The Digest #215

Ajit Jain's Berkshire sales, Dollar Stores, Jobs vs Cook on Innovation, Robert Caro, Fact checking Kamala Harris, Weaponizing political anger, Nick Sleep's letters, Howard Marks on risk, and more ...

Quote of the Week

“Above all, do not lose your desire to walk: every day I walk myself into a state of well-being and walk away from every illness; I have walked myself into my best thoughts, and I know of no thought so burdensome that one cannot walk away from it. Even if one were to walk for one's health and it were constantly one station ahead—I would still say: Walk!”

— Soren Kierkegaard h/t James Clear

Ajit Jain’s Sale of Berkshire Stock

On September 9, Ajit Jain sold 200 shares of Berkshire Hathaway Class A stock at an average price of $695,417.65 for proceeds of $139.1 million. Mr. Jain now owns 61 shares of Class A stock and 466 shares of Class B stock personally, in addition to 55 shares of Class A stock owned by family foundations. An additional 50 Class A shares and 124,308 Class B shares are owned by Mr. Jain’s charitable foundation.

This is obviously a large sale and several readers have asked for my thoughts on what might be behind the transaction. The short answer is that I cannot possibly know Mr. Jain’s motivations and neither can anyone else who Mr. Jain has not spoken to about his decision. This has not stopped the mainstream media and countless others from making guesses, many of which seem off the mark.

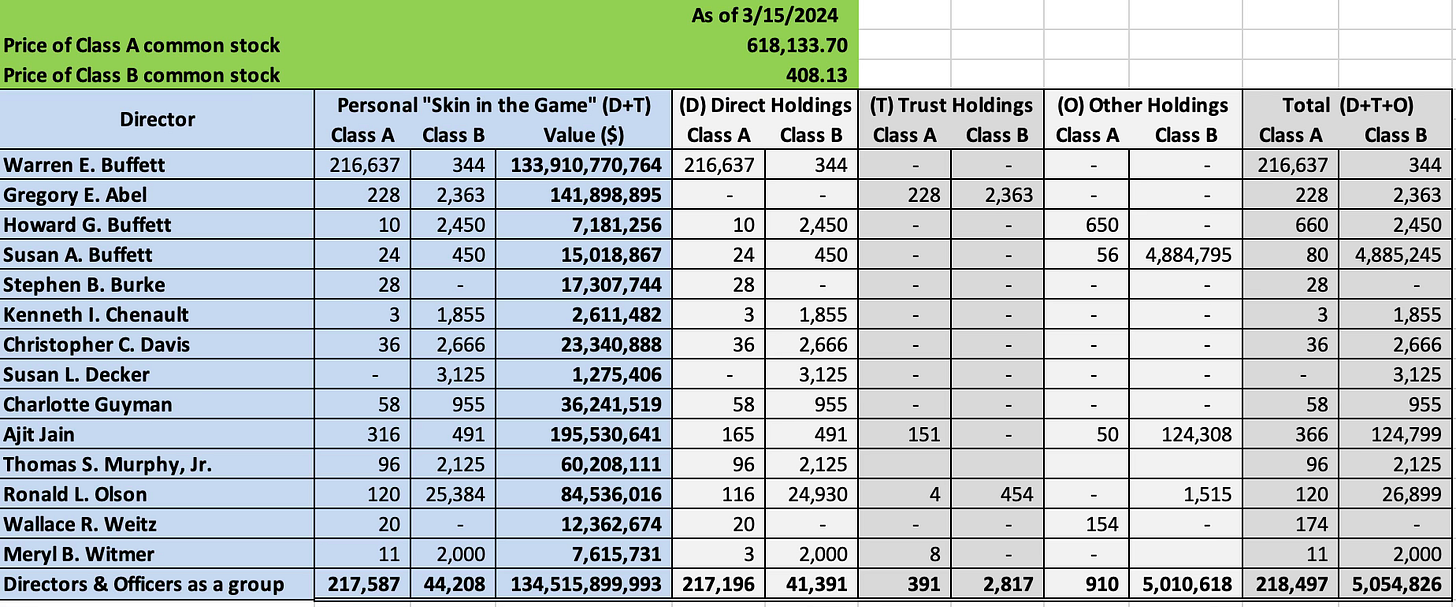

I wrote an article about Berkshire’s 2024 Proxy Statement earlier this year that included the following exhibit showing the ownership interest of the board. This presentation disaggregates ownership interest between personal “skin in the game” represented by direct ownership and trusts and interests in charitable foundations.

