The Role of TIPS in a Fixed Income Portfolio

Treasury Inflation Protected Securities offer the potential for a positive inflation-adjusted return if used appropriately.

The past fifteen years have been challenging for investors seeking a positive inflation-adjusted rate of return on safe fixed maturity investments. For most of this period, interest rates have been unusually low and there were few options for investors looking for both a positive real rate of return and safety of principal. Many investors shifted their asset allocation toward dividend paying stocks or invested in bonds that offered higher yields in exchange for greater risk of default. It is fair to say that conservative investors faced an expensive and unappetizing menu.

Dividend paying stocks can be intelligent investments, but there is no contractual right to dividends on common stocks. One can easily identify and invest in companies that have paid rising dividends over many decades. Most companies with such records will try hard to maintain the dividend, sometimes even making questionable overall capital allocation decisions to do so. Ultimately, dividend paying stocks cannot be considered a perfect, or even a close, substitute for bonds.

Investors sticking with bonds for their income needs must be aware of the risks of fixed maturity investments, a topic that I discussed in detail last month. Additional yield can usually be obtained by purchasing longer term bonds, but this comes at the cost of accepting the risk of a decline in the bond’s price if interest rates increase and the bond is sold prior to maturity. Real purchasing power can also be lost to inflation.

Bonds issued by riskier companies can offer greater returns which, unlike dividends, are backed by contractual terms. However, defaults can occur and the investor in a riskier bond could end up owning equity in a restructured company or, in more extreme cases, losing the entire investment. In my opinion, investing in such bonds requires analysis that is almost identical to evaluating the company’s common stock. The investor must understand the business and his place in the capital structure.

Several years ago, I wrote about bond ladders and compared the strategy to a “financial flu shot”. As the article explains, a bond ladder is a way of constructing a fixed income portfolio that will generate cash flow to match an investor’s needs. The article used an example of an investor who requires $40,000 of cash per year and purchased investments in that amount timed to mature over the following five years.

Why did I compare a bond ladder to a “flu shot”? The answer has to do with investor psychology. I prefer to attempt to build wealth with investments in common stocks and allocate the vast majority of my portfolio accordingly. However, common stocks are notoriously volatile. The reason I was able to stay sane during the bear markets of 2008-2009 and early 2020 is because I knew that I had absolutely no need to sell my stocks anytime soon. This was only possible because I have always maintained an allocation to ultra-safe investments in the form of cash and treasury securities. This psychological ballast is why I compare a bond ladder to an immunization.

Did I take my own advice and maintain a bond ladder after writing the article in late 2017? I intended to do so, but interest rates soon dropped back to extremely low levels. The real rate offered on five year Treasury Inflation Protected Securities went into negative territory. I could not justify moving out on the yield curve beyond six month treasury bills. After the Fed cut rates to zero at the onset of the pandemic in early 2020, I sought refuge in some higher yielding FDIC insured bank accounts.

In late 2020, I pointed out that United States Savings Bonds offered attractive yields. Over the past two years, I Bonds turned out to be a good way to obtain some protection from inflation by owning a very secure asset. However, at the time of my article, the real return on I Bonds was 0%, so the only return was the CPI adjustment. The real return was eventually increased but still stands at a modest 0.4%.

In recent months, Treasury Inflation Protected Securities (TIPS) have offered returns that compare favorably to I Bonds. Unlike I Bonds, TIPS are marketable securities that are purchased either at a Treasury auction or on the secondary market. TIPS can fluctuate in price prior to maturity and, when held in a taxable account, produce taxable “phantom interest” representing the inflation adjustment that is added to the principal of the bond but is not actually received by the investor until the bond matures. TreasuryDirect provides a useful comparison between I Bonds and TIPS.

The following exhibit shows recent real rates of TIPS of various maturities. The real rate fluctuates on a daily basis as the TIPS are traded in the secondary market:

As we can see, the real rate on the five year TIPS was recently 1.36%. Extending the maturity out to seven or ten years does not result in additional yield, while going out to twenty or thirty years only results in a modest incremental yield.

