Superinvestor Portfolio Changes — Q3 2023

A few observations based on recent 13F filings

Introduction

Every quarter, institutional investors managing more than $100 million must disclose their positions in U.S. exchange-traded stocks. The filing deadline for Form 13F is generally within forty-five days after the end of a quarter and most investors wait until the last day or two before the deadline to file since holdings of securities represent an important trade secret, especially for well-known investors.

Although the stated purpose of 13F disclosures is to increase investor confidence in the integrity of markets, portfolio disclosures are routinely used as sources of trading and investing ideas despite many dangers and limitations. In The Perils of Blind Coat Tailing, I wrote about the problems facing investors who rely on 13F disclosures for ideas. However, there is nothing wrong with looking at these filings to build a list of companies to independently research based on the holdings of investors you respect.

Dataroma makes following the portfolio changes of superinvestors very easy. Before the website existed, I used to manually look at 13Fs and compare holdings for certain investors from one quarter to another. Dataroma handles that process and provides other valuable features such as showing us all the superinvestors who own a specific company as well as revealing the top ten most owned companies, insider buying at companies with heavy superinvestor ownership, and much more.

I’ve been going through a number of superinvestor portfolios over the past few days. Now that the last of the quarterly filings are in, I thought it would be interesting to highlight a few noteworthy situations.

Dollar General

In my article on Dollar General on September 4, I noted that several investors I respect added to their positions in the stock during the second quarter. I was curious whether these investors would add to their positions following the collapse of the stock price in late August due to weaker than expected earnings. Although the 13F reports do not disclose the timing of purchases during the third quarter, we can see that Tom Gayner, Chris Bloomstran, and Seth Klarman all added to their positions. In addition, three other investors initiated positions while one investor sold.

Did they buy following the collapse in the stock in late August or earlier in the third quarter? The 13F reports do not tell us, but I suspect that at least some of them added in September. Importantly, with one exception, there were no sales among the investors tracked by Dataroma.

Despite spending quite a bit of time researching the company and visiting a couple of dollar stores to gain familiarity with the industry, I did not purchase shares for my own portfolio. I was getting tempted in early October as the stock plummeted toward $100, but news on October 12 of former CEO Todd Vasos reassuming his old position resulted in a sharp rally. I was not impressed with the actions of the board related to the management change but continue to follow the company.

While the board’s shakeup of management and the compensation package awarded to Mr. Vasos are like nails on a chalkboard for me, perhaps the lesson is that the dilution of the stock grant is not particularly material in the context of a company with a $28 billion market cap. As of this morning, Dollar General is trading around $127 after participating in the rally this week following a lower than expected CPI report.

It’s notable that Dollar General did not appear in Berkshire Hathaway’s 13-F despite being large enough for Todd Combs or Ted Weschler to build a meaningful position for their portfolios without exceeding ten percent ownership. Dollar General is also a company that could theoretically be an acquisition target for Berkshire. However, as Charlie Munger said in a recent interview, maybe retailing is in the “too hard” pile:

“Warren doesn’t like retail … Practically everything that was once mighty in retail is gone. Sears Roebuck is gone, the big department stores are gone. It's just too damn difficult as far as he's concerned.”

Berkshire Hathaway

One of the oddities of securities regulations is that the 13F deadline comes after the deadline for 10-Q quarterly reports. As a result, we could not say much about Berkshire’s portfolio changes in early November, although my overview article on third quarter results did note that Warren Buffett sold shares of Chevron, something that is possible to infer from the 10-Q. The 13F confirmed the sale of part of the Chevron stake as well as several other changes, as shown below:

Of the changes made during the quarter, the Chevron sale was the most significant in terms of the percentage change impact to the overall portfolio. A number of small positions were liquidated as well as the remaining Activision Blizzard shares which were part of a merger arbitrage position. Microsoft finally closed on the acquisition of Activision on October 13 after a twenty month saga.

The other change that was no surprise was the reduction in the HP position since Berkshire was required to file Form 4 disclosures when that position was reduced in September. This was required since Berkshire owns more than 10% of HP shares.