Mr. Jain’s recent sale reduces his “skin in the game” from 316 Class A shares to 116 Class A shares, worth approximately $79.5 million, when including both directly held shares and family trusts. This is still a substantial holding when compared to Mr. Jain’s 2023 compensation of just over $20 million, and it still puts him at the high end of share ownership on Berkshire’s board.

But why did Ajit Jain sell 200 Class A Shares?

Applying Occam’s Razor, my baseline assumption is that he sold the shares because Berkshire stock is no longer cheap, at least compared to its “typical” valuation since the financial crisis of 2008-09. Warren Buffett paused repurchases starting in June as shares continued to appreciate, even as cash on Berkshire’s balance sheet continues to rise toward $300 billion. This is a signal that Mr. Buffett no longer views Berkshire’s share price to be “below intrinsic value, conservatively determined.”

Mr. Jain is seventy-three years old and perhaps he wishes to diversify his holdings or consume some of his wealth. I am skeptical about rumors that he is in poor health, because if that were the case he would likely have avoided selling appreciated shares in order to benefit from the step-up in cost basis that occurs when shares are passed to heirs at death. I am also skeptical that the sale was motivated by charitable donations since it would make more sense to donate appreciated shares directly.

As much as I would like to see Ajit Jain and Greg Abel own even more Berkshire stock, it is hard to be too critical when both men have very large holdings and seem committed to ensuring Berkshire’s success once Warren Buffett is no longer running the company. As Mr. Buffett has said many times, Berkshire shareholders are very lucky to have benefited from Mr. Jain’s wisdom over the past four decades. If he now wishes to enjoy some of the fruits of his labor, I will not criticize his decision.

Articles

What the Struggles of Dollar Stores Reveal about Low-Income America by Gregory Meyer, September 13, 2024. Alternate link via archive.ph. For a newspaper published in the United Kingdom, this article does a good job of identifying the challenges facing low-income people in the United States and the appeal of dollar stores for this demographic that has been hammered by high inflation. (Financial Times)

Dollar Stores Expand Aggressively Even as Sales Shrink by Kate King, September 17, 2024. (WSJ)

DG Tegus Panel Discussion, September 12 2024. (The Science of Hitting)

The Things They Carried by John Gruber, September 16, 2024. A reflection about the items people carry on a daily basis, before and after the invention of the smart phone. The article focuses on Apple’s products and makes some important points contrasting the leadership style of Steve Jobs and Tim Cook. I tend to agree that Apple would be far less risk averse but probably also less financially successful if Steve Jobs had lived and continued to run Apple over the past thirteen years. (Daring Fireball)

Robert Caro on ‘The Power Broker’ 50 Years Later by Christopher Bonanos, September 11, 2024. Alternate link via archive.ph. Robert Caro is arguably the greatest living biographer. At the age of 89, he is hard at work completing his multi-volume biography of LBJ. It has been fifty years since Caro published his biography of Robert Moses. This interview gives readers a sense of how much material Caro has collected on his subjects that did not make it into his books. (New York Magazine)

“Turn Every Page” — Inside the Robert A. Caro Archive. "‘Turn Every Page’ is the first public exhibition drawn from the archive of the author whose award-winning works on Robert Moses and Lyndon B. Johnson are regarded as masterpieces of modern biography and history.” (New York Historical Society)

The Power Broker: Robert Moses and the Fall of New York, June 12, 2020. My lengthy article written soon after I read The Power Broker. (The Rational Walk)

Some Things Never Change: The Timeless Teachings of Warren Buffett by Kingswell September 17, 2024. “Buffett’s ability to keep his message both timeless and timely really sets him apart. Today, I’ve pulled out three lessons from his ‘50s-era letters that could just as easily have been written in the ‘80s, ‘90s, or today.” (Kingswell)

Some Thoughts — Maybe Too Many by Texirish, September 17, 2024. This is a very insightful post about Berkshire Hathaway that encapsulates many of the issues facing the company far better than coverage in the financial media. (Shrewdm.com)

Memo to Janet Yellen: Please Do the Right Thing for Pittsburgh – and for the U.S. by Roger Lowenstein, September 13, 2024. I am more skeptical about trade and foreign investment than I used to be, but I tend to agree with Roger Lowenstein regarding the proposed purchase of U.S. Steel by Japan’s Nippon Steel. National security is unlikely to be compromised by a largely demilitarized country in which the U.S. maintains a large military presence and Nippon Steel’s investment in U.S. Steel appears to be favored by those with the most at stake. (Intrinsic Value)

Nippon Steel Finds Unlikely Ally in Pittsburgh Workers by Kris Maher, Bob Tita, and Aaron Zitner, September 15, 2024. (WSJ)