In my “flu shot” article, I suggest using five year TIPS as the vehicle for building up a bond ladder over time. The idea is that, once such a ladder is constructed, the investor only needs to take one action every year by purchasing a new five year TIPS at a Treasury auction to replace the five year TIPS that matures and provides the desired cash flow. The investor would obtain the funds required to purchase the five year TIPS by liquidating other investments, likely equity securities, but this can be done without the pressure of being a forced seller who needs to fund current consumption. If stocks are deep in a bear market, the investor can always choose to defer purchasing a new TIPS temporarily. There is no need to be a forced seller.

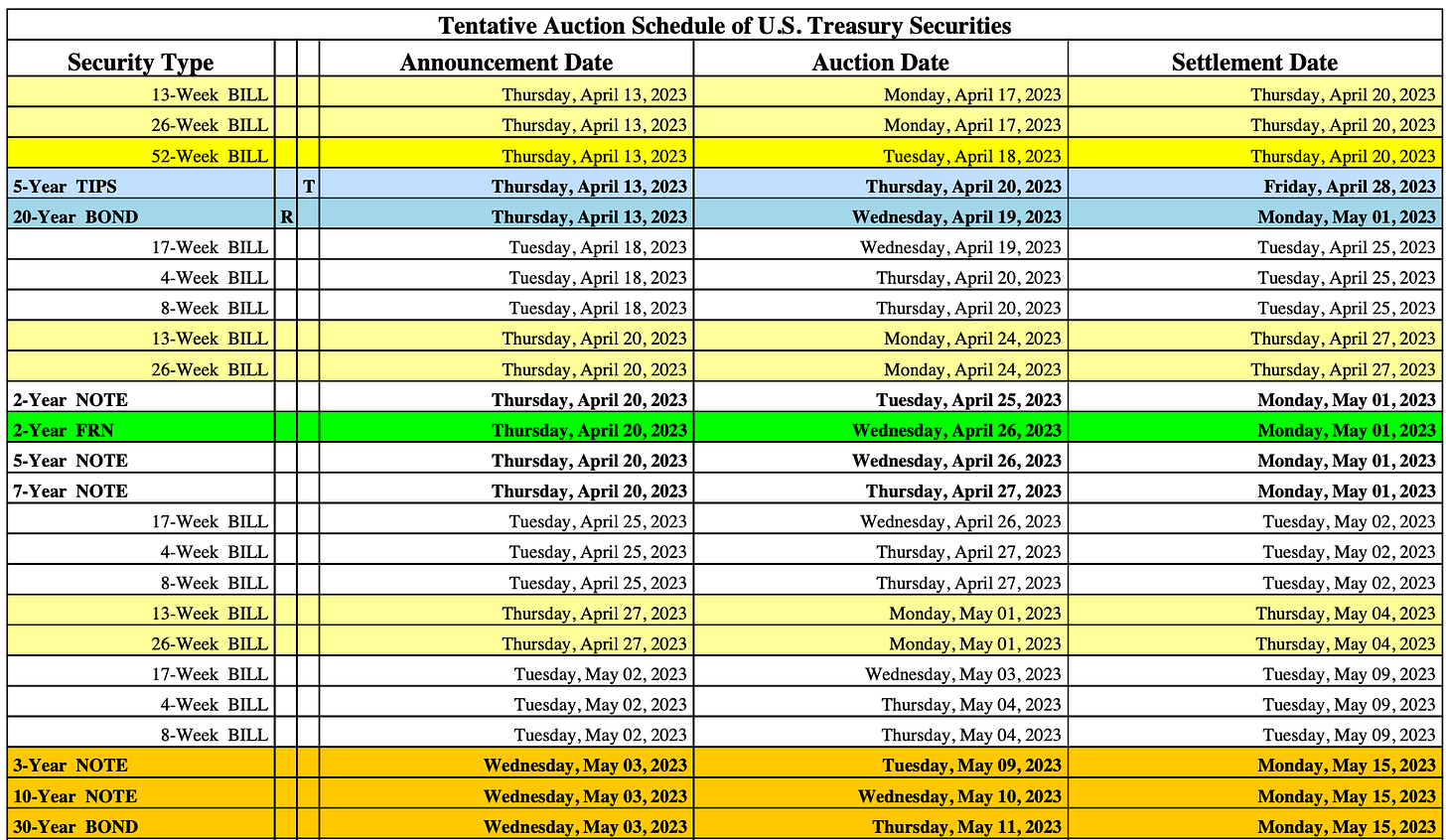

Although TIPS can be purchased on the secondary market (that is, from another investor), it generally better to purchase the security directly from the government at auction. The Treasury publishes an auction schedule on a regular basis. A portion of the current schedule appears below:

As we can see, there is an auction for a five year TIPS on Thursday, April 20. The Treasury provides further information regarding the terms of the security, a portion of which is displayed below:

Since this is a marketable security, the interest rate will be determined at auction but, typically, the rate will not be dramatically different from one day to the next unless there are major market dislocations (such as the bank failures last month which caused significant volatility in interest rates).

I would recommend reading TreasuryDirect’s comparison of TIPS and I Bonds carefully before deciding to buy TIPS, especially the information related to tax consequences if the bond is being purchased in a taxable account. I would emphasize the fact that TIPS are marketable securities and, if sold prior to maturity, might result in a loss. If real interest rates increase, the bond price will decline just like any other fixed maturity investment. In contrast, one cannot lose principal on an I Bond, although it is not possible to sell an I Bond for one year after purchase. TIPS can be sold at any time on the secondary market.