While Dataroma does a fine job of summarizing 13F filings, it is still worthwhile to go to the source documents on the SEC website when it comes to looking at Berkshire’s activity. This is because Berkshire often requests confidential treatment for new positions that it is in the process of building. This was the case during the third quarter based on the following sentence in the filing:

“Confidential Treatment Requested. (The Manager has omitted from this public Form 13F one or more holding(s) for which it is requesting confidential treatment from the U.S. Securities and Exchange Commission pursuant to section 13(f) of the Exchange Act and rule 24b-2 thereunder)”

The SEC does not like to grant confidential treatment requests except under limited circumstances. Presumably, Berkshire argues that Warren Buffett’s fame makes it likely that other investors will bid up the price of stocks that he’s in the process of buying. I can see the logic behind this for new positions, although history suggests that investors do not blindly emulate Mr. Buffett. For example, there was no rush into Occidental Petroleum shares after Berkshire’s latest investment was disclosed.

Berkshire reduced its position in Markel Group by two-thirds during the third quarter. Berkshire first purchased shares of Markel during the first quarter of 2022 and added more shares in the second quarter of 2022 and the first quarter of 2023. Until the third quarter, Berkshire never sold any shares.

When Berkshire announced its intention to acquire Alleghany, I speculated that Markel might be an interesting acquisition target as well. When I wrote my initial article on the subject on April 15, 2022, Berkshire’s 13F for the first quarter of 2022 was not yet released so I had no idea that a portion had been initiated. I covered the initial acquisition of shares in an article that was admittedly a bit self-congratulatory.

Regarding the sale in the third quarter, I do not pretend to know the rationale. Given the timing of the initial purchase of Markel shares around the time of the Alleghany announcement, I suspect that Warren Buffett took the position. If that’s the case, the decision to sell would have been his, but I am speculating. The size of the holding is certainly indicative of a position that Todd Combs or Ted Weschler could have taken.

