On July 5, Berkshire Hathaway Energy (BHE) announced that it will acquire Dominion Energy's natural gas transmission and storage business in a transaction with total enterprise value of $9.7 billion. Warren Buffett is betting that natural gas infrastructure will remain in demand for decades to come.

In a presentation to analysts, BHE estimated that the initial cash outlay will be $3.8 billion, net of cash acquired in the transaction. Of the $5.7 billion of debt that BHE is assuming as part of the deal, $1.2 billion will be paid off over the next year. The transaction is subject to regulatory approval and expected to close by yearend.

BHE is acquiring over 7,700 miles of natural gas transmission lines with 20.8 billion cubic feet per day of capacity along with 900 billion cubic feet of storage capacity. After the deal closes, BHE will carry 18 percent of all interstate natural gas transmission, up from 8 percent today.

The deal includes a 25 percent economic interest in the Cove Point liquefied natural gas export terminal which BHE will operate as the general partner. Dominion will retain a 50 percent interest. Cove Point is one of only six LNG export facilities operating in the United States. It is interesting to note that Brookfield Asset Management is the owner of the remaining 25 percent interest in Cove Point which it acquired for $2 billion in October 2019. Brookfield is known as a smart operator of critical infrastructure. However, their $2 billion investment was made prior to the sharp downturn in the energy industry due to the COVID-19 pandemic.

Berkshire's acquisition does not include the Atlantic Coast Pipeline project which was a joint venture of Dominion Energy and Duke Energy before it was cancelled on July 5.

The prospect of new pipelines being built in the United States is not bright given the environmental opposition and potential regulatory problems. This could make the existing infrastructure that Berkshire is acquiring more valuable in the long run, assuming that natural gas continues to play a role in the country's energy consumption.

Natural gas produces only half as much carbon dioxide per unit of energy compared to coal. BHE believes that demand for natural gas will continue to grow through 2040 and will have a constructive role in the country's move toward fuels that reduce the risk of climate change.

Although a $9.7 billion transaction is not insignificant, the modest size of the cash component of the deal will hardly make a dent in Berkshire's $137 billion cash balance. The deal is best viewed as a "tuck-in" acquisition for BHE. As we can see from the image below, BHE already has significant pipeline infrastructure in the west while the Dominion assets are in the east, adding to overall geographic diversification.

Warren Buffett has not made many public statements since the annual meeting but has clearly been on the hunt for intelligent acquisition targets. It is no surprise that he found a suitable candidate in the battered energy sector which has not fully participated in the sharp rally in equity markets since April. Berkshire shareholders may have a long wait before Buffett makes his next move as long as equity markets continue their march higher.

The Irrational Tax Trap

Oliver Wendall Holmes once said that “taxes are what we pay for a civilized society." Almost everyone concedes that taxes are necessary but very few people are enthusiastic about a high tax bill. Investors are often in a position where they can determine the timing of taxable capital gains. Taking advantage of this flexibility can be beneficial but it is important to not allow the "tax tail to wag the investment dog". Unfortunately, many tax driven decisions are counterproductive.

In a new article on The Rational Walk, I explore the pitfalls of allowing tax considerations to dominate investment decision making. It is a mistake that I have made many times in the past and will probably make in the future, but perhaps there are some strategies to minimize this risk.

Click here to read The Irrational Tax Trap on The Rational Walk

Interesting Links

Twitter: Unique Internet Asset, With Improving Monetization by Elliot Turner, July 3, 2020. This excellent presentation took place at MOI Global's recent Wide Moat Summit: "For the first time in its history, Twitter management is prioritizing revenue opportunities and has a revamped, engaged board with the experience and knowhow in order to guide the process."

Capital Re-Allocation by Geoff Gannon, July 1, 2020. Book review and general discussion of Capital Allocation: The Financials of a New England Textile Mill by Jacob McDonough. This new book discusses Berkshire Hathaway's evolution from 1955 to 1985. (Focused Compounding)

Ethics in Governance Forum: “A Culture Built on Trust", June 25, 2020. Larry Cunningham and Ellen Richstone offer views on building a culture of trust. Cunningham is author of Margin of Trust: The Berkshire Business Model, which was reviewed on The Rational Walk in January. (Saint Anselm College)

Companies Hit by Covid-19 Want Insurance Payouts. Insurers Say No. by Leslie Scism, June 30, 2020. "A battle looms over ‘business interruption’ coverage, which insurers say doesn’t apply unless there is physical damage, like from a fire." (WSJ)

The Definition of Success Is Autonomy by Ryan Holiday, June 30, 2020. "Are you sure that “getting everything you want” is what you actually want? Will it mean the ability to dictate what you do today? Will it give you control of your life—insofar as that is possible as a puny human being?" (RyanHoliday.net)

A Viral Market Update XI: The Flexibility Premium by Aswath Damodaran, July 2, 2020. Professor Damodaran's latest data driven "viral update", complete with downloads and references. (Musings on Markets)

239 Experts With One Big Claim: The Coronavirus Is Airborne by Apoorva Mandavilli, July 4, 2020. The World Health Organization has resisted mounting evidence that viral particles floating indoors are infectious, according to a group of scientists. The W.H.O. says that the research is inconclusive. (N.Y. Times)

Good Enough Is Just Fine by Lawrence Yeo, July 1, 2020. "As a creator, you will never feel that your work is complete. You can only get it to a point where it feels right to let it go. And letting go is the only way to start something else that will further your creative progress." (More to That)

Regrets by Nick Maggiulli, July 7, 2020. "When people tell me that they have “No regrets,” I never believe them. Not because I think they are lying, but because I don’t think they’ve ever seriously considered the question. No regrets? Not a single decision that you would change?" (Dollars and Data)

Keep Running! by Morgan Housel, June 30, 2020. "It’s hard to accept that you have to put in a ton of work just to stay in place, but that’s how it works. Keep running." (Collaborative Fund)

Quote of the Week

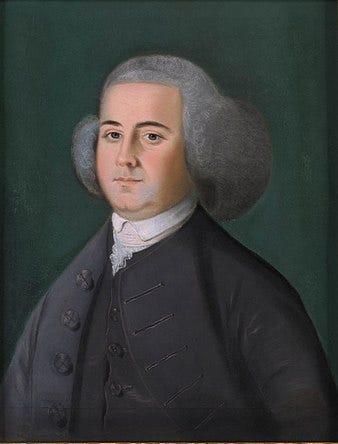

John Adams, in a letter to his wife on July 3, 1776, thought that the celebration of Independence Day would occur on July 2, the day that the Continental Congress approved the document, rather than on July 4 when it was signed.

"The Second Day of July 1776, will be the most memorable Epocha, in the History of America.—I am apt to believe that it will be celebrated, by succeeding Generations, as the great anniversary Festival. It ought to be commemorated, as the Day of Deliverance by solemn Acts of Devotion to God Almighty. It ought to be solemnized with Pomp and Parade, with Shews, Games, Sports, Guns, Bells, Bonfires and Illuminations from one End of this Continent to the other from this Time forward forever more."

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscribers information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.