The Fall of Silicon Valley Bank

A classic run on the bank exposes harsh realities hiding in plain sight

“As of December 31, 2022, on a consolidated basis, we had total assets of $211.8 billion, total investment securities of $120.1 billion, total loans, amortized cost, of $74.3 billion, total deposits of $173.1 billion and total SVB Financial stockholders' equity of $16 billion.”

— SVB Financial Group’s 2022 10-K, published on February 24, 2023

The story of the week, already familiar to anyone who is even casually aware of financial markets, is the fall of SVB Financial Group, the parent company of Silicon Valley Bank. Major newspapers and countless other writers have opined on the situation and what should be done over the weekend from a public policy perspective to prevent contagion from spreading further.

Many articles have discussed the basic problem that brought down the bank. SVB’s funding was comprised primarily of demand deposits — that is, funds that were placed with the bank but could be withdrawn at any time. The majority of deposits were invested in fixed-income marketable securities with long durations. Over the past year, these securities depreciated in value as interest rates skyrocketed. When depositors suddenly lost confidence in SVB and demanded their funds en masse, it became apparent that the bank was insolvent.

What seems to be missing from much of the coverage of SVB’s failure is that the bank’s financial situation should have come as no surprise to anyone. Indeed, the company’s 2022 10-K, filed with the SEC just two weeks ago, made it quite clear that the bank was actually undercapitalized and vulnerable to a bank run.

The quote at the beginning of this article, taken from SVB’s 10-K, indicates that the bank had $16 billion of stockholders’ equity as of December 31, 2022. This is accurate from a GAAP accounting standpoint. There is no reason to believe that there was any fraud or other nefarious activity at SVB. However, it must be emphasized that the bank did not actually have stockholders’ equity of anywhere near $16 billion if we consider the market value of the securities portfolio.

