Navigating Early Retirement

Early retirement is a dream for many Americans. In addition to saving aggressively and investing well, success depends on navigating pitfalls in the tax code.

Introduction

Financial independence is not just about money. It is about control of your time and having the option to stop trading time for money.

A billionaire who is my age has orders of magnitude more wealth than I will ever have. Wealth can purchase trophy homes, private jets, and other luxuries I will never have (and do not want), but it cannot buy substantially more time. Despite the fantasies of many technology billionaires, I am skeptical that vast amounts of wealth will ever make it possible to purchase immortality or even a substantially greater lifespan.

Most people dream about retirement but not necessarily because they dislike work. Having more time to devote to family, recreation, hobbies, and volunteer activities are common motivating factors. Unfortunately, most people fail to achieve financial independence due to the trap of an ever-ratcheting lifestyle. But for those who are motivated, early retirement is within reach even without an unusually high income. It just takes a great deal of discipline and a fiercely independent mindset.

My recent articles, The Role of TIPS in a Fixed Income Portfolio and Hedging Against Inflation Using TIPS and I Bonds, were targeted toward conservative investors who may be in the process of tapping their financial assets for retirement or for other cash flow needs. After writing those articles, it occurred to me that there are several pitfalls and opportunities related to drawdown strategies that deserve a closer look.

Writing about retirement strategies is complicated because of the large number of variables involved and the fact that so much is unknown at the time someone decides to retire. While it is possible to make educated guesses based on health and family history, no one can estimate their own longevity with precision. Healthcare needs later in retirement, including the possibility of nursing care, are also difficult to forecast. The variability of investment returns, inflation, and future tax policy are further complications. All of these uncertainties call for a great deal of conservatism.

Even those who give up employment at sixty-five should plan for at least a quarter century in retirement. Of course, early retirees must plan for a longer retirement, and this is even more true for those who opt for retirement prior to age fifty, the goal of the “FIRE” community which stands for “Financially Independent, Retire Early”. I count myself as a member of this group, although I have become more skeptical about the wisdom of very early retirement. I think that most people in their thirties and forties will be happier in some sort of paid employment that they enjoy.

This article is based on a fictional married couple preparing for retirement at the beginning of 2024 when they both turn fifty-five. The story is meant to illustrate the choices made by one couple and there are a number of simplifying assumptions. The purpose is to illustrate several opportunities and pitfalls in financial planning and the tax code that I have found important to understand in my own journey. By no means is this story an exhaustive treatment of every aspect of early retirement. However, I hope the concepts discussed can help increase awareness of several key issues.

I must stress that nothing in this article is financial or tax advice. Retirement is complicated and heavily influenced by individual circumstances. Only a qualified investment advisor or tax expert can address your specific situation. The scenarios used in this article do not resemble my personal situation and are entirely fictional.

Brenda and Eddie Redux

Brenda and Eddie were still going

Steady in the summer of '75

When they decided the marriage would

Be at the end of July

Everyone said they were crazy

Brenda you know you're much too lazy

Eddie could never afford to live that kind of life

But there we were wavin' Brenda and Eddie goodbye …

Billy Joel’s story of Brenda and Eddie didn’t end well. They were unfortunate victims of the ratcheting lifestyle trap. No matter how much they consumed and accumulated, it was never close to feeling like they had enough. Money got tight, they started to fight, and they just didn’t count on the tears. They soon got a divorce as a matter of course, but they parted as the closest friends.

The fictional Brenda and Eddie in this article made better choices and have enjoyed a much happier outcome. Approaching their mid-fifties after thirty years of marriage, they are empty nesters now that their youngest child has graduated from college. They recently made the final mortgage payment on the modest home in Austin, Texas that they purchased for $100,000 as newlyweds. To their amazement, similar homes in their neighborhood have recently sold for $500,000.1 They have two cars that were purchased for cash and one will be sold once they no longer commute to work.

In addition to home equity, the couple has the following assets:

$500,000 in Treasury Inflation Protected Securities (TIPS), with $100,000 maturing in 2024, 2025, 2026, 2027, and 2028.

$1,500,000 in the Vanguard Total Stock Market Index Fund (Admiral Shares) with a cost basis of $500,000.

$1,000,000 in a Traditional IRA which is also invested in the Vanguard Total Stock Market Index Fund (Admiral Shares).

The couple does not have traditional defined benefit pension plans, life insurance, or long-term care insurance policies and they do not anticipate receiving any inheritances in the future.

