The Digest #212

Berkshire Hathaway at $1 Trillion, Warren Buffett's Canvas, Dollar General, Mr Market Miscalculates, Competing in Search, The American Dream, Li Lu, Deep Dive into AI, The Impact of Debt, and more ...

Berkshire Hathaway at $1 Trillion

Berkshire Hathaway’s market capitalization surpassed $1 trillion for the first time this week. Berkshire’s Class A shares traded above $700,000, just a little over six months after breaching $600,000. Warren Buffett will turn ninety-four years old tomorrow and many people have been suggesting that these milestones are a great “birthday present.” However, the downside is that Berkshire might not repurchase shares during the third quarter while cash on the balance sheet is likely to approach $300 billion.

In February, I wrote Berkshire Hathaway at $600,000 to explain how I thought about the rapid advance in the share price, although I did not present a valuation. However, I did explain the two-column method that Mr. Buffett and others have suggested as a way of thinking about Berkshire’s valuation. The same approach could be used today to consider the stock at $700,000. Shares obviously now trade at a higher valuation

In 2016, I wrote Berkshire Hathaway in 2026 which was my attempt to look forward a full decade. I made the case that Berkshire could approach a $1 trillion valuation by 2026, with assumptions that seemed sensible to me at the time. This figure was outlandish ten years ago but today trillion dollar market caps are not unusual.

Hopefully Warren Buffett has allowed himself to celebrate Berkshire’s trillion dollar milestone, but I suspect that he would be much happier if shares traded at a price at which he would be willing to use the company’s massive cash hoard to repurchase large quantities of stock. It is very unlikely that Berkshire will repurchase stock during the third quarter given where the shares have been trading recently. If this situation persists for many years, the likelihood of a dividend will increase.

