by finance receivables and inventory, and guaranteed by the company. Until this year, Car-Mart did not rely on securitizations as a funding source. However, on April 25, shortly prior to the end of the fiscal year, Car-Mart announced the company’s inaugural $400 million asset-back securitization:

“We are excited to diversify our funding sources by entering the securitization market. This transaction represents an important step as we prepare for continuing growth,” said Jeff Williams, President and Chief Executive Officer of the Company. “As we look ahead, this market will offer us greater access to credit with a more efficient capital structure.”

The company used the net proceeds of the securitization to pay down most of the credit facilities. Unlike the credit facilities, the securitization is a funding source that is non-recourse to the company. Car-Mart will continue to service the auto loan receivables backing the notes. This development marks a significant change in the company’s funding strategy, but presumably if investor demand for securitizations dries up in the future or is available only on unfavorable terms, management would be able to obtain funding through credit facilities again.

The exhibit below shows how finance receivables have changed over the past decade. During this period, finance receivables have grown from $251 million to $854 million.

As discussed previously, Car-Mart’s business model assumes a high level of credit losses which represents a risk in the event that provisions for credit losses end up being lower than actual losses. However, should adverse developments occur, they are known quickly since accounts are ~73 days overdue at the time they are charged off.

Over the past decade, Car-Mart has used $215 million to repurchase its stock. This has driven down the share count by 32%. Stockholders’ equity has increased from $184.4 million at April 30, 2012 to $469.3 million at April 30, 2022. The goodwill on the balance sheet is minimal. The combination of rising stockholders’ equity and declining share count has increased book value per share from $19.66 at April 30, 2012 to $73.65 at April 30, 2022 representing compound annualized growth of 14.1%.

Market Size and Potential Expansion

Does it make sense for Car-Mart to return so much cash to shareholders via share repurchases? Although book value per share has grown at a healthy clip in recent years, one opportunity cost for returning capital is slower expansion.

The used car market in the United States is very large. According to retail sales figures for used car dealers provided by the St. Louis Fed, the size of the market was $162.2 billion in 2021.

With just over $1 billion of sales, Car-Mart has a small share of a large market. This is partly attributable to its focus on serving a small segment of the overall used car market, but is also due to a limited geographic footprint. The map below shows Car-Mart’s current locations which are mostly located in the south-central United States:

Even within the company’s current footprint, it seems like there are many untapped regions for potential expansion, even bearing in mind the focus on smaller cities with a population under 50,000. Car-Mart has expanded slowly over the years with the dealership count rising from 114 to 154 over the past decade.

When new dealerships are opened, the new manager is typically promoted internally and provided with $1.5 to $2.5 million of capital during the first few years of operations. It is common for dealerships to open with very limited personnel and use modular structures until the location is profitable.

With pre-tax profit per car sold running at close to $2,000 and the average dealership selling nearly 400 cars per year, it is easy to surmise that starting successful new dealerships could make a great deal of economic sense. It would take several years to develop a new dealership to the point where it is operating at scale, but the potential to earn $800,000 in pre-tax profits with an initial capital commitment of $1.5 to $2.5 million is clearly very attractive.

Car-Mart has more than sufficient resources to expand its dealership footprint much more quickly than it has in recent years. There are obviously potential customers with limited economic means all over the United States, not just in the company’s current geographic footprint. Management must believe that very conservative expansion into adjacent markets run by managers promoted from within is the safest way to proceed.

Conclusion

America’s Car-Mart has developed an approach to serving the deep subprime automobile market that has worked well for many decades. While some investors may prefer to stay away from companies serving Americans of modest economic means, this is a large demographic group and providing such people with essential non-discretionary goods and services has proven to be a successful business model in many industries.

My initial reaction to learning about Car-Mart’s 16.5% interest rate was that the company seemed to be exploiting its customer base. However, we must keep in mind that no one is forcing Car-Mart’s customers to do business with the company. The reality is that if you do not have much savings, it is not possible to buy a decent vehicle for cash, and lacking decent credit closes the door to auto loans at rates that wealthier people are used to paying.

Car-Mart charges a high interest rate but also accepts the inherent risk of doing business with individuals with a limited financial safety net who default on installment loans at a very high rate. After learning more about the company, it seems to me that Car-Mart is filling a necessary role and has built a successful business model around its mission of keeping customers on the road.

With a current market capitalization of $656 million based on the April 30 share count and the stock trading at around $103 at mid-day on June 8, America’s Car-Mart falls within the category of small-cap stocks. Investors managing several billion dollars of capital would not be able to invest in the stock, but smaller investors clearly could.

The unique economic impacts of the pandemic have boosted operating results, including reported net income, to levels that might not be sustainable over time. However, the company’s longstanding record of growth of book value driven by net income and repurchases seems attractive. It also appears that there is upside in the event that management finds a formula for more aggressive capital-light expansion.

This newsletter is not a stock picking service but instead aims to profile companies with interesting business models that have worked over long periods of time. Hopefully, this profile of America’s Car-Mart has been useful for subscribers interested in learning about interesting business models and could serve as a starting point for investors conducting due diligence on the company.

Downloads

A PDF file containing this profile can be downloaded by using the link below:

Excel data used in this report is available using the link below:

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

No position in America’s Car-Mart.

Here is a brief history of the company published in 2003: Car-Mart shifts gears: company takes buy here/pay here plan national. Based on a 2016 advertisement that’s still up on YouTube, the company’s quirky trade-in policy is still in effect, although I suspect that most trade-ins are actual motor vehicles.

Car-Mart Celebrates 40 Years, August 25, 2021. Unless otherwise specified, all figures quoted in this profile are taken from the company’s 10-K and 10-Q reports filed on the SEC’s website, with the exception of data for fiscal 2022 which ended on April 30, 2022. The company’s 10-K for fiscal 2022 has not been released, so data for that fiscal year has been obtained from the company’s Q4 fiscal 2022 earnings release.

“The Company provides financing to substantially all of its customers who purchase a vehicle at one of its dealerships. The Company only provides financing to its customers for the purchase of its vehicles, and the Company does not provide any type of financing to non-customers.” Source: 2021 10-K.