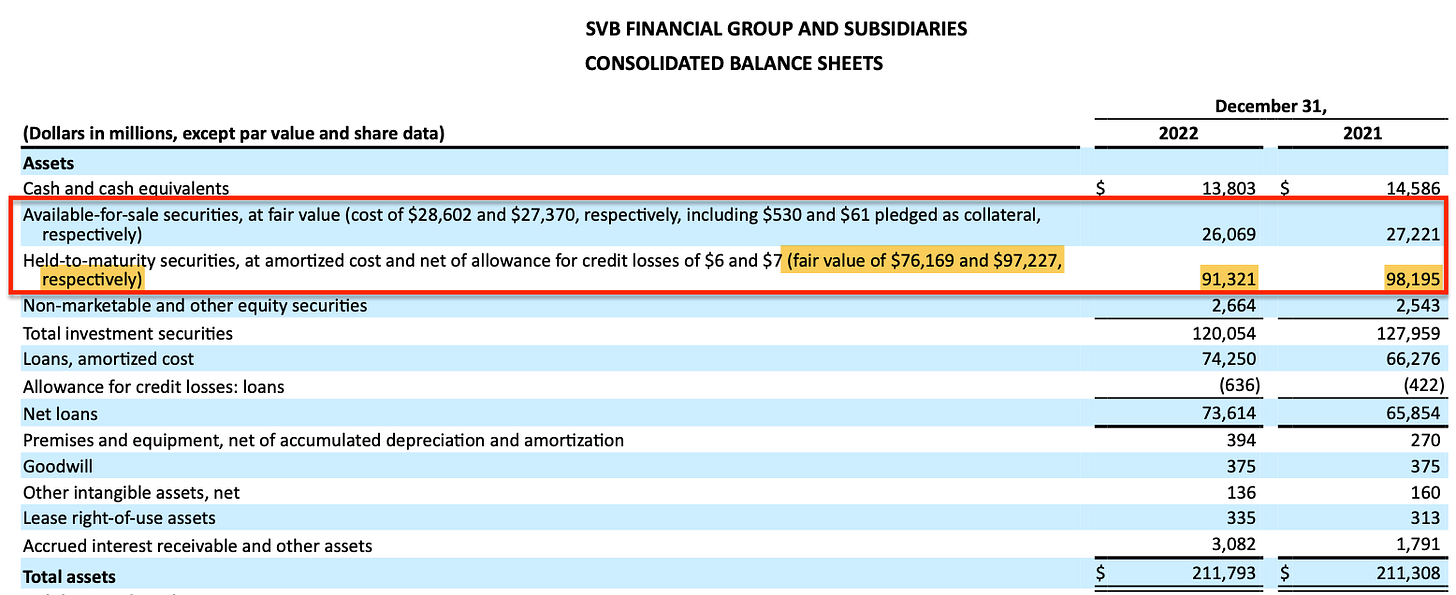

Let’s take a look at the assets side of SVB’s balance sheet:

We can see that SVB categorizes its securities into two “buckets” — available-for-sale (AFS) and held-to-maturity (HTM). GAAP accounting requires AFS securities to be marked-to-market which reflects the actual value of the securities which can either come from quotations in active markets or good faith attempts to estimate the market value of illiquid securities. However, GAAP accounting permits HTM securities to be recorded at amortized cost, net of allowances for credit losses. We can see that SVB’s HTM securities were carried on the balance sheet at $91.3 billion as of December 31, 2022, but fair value was far lower at $76.2 billion.

Let’s turn to the liabilities and equity side of SVB’s balance sheet:

We can see that stockholders’ equity is reported as $16 billion. However, this figure depends on HTM securities being carried at amortized cost rather than at market value. If the HTM securities were instead accounted for as AFS securities, SVB’s stockholders’ equity would drop to under $1 billion leaving the bank severely undercapitalized. It is important to emphasize that there is no evidence that the bank’s management did anything that was not permitted by accounting and regulatory standards. The situation was disclosed in the 10-K published just two weeks ago!

SVB’s investments were predominantly high quality mortgage-backed securities — that is, high quality from a credit standpoint. However, like all fixed-income securities, these investments declined precipitously due to rising interest rates. At the end of 2022, the HTM portfolio had large unrealized losses:

The losses in 2022 were severe due to the fact that SVB’s investments were predominantly in long-duration securities. Basic instruction in any Finance 101 course tells us that long-duration fixed income securities will suffer severe market declines when interest rates increase dramatically, as was the case in 2022.

What justification is there for GAAP accounting and regulators to permit banks to carry HTM securities at amortized cost rather than accepting reality and reporting securities at fair value on a mark-to-market basis?

When a bank classifies securities as held-to-maturity, it is signaling an intent to … hold the securities until they mature. Unless there are defaults, these securities will continue to pay interest and principal as scheduled. In the fullness of time, the unrealized losses that SVB recorded at the end of 2022 could be expected to reverse. In other words, the justification for allowing HTM securities at amortized cost is that the unrealized losses are transitory and will be reversed in due course.

The assumption is that a bank is set up as a going concern, not that it will be forced to return deposits immediately and liquidate.

A bank that is managed as an ongoing entity and retains the confidence of depositors can be expected to grow over time rather than shrink. In contrast, a bank that loses the confidence of depositors will suffer withdrawals. For such a bank, the prospect of reversing unrealized losses on its HTM portfolio in due course is nothing but a mirage in the distance. Time is not on management’s side.

When management is forced to liquidate securities classified as HTM, the unrealized losses become realized. In addition, the status of the remaining HTM portfolio is called into question. Rather than being held to maturity, those securities suddenly must be regarded as available for sale. As soon as this happens, they must be marked to market on the balance sheet and the bank’s stockholders’ equity plummets.

Unlike many recent financial scandals, there is no reason to suspect fraud at SVB. However, any bank failure calls into question the decisions made by management and whether government policies or regulatory failure contributed to the situation. In this case, it is difficult to ignore the role of zero interest rate policy (ZIRP).

