The Digest #182

Passive Investing, Low Trust Societies, Greg Abel in the spotlight, Capital allocation at Berkshire, Better habits for 2024, Amusing CPA stories, Ben Graham, Charlie Munger, Pernod Ricard, and more...

Passive vs. Active Investing

Recently, I have been questioning whether it makes sense to continue investing in individual stocks in the future. As I was thinking about this, I decided to post the following on X/Twitter assuming that it would attract just a few responses. However, it attracted quite a bit of attention and the point I made was misunderstood.

Since 2000, when I began investing actively, I have had only two down years (-29% in 2008 and -2.6% in 2015) and I outperformed the S&P 500 in fourteen of twenty-three years. On a weighted cash-flow basis, my returns have clearly outperformed the S&P 500 since 2000. However, my most important investment throughout this period has been Berkshire Hathaway which deserves credit for the vast majority of my unrealized and realized gains in dollar terms. I’m happy with my results but I am not sure active stock picking is worthwhile in the future given my personal circumstances.

Some of the responses assumed that I was either throwing in the towel due to poor performance or that I was trying to chase the “magnificent seven” companies that have dominated market returns this year in the United States. Other responses seemed to assume that I was planning sell my long-held shares of Berkshire, pay taxes on realized capital gains, and reinvest the proceeds in the S&P 500.

I am not currently planning to sell my Berkshire shares, especially not in my taxable account, and I am certainly not motivated by a desire to chase the “magnificent seven” by purchasing an index that these mega-cap tech companies dominate.

The reason I am considering a passive strategy for new investments is because I am not sure that I want to spend the majority of my time on stock research in the future. If I adopt a passive strategy, it will not necessarily track the S&P 500. There are numerous ETFs tracking domestic and foreign markets. It is also possible to track the S&P 500 on an equal-weighted, rather than market-cap, basis through Invesco’s RSP ETF.

I plan to write about passive strategies in 2024 as I investigate what is available. As far as Berkshire is concerned, I have no problem owning this well-run and diversified conglomerate in a concentrated manner for the foreseeable future. I wrote about concentrated investments in general and Berkshire in particular in a recent article for paid subscribers which has a free preview for all readers.

From the Archive: The Paradox of Trust

I’m in the process of migrating hundreds of articles from my website to my newsletter archive on Substack. Occasionally, I will send out an older article that remains timely since the vast majority of current subscribers will not have seen it before. I am also planning to include links to articles from the archive in issues of The Digest.

The Paradox of Trust, October 31, 2019. In retrospect, I wrote this article at a critical inflection point for American society. It was written just three months before the pandemic hit, although obviously I did not know it at the time. I had just returned from a few weeks walking through Spain and immediately noticed the relative lack of trust in the United States compared to what I encountered in rural Spain, where I spent most of my time, as well as in Madrid. My point was that trust in society is critical for anything to work well. In my opinion, the pandemic drastically reduced our already low levels of societal trust and we have yet to recover. In fact, political strife in 2024 could make the situation far worse. (The Rational Walk)

Related Article: In his recent article, Why the US can’t have nice things, part 2,

made these remarks about social trust after observing conditions on New York City’s subway system: “Social trust is also extraordinary important to maintain, because like a ratchet wheel, once it comes undone, it spins quickly out of control, and getting it wound back is a long, arduous, and complex process, that requires moving it tighter one painful ratchet at a time. Right now in the US, the social trust ratchet wheel has come completely undone.” I recommend reading the full article as well as Dignity: Seeking Respect in Back Row America, Chris Arnade’s excellent book which I briefly described in Holiday Book Recommendations for 2019.

Featured Links

The Man Preparing for a Berkshire Hathaway Without Warren Buffett by Justin Baer, December 23, 2023. This is a profile of Greg Abel who has been Warren Buffett’s designated successor since 2021. From time to time, Mr. Abel has been in the spotlight, but in general he has succeeded in keeping a low profile which is apparently how he likes it. As he goes about his days in Des Moines, he is usually not even recognized. Warren Buffett and Berkshire director Ron Olson are quoted in the article:

Warren Buffett: “Greg will be more successful than I have been, and if I said otherwise, my nose would grow.”

