The Digest #126

Tom Murphy Interview From 2000, Apple's Ad Opportunity, Ruined by Crypto, Interviews of Nick Howley and Nassim Taleb

“Do you think that no one will suffer?”

The consumer price index increased by 9.1% over the past twelve months, according to the inflation report released by the BLS last week. Meanwhile, the BLS reports that real average hourly earnings declined by 3.6%. The increases in nominal wages we have read so much about were more than offset by the rising cost of living. Money illusion doesn’t work so well when inflation is running close to double digits.

There’s not much I have to add beyond what I wrote in Enduring Inflation last month other than to post this epic quote by Thomas Hoenig who retired as President of the Kansas City Fed in 2011:

“An entire economic system. Around a zero rate. Not only in the U.S. but globally. It’s massive. Now, think of the adjustment process to a new equilibrium at a higher rate. Do you think it’s costless? Do you think that no one will suffer? Do you think there won’t be winners and losers? No way. You have taken your economy and your economic system, and you’ve moved it to an artificially low zero rate. You’ve had people making investments on that basis, people not making investments on that basis, people speculating in new activities, people speculating on derivatives around that, and now you’re going to adjust it back? Well, good luck. It isn’t going to be costless.”

Mr. Hoenig’s story is told in The Lords of Easy Money by Christopher Leonard which I reviewed in January. I highly recommend this book to anyone who is under the impression that “no one could have seen this coming”.

Articles

Interview with Thomas Murphy, December 2000. This is a transcript of an interview of Thomas Murphy archived as part of the Harvard Business School Entrepreneurs Oral History Collection. I wish I had known about this transcript before I wrote Business Lessons from Tom Murphy earlier this year after he stepped down from Berkshire Hathaway’s board. Mr. Murphy died on May 25 at the age of 96 and the May 31 issue of the Weekly Digest included a number of links about his life.

Running the business as if he owned 100 percent of it: “Capital Cities had started with about $1 million to $1 1/2 million. And having gone through those rough first three years, I always ran the company, for better or for worse, as if I owned 100 percent of it. We really thought about our stockholders. We ran the company to do the best job for our stockholders. We never ran it to get big. We ran it, if we could, to get our stockholders rich. We weren’t exorbitant in taking options or in what we paid each other. We didn’t take ourselves too seriously.”

Computers, the internet, and television: “I think it’s a short matter of time before you won’t be able to tell the difference between your computer, the Internet, and your television set. I think that’s what will happen, though I’m not well enough equipped with knowledge about electronics to tell you when or how it’s going to happen.”

Going into the right business at the right time: “Looking back, I think I was in the right business at the right time. I was smart enough to stay in the businesses that made sense or were compatible with radio and television. First we went into the newspaper business, then we went into the cable business, and then we went into the network business. So I stayed in businesses I could understand, which were, by and large, not capital intensive and were advertiser supported. As a manager, I always put a premium on hiring the smartest people we could find, and not having any more people than we absolutely needed. Also, we’re not in a high-tech business, so I always went for brains more than I did for experience. By and large, it worked.”

A 2,000-bagger is a “pretty good” record! “People who became stockholders when Capital Cities went public got $2,000 for every dollar they put in. That’s 2,000 to 1. For the original stockholders, the gain was 10,000 to 1. Now, that’s a pretty good record.”

How Apple Could Build Out a $20 Billion Ad Business by Eric J. Savitz, July 14, 2022. On the internet, you are usually either the customer or you are the product. One of Apple’s major talking points has long been that it considers the privacy of customers to be sacrosanct. This makes proposals to monetize user data by selling advertisements very tricky. Four years ago, I moved all of my devices to the Apple ecosystem with privacy and security being the top motivating factors. I am skeptical that Apple can thread the needle here without sparking a customer backlash. (Barron’s)

Country Risk: A 2022 Mid-year Update! by Aswath Damodaran, July 13, 2022. This article discusses significant events that have taken place during the first half of the year that impact measures of country risk. The retreat of risk capital in general has impacted higher risk countries the most. In addition, Russia’s invasion of Ukraine and tumult in Sri Lanka and Pakistan have had major impacts. (Musings on Markets)