It’s Not Too Late to Start Reading the Great Books by Erik Rostad, September 17, 2024. “I wish I had started reading The Great Books as a teenager. I dabbled but didn’t get serious about it until I was 43 years old. I’m now on a quest to read 200+ of those books in chronological order over the next 15 years. I came to a point where I didn’t want to die not having read The Great Books.” I agree completely. (Books of Titans)

Why Insulin Resistance Is The Biggest Silent Risk Factor For Heart Disease by Dr Paddy Barrett, September 14, 2024. Insulin resistance is a major risk factor for heart disease but is rarely formally tested. (Dr. Paddy Barrett)

Fact Checking Kamala Harris at the Debate by Drew Holden, September 17, 2024. The mainstream media’s job is to provide informative reporting across the political spectrum. They certainly do so when it comes to “fact checking” Donald Trump, but they fail when it comes to applying equal scrutiny to Kamala Harris. Regardless of who one favors in this presidential election, this state of affairs is unhealthy for our society. Drew Holden goes where the mainstream media dares not tread and fact checks several dubious statements made by Kamala Harris in the recent debate. (Holden Court)

The Trust Deficit, July 4, 2024. (The Rational Walk)

Biden’s Withdrawal and Limits of Gaslighting, July 22, 2024. (The Rational Walk)

Weaponizing Anger is a Useful Political Strategy by Rob Henderson, September 15, 2024. “It seems like people are angrier than ever. According to a poll by CBS News, 84 percent of Americans believe we are angrier than previous generations. Another survey recently found that nine in ten Americans can name either a recent news event or something about American politics that made them angry, while only half could identify a recent news event or something about American politics that made them proud.” (Rob Henderson’s Newsletter)

Politics

This newsletter includes short essays and links to articles that I find interesting. Occasionally, this involves politics, and I make no apology for such material.

The legacy mainstream media no longer has a monopoly on political discourse. I choose to use my small platform to weigh in on topics when I see fit and to bring attention to other writers who are making a good faith effort to practice the type of journalism long abandoned by a highly corrupted mainstream media.

Occasionally I hear from readers who are “triggered” by politics. Such readers should feel free to skip such content, which is typically a small percentage of what I publish, and I take no offense if readers choose to unsubscribe entirely.

The Rational Walk is entirely free to read and is not supported by advertisements in order to provide the intellectual freedom to serve as my First Amendment platform.

Thanks for reading!

Podcasts

Nick Sleep’s Letters: The Full Collection of the Nomad Investment Partnership, September 16, 2024. 56 minutes. This is a must-listen episode for all investors! “I read all 110,000 words of Nick’s letters (twice!) to make this episode and what I found most important is Nick’s ability to develop a deep understanding of ‘honestly run compounding machines’ (like Costco and Amazon) years before everyone else.” (Founders Podcast)

How to Think About Risk with Howard Marks, September 2024. This is a ten-part series of short videos covering the all-important topic of taking investment risks. Howard Marks is one of the most insightful investors on this topic. (Oaktree Capital)

The Mark Zuckerberg Interview, September 18, 2024. 1 hour, 27 minutes. Video. I’m no fan of Mark Zuckerberg and Meta for a variety of reasons (here’s just one example) but there is no denying that he built an extremely valuable business from nothing. I suspect readers will be interested, so I’m including the link. (Acquired Podcast)

What Modern Medicine Gets Wrong, September 16, 2024. 1 hour, 13 minutes. “Johns Hopkins surgeon Dr. Marty Makary talks about his book Blind Spots with EconTalk's Russ Roberts. Makary argues that the medical establishment too often makes unsupported recommendations for treatment while condemning treatments and approaches that can make us healthier. This is a sobering and informative exploration of a number of key findings in medicine that turned out to be wrong and based on insufficient evidence.” (Econ Talk)

Peter Attia also interviewed Marty Makary earlier this week. (The Drive)

A 1,300 Year History of the Middle East in Seven Religious Wars, September 12, 2024. 49 minutes. “From the taking of Jerusalem in the 7th century AD by Caliph Umar, to the collapse of the Ottoman Empire following the end of World War I, Christian popes, emperors and kings, and Muslim caliphs and sultans were locked in a 1300-year battle for political, military, ideological, economic and religious supremacy.” (History Unplugged)

Note to Readers: I no longer permit comments on newsletter articles for the same reason that I have stopped using all forms of social media. It takes too much time to enter into discussions online and the costs far outweigh the benefits for me. Readers who wish to send feedback may reply to any newsletter email. While some replies invariably get caught up in spam filters, I do read comments that reach my inbox although I cannot promise to provide replies to all emails. Thanks for reading.

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC. The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Individuals associated with The Rational Walk own shares of Berkshire Hathaway.