The Digest #128

Truth and Lies, Recession or Hovering?, Forward Guidance, Howard Marks, TransDigm, Tumi & Roam Luggage, Jeremy Grantham

Truth and Lies

“Oh, what a tangled web we weave, When first we practise to deceive!” — Sir Walter Scott

“If you tell the truth you don't have to remember anything.” — Mark Twain

“Lies multiply, branching out into more lies; truth doesn't.” — Nassim Nicholas Taleb

“Above all, do not lie to yourself. A man who lies to himself and listens to his own lie comes to a point where he does not discern any truth either in himself or anywhere around him, and thus falls into disrespect towards himself and others.” — Fyodor Dostoevsky

“If you are ever going to lie, you go to jail for the lie rather than the crime. So believe me, don't ever lie.” — Richard Nixon

The Hovering Economy

The great Dana Carvey impersonating George H.W. Bush in December 1991:

“Certainly, the economy is a little sluggish. Momentarily a bit soft … notice I didn’t say ‘recession’. Not afraid to say recession! Recession, recession, recession! Heck, I’ll say it all day, but I don’t have to because we are not in a recession. We’re not even in a downturn here. We’re more in sort of a hovering action there. We’re kind of hovering around as if idling there…”

Turns out that President Bush was right! There was no recession in December 1991.

The recession ended in March 1991 according to the National Bureau of Economic Research which is considered the authority on dating recessions. The problem is that recessions are dated with a significant lag. The press release in the link is dated December 22, 1992, almost two years after the official end of the recession.

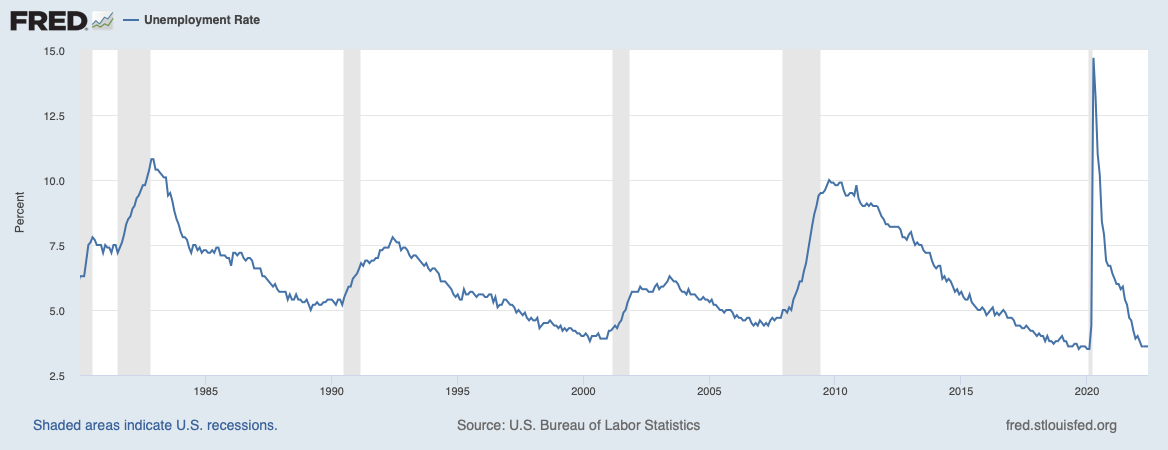

From a political perspective, the “official” dating of a recession is beside the point. The unemployment rate is normally a far better indicator of how people feel about the economy. Unfortunately for President Bush, the unemployment rate continued to go up in the months after the recession officially ended in March 1991. Unemployment, not the official definition of a recession, arguably played the most important role in the president’s defeat at the polls in November 1992.

Politicians can endlessly debate whether two consecutive quarters of falling real GDP constitutes a recession or not. By that definition, the economy has been in recession since the beginning of 2022. What is interesting about this recession, or hovering action, is that unemployment is at very low levels. However, inflation has more than offset increases in nominal wages. Food, housing, and energy costs have skyrocketed which has naturally irritated voters just a few months before the mid-term elections. Politicians will always spin economic developments to suit their electoral interests.

The pandemic and the government’s response to it created an economic situation that has no close historical parallels. There are plenty of prognosticators who claim to know where the macroeconomy is going next, but I am not one of them. In my opinion, it is extremely difficult to predict the macroeconomy in a run-of-the-mill economic cycle and next to impossible in the current situation.

The Rational Walk is a reader-supported publication

To support my work and to receive all articles that I publish, including premium content, please consider a paid subscription. Thanks for reading!