Brenda and Eddie are debt free and have a net worth of $3.5 million including home equity. Their financial assets total $3 million, of which $2 million is accessible to them without tapping their traditional IRA which would incur early withdrawal penalties if taken prior to the year in which they turn 59 1/2.2

Conventional wisdom suggests that Brenda and Eddie could safely consume four percent of their financial assets annually with minimal risk of running out of money. However, for reasons that I have previously described, I prefer to use a more conservative three percent withdrawal rate especially for early retirees who should plan for a retirement horizon of four decades or more.

Let’s say that Brenda and Eddie agree with the three percent withdrawal rate. Should they apply this rate to their entire net worth? Or to the sum of their financial assets? Or to just the subset of their financial assets that are available to them without incurring early withdrawal penalties from an IRA?

These are some of the questions that I will attempt to answer in this article. I will also assume that Brenda and Eddie plan to retire on January 1, 2024, the month in which they will both celebrate their 55th birthdays, and that their financial asset balances will remain unchanged between now and January 1, 2024.

Key Dates in Retirement

Let’s take a brief detour from Brenda and Eddie’s story to review some key dates to be aware of in retirement planning. While there are exceptions to these general rules, they apply to the majority of people who are currently in their fifties.

Prior to age 59 1/2, there is generally no access to retirement accounts without paying an early withdrawal penalty so IRA, 401k, and similar accounts should not be tapped. Health insurance will usually be purchased via the Affordable Care Act (ACA), either on the federal exchange or on state exchanges, if available. Most early retirees will be able to qualify for ACA subsidies with proper planning.

At age 59 1/2, retirees gain full access to retirement accounts. Traditional IRA and 401K plans can be accessed without paying any early withdrawal penalties, although income taxes will be due. Roth IRA plans can be accessed without incurring early withdrawal penalties or taxes, subject to limitations that are usually easy to address. However, retirees who avoid tapping these accounts can continue to enjoy valuable tax deferred compounding for many years to come.

At age 62, retirees qualify for social security benefits, albeit at a lower benefit level that will remain reduced for life. Unless a retiree faces severe financial difficulties or has strong reason to believe that he or she faces an unusually short life expectancy, it usually makes sense to avoid taking social security at 62.

At age 65, retirees qualify for Medicare. Most workers will qualify for Medicare Part A (hospital benefits) without paying a premium, but Medicare Part B requires a monthly premium of $164.90 in 2023, with higher premiums for individuals with modified adjusted gross income (MAGI) of over $94,000. Married couples filing jointly begin to incur higher premiums with MAGI over $197,000.3

At age 67, retirees qualify for “full” social security benefits. However, individuals who opt to defer receiving social security benefits will continue to accrue additional benefits until reaching age 70.

At age 70, the maximum Social Security benefit is reached and there is no further benefit enhancement for those who defer enrollment. Therefore, retirees should plan to enroll at age 70 if they have not already done so.

At age 75, retirees must begin to take required minimum distributions (RMDs) from traditional IRAs and 401Ks. Note that for those born prior to 1960, RMDs are required starting at age 73. However, Brenda and Eddie were born in 1969.

Overall Strategy

The day has finally come: Brenda and Eddie call it quits on December 31, 2023 and they are finally retired. With a mortgage-free home and substantial financial assets, the couple feels financially secure, optimistic, and very excited about the future. Even better, Brenda and Eddie both feel like they are in the prime of their lives and have every reason to believe that they will live for many decades to come.

Having lived a frugal life, Brenda and Eddie have saved substantial funds. Aside from servicing their mortgage, which has recently been paid off, they have rarely spent more than $50,000 in any year. But now they wish to spend more freely to travel and enjoy life. After decades of living frugally, they would like to aim for an annual spending rate of $100,000 per year, allowing for substantial discretionary spending.

Given their good health and life expectancy, Brenda and Eddie are planning to wait until age seventy to claim social security benefits in order to maximize the size of the benefit. In addition, they do not plan to tap their traditional IRA accounts until they are required to begin taking required minimum distributions at age seventy-five.

This means that Brenda and Eddie must initially rely on the $2 million of assets in taxable accounts consisting of $500,000 in TIPS and $1,500,000 in the Vanguard Total Stock Market index fund. Since they would like to spend $100,000 per year, this means that they will tap five percent of the $2 million each year. This is above both the conventional four percent rule and my preferred three percent rule. Is this a problem?

There is no problem.

