The Digest #146

The Buffalo News, Powell's High Stakes Mission, Longevity, Unsolicited Advice, Disneyland, Paul Graham on Reading, Keith Creel, Howard Marks

The Buffalo News

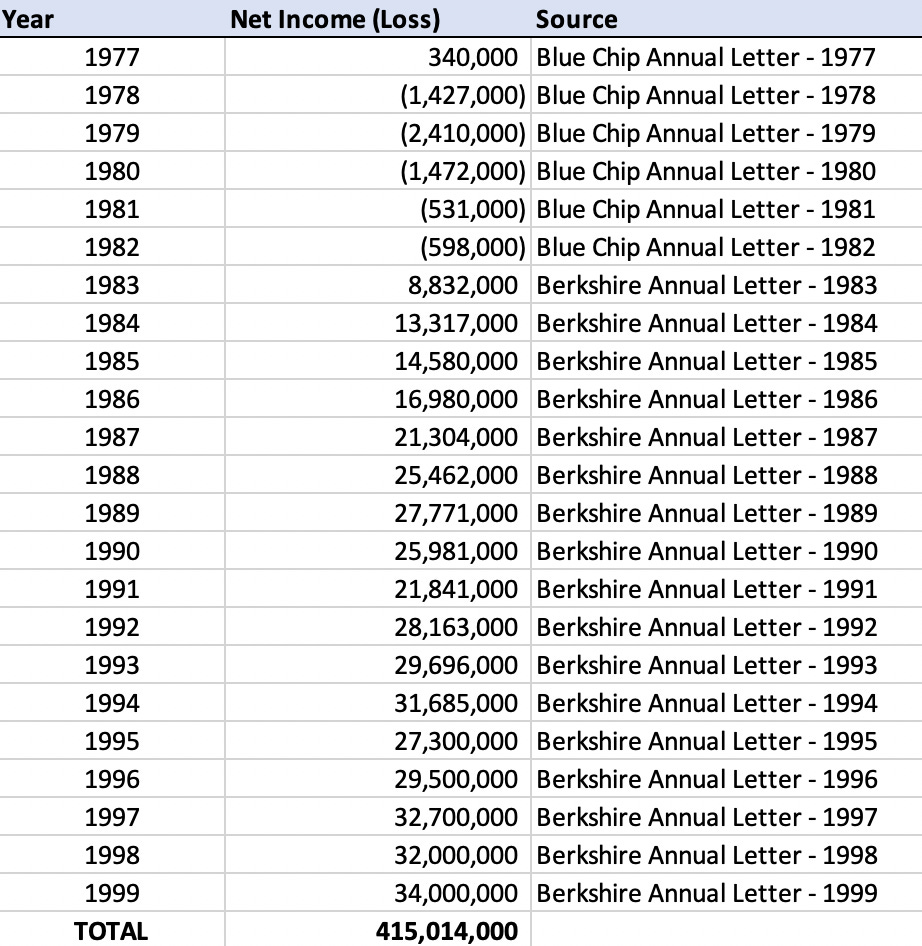

In 1977, Blue Chip Stamps purchased the Buffalo News for $35.5 million. Berkshire Hathaway held a majority stake in Blue Chip and Charlie Munger was Chairman.

The story of The Buffalo News turned out to be a happy one in the end, but the process of getting there was anything but pleasant. After many years of trouble, the newspaper was beginning to turn around when Charlie Munger wrote his 1982 letter to shareholders of Blue Chip. However, rather than congratulating himself for the turnaround, Mr. Munger urged Blue Chip shareholders to hold him accountable for making a poor decision five years earlier:

“Finally, our shareholders should recognize that if our 1977 purchase of the News has now worked out acceptably from their viewpoint, which contrary to our prediction last year may now be true even after taking into account time delays, the conclusion does not follow that we made a sound managerial decision buying the News when we did for the price we paid. In retrospect, we were strongly influenced because we liked the newspaper, its people and the city, and we may simply have gambled shareholders’ money against the odds and won. Our stewardship may have been, at best, dubious in this instance. We know that the financial outcome we now report could with slightly different breaks just as well have been either (1) a large loss on closure of the News or (2) the expectation of much more money-losing in continued operation, as part of the only defensive strategy with reasonable prospects.”

