The Digest #160

Steve Jobs in his own words, Risk free rates, Saving for a home, Buffett's investments in Japan, Flawed memories, Podcast interviews with Rudy Havenstein, Doomberg, Paul Graham, Guy Spier, and more...

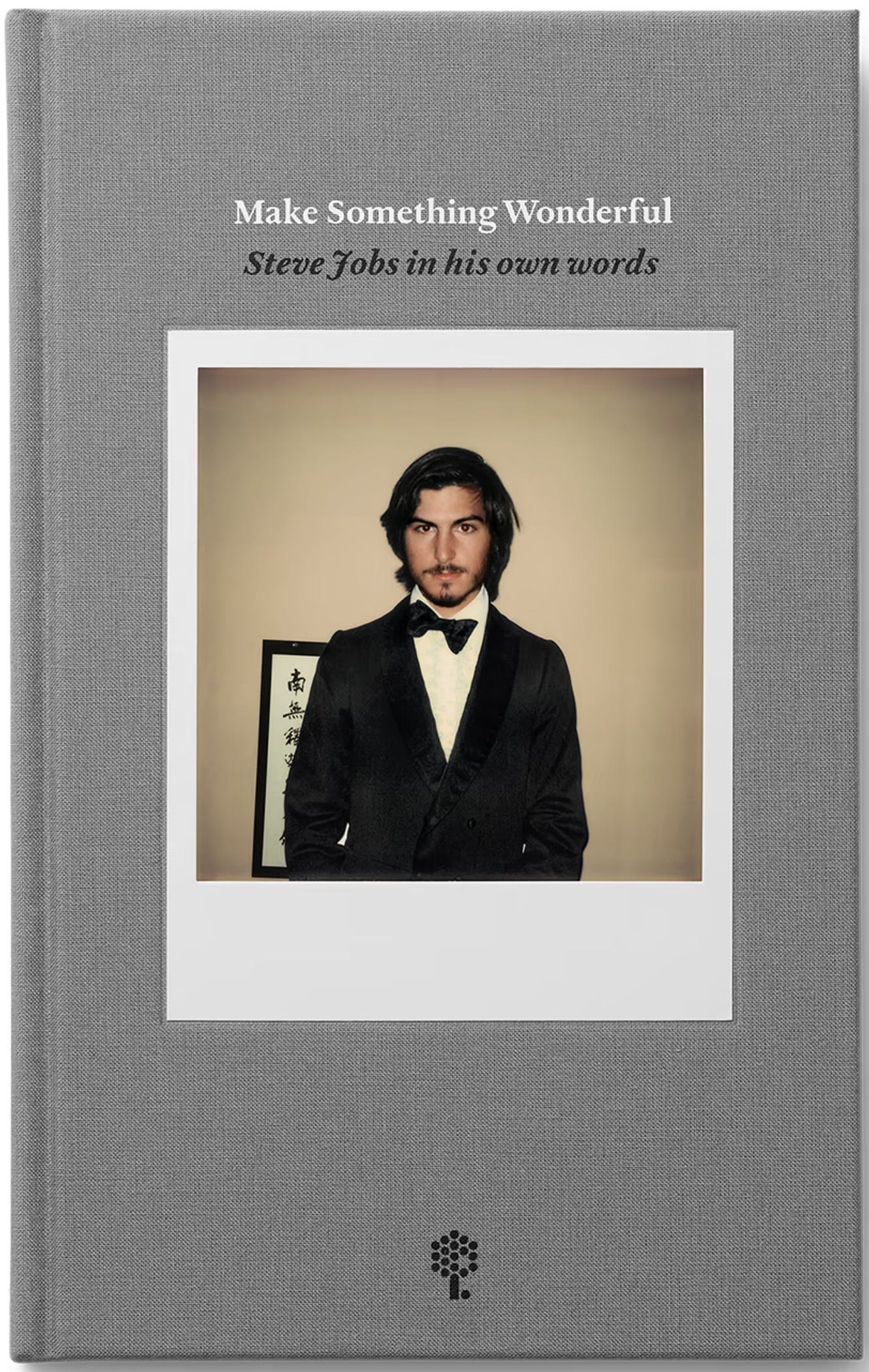

Make Something Wonderful

Here’s an interesting quote from a speech given by Steve Jobs on July 15, 1983. What would Jobs think of ChatGPT and artificial intelligence forty years later?