We need to consider Brenda and Eddie’s retirement in phases. They will rely exclusively on their taxable accounts for the next fifteen years until they reach age seventy. At that age, they will begin to draw on social security and at that point they will need to draw less from taxable accounts. At age seventy-five, they will be required to begin taking RMDs from their traditional IRA and, at that point, they anticipate that there will no longer be any need to draw funds from their taxable accounts.

It’s important to note that Brenda and Eddie have significant optionality if things do not go as planned and they need additional funds prior to age seventy. Starting in 2028, they will have the option of drawing from their traditional IRA without paying penalties since they will both turn 59 1/2 years old that year. Starting in 2031, they will have the option to begin taking social security benefits. Brenda and Eddie do not intend to exercise these options, but they can do so if absolutely necessary.

In addition to the optionality of drawing from retirement accounts and taking early social security benefits, if needed, Brenda and Eddie’s cash requirements are highly tilted toward discretionary spending. If needed, they could easily cut their spending down to $50,000 or even less. After all, they are debt free and they have lived a frugal life unaccustomed to luxury, and they both have inexpensive hobbies in Austin that can consume their time if financial setbacks require reducing their spending.

To summarize, we can simplify Brenda and Eddie’s phases of retirement as follows:

Age 55 to 64

Funds to be drawn exclusively from taxable accounts.

Health insurance purchased on the ACA exchange.

Age 65 to 69

Funds to be drawn exclusively from taxable accounts.

Health insurance provided by Medicare.

Age 70 to 74

Begin taking social security benefits. Taxable accounts will continue to provide for spending in excess of social security benefits.

Health insurance provided by Medicare.

Age 75 onward

Begin taking required minimum distributions from IRAs. When combined with social security, there should no longer be a need to tap taxable accounts.

Health insurance provided by Medicare.

With the stage now set, let’s take a look at each of the phases of Brenda and Eddie’s retirement in more detail, with particular attention on how we should look at their financial assets, the sustainability of their spending, and various risks that could arise.

Phase I: 2024 to 2033

The early years of retirement can be exciting, but it is critical to put in place a strong foundation for the years to come. In Brenda and Eddie’s case, they will face two important choices right away. First, they will need to consider how to tap their taxable accounts for cash flow needs. Second, they are now responsible for ensuring that they have appropriate insurance coverage for their healthcare needs.

On January 1, 2024, Brenda and Eddie have the following assets in taxable accounts:

$500,000 in Treasury Inflation Protected Securities (TIPS), with $100,000 maturing in 2024, 2025, 2026, 2027, and 2028.

$1,500,000 in the Vanguard Total Stock Market Index Fund (Admiral Shares) with a cost basis of $500,000.

To meet the couple’s goals, they will draw down $100,000 from the $2 million portfolio in 2024. In subsequent years, they will increase their withdrawal based on inflation, as measured by the CPI-U index. Although Brenda and Eddie’s personal cost of living might not track the CPI-U index perfectly, it is a rough proxy that is meant to make it more likely that their standard of living will remain constant over time.

As I wrote in The Role of TIPS in a Fixed Income Portfolio, I like the idea of maintaining a “bond ladder” that covers five years of cash flow needs. It so happens that Brenda and Eddie have a portfolio of TIPS that is sufficient to cover their needs for the next five years. To maintain this TIPS ladder, they will need to purchase a new five year TIPS every year using funds drawn from the Vanguard Total Stock Market index fund.

The presence of the TIPS ladder insulates Brenda and Eddie from feeling compelled to liquidate stocks in a severe bear market. If the couple and their financial advisor feel that stocks should not be sold in any given year, they can forego sales in exchange for shortening the TIPS ladder. At a future date when they feel that stocks are trading at more normal levels, they can re-establish the full five year ladder.

How would the mechanics of this process work?

Cash flow for 2024 will be covered by the first maturing TIPS. Assuming the 2024 TIPS matures in January, Brenda and Eddie will keep part of the $100,000 at their bank and invest the rest in short term treasury bills for spending needs later in 2024.

However, by using the first TIPS for spending needs, the couple now has a four year TIPS ladder rather than a five year ladder. They need to purchase a new five year TIPS that will mature in 2029. How will they fund this new TIPS purchase? They will need to come up with the cash to buy the TIPS from their Vanguard stock index fund.

As of May 31, 2023, the Vanguard Total Stock Market index fund had a dividend yield of 1.55%. Brenda and Eddie will tell Vanguard to no longer reinvest dividends. This will generate approximately $23,000 of cash flow during 2024 based on their $1.5 million account balance. This is not enough to purchase a $100,000 five year TIPS, so they will sell $77,000 worth of shares in the fund.