‘They couldn’t even scream any more. They were just sobbing’: the amateur investors ruined by the crypto crash by Sirin Kale, July 12, 2022. “When Taleb published his 2021 paper [critical of bitcoin], he received so much abuse that he had to lock his Twitter account. “I could not believe how psychopathic bitcoin people were,” says Taleb. Watching his tormentors have their portfolios wiped out has provoked a degree of schadenfreude, he admits. But he has compassion for the inexperienced investors who got swept up in the hype. “Lots of these kids lost everything they have,” he says. “You feel empathy for them.” The scammers, who urged others to invest in doomed projects while they were secretly cashing out? “They must be punished,” Taleb says.” (The Guardian)

The Things You Think Matter…Don’t by Ryan Holiday, July 13, 2022. “I dropped out of college. When this happened it was a big deal—to my parents anyway. Then it was a big deal when people met me because they were constantly surprised by it. You didn’t finish college?! But for all the warnings and then surprise, there has been literally zero times where my lack of a degree has come up in the course of any business deal or project.” (RyanHoliday.net)

Social Comparison Orientation and Its Correlates by Rob Henderson, July 10, 2022. What a terrible way to go through life! “The questionnaire contained items like: A. You have 2 weeks of vacation; others have 1 week. B. You have 4 weeks of vacation; others have 8 weeks. By now, you probably won’t be surprised to learn that people who are high on social comparison are more likely to choose option A. Social comparers prefer to make everyone else worse off, if it means they will obtain a relative advantage.” (Rob Henderson’s Newsletter)

Long Covid May Be Long Tail of Risk for Insurers by Telis Demos, July 11, 2022. Lingering effects of Covid infection are increasingly common and hard to define, causing unexpected losses. “We are seeing a modest amount of claims coming in from long Covid meet the definition of a long-term disability,” Christopher Swift, chief executive of Hartford Financial Services Group, told analysts on a call earlier this year, which “is dictating some of the pricing expectations that are changing” to cover some of that risk.” (WSJ)

The 6 Principles of Incentive Design by Sahil Bloom, July 13, 2022. “Incentives are a powerful and ubiquitous force. "Show me the incentive and I will show you the outcome" - Charlie Munger. Thoughtfully-designed incentives are likely to create wonderful outcomes. Poorly-designed incentives are likely to create terrible outcomes.” (The Curiosity Chronicle)

The Rational Walk is a reader-supported publication

To support my work and to receive all articles that I publish, including premium content, please consider a paid subscription. Thanks for reading!

Podcasts

TransDigm: Foundations with Nick Howley, July 14, 2022. 1 hour, 24 minutes. This is the first episode of a new podcast hosted by William Thorndike, author of The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success. “Since inception in 1993, TransDigm has returned over 1,750X its primary equity and a remarkably evenly distributed 36% IRR. In this discussion, we explore TransDigm’s foundations under private ownership, digging into its core value drivers, decentralized culture, differentiated compensation program, and early M&A motion.” (50x)

Related: Profile of TransDigm Group, April 29, 2016 (The Rational Walk)

Nassim Nicholas Taleb on the Nations, States, and Scale, July 11, 2022. 1 hour, 5 minutes. “A language, a flag, a national anthem and shared history—like a heart that has to pump harder to support a heavier body, the bigger a nation gets, the harder to curate an identity. Nassim Nicholas Taleb talks about scale and governance... Taleb sings the virtues of smaller relative to larger and decentralized as much as possible relative to centralized. Along the way, he provides a framework for Russia's war against Ukraine and explains why the United States has thrived despite its size and scope.” (EconTalk)

TaskRabbit: Leah Solivan, July 11, 2022. 1 hour, 18 minutes. “One snowy night in Boston, Leah Solivan ran out of dog food for her 100-pound yellow lab. She wondered: shouldn’t I be able to resupply Kobe without going to the store? That was the origin of TaskRabbit, an online errand service that matches users with “taskers” to do deliveries and other chores. When Leah left her IBM job to start coding the service, the peer-to-peer economy was still in its infancy. But she saw that three important developments—mobile, location services, and social media—were about to converge. She recruited errand-runners from Craigslist, and took an expensive gamble on a 15-minute meeting with Tim Ferriss to get advice and investors. After some management hiccups and a difficult rebranding, TaskRabbit sold to IKEA in 2017.” (How I Built This w/Guy Raz)

Creative Destruction

This is an incredible short video and might be surprising even for those of us who have been adults throughout this period and observed the tech landscape firsthand. For some reason, I did not recall how recently Yahoo! peaked and how rapidly it fell.