I Bonds can only be purchased using TreasuryDirect. TIPS can be purchased using TreasuryDirect as well as through most brokerage firms. I personally prefer to purchase Treasury securities at auction from a brokerage firm. Both Fidelity and Vanguard charge no fees for buying these securities at auction and you receive the same terms as you would when using TreasuryDirect. In addition to offering a more user friendly website, holding the security at a brokerage provides the option of selling it prior to maturity if absolutely needed. TreasuryDirect does not permit sales and it is complicated to transfer securities from TreasuryDirect to a brokerage.

It is possible that the real interest rate on I Bonds will increase from 0.4% to something a bit closer to the real rate on the five year TIPS. The I Bond rate will reset on May 1. However, I suspect that any increase in the I Bond real rate will be modest and will not approach the current rate on the five year TIPS. Furthermore, the $10,000 annual limit on I Bond purchases is an important limitation to consider. There is no limit to the amount of TIPS an investor can own, although there is a $10 million limit for noncompetitive bids via TreasuryDirect.

Should you build a bond ladder and, if so, use TIPS? That is a question that each investor must answer based on his or her financial situation.

In my opinion, a bond ladder using TIPS makes sense for a retiree or anyone counting on cash flow from an investment portfolio. While the inflation protection is far from perfect, having an option to put aside funds today that are at least somewhat protected from the ravages of inflation over the next five years seems like a good hedge. This is ballast for a portfolio that will never make you rich but might provide peace of mind and the fortitude to view price fluctuations in stocks with equanimity.

Further Reading:

The Financial Flu Shot: Using Bond Ladders, December 27, 2017 (The Rational Walk)

The Case for U.S. Savings Bonds, December 23, 2020 (The Rational Walk)

Earnings a Risk Free 7% Return in I Bonds, November 2, 2021 (The Rational Walk)

The Risks of Investing in Bonds, March 15, 2023 (The Rational Walk)

Comparison of TIPS and Series I Savings Bonds (Treasury Direct)

Upcoming Treasury Auctions (Treasury Direct)

Tentative Auction Schedule of U.S. Treasury Securities (United States Treasury)

If you found this article interesting, please click on the ❤️️ button and consider sharing this issue with your friends and colleagues or on social media.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Been thinking this way myself lately. Considering rolling some of my t-bills into longer dated tips.

Not selling my iBonds just yet. But the penalty may be worth it to get the better real rate available from tips.

This was great. Thank you!