Berkshire Hathaway and Blue Chip Stamps merged in 1983 and the 1982 letter to Blue Chip shareholders turned out to be the last one. The turnaround at the Buffalo News ended up being better than anyone could have hoped for at the time, as the following table with results through 1999 clearly demonstrates:

The story of The Buffalo News is fascinating and best approached by reading The Buffalo News: From Butler to Buffett by Murray Light. I wrote a review of the book a couple of years ago and also included information from a great compilation of Blue Chip Stamps shareholder letters published by Max Olson.

Perhaps out of a sense of nostalgia, Warren Buffett made an attempt to get into the local newspaper business during the early 2010s. This did not work out well, as I discuss in the book review. In January 2020, Berkshire’s newspaper operations were sold to Lee Enterprises. It is one of the few cases where Berkshire Hathaway’s aspiration to permanently hold its acquisitions did not work out.

Read my book review of From Butler to Buffett on The Rational Walk

The Rational Walk is a reader-supported publication

To support my work and to receive all articles that I publish, including premium content, please consider a paid subscription. Thanks for reading!

Articles

Fed Chair Jerome Powell is on a high-stakes mission to tame inflation by Christopher Leonard, November 29, 2022. The Federal Reserve gets mostly adulatory media coverage, so I’m sharing this article written from a more skeptical perspective. Leonard is the author of The Lords of Easy Money which I reviewed early this year. The Fed will soon enter the “quiet period” that precedes the FOMC meeting on December 13 and 14. The consensus appears to expect a 50 basis point rate hike. (Fortune)

What to Know About RMDs and Retirement Planning by Glenn Ruffenach, November 27, 2022. Adopting a coherent strategy for required minimum distributions (RMDs) from retirement accounts can be a multi-decade process that should begin long before retirement. Otherwise, there’s a risk of realizing taxable income that not only pushes the retiree into higher tax brackets but also impacts Medicare premiums. This article does a good job of covering the complexity. (WSJ)

Inside the billion-dollar meeting for the mega-rich who want to live forever by Jessica Hamzelou, November 16, 2022. I have always regarded the idea of extreme longevity with skepticism, and not just because I doubt those who claim this is possible. Accepting the briefness of life allows us to focus on making the most of the time we have. Thinking that we might have 120 or more years of life could lead to a lack of urgency. However, I wouldn’t turn down 120 years of healthy life if it was offered to me … This is an interesting read. (MIT Technology Review) h/t The Profile.

The CEO In Search Of The Fountain Of Youth… For Dogs, December 1, 2022. 43 minutes. This is an interesting interview of Celine Halioua, the CEO of Loyal, a biotech startup with a mission to extend the lifespan of dogs. The research could apply to humans as well. (The Problem with Jon Stewart)

Getting Wealthy vs. Staying Wealthy by Morgan Housel, November 28, 2022. This is an excerpt from The Psychology of Money, one of the best books on personal finance that I often recommend to readers, friends, and family. You can read more about the book in the review I wrote shortly after it was published in 2020. (Collaborative Fund)

Some Unsolicited Advice on Unsolicited Advice by Rob Henderson, November 27, 2022. It’s too bad that this article was published a few days after Thanksgiving, a day that often includes much unsolicited advice. The truth is that offering advice without being asked is almost always a terrible idea. It sets up a power dynamic that is usually dysfunctional and can damage relationships. (Rob Henderson’s Newsletter)

Disneyland by David Perell, November 28, 2022. Some interesting thoughts on Disneyland: “The story of Disneyland is the story of care. Walt’s obsession with detail was a bet on our humanity. People can sense care, even if they can’t always put words to the experience, or model it on a spreadsheet. At a time when amusement parks referred to their visitors as ‘marks,’ Walt insisted on creating a hospitality business and calling visitors ‘guests’. Instead of thinking like a financier, he thought like a hotelier.” (Monday Musings)

The Need to Read by Paul Graham, November 2022. Paul Graham makes the point that you can’t think well without writing well, and you can’t write well without reading well. “A good writer doesn't just think, and then write down what he thought, as a sort of transcript. A good writer will almost always discover new things in the process of writing. And there is, as far as I know, no substitute for this kind of discovery. Talking about your ideas with other people is a good way to develop them. But even after doing this, you'll find you still discover new things when you sit down to write. There is a kind of thinking that can only be done by writing.” (PaulGraham.com)