Articles

Models, Guidance, Humility: Has Jay Powell Learned an Important Lesson? by Roger Lowenstein, July 29, 2022. “Forward guidance had been deemed particularly useful when interest rates were zero. Since the Fed couldn’t move the short-term below zero, signaling that rates would remain at nil was a way of increasing the stimulus during a crisis. The problem with this theory is that guidance can never be better than the predictive powers on which the guidance is based. Consider how the guidance worked in practice. The biggest beneficiaries of guidance were said to be to banks, who were reassured that they could continue issuing low-interest business loans and mortgages. Banks that did so now are saddled with unprofitable assets.” (Intrinsic Value by Roger Lowenstein)

Related Articles:

Fed Fallacies by Jason Zweig, July 26, 2022. “Market commentators are going to fill your ears this week with endless pontification about what the Fed is going to do next. They won't tell you two important things. First, the Fed itself often doesn't know what it will do over any period longer than a few weeks in advance. Second, you shouldn't reposition your portfolio based on an interest-rate forecast, no matter how certain the consensus view seems to be. It's highly likely to be wrong.” (The Intelligent Investor)

Pounds of Salt: The Fed’s Epistemic Arrogance, The Rational Walk, June 17, 2021. “I am not advocating that the Federal Reserve fire its economists and give up on making economic projections entirely. However, I do question the utility of communicating these projections through countless speeches, policy statements, and press conferences that give the appearance of jawboning the market. For one thing, anyone who looks at the Fed’s track record can see that the projections have no particular credibility. We have more transparency than ever before, but more and more it looks like the ‘man behind the curtain’ resembles the Wizard of Oz.”

I Beg to Differ by Howard Marks, July 26, 2022. “This all leads me back to something Charlie Munger told me around the time The Most Important Thing was published: ‘It’s not supposed to be easy. Anyone who finds it easy is stupid.’ Anyone who thinks there’s a formula for investing that guarantees success (and that they can possess it) clearly doesn’t understand the complex, dynamic, and competitive nature of the investing process. The prize for superior investing can amount to a lot of money. In the highly competitive investment arena, it simply can’t be easy to be the one who pockets the extra dollars.” (Oaktree Capital)

Related Articles:

The Value of Repetition, The Rational Walk, July 27, 2022. “When Howard Marks seems to repeat himself in his memos, I suspect it is by design. He is sending a message that there are basic investing principles that we should return to again and again, applying them to current circumstances in intelligent ways. At the same time, Mr. Marks is not rigid in his thinking and has been open to considering new ideas, most notably in his January 2021 memo, Something of Value, in which he described discussions about value vs. growth investing with his son, a professional investor who seems to tilt more toward the growth camp.”

Mastering the Market Cycle, The Rational Walk, October 13, 2018. This is a book review of Mastering the Market Cycle, published by Howard Marks in 2018. “Mr. Marks is very well known in the value investing community and his previous book, The Most Important Thing, has been incorporated in many lists of must-read resources. Both of his books draw heavily from the author’s collection of memos to Oaktree Clients. These memos are certainly “evergreen” in terms of covering important topics using current and historical examples.”

Coping With Irrational Markets, The Rational Walk, January 18, 2016. “Howard Marks recently released his latest memo, On the Couch, in which he provides commentary on recent market developments and current investor psychology. Toward the end of the memo, Mr. Marks outlines his prescription for investors …”

The Force That Can Lift Stocks but Wreck You by Jason Zweig, July 22, 2022. It is now possible to buy leveraged exchanged traded funds offering exposure to a single stock. “Greg Bassuk, chief executive of AXS, calls the new ETFs ‘sharper knives that traders can use to express very short-term, high-conviction views on the upside or downside of individual stocks’ … Some financial watchdogs worry those knives could maim the unwary. Two officials of the Securities and Exchange Commission said in separate statements that the new ETFs create greater risk and destroy the benefits of diversification. I think they’re right and these funds are suitable for almost no one except full-time traders.” (WSJ)

Why Writing Became Sterile by David Perell, July 25, 2022. Tools like Grammarly tend to make writing standardized and boring. In this article, David Perell points out that Hemingway wouldn’t have been Hemingway if his writing had been run through Grammarly software. “Ultimately, you want to develop a distinct and unmistakable voice. This voice becomes a pillar of your Personal Monopoly. That style can show up in infinite ways. Packy McCormick injected humor into the antiseptic world of business writing and explained ideas with memes. Tim Urban got tired of buttoned-up explanations of intellectual concepts and played around with stick figure drawings instead. Nassim Taleb personifies his ideas by pulling from a cadre of characters like Fat Tony, an Italian guy with serious street smarts who is straight out of The Sopranos.” (Monday Musings)

