Berkshire Hathaway reported $5.5 billion of operating earnings for the second quarter of 2020, a 10.2% decline from the second quarter of 2019. The effects of the COVID-19 pandemic negatively impacted results in the railroad, manufacturing, service, and retailing sectors while insurance underwriting results improved.

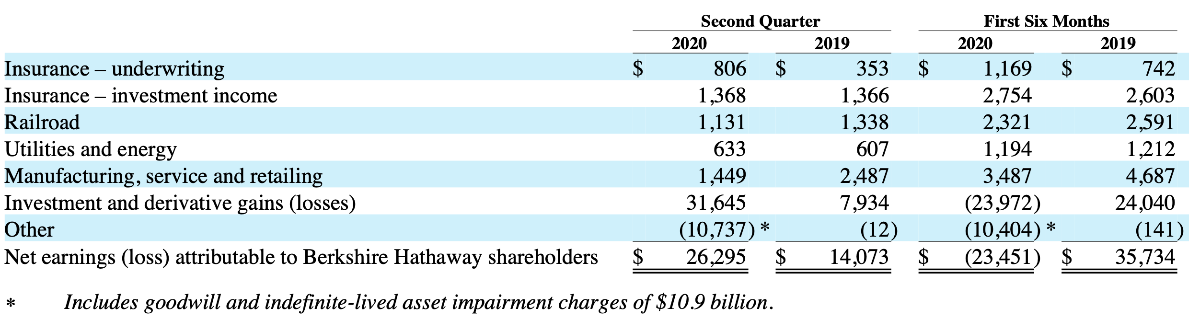

Net income for the quarter came in at $26.3 billion, up sharply from $14.1 billion in the year-earlier period. The following exhibit from the MD&A of the 10-Q report provides a useful summary of results:

As I explained in a newsletter issue following the 2019 annual report, headline net income can be very misleading when it comes to evaluating Berkshire's business performance. Accounting rules require Berkshire to report changes in the fair market value of its large portfolio of publicly traded stocks as part of net income each quarter.

During the second quarter, the stock market rallied sharply causing Berkshire's equity portfolio to rise in value by $34.5 billion, all of which is reported as part of net income. Large swings in stock prices drown out the underlying business results of Berkshire's operating companies which is why Warren Buffett prefers to focus on changes in operating income rather than net income.

Impairment Charges

Berkshire recorded $10.9 billion of goodwill and intangible impairments during the quarter, with $9.8 billion attributable to Precision Castparts which has been severely impacted by the COVID-19 pandemic. Berkshire acquired Precision for $32.7 billion in January 2016. Precision's revenue for the second quarter was $1.8 billion, down 32.5% from the year-earlier period. Pre-tax loss was $78 million for the quarter compared to pre-tax income of $481 million for the second quarter of 2019. Precision laid off approximately 10,000 employees, or 30% of its workforce, during the first half of the year and took restructuring and inventory charges of $250 million during the second quarter.

Berkshire notes that the future of commercial air travel and the aerospace industry remains uncertain and disclosed that approximately $21 billion of goodwill and intangible assets related to Precision remain on Berkshire's balance sheet following the second quarter write-down. Berkshire will be required to continue evaluating Precision's goodwill and intangibles for impairment and may have to take further write downs. These are non-cash charges but impact net income in the period they are recognized.

Insurance Underwriting

Insurance underwriting results represented a bright spot for Berkshire during the quarter with GEICO posting a 77.2% combined ratio as fewer miles driven due to the lockdowns of the second quarter translated into fewer claims from policyholders. However, GEICO announced a Giveback program during the quarter that provides 15% discounts to most new and renewing policyholders from April 8 to October 7, 2020. Berkshire estimates that GEICO premiums will be reduced by approximately $2.5 billion between April 8, 2020 and April 7, 2021 as a result of the Giveback program and that the program could result in underwriting losses later this year.

Berkshire's reinsurance group posted $1.1 billion of underwriting losses for the quarter, but only $350 million was attributed to COVID-19 related claims. For the first half of the year, COVID-19 related claims in the reinsurance segment were $575 million. At least from the perspective of management, pandemic related claims appear limited although it is likely that lawsuits related to business interruption claims will drag on for many years.

