The Financial Flu Shot: Using Bond Ladders

Avoiding panic requires having sufficient resources to ride out storms

Take a moment to log into your investment account and write down the balance.

In late 2017, you probably feel pretty good about it if you have diligently saved over the years and participated in the long bull market that has propelled financial assets upward since the end of the 2008-09 financial crisis.

Now take the balance and divide it by two. Actually write it down on a piece of paper. Suppose that a year from now, this will be the new value of your portfolio. How do you feel now?

For nearly everyone, the answer is obvious. You will probably feel rotten and suffer from a sense of loss and regret. Why didn’t you see it coming and take actions to prevent the damage! These are natural gut-level reactions to a sudden shock.

But are you in a state of panic as well?

Individuals will react differently to market fluctuations and it is impossible to predict how someone will react until faced with adversity. Establishing a portfolio “on paper” and pretending that it has declined is completely useless when it comes to understanding your own psychology. Even reading about psychology is not adequate preparation. Some things must be directly experienced to be understood.

Know Yourself

For those of us who have experienced financial market declines, it is possible to have a direct understanding of how we would react to a severe correction in security prices. The most recent period of sustained declines was, of course, the 2008-09 financial crisis. To say that this period was stressful would be an understatement but two factors kept me from descending into a state of panic and “selling everything” at depressed prices. First and most importantly, I had a significant reserve of cash and would not be in a position to need to sell securities in order to fund expenses for several years. Second, as a full time investor, I was excited about the opportunity to deploy funds in stocks that were trading at very depressed valuations. I also understood what I owned and had a sense of the value of these businesses independent from momentary changes in stock prices.

The situation would have been far different if I had been in the position of needing to liquidate stocks in order to fund expenses the next month. In such a situation, anyone would probably go into a state of panic and sell at any price in order to ensure that enough money was available to pay the ongoing expenses of daily life including housing, food, utilities, and so on.

For those of us who rely on investment returns to fund ongoing expenses, it is vital for our mental and financial health to have a strategy in place that does not subject the need for ongoing cash flow to the vagaries of short term financial market fluctuations. This article covers strategies that will help to ensure adequate cash flow and prevent panic in the event of a financial market meltdown.

The Three Percent Rule

Let’s take a step back and consider how much of a portfolio can be safely tapped for income each year. In a previous article, I outlined a number of concepts related to financial independence and suggested that one should be very conservative when drawing down a portfolio in today’s environment. For many years, it was conventional wisdom that one could withdraw about four percent of a portfolio’s value and be confident in not running out of money. However, this advice was formulated at a time when interest rates were at higher levels and it was easy to purchase high quality bonds with nominal yields in the mid-single digits. With the ten year treasury note yielding around 2.5 percent as of December 2017 and the Federal Reserve dead set on devaluing the U.S. dollar by 2 percent per year, there are scant returns to be found in the safest investment choices. In addition, stock valuations are historically high as one can see from the Shiller PE ratio in the chart below:

No one can accurately predict stock prices or interest rates over the next year, despite the many charlatans who claim to be able to do so. However, it is quite apparent that today’s environment is one in which caution should be exercised especially when it comes to decisions that could prematurely deplete an investment portfolio. For this reason, I would be hesitant to deplete a portfolio by four percent per year. Even three percent might be considered a little too aggressive but by choosing a withdrawal rate that is far too low, it is possible that you may not enjoy the fruits of your work and savings sufficiently. Running out of money is a major risk but so is living so far below your means that you forego things that you want to do for no good reason.

The Financial Flu Shot

The question of how to construct your portfolio during retirement is important but can be complex. The proportion of assets invested in various asset classes, such as stocks, bonds, and real estate, will drive the majority of returns for most investors. The decision regarding whether one should invest in broad based index funds, in funds run by managers seeking better than average returns, or through direct investment in securities will also have a major impact on results.

Rather than discussing overall investment strategies for retirement, I would like to emphasize the need to “immunize” yourself against the psychological perils associated with fluctuating financial markets. The price of longer term financial assets, such as stocks and longer term bonds, can move around a great deal in short periods of time. It can be more than mildly disconcerting for most people to watch these types of fluctuations. More accurately, people do not mind upward fluctuations in price but become concerned and can even panic when fluctuations are negative, as they inevitably will be from time to time.