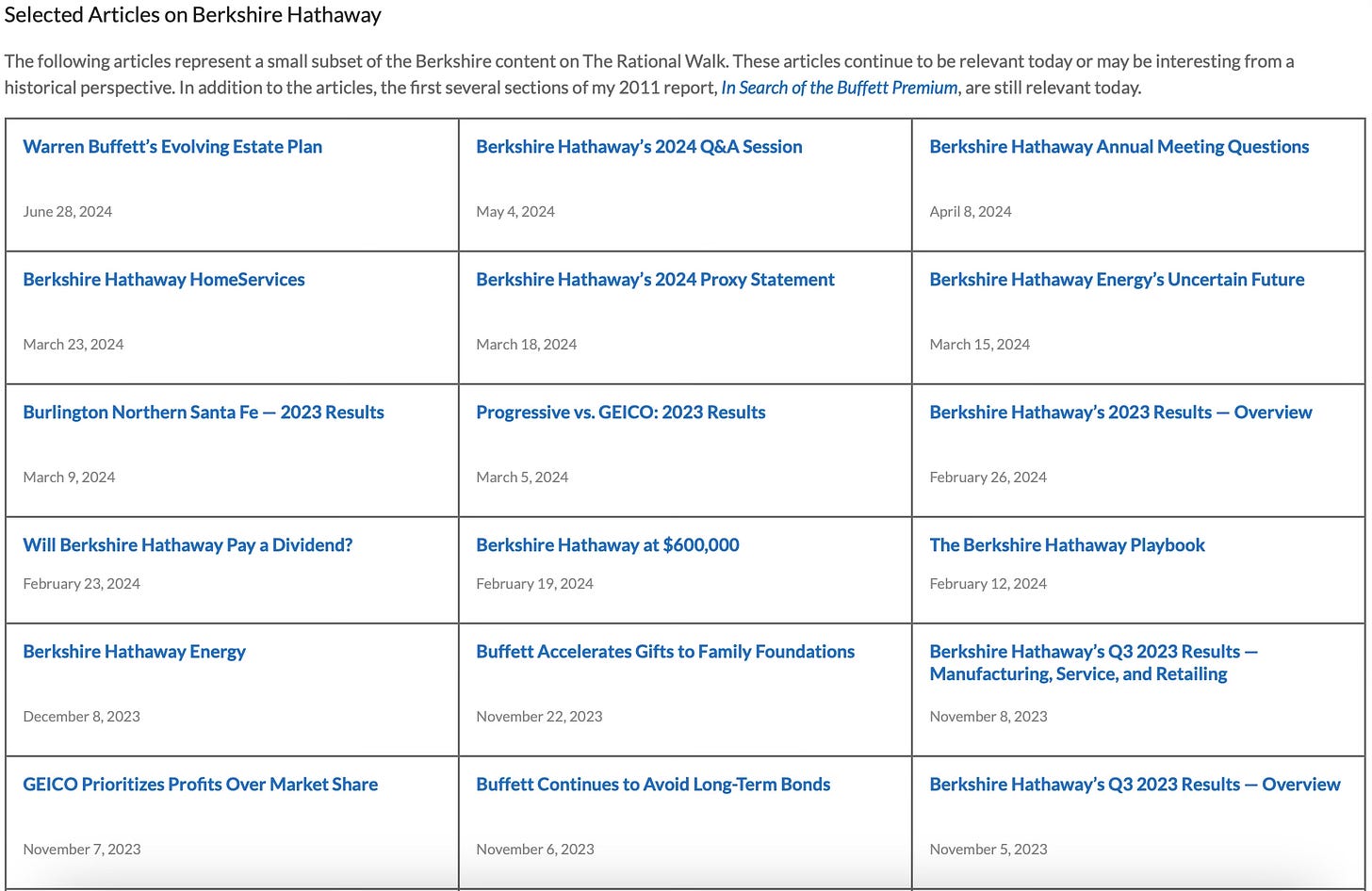

I have published many articles about Berkshire Hathaway over the years. Readers who are interested in these articles can visit the selected articles section of the Berkshire Hathaway archive on The Rational Walk website. The first several articles in the archive are shown in the image below. However, since ending paid subscriptions I no longer provide detailed coverage of Berkshire or other companies.

Articles

Warren Buffett’s Canvas, August 30, 2023. I wrote this article as a tribute to Warren Buffett a year ago on his ninety-third birthday. I’ll repeat my closing comment again this year! “The painting remains incomplete, the canvas is still on the easel, and hopefully this state of affairs will continue for many years to come!” (The Rational Walk)

Dollar General 2Q'24 Update by Abdullah Al Rezwan, August 29, 2024. This is a concise update outlining Dollar General’s dismal quarterly results which sent its stock down by over 30% in today’s trading session. (MBI Deep Dives)

Dollar General: Value or Value Trap?, September 4, 2023. I spent Labor Day weekend last year researching Dollar General after the company reported poor results, so today’s news seems like déjà vu … it is now looking like Dollar General has significant problems and that re-hiring the company’s former CEO in October 2023 was no panacea. Although I did not purchase shares, researching the company and visiting one of its stores provided useful insights into lower income consumer behavior in rural areas. (The Rational Walk)

Mr. Market Miscalculates by Howard Marks, August 22, 2024. “Given Mr. Market’s inconsistent behavior, the prices he assigns to stocks each day can diverge – sometimes wildly – from their fair value. When he’s overenthusiastic, you can sell to him at prices that are intrinsically too high. And when he’s overly fearful, you can buy from him at prices that are fundamentally too low. Thus, his miscalculations provide profit opportunities to investors interested in taking advantage of them.” (Oaktree Capital)

Competing in Search by Benedict Evans, August 19, 2024. “A quarter century after ‘don't be evil’ a judge has found that Google is abusing its monopoly in search. But no-one knows what happens next, and whether this ruling will change anything. Will Apple build a search engine? Will ChatGPT change search? Does it matter?” (Benedict Evans)

How Costco Hacked the American Shopping Psyche by Ben Ryder Howe, August 20, 2024. This is a well written article about Costco’s business model. I became a new Costco member two years ago and there’s no doubt that I have saved hundreds of dollars. The key is to be disciplined and avoid impulse purchases! (New York Times)