Podcasts

Keith Creel: Lessons from Life on the Railroad, November 29, 2022. 1 hour, 22 minutes. Keith Creel is CEO of Canadian Pacific Railway and a protégé of the late Hunter Harrison who was the architect of precision scheduled railroading, an approach to railroading that has transformed the industry in recent decades. Creel discusses his relationship with Harrison among many other topics. I was particularly interested in the discussion toward the end regarding the battle between Canadian National and Canadian Pacific for Kansas City Southern. (The Knowledge Project)

Railroader: The Unfiltered Genius and Controversy of Four-Time CEO Hunter Harrison, September 20, 2022. Hunter Harrison was quite a character. I read his biography as part of my railroad industry research earlier this year which was the basis for the BNSF and Union Pacific business profiles. (Rational Reflections)

Brookfield Asset Management, November 25, 2022. 55 minutes. Brookfield is a Canadian company run by longtime CEO Bruce Flatt, a man who is often compared to Warren Buffett. Brookfield is a complicated company so I was skeptical that a podcast lasting under an hour could adequately describe it. However, the discussion was a good introduction to Brookfield’s many complex moving parts. (Business Breakdowns)

What I Learned Before I Sold to Warren Buffett, November 29, 2022. 1 hour, 6 minutes. Barnett Helzberg happened to see Warren Buffett on the street in New York City in 1994. Helzberg saw an opportunity and pitched Buffett on buying his family’s 79-year-old jewelry business. Berkshire Hathaway ended up buying the business. This crazy story of serendipity seems almost unbelievable! (Founders Podcast)

Book Review of What I Learned Before I Sold to Warren Buffett, January 19, 2011. Helzberg’s three “magic questions” for customers are: “What do you like that we are doing? What do you not like that we are doing? What are we not doing that you would like?” (The Rational Walk)

Howard Marks, November 23, 2022. 51 minutes. “Where are we in the market cycle? Legendary investor Howard Marks, co-founder and co-chairman of Oaktree Capital Management, shares his observations and discusses where the 'pendulum' may be heading in this interview with Alex Steger and Alex Rosenberg. Recorded live in San Francisco on November 17th.” (Citywire: Mistakes Were Made)

Twitter Threads

Jason Zweig has published a list of books that would make great gifts for investors:

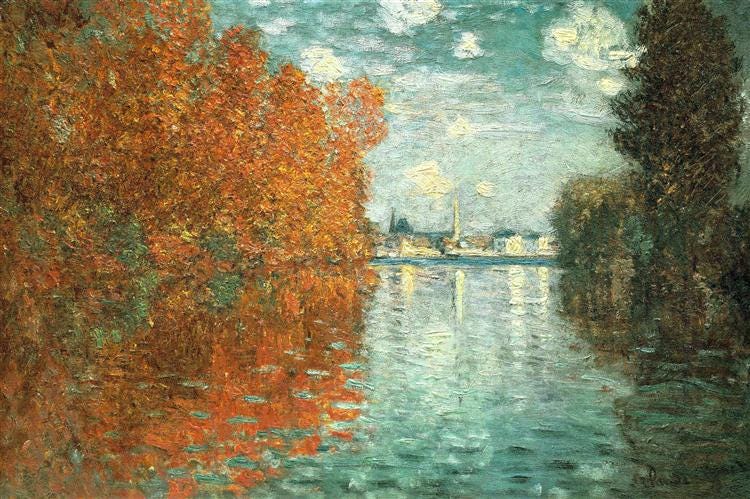

Autumn Effect at Argenteuil

From The Courtauld Institute of Art:

“Claude Monet lived in Argenteuil, a suburb of Paris, from 1871 to 1878. It was an affordable alternative to the capital, easily accessible by the new railroads. As a formerly rural town undergoing rapid industrial change, it also offered him a uniquely modern landscape. He painted this view of the river Seine and the town from his specially designed studio boat, moored on a quiet side channel. Although parts of Argenteuil’s townscape can be recognised in the background, the real subjects of this work are the flamboyant autumn colours and the effect of light and wind on water. The fluttering orange leaves contrast with the blue water, rendered as thick parallel lines. Monet added texture to the trees by scratching into the paint with the handle of his brush.”

If you found this Weekly Digest interesting, please click on the ❤️️ button and consider sharing this issue with your friends and colleagues.

Thanks for reading!

Copyright and Disclaimer

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Thanks for sharing that podcast about BAM! Very helpful.