What is needed is the equivalent of a financial flu shot. Like an annual shot to help prevent influenza, a financial flu shot may not be 100 percent effective but can go a long way toward limiting risk.

Essentially, a financial flu shot requires an investor to ensure that a significant amount of money is held in assets not subject to significant market price fluctuations.

These funds will likely earn only small returns but will prevent the individual from entering a state of panic if his or her other assets decline in price. Some people may panic anyway and act irrationally, such as selling all stocks after a steep market decline, but for most people, having a significant amount of solid assets that do not fluctuate greatly in price will have a calming effect.

Using Bond Ladders

Over long periods of time, investing in high quality businesses via the stock market will almost always exceed returns available from investing in high quality bonds. However, in the short run, bonds are a more reliable option for those seeking regular income. A “bond ladder” involves purchasing bonds at maturity dates that coincide with a need for funds. In the context of retirement, an individual might decide to establish a ladder consisting of equal amounts maturing 1, 2, 3, 4, and 5 years from now. This five year ladder will ensure that funds are available when they are needed, assuming of course that the bond issuer does not default. The risk of default can be effectively eliminated by using only United States Treasury obligations.

Let’s say that an individual requires $40,000 per year in cash flow to consider herself financially independent and has accumulated a portfolio of $1,350,000. This implies a withdrawal rate of just under 3 percent (40,000/1,350,000). Establishing a five year bond ladder would involve buying bonds with the following maturity profile:

This also assumes that approximately $40,000 in cash is available to fund expenses between now and the maturity of the first bond a year from now, in January 2019. By having this portfolio of bonds that are solely dedicated to funding expenses for the following year, there is no rational reason to panic if longer term assets, such as stocks, suffer a major decline. One can rest easy knowing that funds will be available in due course to pay for ongoing expenses for up to half a decade.

Of course, holding $40,000 in cash plus $200,000 in the bond ladder comes at a cost. These funds are no longer available for longer term growth and will likely earn very low returns. But is this a major problem? In the context of a $1,350,000 portfolio, holding $240,000 in low return assets is less than 18 percent of the overall portfolio. This leaves 82 percent to be invested in assets that could potentially earn higher returns over the long run, although at the risk of potentially suffering short term declines in value.

A bond ladder is easy to maintain over time. The only task is that every year a new five year bond must be purchased to replace the one that is maturing. In January 2019, a bond will mature and will be used to fund ongoing cash expenses in 2019. However, if a new bond is not purchased, what is now a five year bond ladder will become a four year ladder. The fifth year of the ladder must be replenished by purchasing a new five year bond. Unless security prices are massively depressed (such as in early 2009), the task is to simply liquidate $40,000 worth of securities and purchase a new five year bond. However, the individual does not need to do so immediately if markets are in the midst of a panic driven sell off. In such a case, it would be acceptable to simply wait because there are still four years of cash expenses available in the ladder. Obviously, this cannot be taken too far because eventually the four year ladder will shrink to three, then two, and then one year if it is never replenished but the point is that a five year ladder leaves quite a bit of room for intelligent action if markets have declined temporarily.

Selecting Bonds for the Ladder

Assuming that the concept of a five year bond ladder makes sense, the next question is what bonds to select for the ladder. My view is that this part of an investor’s portfolio should not attempt to do anything heroic in terms of squeezing out a small amount of additional returns. Safety should be paramount and that means using United States Treasury securities to build the ladder. Despite occasional reports of government shutdowns and potential debt defaults, the reality is that the federal government is not going to default on its debt. The U.S. dollar is a fiat currency that also serves as the world’s most important reserve currency. A sovereign state that controls the supply of its own currency is not likely to default on its debt, although inflation could very well be a concern. For our purposes, we can consider treasury obligations to be “risk free” in terms of risk of default.

Treasury Notes

The next question involves what type of U.S. Treasury obligations to use for the ladder. The most straight forward option involves using treasury notes. The U.S. Treasury holds weekly auctions for a variety of treasury bills, notes, and bonds. These instruments can be purchased by anyone at auction either through Treasury Direct or any discount or full service brokerage. Using Treasury Direct is free of charge and could be a good option for many people. However, large brokerages such as Fidelity and Vanguard offer clients the ability to participate in treasury auctions at no charge. For those who have existing brokerage accounts, it is worth checking whether it is possible to purchase treasuries at auction with no commissions. Although the design of a bond ladder assumes that bonds will be held to maturity, the ability to easily sell bonds through a brokerage is a distinct advantage. Treasury Direct no longer facilitates the sale of treasuries.

