The Digest #134

Growth vs. Value, Apple's New Products, Precision Railroading, Julian Robertson

Quote of the Week

“It is my opinion that in almost any field nothing is worth doing unless it is worth doing right. When it comes to selecting growth stocks, the rewards for proper action are so huge and the penalty for poor judgment is so great that it is hard to see why anyone would want to select a growth stock on the basis of superficial knowledge.”

— Philip A. Fisher, Common Stocks and Uncommon Profits

Growth vs. Value

Is this a good time to own growth stocks or value stocks?

This question seems to pop up at regular intervals and is taken quite seriously by the media and many investors. The reality is that the distinction between growth and value as investment strategies makes little sense. The most successful investors know that the rate at which a business can grow represents a component of its value.

All active investment strategies are ultimately based on a belief that the present value of all future cash flows emanating from ownership of the asset exceeds what must be paid to acquire the asset today. To the extent that growth increases future cash flow, the value of the asset will be greater than if there are limited growth prospects.

The best type of business to own is one that produces a high return on invested capital and has the ability to reinvest earnings at a high return for a long period of time. The issue is that if market participants recognize the situation, the price of acquiring the business might be extremely high. The “growth stock” investor must therefore seek out businesses that not only have a promising future but are not fully recognized as having a bright future by other market participants.

Many “growth investors” do not view the world in terms of free cash flow but only care about the possibility of reselling the business they are buying to someone who might pay a higher price in the future. This is speculation, not investing.

Philip A. Fisher is well known as an advocate of investing in growth stocks, but he was no speculator. In Common Stocks and Uncommon Profits, which I reviewed many years ago, he presents a rigorous process for seeking high growth stocks and strategies for avoiding trouble. He counsels investors to avoid promotional situations and to be cognizant of the danger of paying a price that already discounts very high growth far into the future.

There is no doubt that Phil Fisher’s approach was more venturesome than the policies advocated by Benjamin Graham, but both men demanded rigor in their analytical process. Warren Buffett was clearly more influenced by Graham in his early years but came to appreciate Fisher as well. Charlie Munger’s approach tilts more toward Fisher and less toward Graham.

When asked about the distinction between value and growth during the 2001 Berkshire Hathaway annual meeting, Warren Buffett clearly explained the fallacy of thinking in such terms. Charlie Munger chimed in with the observation that selecting companies with growth prospects reduces the number of decisions that they would have to make over time.

My copy of Common Stocks and Uncommon Profits is over two decades old and there are many notations within the book. Perhaps it is a matter of personality, but I have never been comfortable paying the valuations required to own the most successful growth companies of the 21st century. Hindsight bias makes it clear which companies should have been owned in recent decades. What is more difficult is identifying the growth stories of the next ten to twenty years and deciding what price to pay.

The Rational Walk is a reader-supported publication

To support my work and to receive all articles that I publish, including premium content, please consider a paid subscription. Thanks for reading!

Articles

The Services iPhone by Ben Thompson, September 8, 2022. Ben Thompson has been covering Apple product launches for a decade. In this article, he provides a number of links to his work related to previous product launches and presents his assessment of Apple’s current competitive position. “Very few people just buy an iPhone: they upgrade to a higher-priced model, they spend money in the App Store and on subscriptions, and they buy an Apple Watch and AirPods that work seamlessly with their phone. The end result is that Apple isn’t making $550 per customer, to go back to the iPhone 5C, or $650 in the case of the 5S: they’re making upwards of $2000…” (Stratechery)

Will the Apple Watch Ultra make Garmin the next Nokia? by Thomas Ricker, September 8, 2022. Mobile phones have steadily incorporated functions that used to require separate devices, with cameras being the most obvious example. As the Apple Watch matures and gains additional functionality, it may displace fitness and adventure watches produced by Garmin. Fitness watches used to be a niche product before the Apple Watch came along. Although Apple’s offering still does not provide all of the functionality of a high-end Garmin, the gap is closing. (The Verge)

The Illusion of Knowledge by Howard Marks, September 8, 2022. “A few years ago, a highly respected sell-side economist with whom I became friendly during my early Citibank days called me with an important message: ‘You’ve changed my life,’ he said. ‘I’ve stopped making forecasts. Instead, I just tell people what’s going on today and what I see as the possible implications for the future. Life is so much better.’ Can I help you reach the same state of bliss?” (Oaktree Capital)

Railroads Reverse Years of Streamlining to Improve Freight Service by Esther Fung, September 6, 2022. As part of my research into the railroad business, I have been reading Railroader, a biography of Hunter Harrison who pioneered precision scheduled railroading. Much of the improvement in the economics of railroads over the past two decades has been attributed to precision scheduled railroading, so it was interesting to read this article reporting on how some railroads have partially reversed course. Berkshire’s BNSF, which I profiled last month, is the only major railroad that has not implemented precision scheduled railroading, perhaps for good reasons. (WSJ)