When I was going to school, I had a few great teachers and a lot of mediocre teachers. And the thing that probably kept me out of jail was the books. I could go and read what Aristotle or Plato wrote without an intermediary in the way. And a book was a phenomenal thing. It got right from the source to the destination without anything in the middle.

The problem was, you can’t ask Aristotle a question. And I think, as we look towards the next fifty to one hundred years, if we really can come up with these machines that can capture an underlying spirit, or an underlying set of principles, or an underlying way of looking at the world, then, when the next Aristotle comes around, maybe if he carries around one of these machines with him his whole life—his or her whole life—and types in all this stuff, then maybe someday, after this person’s dead and gone, we can ask this machine, “Hey, what would Aristotle have said? What about this?” And maybe we won’t get the right answer, but maybe we will. And that’s really exciting to me. And that’s one of the reasons I’m doing what I’m doing.

Published by friends and family of Steve Jobs, Make Something Wonderful: Steve Jobs in his own words, collects a number of his writings and speeches and organizes them into a chronological narrative. There’s also commentary putting everything in context, many vintage photographs, as well as an introduction written by Laurene Powell Jobs.

The hardcover version of the book was given to Apple employees but not released to the general public. While the hardcover is selling for several hundred dollars on sites such as eBay, the ebook is available free of charge. I highly recommend reading it.

Founders Podcast #299 covers many highlights of the book very well.

Articles

In Search of Safe Havens: The Trust Deficit and Risk-free Investments! by Aswath Damodaran, August 15, 2023. Finance 101 courses typically treat the risk free rate as the government bond rate and pay scant attention to the complicating factors discussed at length in this article. (Musings on Markets)

How to Save for a House: The Comprehensive Guide to Homeownership by Nick Maggiulli, August 15, 2023. Many articles about home ownership oversimplify the situation and gloss over important costs. This article presents a conservative approach regarding the savings needed to truly afford a home. These points need to be made even if it isn’t what aspiring homeowners want to hear. (Of Dollars and Data)

Behind The Curtains of Buffett's Life with Alice Schroeder by Frederik Gieschen, August 9, 2023. Alice Schroeder published her biography of Warren Buffett in 2008 after years of close collaboration with her subject. When I read the book, I was struck by the personal details that it included. Although Schroeder has kept a low profile in recent years, she initially granted interviews. This article draws lessons from the book and some long-forgotten interviews of the author. (Neckar's Alchemy of Money)

Buffett's 44% CAGR and Various Types of High Quality Investments by John Huber, August 13, 2023. This article presents an interesting commentary on Berkshire’s recent investments in Japan among other observations regarding Warren Buffett’s investing style. “One of many things that has made Buffett a special investor is he looks at the facts and ignores the narratives. I think this method allows you to be open minded and receptive to quality investment ideas, wherever they might be.” (Base Hit Investing)

Dakshana Annual Letter by Mohnish Pabrai, August 9, 2023. Mohnish Pabrai is well known as a successful investor but his philanthropic track record is even more impressive according to Warren Buffett. Dakshana enables bright young people in India to prepare for admission to the country’s elite IIT system which has an overall acceptance rate of only 1.3%. “In 2023, out of 600 Dakshana scholars who were prepared for the IIT entrance test, 370 made it – a success rate of 62%.” (The Dakshana Foundation)

Your Memory is Lying to You by Jim O'Shaughnessy, August 16, 2023. Memories can shift over time and provide a misleading or entirely false narrative of past events. This article recommends keeping a handwritten journal because it makes it difficult, if not impossible, to retroactively change our narrative of why we made decisions. I recently experienced exactly what this article describes when I reviewed a travel journal written in 2019. My memory of one part of that trip was mostly false, rewritten in my mind long after the trip to fit a more pleasant narrative. (Infinite Loops)

