The Digest #204

Buffett buys more Occidental, Daily Journal annual meeting notes, Experts vs. Imitators, Slowing down time, Return of meme stocks, The U.S. Constitution, Gouverneur Morris, Cleopatra, and more ...

Occidental Petroleum

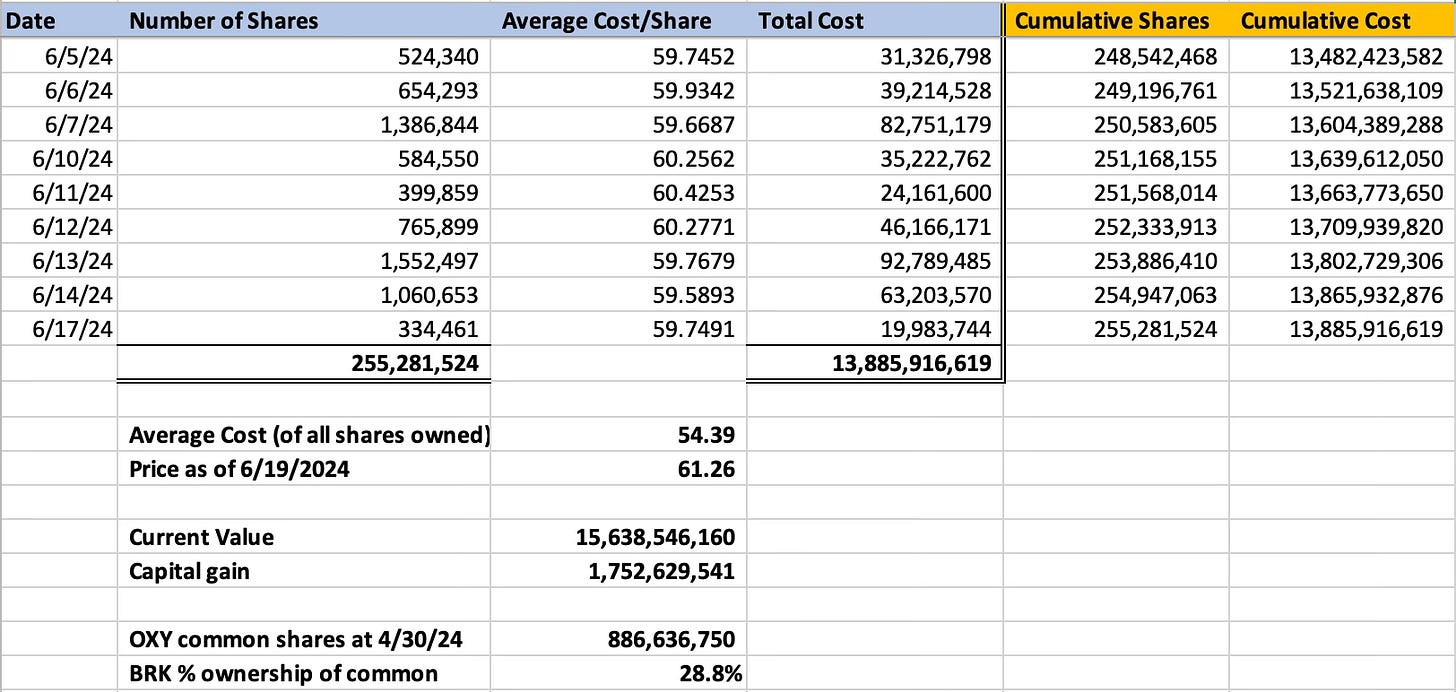

Starting on June 5, Warren Buffett bought shares of Occidental Petroleum on nine consecutive trading days with the latest reported purchases taking place on Monday, June 17. Over this period, he used $434.8 million to purchase 7,263,396 shares at an average cost of $59.86. Berkshire now owns a 28.8% stake in the oil company.

In addition to the investment in Occidental common stock, Berkshire owns $8.5 billion of preferred stock as well as common stock warrants allowing Berkshire to purchase up to 83.86 million shares of Occidental at an exercise price of $59.62. The warrants are exercisable until one year after the preferred stock is fully redeemed.

At the 2023 annual meeting, Warren Buffett stated that Berkshire will not “buy control” of Occidental because the right management is running the company and he “wouldn’t know what to do with an oil field.” Buying control could be interpreted as making purchases that breach the 50% level or acquiring the entire company.

If the options are eventually exercised, I estimate that Berkshire Hathaway would own approximately 35% of Occidental common stock, assuming a constant share count and accounting for issuance of the new shares. This leaves room to continue buying shares in the open market without the “risk” of eventually gaining control of Occidental.

While I take Mr. Buffett’s statement at the 2023 annual meeting at face value, I would suggest that circumstances could change in the future. I would also point out that Berkshire routinely leaves management in place after gaining control of companies. Berkshire’s corporate headquarters “would not know what to do with” many of its wholly owned subsidiaries without management in place. Occidental is no different.

The International Energy Agency made news recently with its prediction of an oil supply glut by 2030. However, if the transition to renewable energy takes longer than anticipated or if geopolitical tensions rise, this benign scenario could be optimistic.

The exhibit below shows Berkshire’s recent purchases and a running total of shares owned and the cost of the position. I previously wrote about Occidental in October.