The alert reader might be wondering if I am ignoring the question of taxes. After all, if Brenda and Eddie receive dividends and sell shares in a taxable account, they need to account for income taxes and cannot count on the full amount to buy a TIPS.

Fortunately, Brenda and Eddie will not pay any income taxes in 2024!

How is this possible? Although Texas has no personal income tax, the couple has been paying substantial federal income taxes and payroll taxes for their entire working lives and they are now multi-millionaires with a net worth of $3.5 million!

The fact is that the current tax code is very friendly to early retirees who are careful when it comes to managing their income. In Brenda and Eddie’s case, substantially all of their dividend income represents “qualified dividends” and all of the capital gains realized from selling shares in the index fund are long term capital gains.4

The federal income tax rate on long term capital gains and qualified dividend income is 0% for couples with taxable income under $89,250 in 2023. This figure is indexed for inflation and will be substantially higher in 2024 based on recent inflation trends.

Brenda and Eddie are likely to have the following gross income in 2024:

~ $25,000 in interest and inflation adjustments for the TIPS portfolio. As I explained in Hedging Against Inflation Using TIPS and I Bonds, the IRS considers TIPS inflation adjustments to be income on an annual basis even though the adjusted principal is not received until maturity. This is considered ordinary taxable income. The amount might be higher or lower than $25,000 depending on the rate of inflation in 2024, but $25,000 seems like a reasonable estimate.

~ $23,000 of dividend income from the Vanguard Total Stock Market Index mutual fund, which will be almost entirely comprised of qualified dividends eligible for the 0% federal income tax rate.

~$51,000 of long term capital gains from the sale of $77,000 of Vanguard Total Stock Market Index mutual fund shares. Recall that the average cost basis of the account is $500,000, representing one-third of the current market value. I assume that the average cost basis method is used to calculate realized capital gains, which will result in a long term capital gain of ~$51,000 in 2024.

The standard deduction for married couples in 2023 is $27,700 and will increase in 2024 based on the rate of inflation this year. The standard deduction will more than fully offset the ~$25,000 of ordinary income from the TIPS portfolio and the small amount of non-qualified dividend income. This will leave the couple with ~$74,000 of combined qualified dividend income and long term capital gains, well below the $89,250 threshold for the 0% tax rate on such income. As a result, it appears that Brenda and Eddie will not owe any federal income tax in 2024. Assuming that tax laws remain unchanged, which is not a certainty, Brenda and Eddie are unlikely to pay any material amount of income taxes during the first fifteen years of their retirement.

But wait, there’s more good news!

Brenda and Eddie used to get health insurance coverage from their jobs, but this ended when they retired. Although many employers allow workers to continue workplace coverage for a period of time at their own expense, Brenda and Eddie are aware of the subsidies available under the Affordable Care Act.

To get an idea of the plans available to Brenda and Eddie, I ran a search on the healthcare.gov website using the Austin zip code of 78704. This will not exactly match the financial situation or plan choices in 2024, but it serves as a good proxy.

The ACA guarantees that Americans can sign up for healthcare plans without medical underwriting, that is, without consideration for any pre-existing conditions. The only questions that must be answered to produce a quote are the ages of the individuals seeking coverage, their smoking status, and their zip code.

Subsidies are determined based on adjusted gross income (AGI). In Brenda and Eddie’s case, all of their income sources count toward AGI. Based on the analysis above, they expect $99,000 of AGI. This entitles the couple to a subsidy of $923 per month toward a health insurance plan of their choice.

My search produced 126 plans ranging in price from $1,120 to $2,655 per month. These plans vary in quality in terms of level of coverage and deductibles. However, the $923 monthly subsidy can cover a large percentage of the vast majority of ACA plans. As a result, Brenda and Eddie’s health insurance expenses should be quite low.

Several of the plans qualify for an annual health savings account (HSA) contribution. In Brenda and Eddie’s case, they would be able to contribute up to $10,300 toward a HSA in 2024. HSA contributions are deducted from both AGI and taxable income. Funds within HSAs grow tax free and withdrawals can be made tax free for qualifying medical expenses, with unspent funds carrying over from year to year.

Is it right that multi-millionaire early retirees like Brenda and Eddie can qualify for very large subsidies under the Affordable Care Act? This is a political question. Obviously, Brenda and Eddie could decline to accept ACA subsidies, but I do not consider it morally wrong to maximize benefits available in the tax code.