Ron Olson: “[Greg] is no Warren Buffett. But neither is anyone else. He’s still a numbers guy and understands the language of business as well as anyone but he loves to learn.”

The death of Charlie Munger has reminded us that Warren Buffett will not be running Berkshire Hathaway forever. This article might raise concerns among shareholders that Mr. Buffett could be planning to step down soon or might have health problems. However, I’m confident that if Mr. Buffett develops problems that could force him to retire, he would be open and candid with shareholders in a timely manner. (WSJ)

Warren Buffett, Teledyne, and the Art of Allocating Capital, December 20, 2023. 35 minutes. Video. Geoff Gannon and Andrew Kuhn discuss capital allocation in general and also comment on Berkshire Hathaway’s potential for reinvesting capital in the years to come. I am in general agreement with their statements regarding the importance of return of capital in the future as well as the comments favoring special dividends over the rigidity of regular dividends. My strong preference is for share repurchases so long as the stock price is not overvalued. (Focused Compounding)

Thoughts on Share Repurchases and Capital Allocation, July 19, 2018. I wrote this article two days after Berkshire revised its repurchase policy in July 2018. Since the policy was amended, Berkshire has used $72.9 billion to repurchase 199,930 Class A equivalents. Berkshire now has fewer shares outstanding than at any time since prior to the General Re acquisition in 1998. All of the shares that were issued to partially fund the BNSF acquisition in 2010 have been retired, and more. This shrinkage in share count is likely to continue. (The Rational Walk)