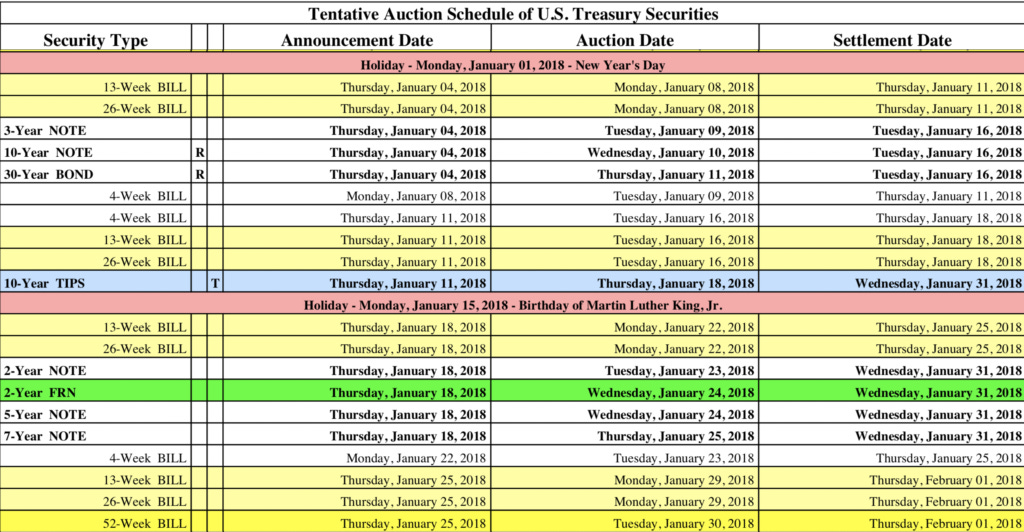

The Treasury publishes a listing of upcoming auctions. Let’s take a look at the auctions that are coming up for the month of January 2018:

From this schedule, we can see that it is possible to purchase the following securities for four of the steps of the ladder:

Purchase $40,000 of the 52 week Treasury Bill at auction on January 30.

Purchase $40,000 of the 2 year Treasury Note at auction on January 23.

Purchase $40,000 of the 3 year Treasury Note at auction on January 9.

Purchase $40,000 of the 5 year Treasury Note at auction on January 24.

We are missing a four year note because the Treasury does not directly offer four year notes. However, one can easily purchase a Treasury Note with four years left until maturity by purchasing in the secondary market (that is, from another investor). Treasury notes are extremely liquid securities and there is a large secondary market.

What are the yields one can expect by investing in this ladder? The Treasury publishes what is known as a “yield curve” at the close of trading every day. The exhibit below shows the yield for various maturities over the course of December 2017:

If rates are approximately the same as they are today when the securities in the ladder are purchased in January, one can expect to earn from 1.75 percent on the 52 week Treasury Bill to 2.25 percent on the five year Treasury Note. During normal conditions, the longer a bond’s maturity, the greater the yield will be. In today’s low rate environment, these yields will barely cover expected annual inflation. The Federal Reserve has a stated goal to devalue the U.S. dollar by 2 percent annually. If we’re very lucky, the pre-tax yield from the bond ladder will just cover inflation.

A few words on mechanics: Treasury bills are purchased at a discount to par value of 100. If current rates hold, the $40,000 52 week bill will cost the investor around $39,300 when it is purchased at auction. It will mature one year later at $40,000 with the $700 difference representing the interest. The 2, 3, 4, and 5 year Treasury Notes pay interest semi-annually. Taking the three year note as an example, one would pay close to $40,000 at the auction and receive payment of approximately $400 twice a year. Note that these funds should not be spent but kept in cash or a short term Treasury Bill since the funds barely make up for inflation. The $40,000 drawdown in Year 5 will really need to be somewhat more than $44,000 in 2023 dollars if the Federal Reserve keeps its promise to devalue the currency by 2 percent annually.