“An entire economic system. Around a zero rate. Not only in the U.S. but globally. It’s massive. Now, think of the adjustment process to a new equilibrium at a higher rate. Do you think it’s costless? Do you think that no one will suffer? Do you think there won’t be winners and losers? No way. You have taken your economy and your economic system, and you’ve moved it to an artificially low zero rate. You’ve had people making investments on that basis, people not making investments on that basis, people speculating in new activities, people speculating on derivatives around that, and now you’re going to adjust it back? Well, good luck. It isn’t going to be costless.”

If we rewind to 2021, SVB’s financial statements reveal that 67% of its average total deposits were not interest-bearing. In 2022, this figure dropped to 59%. Banks have been in the enviable position of being able to attract deposits while paying minimal interest and as long as the Federal Reserve held short term interest rates to near zero, depositors had little opportunity cost for leaving deposits at banks earning next to nothing. This began to change in 2022 as the Federal Reserve increased the fed funds rate. Today, short-term risk-free treasury bills yield close to 5% so the opportunity cost of keeping deposits in the banking system earning next to nothing has increased.

In 2021, in order to earn a return on deposits, SVB had to invest in longer duration securities because short term securities earned hardly any interest. By investing in longer duration securities in 2021, SVB’s management took on interest rate risk. When rates rose dramatically in 2022, this resulted in unrealized losses.

Even without a run on the bank, the availability of a risk free return of 5% on treasury bills would be likely to result in depositors shifting funds from non-interest bearing deposits to treasury bills. This is obviously going to be accentuated in the event of a loss of confidence in the bank. At the same time, the depreciated HTM securities in SVB’s portfolio would have to be marked-to-market if the bank needed liquidity.

As Thomas Hoenig pointed out years ago, the adjustment from ZIRP to a normal interest rate environment was sure to cause inevitable pain in the economy.

SVB is the latest example of the pain manifesting itself in the real world. The simple analysis of SVB’s financial position shown in this article can be repeated with any bank. The presence of unrealized losses on HTM portfolios is not unique to SVB.

The fear in the financial markets this weekend stems from the fact that investors are scrutinizing other financial institutions for similar vulnerabilities. Fractional reserve banking is a system that requires confidence. Other banks in a position similar to SVB could face bank runs next week which is why market participants fear contagion.

The failure of SVB itself is not a systemic risk to the economy, but systemic risks could arise if the bank run on SVB becomes a stampede next week. Small depositors are protected due to $250,000 of FDIC insurance. Large depositors should view themselves as creditors and must accept risk of loss. It should go without saying that those who invest in stocks and bonds of banks should be prepared to bear losses.

There have already been scattered calls for bailing out SVB due to fear of systemic risk and some have called into question whether the Federal Reserve can afford to continue raising interest rates to fight inflation.

Bailouts and easing financial conditions act like a shot of morphine, dulling the immediate pain but doing nothing to address the underlying problems.

The next few days will be very interesting.

If you found this article interesting, please click on the ❤️️ button and consider sharing this issue with your friends and colleagues. The Rational Walk no longer uses social media. Readers who use social media are encouraged to post links.

Thanks for reading!

Copyright and Disclaimer

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

I wish I had seen this tweet from Bill Ackman before posting this article… the idea that (sophisticated) depositors with over $250K in a bank didn’t realize what they were doing seems crazy to me. Bailouts cannot be the perennial answer.

https://mobile.twitter.com/BillAckman/status/1634564398919368704

“By allowing @SVB_Financial to fail without protecting all depositors, the world has woken up to what an uninsured deposit is — an unsecured illiquid claim on a failed bank.”

As an ALM actuary it always amazes me when bank regulators tell life insurers that banks do ALM better. All could improve. In today's environment too many are relying on rules of thumb that are no longer appropriate. Risk teams should all be running scenarios based on cash flows and market value in addition to those based on GAAP. Finance 101 gets forgotten as you get more sophisticated.