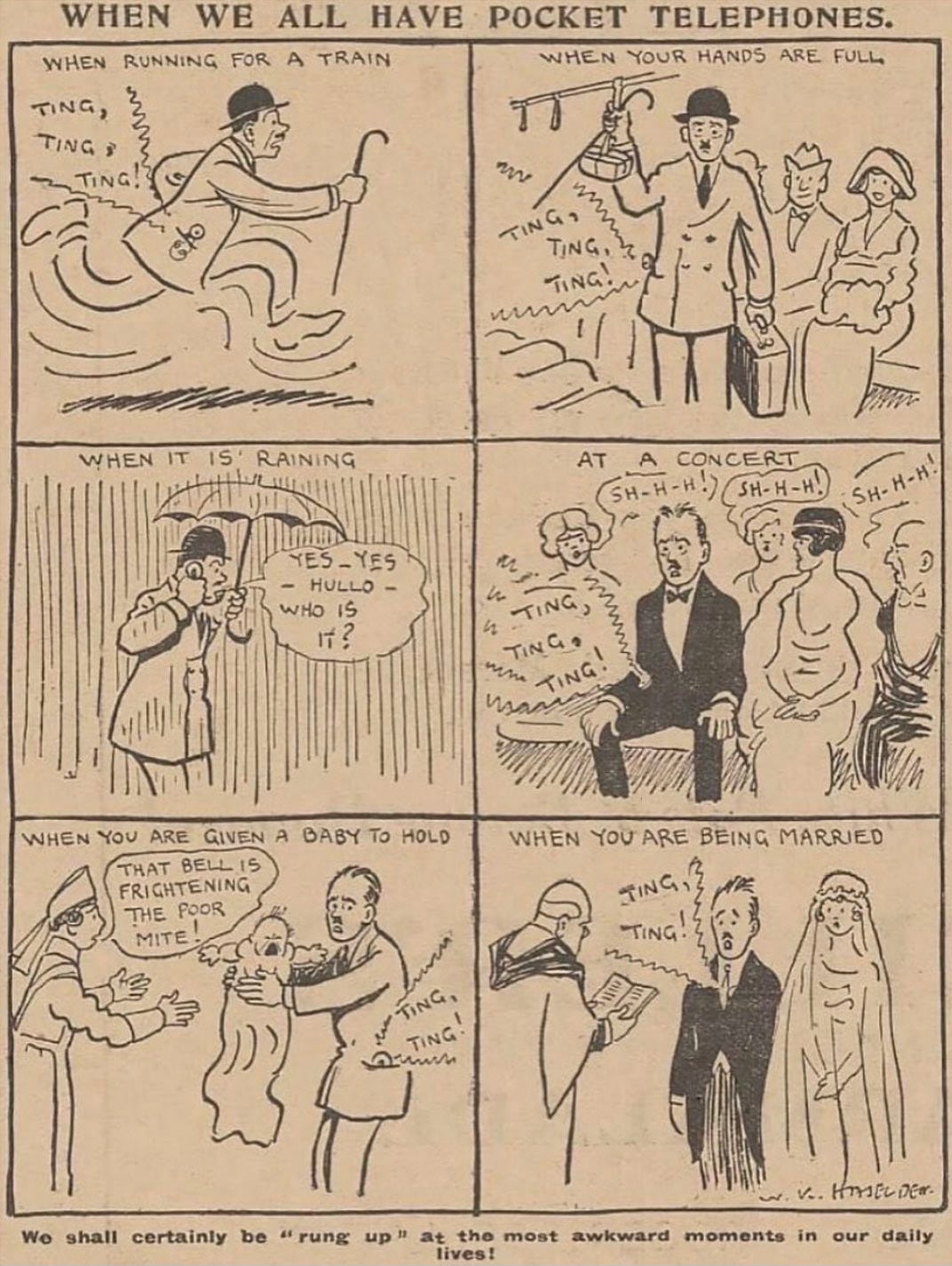

When We All Have Pocket Telephones

This is a 97 year old comic strip about what the world would be like in the future when everyone carried around a phone in their pocket. h/t @historyinmemes

Articles

Warren Buffett’s Letters to Shareholders — Searchable Memorex This is a new website that contains all of Warren Buffett’s letters in a searchable format. The site was built by Max Olson who worked with Warren Buffett to publish the first fifty years of Berkshire Hathaway shareholder letters. Last year, I purchased the Kindle version of the letters which is a great deal at just $3.99. I did so in order to be able to search by topic which is something that is now possible on this new website as well.

Charlie Munger Q&A Transcript || University of Michigan (2017) by

, December 18, 2023. This is the latest in a series of useful transcripts: “On November 30, 2017, Charlie Munger spoke at an alumni event for the University of Michigan’s Ross School of Business held in Los Angeles. For nearly an hour, he expounded on a wide range of topics — from growing up in Omaha during the Great Depression and partnering with Warren Buffett at Berkshire Hathaway to cryptocurrency and China.” (Kingswell)Ben Graham and His Errant Brothers, December 2023. This is the tenth installment in a series of reminiscences of Benjamin Graham written by his granddaughter. In this article, the author goes into Ben’s childhood years and his often challenging relationship with his brothers. Ben was the youngest of three brothers born in close succession. It is always interesting to read about the early years of someone who later reached the pinnacle of his profession. (Beyond Ben Graham)

How To Have Better Habits in 2024 by Ryan Holiday, December 20, 2023. There’s no shortage of articles on habit building at the end of the year as people get ready to resolve to make a fresh start. . I like this list of suggestions. (RyanHoliday.net)

Atomic Habits, February 8, 2021. I read James Clear’s book, Atomic Habits, in early 2021 and wrote this review soon after. It is probably the best book on habit building that I have ever read, aside from the stoic classics. (The Rational Walk)