Articles

Daily Journal Annual Meeting Notes, June 17, 2024. A reader generously shared his notes from the Daily Journal annual meeting which took place in Los Angeles on February 15, 2024. This was the first annual meeting after Charlie Munger’s death in November 2023 and the notes are quite interesting. (The Rational Walk)

A Lesson in Restraint: Warren Buffett's "Abstention Heard 'Round The World" by Kingswell, June 18, 2024. This article is about Berkshire’s abstention on a vote to affirm Coca-Cola’s executive compensation plan in 2014. At the time, Warren Buffett was criticized for not voting against the plan but he felt that abstaining would send a loud enough message. (Kingswell)

Coca Cola Misfires on Share Repurchase Rationale, March 29, 2014. Coca-Cola’s board made some poor decisions in 2014. I was reminded of the situation by Kingswell’s article and recalled writing about it. My criticism had to do with the board’s fallacious rationale for share repurchases to offset dilution caused by executive compensation, as if repurchases are somehow free. (The Rational Walk)

Experts vs. Imitators, June 2024. It sometimes seems like everyone who is interviewed for a value investing podcast sounds the same — paying homage to Ben Graham and Warren Buffett before making the point that Mr. Buffett eventually adapted by listening to investors like Phil Fisher and Charlie Munger who placed a higher value on growth. It is easy to master “talking points” but harder to dive into the substance. This brief article has some good ideas about how to distinguish between the poseurs and those who really have something valuable to bring to the table. (Farnam Street)

Quiet Compounding by Morgan Housel, June 17, 2024. (Also available as a podcast episode) “Long-term investing is about being able to absorb manageable damage; if you can’t do that, you’re pushed into the much harder trick of attempting to avoid short-term volatility. You’re only durable when you care more about surviving volatility than you do looking dumb for getting hit by it in the first place.” (Collaborative Fund)

Hot Funds and the Curse of ‘Self-Inflated Returns’ by Jason Zweig, June 14, 2024. “Hot money—a sudden influx of cash from people trying to get rich quick—can overheat an ETF and create what new research calls ‘self-inflated returns.’ The result, sooner or later, is self-inflicted losses. Fortunately, you can protect yourself with some common sense.” (WSJ)

Learning to Slow Down Time by Trungphan2, June 13, 2024. Summer seems to last forever as a child but it goes by very quickly as an adult. Obviously, the number of days in a season has not changed but our perception of time does change as we get older, as we have few new and novel experiences. The key to slowing down time is to make a conscious effort to experience new things on a more frequent basis. (Sat Post)

The C Word by Jonathan Clements, June 15, 2024. After writing about investing for decades at the Wall Street Journal, Jonathan Clements founded Humble Dollar, a blog about personal finance. I do not know Jonathan, but when you read someone’s work for decades, you feel like you almost know them. So I was shocked and saddened to read of Jonathan’s stage four cancer diagnosis. It is particularly poignant to read about such terrible news impacting someone who is only 61 years old and has written about his own meticulous retirement planning. (Humble Dollar)

Podcasts and Videos

2024 Markel Group Annual Meeting, May 22, 2024. 2 hours, 10 minutes. Over the past few years, Markel has made an effort to establish traditions surrounding its annual meeting and to turn it into an event similar to Berkshire Hathaway’s annual meeting, albeit on a smaller scale. (Markel Group)

Howard Marks on “In Good Company”, June 18, 2024. 41 minutes. This discussion covers how Howard Marks thinks about investment philosophy, risk management, and how to determine the quality of a decision. (The Memo by Howard Marks)

The Return of Meme Stock Investing, June 17, 2024. 50 minutes. Demetri Kofinas speaks with Spencer Jakab and Andrew Left about the resurgence of the meme stock mania triggered by Keith Gill’s reemergence on social media. (Hidden Forces)

The Revolution That Wasn’t, December 14, 2024. My book review of Spencer Jakab’s book about RobinHood, GameStop, AMC, and more. (The Rational Walk)

Science and Art Are Poisoning You, June 15, 2024. 1 hour, 41 minutes. Transcript. Johnathan Bi delivers a very interesting introductory lecture summarizing the key ideas of Jean-Jacques Rousseau's Discourse on the Arts and Sciences. This was my first exposure to Rousseau’s philosophy. (YouTube)

How the Constitution Can Bring Us Together, June 10, 2024. 1 hour, 2 minutes. “Yuval Levin of the American Enterprise Institute and author of American Covenant argues that the Constitution unified the United States at the founding of the country and that understanding the Constitution can help bring the country together today.” (Econ Talk)

Can the Constitution Reconcile America? by Barton Swaim, June 14, 2024. This article is an interview of Yuval Levin, who was also interviewed on the Econ Talk podcast linked to above. The focus is his new book, American Covenant. (WSJ)

Ten Things about Gouverneur Morris, June 17, 2024. 56 minutes. This is a very interesting discussion about one of the forgotten founding fathers. Gouverneur Morris was the author of the Preamble to the United States Constitution and played other important roles in early American history. (Listening to America)

The Seven Cleopatras Who Ruled Egypt, 47 minutes. “Behind the legendary, singular figure of Cleopatra stood six other women who bore her name. The infamous Cleopatra we think we know was actually the seventh queen in a long line of powerful female rulers whose stories have been lost to history. The seven queens named Cleopatra, ruling from 192–30 BC, defied the stereotype of the nameless, faceless women of antiquity and instead challenged the norms of their time.” (History Unplugged)

Washington Rallying the Troops at Monmouth

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC. The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Individuals associated with The Rational Walk own shares of Berkshire Hathaway.