Treasury Inflation Protected Securities

The U.S. Treasury has been offering Treasury Inflation Protected Securities (TIPS) for over two decades. The purpose of these securities is to generate a “real return” – that is, a return in excess of whatever inflation proves to be over the term of the security. However, do not get too excited. The real yields are very small as shown in the real yield curve table below:

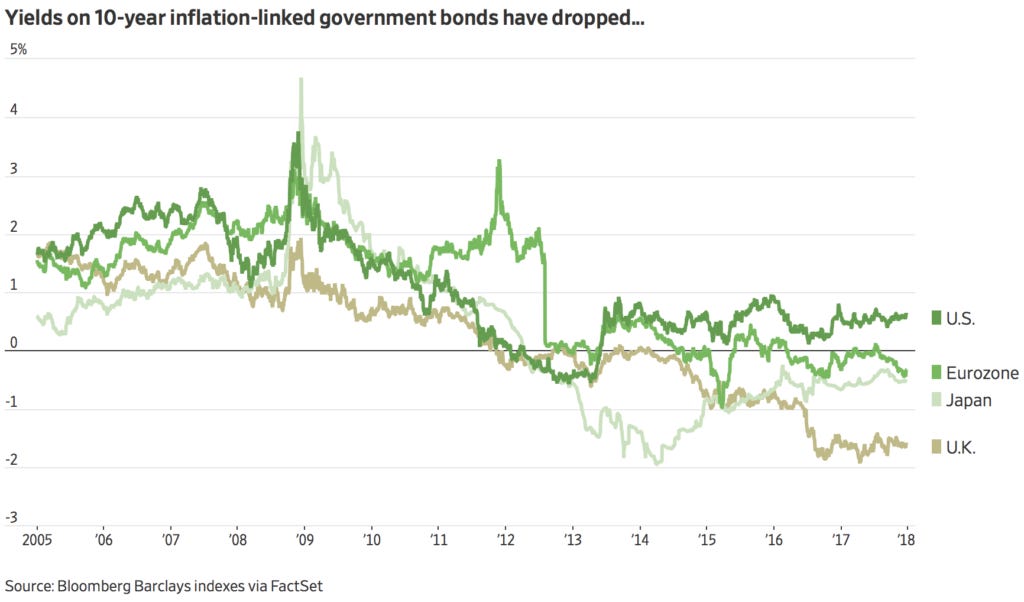

We can see that the real yields range from just under 0.5 percent all the way up to a whopping 0.83 percent. Real yields have been depressed in recent years, as The Wall Street Journal noted in a recent article. Before the financial crisis, real yields on longer term TIPS were often in the 2 percent range. On the bright side, at least real yields are in positive territory again after dipping below 0 percent earlier this decade. The chart below, from the Wall Street Journal’s article, shows how low real yields are today:

The mechanics of building a bond ladder using TIPS is slightly more complicated than using regular Treasury Notes because the shortest term TIPS is five years. One can build a TIPS ladder in the secondary market (buying from other investors) at any time or slowly over time by using regular Treasury Notes initially but purchasing a 5 year TIPS at auction every subsequent year. Eventually this will result in TIPS with remaining maturity of 1, 2, 3, 4, and 5 years but it will take four years to get there.

The mechanics of TIPS work differently from regular Treasury Notes. The U.S. Treasury’s full explanation is required reading for anyone seriously considering these securities. The short version is that returns from TIPS are provided in two “buckets”. First, one receives interest payments based on the “real” yield – these are the yields shown in the table above. Second, the value of the TIPS principal is adjusted periodically based on fluctuations in inflation.

When the note matures, you will receive the principal adjusted for reported inflation. One catch is that investors holding TIPS in taxable accounts must pay annual income taxes on both the actual cash received from interest payments and increases in the value of the TIPS due to inflation. In other words, you will be required to pay tax on cash that you will not see until the TIPS actually matures. This is probably only a minor annoyance for most investors and a non-issue for those holding TIPS inside a tax deferred account such as an IRA.

Regular Treasury Notes vs TIPS

Should you use regular Treasury Notes or TIPS to form your bond ladder? The question boils down to inflation expectations. Ignoring tax issues, if you purchase a five year TIPS with a real yield of 0.5 percent instead of a regular 5 year Treasury Note yielding 2.25 percent, you are implicitly saying that you expect inflation to exceed 1.75 percent. If inflation stays below 1.75 percent over the next five years, you would have done better by purchasing a regular Treasury Note. If inflation exceeds 1.75 percent, the TIPS will be the better choice. Remember that the Federal Reserve has a stated goal of causing inflation of 2 percent annually. Clearly the market does not believe that the Fed will achieve this goal, but remember that the Fed directly controls short term interest rates and the money supply. “If there’s a will, there’s a way” comes to mind.