The Writing Mission (is to be curious), a New Covenant, and Twelve Questions by

, December 22, 2023. “The best writing feels urgent, emotional, important, and uncomfortable. It feels like a tiny Jerry Stiller is preparing for the ‘airing of grievances’ during Seinfeld’s Festivus, yelling that he’s “got a lot of problems with you people, and now you're gonna hear about it!” (‘You people’ being society at large, not the readers.) The best writing needs to be spilled out on the page, it cannot be held back. This is a selfish way to write, but the only one I’ve found worth pursuing.” (The Alchemy of Money)Taxing Our Brains by Dan Smith, December 20, 2023. I got a few laughs out of reading this article written by a retired CPA recounting strangely irrational attitudes among his former clients. A sample: “Years ago, I asked a friend why she hadn’t refinanced her home loan after mortgage rates dropped sharply. Her response? She said she needed the bigger tax deduction. Even after I explained that she only saved 15 cents in tax for every $1 spent on mortgage interest, she still didn’t get it.” (Humble Dollar)

Podcasts

Respect Each Other’s Delusions, December 22, 2023. 9 minutes. This is the podcast version of a recent article. “When you realize that you – the good, noble, well-meaning, even-tempered, fact-driven person that you are – have views of how the world works that are sure to be incomplete if not completely wrong, you should have empathy for others whose deluded beliefs are obvious to you. I am such a fan of Daniel Kahneman’s observation that we are better at spotting other people’s flaws than our own.” (The Morgan Housel Podcast)

Pernod Ricard: Luxury Liquor, December 20, 2023. 47 minutes. Transcript. “Pernod Ricard [is] a business whose history dates back to 1797. Today, the business is the second-largest global producer of wine and spirits with a portfolio of 17 of the top 100 spirits brands, including Absolut vodka, Beefeater gin, Jameson Irish whiskey, and Malibu rum. The portfolio produces north of EUR 12 billion in sales and generates an impressive 60% gross margin and high 20% operating margin.” (Business Breakdowns)

An Extraordinary Introduction to the Birth of Israel and the Arab-Israeli Conflict, December 18, 2023. Transcript. This is one of the best explanations of the conflict I have listened to in recent weeks because it goes back far beyond 1948 to explain the conditions in the nineteenth century that gave rise to the Zionist movement. “We have two topics for today. The first, we're going to take an historical look at European Jew-hatred, antisemitism, and the second is the current situation here in Israel as the war in Gaza enters its sixth week. And we'll see some of the ties between those two events.” (Econ Talk)

Jesus, December 24, 2023. 35 minutes. David Senra discusses what he learned from reading Jesus: A Biography from a Believer by Paul Johnson. I found this description of the book on Amazon: “Few figures have had such an influence on the world as Jesus of Nazareth. Paul Johnson's brilliant and powerful reading of Jesus' life at once captures his transfiguring message and his historical complexity.” (Founders)

Census at Bethlehem

Pieter Bruegel the Elder painted the scene below in 1566 shortly after of one of the harshest winters on record. The painting portrays Bethlehem as a Flemish village toward the end of the day, with Joseph and Mary approaching the crowd on the left.

Description via Wikipedia:

The painting shows Bethlehem as a Flemish village in winter at sundown. A group of people is gathered at a building on the left, having their details taken down by a scribe. A sign bearing the Habsburg double-headed eagle is visible on the building. Other people are making their way to the same building, including the figures of Joseph and the pregnant Virgin Mary on a donkey. A pig is being slaughtered, though of course such an event would never have occurred in Jewish Bethlehem.

People are going about their daily business in the cold, children are shown playing with toys on the ice and having snowball fights. At the very centre of the painting is a spoked wheel, sometimes interpreted as being a reference to the wheel of fortune.

To the right, a man in a small hut is shown holding a clapper, a warning to keep away from leprosy. Leprosy was endemic in that part of Europe when the painting was created. There is a begging bowl in front of the hut. In the background, men drink at a makeshift bar, and in the distance are a well-kept church and a crumbling castle.

This is a very creative depiction of the scene described in Luke 2:1-5.

For all those who celebrate, Merry Christmas!

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.