Manufacturing, Service, and Retailing

Berkshire's manufacturing, service, and retailing group was clearly impacted by the pandemic, as shown in the following exhibit from the 10-Q:

Few businesses within Berkshire's large collection of manufacturing, service, and retail businesses escaped the effects of COVID-19 during the quarter with the group as a whole posting a 16.1% drop in revenues and 44.4% drop in pre-tax earnings. While the overall level of operating leverage caused earnings to decline much more than revenues on a percentage basis, it is notable that the group, in aggregate, continued to be profitable both for the quarter and the six month period.

Most of the damage occurred in the industrial sector of the manufacturing group, as we can see from the following exhibit also taken from the 10-Q:

Precision Castparts is the largest business within the manufacturing segment and the impact of Precision's slowdown is seen within the industrial products sector. Within the industrial sector, Lubrizol, Marmon, and IMC also posted sharply lower revenue and earnings for the quarter.

Within building products, strong results at Clayton Homes partially offset aggregate declines in Berkshire's other building products businesses. Clayton posted $2 billion of revenues for the quarter, an increase of 8.2% over the prior-year period, and pre-tax earnings of $319 million, an increase of 13.2%. Clayton has been shifting its product mix toward higher priced site-built homes. Clayton also reported higher interest income from housing loans outstanding.

As of June 30, 98% of Clayton's $17.3 billion portfolio of loans were performing. However, numerous government programs including expanded unemployment assistance and stimulus checks for individuals must have helped many borrowers continue to remain current on loans. Expanded federal unemployment benefits expired at the end of July and, as of today, have yet to be extended. This could have an adverse impact on Clayton's portfolio of loans.

As expected, the service and retailing group posted lower results due to the COVID-19 lockdowns, as shown in the following exhibit:

When the widespread lockdowns began in March, I took a deep dive into Berkshire's operating businesses and I concluded that it was unlikely that the non-insurance businesses, in aggregate, would post operating losses or consume cash even in a worst-case scenario:

Despite the inability to be precise, it seems to me that it is highly unlikely for Berkshire’s operating earnings to be negative or operations, in aggregate, to consume cash for any length of time. If there are quarters in which there are operating losses for the group as a whole, Berkshire certainly has ample cash resources to avoid any kind of financial distress.

The real long term risk for Berkshire’s operating earnings is the same as the risk for the overall economy. If we emerge from the pandemic with a much diminished GDP which does not bounce back quickly, then we will face many years before 2019 GDP is again achieved. We cannot expect Berkshire’s operating companies, in aggregate, to achieve 2019 level results under conditions of economic depression, should that be the outcome of the pandemic.

Berkshire's operating results for the first half of 2020 are consistent with what I expected in March. The good news is that the businesses are still generating cash despite the severity of the downturn. The bad news is that we still have no visibility regarding the timing of a return to normalcy.

Berkshire's operating companies are unlikely to achieve pre-pandemic results until the economy fully reopens and people are confident enough to resume normal activity. Furthermore, the risk of new lockdowns and the expiration of expanded unemployment benefits could adversely impact Berkshire's businesses going forward.

Repurchase Activity

Warren Buffett's SEC filing in early July disclosing his charitable gifts led some Berkshire shareholders to suspect that the company repurchased a substantial number of shares during the second quarter. This turned out to be the case. Berkshire spent $5,115 million during the second quarter to repurchase 19,384 Class A equivalents (each B share has economic rights equal to 1/1500 of one A share).

The details of the repurchase appear in the exhibit below:

The effective purchase price per A equivalent is $263,881 which is 107.3% of quarter-end book value of $245,836 per A share.

It appears that Berkshire continued repurchasing shares during July. Page one of the 10-Q report shows 1,592,144 A equivalent shares outstanding as of July 30, 2020. This implies that 8,496 A equivalent shares were retired between July 8, the date of Buffett's SEC filing and July 30. Assuming that shares were repurchased at an average price of around $285,000, this implies about $2.4 billion was used to repurchase shares in July.

Berkshire ended the quarter with nearly $143 billion of cash, and most of that is deployable, so there is plenty of additional capacity for repurchases should Warren Buffett and Charlie Munger decide to buy back more shares. However, the stock price has increased substantially in recent days so it is reasonable to believe that repurchase activity might have slowed down as well.

The preceding discussion obviously doesn't include all of the details of Berkshire's results, only the highlights as one shareholder sees them. For more details regarding the quarter, readers should definitely refer to Berkshire's press release and 10-Q report.

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscribers information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

Individuals associated with The Rational Walk LLC own shares of Berkshire Hathaway which is mentioned in this issue of Rational Reflections.