The Knowledge That Won't Fit Inside Your Head - Commonplace Books by Mark Dykeman, July 6, 2022. I’ve maintained a morning pages journal for the past three years, but for some reason, I have not had much success creating commonplace books which is the subject of this article. “In the centuries before computers, commonplace books were a scholarly way to amass and retain information. Everything was handwritten because there was no alternative for most people to record information. You could write your findings in a chronological order like a diary or, in some cases, you might set up a simple alphabetical indexing system or keep a table of contents. As for what you could (or can) record in a commonplace book, there’s really no limit. And there’s no need to handwrite everything, it’s perfectly acceptable to cut and paste material to save time and effort.” (How About This)

Related Article:

The Power of Morning Pages, The Rational Walk, August 15, 2020. “The concept behind morning pages is simple, so simple that it is tempting to dismiss it as a gimmick out of hand. The only rule is that you are supposed to sit down first thing in the morning immediately after waking up and write three pages of longhand, in a stream-of-consciousness style.”

Podcasts

TransDigm: Operator to Capital Allocator with Nick Howley, July 28, 2022. 1 hour, 11 minutes. This is the third episode in a series on TransDigm. I thought this quote by Nick Howley encapsulates TransDigm’s strategy: “Our experience in this industry is what matters is the product works, you keep up with the technology mostly, which is make the life longer. You deliver them on-time, service the heck out of it. And pricing is a distant third or fourth in the value creation because, once again, these are little things going into big things. What matters is they don’t foul the big thing up. [emphasis added] They work and you get them there on time. And if something goes wrong with that, you fix it fast.” (50x)

Tumi & Roam Luggage: Charlie Clifford, July 25, 2022. 1 hour, 9 minutes. “Over nearly 50 years in the luggage business, Charlie Clifford has built two premium brands and weathered three existential crises: the recession of 1982, the travel slowdown post- 9/11, and the extreme aftershocks of Covid. His first luggage company, Tumi, was inspired by his time as a Peace Corps volunteer in Peru. Charlie began by importing hand-crafted leather duffels from South America, but quickly pivoted into more durable and distinctive ballistic nylon bags. Business travelers loved them, and by the 1990’s, Tumi was spreading to Europe and Japan. Today, Tumi is owned by Samsonite and its stores are in airports and shopping malls around the world. Meanwhile, Charlie—unfazed by the challenges he’s faced over the years—has launched another premium luggage brand, Roam.” (How I Built This)

Value Investing, Compounding and Lifelong Learning with Gautam Baid, July 25, 2022. 48 minutes. “In this episode we speak with Gautam Baid, author of The Joys Of Compounding. We talk about the power of compounding and the criteria he uses to identify long-term compounders. We also cover a wide range of other topics, including why value investing works over the long-term, what to make of the recent struggles of value and the long-term potential of the Indian market.” (Excess Returns)

Review of The Joys of Compounding by Gautam Baid, The Rational Walk, June 1, 2020. “Baid believes that compounding positive thoughts, good health, good habits, knowledge, and goodwill all have enormous benefits in life that go well beyond money. But the fact is that the side effect of compounding in these areas can also lead to compounding wealth.”

The Bear Has Arrived w/Jeremy Grantham, July 29, 2022. 1 hour, 21 minutes. “Jeremy is the co-founder and Chief Investment Strategist of Grantham, Mayo, and van Otterloo or more commonly known as GMO … In this episode, Trey discusses with Jeremy his thoughts on how the markets have materialized since they last spoke, they also dove deeper into his knowledge around climate change.” (We Study Billionaires)

Preventing cardiovascular disease and the risk of too much exercise, October 26, 2020. 2 hours, 9 minutes. I particularly recommend this discussion if you engage in intense cardiovascular workouts. “James O’Keefe is a preventative cardiologist and bestselling author of The Forever Young Diet and Lifestyle. In this episode, James discusses cardiac physiology and what makes the human heart susceptible to disease. He provides evidence for what supports his approach to exercise–elucidating both positive and negative kinds of exercise for heart health. He also discusses the role of nutrition, specific nutrients, and pharmacological interventions to support heart and brain longevity.” (Peter Attia)

Tweet of the Week

If you enjoyed reading the Weekly Digest, please click on the heart/like button and consider sharing this issue with your friends and colleagues. Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Thanks for the link! Enjoying your newsletter as well!

Great article