Is it possible to project how Brenda and Eddie’s financial situation will develop for Phase I of their retirement? With the important caveat that investment returns will vary considerably from year to year, we can make a rough estimate of the depletion of their taxable funds and the growth of their traditional IRA from 2024 to 2033.

In the exhibit below and throughout this article, all figures are presented in real terms using 2024 dollars. My assumption is that the Vanguard Total Stock Index fund will produce a real return of 4% and that the TIPS portfolio will produce a real return of 0%. I am presenting these figures in real terms because the rate of inflation over the next decade is impossible to predict. Selecting 4% as the real return on stocks is meant to be conservative. From May 1993 to May 2023, the real return on the S&P 500 was 5.1% without including dividends and 7.1% assuming reinvestment of dividends.

Looking at each line of the exhibit, we can see that the real value of the taxable stock portfolio declines as withdrawals are made. For example, the taxable stock portfolio’s projected value for 2025 is calculated by taking the initial value of $1,500,000, subtracting the $100,000 drawdown for 2024, and assuming a 4% real return:

2025 Value = (2024 Value - 2024 Drawdown) * 1.04

2025 Value = (1,500,000 - 100,000) * 1.04

2025 Value = $1,456,000The same formula is used for the subsequent nine years of the exhibit. The reason the real value of the taxable portfolio is declining is because the assumed real return is not sufficient to fully offset the rate of withdrawals.

The TIPS portfolio just holds its value in real terms, so why maintain it? As I alluded to earlier in this article and in my previous articles on bond ladders, the presence of the TIPS portfolio is to act as ballast for the couple’s finances during times when stocks are in a bear market. In reality, returns on stocks will not occur in the steady manner shown in the exhibit. Stock returns are volatile. Knowing that the TIPS portfolio is available to tap into for an extended period of time without a fire sale of stocks should provide a psychological benefit as well as a potential financial benefit.

Turning our attention to the last column of the exhibit, we can see that the couple’s total assets in real terms is holding up quite well because the IRA is being left to compound undisturbed for the entire period. The return assumption for the IRA is also a 4% real return since it is invested identically to the taxable stock portfolio.

Assuming that the tax code is not materially changed over the ten year horizon, Brenda and Eddie appear to be on course to enjoy their first decade of retirement drawing a substantial income with minimal income tax liabilities and their health care costs should be well contained assuming that ACA subsidies are not reduced. Better yet, their real net worth should hold fairly steady over this period as well, providing safety and flexibility as they enter the next phase of their journey.

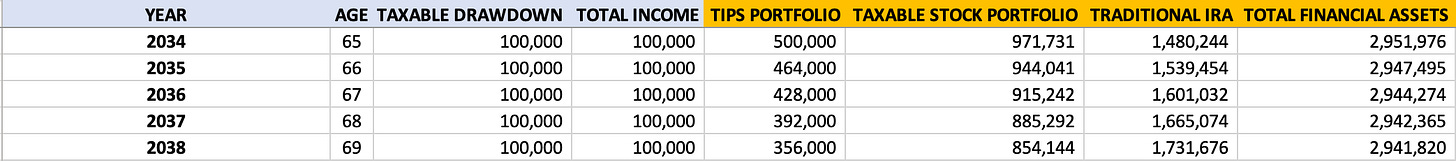

Phase II: 2034 to 2038

Note: All dollar figures in this article are expressed in 2024 dollars.

Starting in 2034, Brenda and Eddie will qualify for enrollment in Medicare, so they will no longer purchase health insurance on the ACA exchange. As we discussed in Phase I, generous ACA subsidies should be available based on projected adjusted gross income during the first ten years of retirement. However, without subsidies, ACA plans can be expensive. At age 55, the cost of an unsubsidized plan for the couple ranges from $1,120 to $2,655 per month and this cost increases with age.

Medicare Part B requires a monthly premium of $164.90 in 2023, with higher premiums for individuals with modified adjusted gross income (MAGI) of over $94,000. Married couples filing jointly begin to incur higher premiums with MAGI over $197,000, so it is important to avoid income spikes in any single year that could result in higher premiums. Those who enroll in traditional Medicare often choose to purchase a “Medigap” plan which helps pay for out-of-pocket costs not covered by insurance. Alternatively, some beneficiaries opt to enroll in a Medicare Advantage “managed care” plan offered by private companies.

A full discussion of the pros and cons of the options available in Medicare enrollment is beyond the scope of this article, but the transition from a subsidized ACA plan to Medicare is likely to be relatively neutral in terms of overall costs.

