For the third year in a row, Warren Buffett made extra donations to his family foundations timed for the Thanksgiving holiday. These gifts were disclosed in a press release followed by a SEC filing and they supplement his annual giving pledges which have been in place since 2006. Mr. Buffett converted 1,600 Class A shares of Berkshire Hathaway into 2,400,000 Class B shares before making his donations which were valued at $1.15 billion based on the closing price of the stock on November 25.

The press release includes Mr. Buffett’s advice regarding how to manage inheritance issues in a manner that minimizes family disputes. I particularly like his philosophy of leaving children enough money to do anything, but not so much that they can spend a lifetime doing nothing. It is obviously bad if an estate is squandered because resources that took a lifetime to build would be wasted. But it is even worse to facilitate a lifetime of idleness which could destroy human potential and lead to misery.

I wrote about Warren Buffett’s philanthropic record two years ago and I updated my comments last year in another article. The timing of his gifts near the Thanksgiving holiday is no accident. Mr. Buffett is clearly pleased with how his children have turned out and is expressing gratitude. He has so much confidence in his children that the balance of his estate at the time of his death will be entrusted to their oversight.

The Buffett legacy is not intended to be multi-generational and he hopes that his children will live long enough to give away his remaining assets but has designated successor trustees if necessary. The Gates Foundation will not be a beneficiary of Mr. Buffett’s estate, as I discussed in an article earlier this year, although annual gifts to the Gates Foundation will apparently continue during Mr. Buffett’s lifetime.

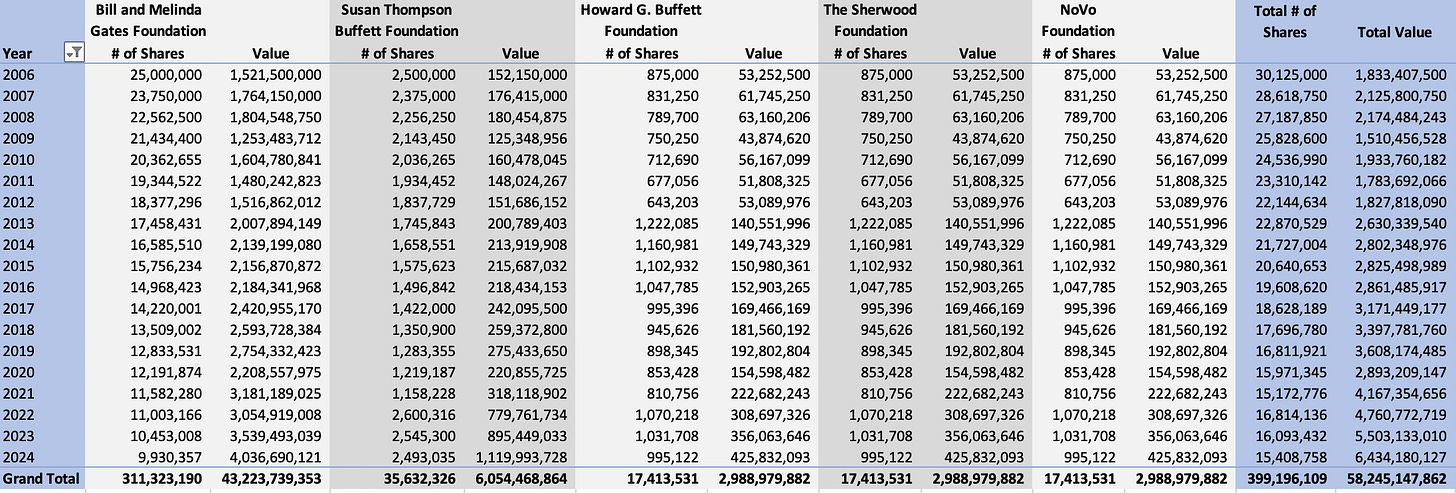

Readers who are interested in more details should refer to my articles linked above. I have updated my analysis of Mr. Buffett’s gifts to the four family foundations as well as to the Bill and Melinda Gates Foundation. The exhibit below is a summary of gifts given to each foundation aggregated by year. The value columns show the value of the gifts at the time they were made. While the gifts were valued at $58.2 billion at the time they were made, the shares would be worth nearly $190 billion at today’s market price.

Warren Buffett will be remembered as one of the greatest investors and businessmen of all time, but he is also an excellent teacher and an exceptional philanthropist. The press release shows that he’s quite aware of his limited life expectancy at age 94, but I believe that if he had any materially negative news, he would share it with the public. In 2000 and 2012, Mr. Buffett shared personal details regarding his health that went well above and beyond what he was required to do. For this reason, I view the absence of such information in yesterday’s press release to be a positive indicator of his health.

Berkshire Hathaway’s ownership will change dramatically over the next two decades as Mr. Buffett’s shares are given away to foundations that will sell the stock in order to fund operations. This will likely result in the shareholder constituency shifting toward institutional owners. Voting control will change as the dwindling number of Class A shares exert their power. If I have any concerns about Berkshire, it is that it will gravitate toward a more typical corporate governance structure in the decades to come. For this reason, I have suggested that the Class A shares might be split to allow more longtime individual investors to retain their voting power over time.

But these are concerns for another day. Thanksgiving is a good time of year to count our blessings and I consider it a privilege to have had Warren Buffett as a “partner” in business over the past quarter century. Come to think of it, I should not put partner in quotes because Berkshire is actually managed with shareholder-partners in mind.

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC. The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Individuals associated with The Rational Walk LLC own shares of Berkshire Hathaway.