Semper Augustus

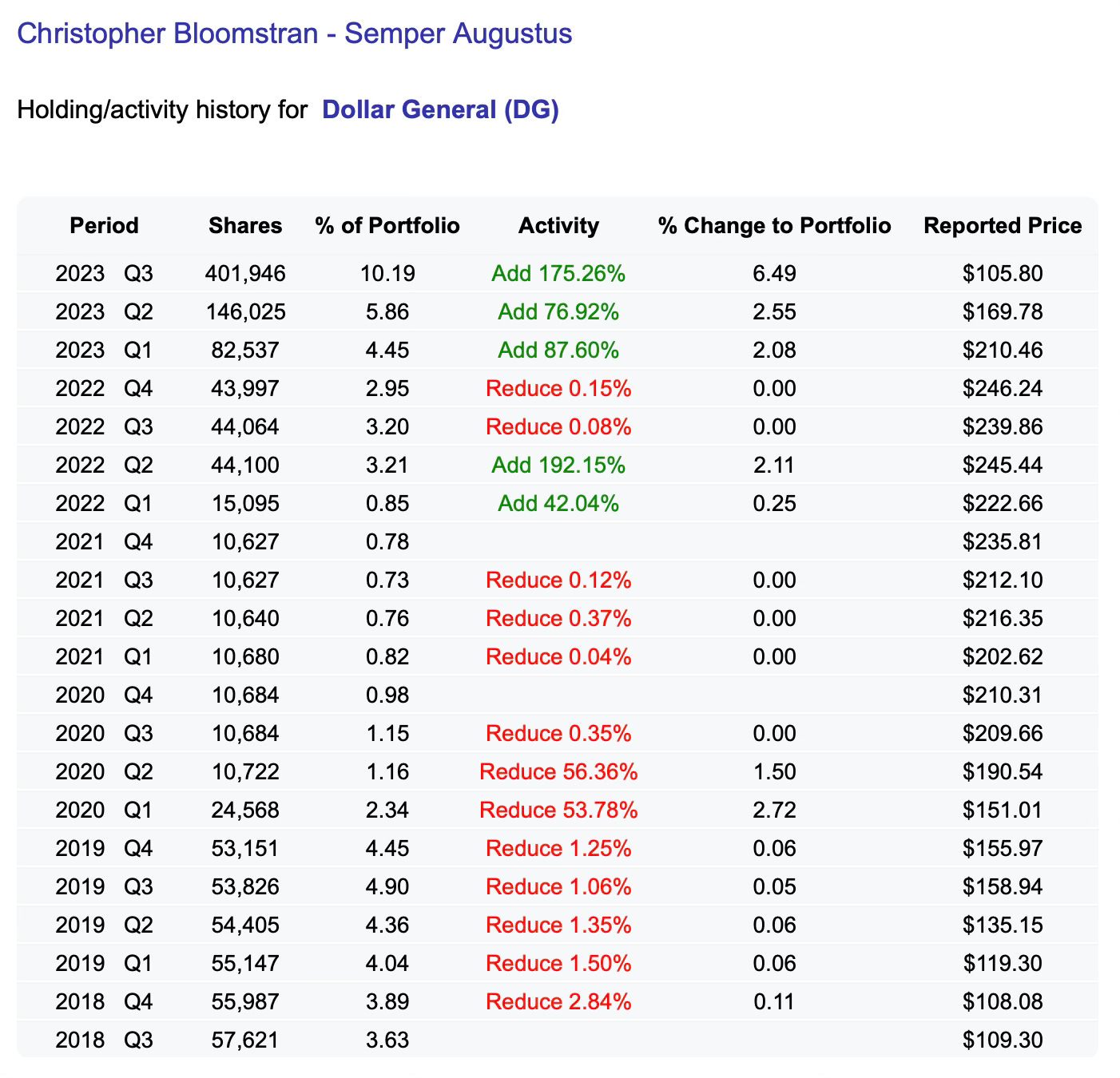

Chris Bloomstran’s annual letters are legendary in the value investing community due to his in-depth coverage of Berkshire Hathaway. As I mentioned earlier in this article, Semper Augustus increased its position in Dollar General substantially during the third quarter. Dollar General accounted for over 10% of the portfolio at the end of the quarter which is the fund’s second largest holding after Berkshire Hathaway. Here is the history of Semper Augustus and Dollar General over the years:

The combination of position sizing and recent activity makes this seem like a high conviction move, particularly when we consider that Semper Augustus added to its position in Dollar Tree as well, which was a 2.19% position at the end of the quarter.

Semper’s third largest position, behind Berkshire Hathaway and Dollar General, is Mercury General at 9.08%. Mercury General is an auto insurer that I am vaguely familiar with based on research over a decade ago. Semper has added to its position in Mercury for eight quarters in a row. It might be a company worth investigating.

Other Dataroma Screens

Dataroma has several powerful screening capabilities. One of the screens permits users to create a list of stocks where at least one superinvestor has a ten percent position in the company. We can then sort this list in a number of ways. For example, the screen below shows stocks that are ten percent positions in at least one portfolio sorted based on how close they are to fifty-two week lows:

The attraction of this type of screen is to spot stocks that are out of favor but comprise a large percentage of at least one superinvestor portfolio. Users can modify the screen criteria and I’d encourage anyone interested in stock ideas to try it out.

Conclusion

Despite the many limitations of 13F filings, spending some time each quarter on Dataroma looking at what successful investors are doing is not a waste of time when approached with the right mindset. I think that this is especially true for long-only managers who are known to concentrate their positions in relatively few stocks and tend to hold for long periods of time. In such cases, even though a 13F is stale by several weeks, it is likely that positions and sizing have not changed dramatically.

Investors with a large number of small positions are much less useful to track and it can be downright hazardous to infer conviction from 13Fs for managers who run long/short portfolios. We only see the long positions and this can be very misleading. If such an investor has made a pair trade, going long on one stock and shorting another, the bet is on the relative performance between the two stocks, not the absolute movement of the long position. It is also possible for an investor to have hedges in place against long positions through derivatives that are not on 13F filings.

From the perspective of an observer, more disclosure is better than less, but it is understandable that managers do not want their activities to be known while building or disposing of positions. The SEC has proposed changes to short selling disclosures and, at various times, has proposed other reforms to the system. If I could have one change, it would be to require disclosure of 13F positions within five or ten days after the end of a quarter rather than forty-five days. If that is not possible, the 13F deadline should at least occur prior to the 10-Q deadline.

If you’d like to see regular quarterly articles with my thoughts on 13Fs, please indicate your interest by either liking this article or commenting.

If you found this article interesting, please click on the ❤️️ button and consider referring a friend to The Rational Walk.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Long Berkshire Hathaway.