How to Get More Time by Nick Maggiulli, September 6, 2022. If you are getting older and have not made progress saving for retirement, it is hard to catch up. You might need to save more and retire later than those who started earlier. But this doesn’t mean that you must resign yourself to a brief retirement. By incorporating exercise into your lifestyle, you can add many years to your lifespan and, more importantly, to your “health-span” — that is, the number of years of healthy life that you will be able to enjoy once you are finally able to retire. This article provides excellent advice whether you are dialed in financially or find yourself behind. (Of Dollars and Data)

The Tiger That Was a Wolf: Lessons From Julian Robertson by Frederik Gieschen, September 4, 2022. This is a nice tribute to Julian Robertson who passed away last month. “Despite exiting during a drawdown, I think he made a smart choice for himself. He kept doing what he loved: he mentored great talent, traveled the world, and pulled the trigger on investing his own capital. The work of answering to investors, navigating a massive fund, and managing an extensive staff disappeared. He’d returned to what he loved: the craft of investing and spending time with his favorite people.” (Neckar's Minds and Markets)

A Value Investor’s Analysis of Student Loan Forgiveness by Vitaliy Katsenelson, August 31, 2022. This is a well-reasoned and fair critique of the President’s executive order canceling student loans. Aside from the cost of the program and the fact that Congress did not appropriate money for this purpose, moral hazard and lack of structural reform make it likely that we will see similar problems in the future. “This executive order doesn’t even attempt to fix the core issue of runaway inflation in college tuition. In fact, it will likely make tuition inflation even worse by throwing more taxpayer money at colleges and lead to endless ‘forgiveness’ in the future.” (Contrarian Edge)

Growing a New Type of Organ Donor by Amy Dockser Marcus, September 6, 2022. Over ten million hogs are slaughtered every month in the United States for food, but somehow this article about genetically modified pigs designed to produce organs for transplant into humans immediately raised ethical concerns in my mind. Apparently, the ethical questions are something researchers are grappling with as well. Is there a difference between raising pigs for food consumption and raising them to harvest organs for transplant? Assuming that scientists can perfect the process, it will be hard to argue against this type of xenotransplantation on moral grounds. However, Carl Icahn and others have advocated for the welfare of pigs and make convincing cases. Preventing needless suffering for animals is a worthy objective. (WSJ)

Podcasts

Henry Ford's Autobiography, September 7, 2022. 1 hour, 27 minutes. Henry Ford’s autobiography, My Life and Work, was published in 1922 and contains details about his early efforts at innovation in the automobile industry. There is plenty to dislike about Henry Ford as an individual, but his approach to hard work, innovation, and industry is something that we can all learn from. “Reading this book is like having a one-sided conversation with one of the greatest entrepreneurs to ever live who just speaks directly to you and tells you, ‘Hey this is my philosophy on company building.’” (Founders)

Interest Rates, US Deficit, and the First 8 Things to Look at When Researching a Stock, September 7, 2022. 1 hour, 57 minutes. Geoff Gannon and Andrew Kuhn discuss a wide range of topics including how to go about reading 10-Ks, inferring value creation based on long term stock price performance, the entertainment industry, Disney, and how to think about IPOs. Although I listened to the podcast, I have linked to the YouTube video which includes slides. (Focused Compounding)

AMD: How Chips Are Changing, September 7, 2022. 52 minutes. “AMD isn't the biggest and it hasn't always been the best chip-maker in the world, but as cyclical and structural changes take place in the semiconductor industry, AMD serves as a great proxy for what's going on and why. … We explore the rise of custom silicon, AMD's competition with Intel and Nvidia, and whether chip-making is a good business at all.” (Business Breakdowns)

Tweet of the Week

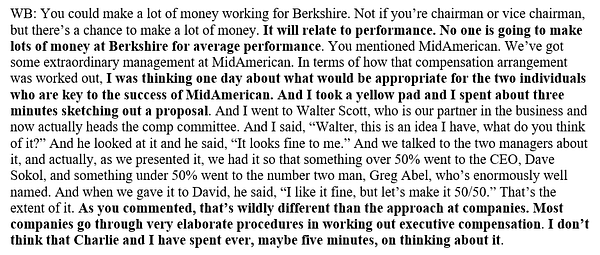

Warren Buffett explains his approach to executive compensation in general and how he set pay for David Sokol and Greg Abel at MidAmerican Energy, which has since been renamed Berkshire Hathaway Energy:

Photo of the Week

If you enjoyed reading the Weekly Digest, please click on the ❤️️ button and consider sharing this issue with your friends and colleagues.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.