Wealth is the Control of Time by Conor Mac and Six Bravo, August 9, 2023. This is 100% correct: “While most people measure wealth in terms of money, true wealth is ultimately about controlling one’s time. Time, after all, is the scarcest of resources. This concept isn’t new. Its most recent incarnation is the financial independence movement where the goal is not money for money’s sake but money to free up time.” (Investment Talk)

Learning from Tractor Supply Company, August 9, 2023. This is a very interesting overview of a great American success story. “Tractor Supply's story underscores essential principles: maintain focus on a defined niche, empower employees, listen to customers, and embrace continuous innovation. Its success as the largest rural lifestyle retailer in the U.S. is a testament to the power of culture and values in driving long-term growth and customer loyalty. Businesses and investors alike can draw inspiration from Tractor Supply's journey and learn that staying true to their core strengths and values is the key to overcoming challenges and achieving long term success.” (Investment Master Class)

Tractor Supply Company, July 12, 2022. I spent several weeks studying Tractor Supply last year and published this report for subscribers. (The Rational Walk)

Trader Joe's: The Anti-Grocer by Trung Phan, August 11, 2023. I never get tired of reading about Trader Joe’s or shopping at its stores. Aside from Costco, I don’t know of a grocery retailer that has a more customer-focused philosophy. (SatPost)

Becoming Trader Joe, February 17, 2022. This is a book review of Joe Coulombe’s autobiography. Coulombe founded Trader Joe’s in 1967. (The Rational Walk)

Becoming Trader Joe: How I Did Business My Way and Still Beat the Big Guys, June 28, 2021. A podcast about Joe Coulombe’s autobiography. (Founders Podcast)

A Few Stories About Big Decisions by Morgan Housel, August 9, 2023. “Most decisions aren’t made on a spreadsheet, where you just add up the numbers and a rational answer pops out. There’s a human element that’s hard to quantify, hard to explain, and can seem detached from the original goal, yet carries the most influence.” (Collaborative Fund)

Podcasts

The Celebrity Investor, August 16, 2023. 1 hour, 34 minutes. This is an interesting conversation between Guy Spier and Stephen Clapham covering a range of topics, with a focus on how Guy has created the right kind of environment for success based on his personality and interests. Behind the Balance Sheet

Review of The Education of a Value Investor, October 2, 2014. I wrote this review of Guy Spier’s book shortly after its release in 2014. (The Rational Walk)

Annotated interview with Natalie Brunell, August 9, 2023. 1 hour, 22 minutes. I’ve followed Rudy Havenstein on Twitter for many years and enjoy reading his Substack. Rudy recently agreed to be interviewed on a few podcasts and this one is the most recent. His pinned tweet reads as follows: “I have two main issues: 1. The military-industrial complex Eisenhower warned us about in 1961, and, related to that, 2. The Big Bank crime wave and associated kleptocracy... plus all the politicians, institutions, think tanks, economists, media fanboys etc. who support #1 & #2.” (A Havenstein Moment)

Paul Graham on Ambition, Art, and Evaluating Talent, August 9, 2023. 54 minutes. I have posted links to many Paul Graham essays over the years but I cannot recall any podcast interviews. A full transcript is also available. (Conversations with Tyler)

Doomberg: "Our Fragile Energy Economy", August 9, 2023. 1 hour, 42 minutes. Transcript. For clear thinking on energy, listen to this interview with one of the anonymous creators of Doomberg. “How have the narratives created around different types of energy - from renewables to nuclear - affected current policy making around the world? Will the increasingly precarious state of the global debt and monetary system shift the geopolitical landscape? How have increasing global tensions combined with a rise in green energy policy affected nations’ desire for energy security - and what does it mean for future policy as we enter a period of decreasing energy availability?” (The Great Simplification)

Fluke — A Story About How Fragile the World Can Be, August 11, 2023. 11 minutes. I’ve long been a fan of Morgan Housel’s writing and I also enjoy his podcast series. All of the episodes are very brief. I like informative long-form podcasts but it also takes skill to pack this much wisdom in just eleven minutes. (The Morgan Housel Podcast)

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues.

Thanks for reading!

Summer in the High Sierra

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Thanks for sharing and appreciate the mention!

Thank you