My view is that taking the inflation protection offered by TIPS is worth the slightly more difficult process of building a five year bond ladder and dealing with the tax quirks. Remember that the goal of the bond ladder is to supply yourself with cash for ongoing expenses for the next five years. What you should care about is purchasing power. As long as the TIPS offer some real yield (above 0 percent), at least in theory the $40,000 our fictional investor puts into a 5 year TIPS today should hold its purchasing power when the note matures in 2023. There are all sorts of reasons to doubt official inflation statistics, but that’s beyond the scope of this article and there isn’t much an investor building a bond ladder can do about it. If you insist on total safety, you simply have to choose between Treasury Notes and TIPS.

Price Fluctuations

Treasury Notes are not immune from price fluctuations but these should be steadfastly ignored by an investor who is using these instruments to build a bond ladder. The only thing the investor should care about is that the note will mature and pay 100 cents on the dollar at maturity. If interest rates suddenly shoot up between now and when the note matures, the market value of the note will temporarily decline. However, it will still pay out 100 cents on the dollar at maturity. By investing in TIPS rather than regular Treasury Notes, the investor would also gain some level of protection if interest rates jumped up due to much higher than anticipated inflation. My recommendation is to not even check the market value of the bond ladder. Simply ignore all price fluctuations.

This Is Too Complicated!

Although setting up the ladder might seem a little complicated, it is important to note that once it is set up, there is only one step that needs to be taken annually: purchase a new five year Treasury Note (or TIPS) using the proceeds from selling securities in your longer term investment portfolio. This can be handled in a mechanical way by simply selling down everything you own in your longer term portfolio in equal proportions or selecting securities to sell that seem overvalued. If market prices are severely depressed, like in early 2009, it is possible to just skip buying the new 5 year note for a few months or even a year since there will still be four years of bonds in the ladder.

However, if this still seems too complicated, you may want to consider using mutual funds rather than individual bonds. Mutual funds do not “mature” so you would not purchase five mutual funds. Instead, you would most likely purchase just one short term bond fund. You would still have to replenish this fund annually by selling down securities in your longer term portfolio but you would not have to identify a specific bond to purchase.

There are two problems with mutual funds that one must consider. First, even the cheapest mutual funds charge management fees. This will be a drag on your returns especially given how low interest rates are today. Second, a bond mutual fund never matures. If interest rates increase, the price of the mutual fund will decline and you cannot deal with this psychologically by knowing that the fund will mature at a specific date. It is true that the mutual fund will benefit from purchasing new bonds at higher rates and, in the long run, the fact that a fund doesn’t mature should not be a major issue. Still, some investors might be more comfortable in individual bonds with set maturity dates.

For those interested in bond funds, the Vanguard Short-Term Treasury Fund has an average duration of 2.4 years and has an expense ratio of 0.2 percent. Those who are investing over $50,000 can purchase the admiral class of this fund which carries an expense ratio of 0.1 percent. If TIPS seem more compelling to you but you want a fund rather than individual bonds, consider the Vanguard Short-Term Inflation-Protected Securities Index Fund which has an average duration of 2.5 years and an expense ratio of 0.16 percent. Those who are investing over $10,000 can purchase the admiral class of this fund which carries an expense ratio of 0.07 percent.

Conclusion

If you have never experienced a severe bear market, it is not possible to know in advance how you will react. You may react with equanimity or you may panic. The odds of acting in a rational manner will increase if you are not relying on the longer term portion of your portfolio to fund your living expenses next month. By keeping a significant amount of money in cash and a bond ladder, you can stack the odds in your favor. You are more likely to stay the course in your investment portfolio and avoid costly mistakes such as selling everything at the low point of a bear market.

Even those with more experience who have navigated past bear markets well do not know with certainty how they will react in the future. Bond ladders will provide some level of protection but the concept is not a panacea. Just like a flu shot might be only 60 or 70 percent effective, a bond ladder will only stack the odds in your favor.