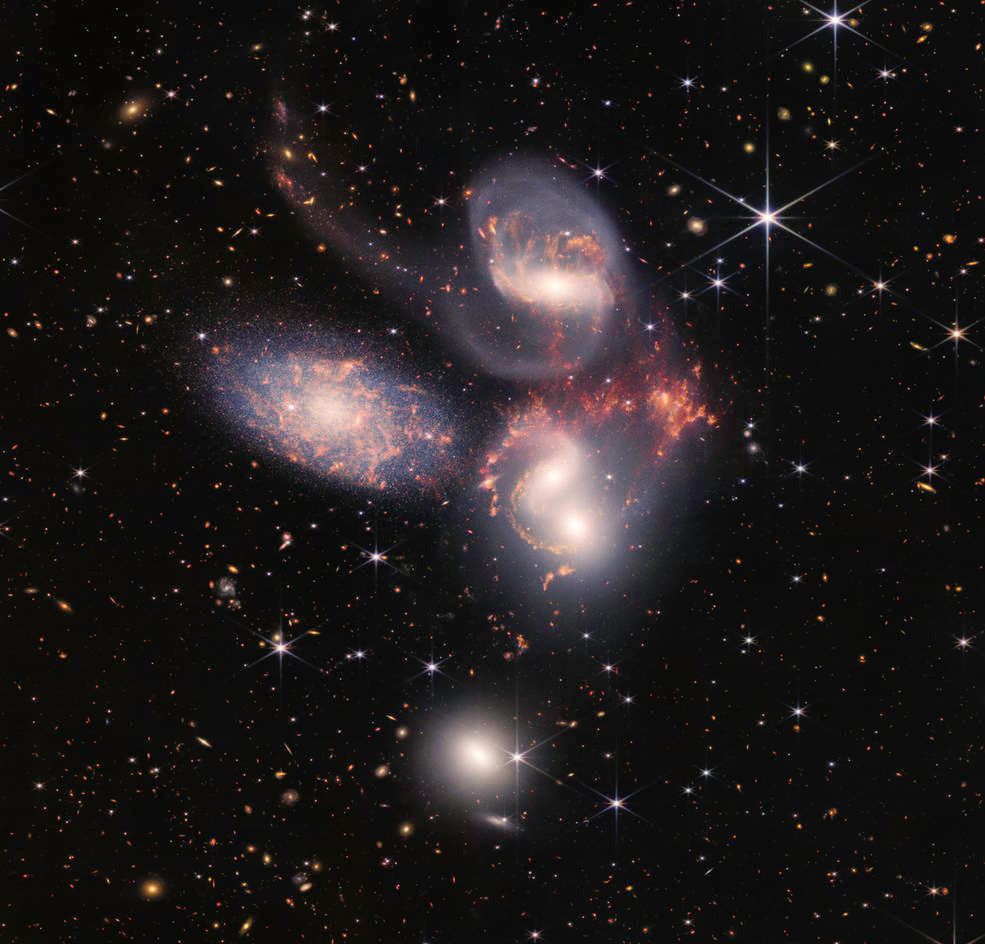

First Images from the James Webb Space Telescope

The images released by NASA this week are absolutely incredible.

“Today, we present humanity with a groundbreaking new view of the cosmos from the James Webb Space Telescope – a view the world has never seen before,” said NASA Administrator Bill Nelson. “These images, including the deepest infrared view of our universe that has ever been taken, show us how Webb will help to uncover the answers to questions we don’t even yet know to ask; questions that will help us better understand our universe and humanity’s place within it.”

If you enjoyed reading the Weekly Digest, please click on the heart/like button and consider sharing this issue with your friends and colleagues. Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.