The American Dream Feels Out of Reach for Most by Rachel Wolfe, August 28, 2024. Our society is built on the belief that the American Dream is within reach, so we should be concerned that a majority of Americans no longer believe it is attainable. This article highlights how inflation has hammered Americans and how very rapid home price appreciation is a highly dubious “benefit” for many homeowners. (WSJ)

A Time to Give by Jonathan Clements, August 24, 2024. No one likes to think about death, but sometimes circumstances force us to consider the financial implications. This has been the case for Jonathan Clements who has been very generous in sharing the details of his financial journey after his recent cancer diagnosis. (Humble Dollar)

New Painkiller Could Bring Relief to Millions—Without Addiction Risk by Marla Broadfoot, August 20, 2024. “The medication initially known as VX-548 blocks sodium channels in nerves, blocking pain signals before they reach the brain.” (Scientific American)

How to Die in Good Health by Dhruv Khullar, April 15, 2024. This is a somewhat skeptical article about Dr. Peter Attia’s approach to longevity based on an interview with Dr. Attia as well as some of his critics, including Ezekiel Emanuel who “derides Attia as an ‘American immortal’ who overcomplicates straightforward advice.” In my view, the critics have not bothered to understand that Dr. Attia’s primary goal is not longevity, per se, but improving health span — the number of years of healthy life during which people can pursue the activities they find meaningful. (The New Yorker)

Outlive: The Science and Art of Longevity, April 6, 2023. My review of Peter Attia’s book. I have adopted a number of the suggestions in this book, particularly regarding exercise and metabolic health. (The Rational Walk)

Live Music Is Coming Back! by Ted Gioia, August 25, 2024. This is great news! “Live music somehow out-lasted COVID. It resisted urban blight. And it has survived the disappearance of almost every newspaper music reviewer on the planet. Most amazing of all—it overcame all the distractions on your smartphone.” (The Honest Broker)

Podcasts

Li Lu, August 26, 2024. 38 minutes. Transcript. “Charlie Munger said that Li Lu was the only outsider he ever trusted with his money. Decades before Li Lu made Munger half a billion dollars, Li survived one of the most horrific childhoods imaginable: Born into poverty, abandoned, hungry, beaten, surrounded by death. Persistent. Smart. Disciplined. Intensely curious. Obsessed with reading and learning. Determined to escape. This is a story you absolutely cannot miss.” (Founders Podcast)

Gavin Baker - AI, Semiconductors, and the Robotic Frontier, August 27, 2024. 1 hour, 33 minutes. Transcript. This is an excellent discussion which goes into great depth on AI and semiconductors. However, many technical details were difficult to follow, which just proves that my circle of competence does not extend to anywhere near the red hot companies operating in artificial intelligence. (Invest Like the Best)

The Impact of Debt with Howard Marks and Morgan Housel, August 27, 2024. 39 minutes. “[Marks and Housel] explore the relationship between leverage and longevity, the nature of risk, and the eternal relevance of Voltaire’s famous saying: ‘History doesn’t repeat itself. Man always does.’” (Behind the Memo)

The Impact of Debt by Howard Marks, May 8, 2024.

How I Think About Debt by Morgan Housel, April 30, 2024.

Life after near-death: a new perspective on living, dying, and the afterlife, August 26, 2022. 2 hours, 22 minutes. Video. Show Notes. Sebastian Junger remains a self-described atheist, but his experiences when he suffered an abdominal aneurysm and nearly died caused him to question whether there might be an afterlife and led him to write a book. In this episode, he discusses the experience with Peter Attia. (The Drive)

Steering an Aerial Plywood Box Through Enemy Fire: The Glider Pilots of WWII, August 29, 2024. 42 minutes. This is an amazing story I was unaware of: “The men who flew on gliders were all volunteers, for a specialized duty that their own government projected would have a 50 percent casualty rate. In every major European invasion of the war they led the way. They landed their gliders ahead of the troops who stormed Omaha Beach, and sometimes miles ahead of the paratroopers bound for the far side of the Rhine River in Germany itself. From there, they had to hold their positions.” (History Unplugged)

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC. The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Individuals associated with The Rational Walk own shares of Berkshire Hathaway.