In terms of drawdown strategy, nothing will change in Phase II. The couple will continue to draw down $100,000 per year from their taxable portfolio since they will opt to defer starting social security and will not draw funds from the traditional IRA.

However, now that social security benefits are on the horizon, it is important to plan for how the composition of the couple’s income will change starting in Phase III. The couple’s social security benefit is likely to be around $36,000. Starting in 2039, they will no longer need to draw down $100,000 from their taxable investment account. Instead, they will only need to draw down $64,000.

As a result, the TIPS ladder can become smaller. Each year during Phase II, Brenda and Eddie will consume the maturing $100,000 TIPS, but they will only invest $64,000 in a new five year TIPS. Over the five years of Phase II, $64,000 will be invested in TIPS maturing in 2039, 2040, 2041, 2042, and 2043. This reduces the amount of stock that the couple must liquidate from their taxable portfolio, thereby resulting in lower realized long-term capital gains. In addition, the smaller TIPS portfolio will produce less taxable income during Phase II.

The following exhibit shows the projected portfolio during Phase II. The assumption of a 4% real return on stocks and a 0% real return on TIPS remains unchanged.

Despite only liquidating $64,000 from the taxable stock portfolio every year rather than the $100,000 liquidation that was required in Phase I, the real value of the portfolio continues to decline. However, the traditional IRA’s value continues to increase since it has been left untapped. Overall, total financial assets remain relatively constant in real terms.

As we reach the end of the first fifteen years of Brenda and Eddie’s retirement, we can see that the taxable stock portfolio’s real value has declined from $1.5 million in 2024 dollars to just over $850,000. The taxable stock portfolio has borne the burden of supporting the couple’s retirement for a decade and a half, but their income situation will change significantly over the next decade, as we will see in the next two phases.

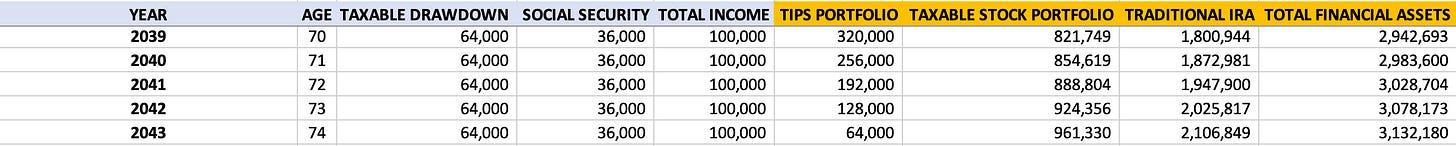

Phase III: 2039 to 2043

Note: All dollar figures in this article are expressed in 2024 dollars.

As Brenda and Eddie blow out the candles on their seventieth birthday cakes, they will celebrate finally being on the receiving end of social security when they start taking benefits. By waiting until seventy, they will enjoy maximum social security benefits, indexed for inflation, for life.5

The couple’s $36,000 social security benefit is not sufficient to fund their desired $100,000 of spending, so they will require funds from their taxable portfolio. Due to their good planning during Phase II, a TIPS will mature every year during Phase III which will provide the necessary $64,000 of cash to supplement social security.

Since Brenda and Eddie are forward looking, they realize that in five years they will have to start taking required minimum distributions (RMDs) from their traditional IRA at the age of 75. Given the large size of the IRA and the formula for RMDs (which will be discussed in more detail in Phase IV), it appears that the combination of the RMD and social security will more than cover the couple’s cash flow needs starting at age 75, meaning that no further funds will be required from the taxable portfolio.

Up to this point, the couple has regularly liquidated stock in their taxable portfolio to purchase a new five year TIPS every year. However, starting in 2039, this will no longer be necessary since RMDs and social security will cover their spending starting in 2044 when they turn 75. As a result, the taxable TIPS portfolio will be allowed to “run off” and no new TIPS will be purchased. This means that no stock will be liquidated in the taxable portfolio and no long term capital gains will be realized.

Although it is likely that part of the couple’s social security income will be taxable, the fact that the TIPS portfolio will be in “run off” mode means that it will produce less taxable income every year and there will be no capital gains since no stock will be sold in the taxable portfolio. As a result, income tax liability should be fairly minimal during Phase III. The couple may choose to realize tax-free capital gains every year and immediately repurchase stocks which will result in a higher cost basis and a lower future income tax burden. However, doing so is entirely optional.

The following exhibit shows the projected portfolio during Phase III. The assumption of a 4% real return on stocks and a 0% real return on TIPS remains unchanged.

We can see that the TIPS portfolio is dwindling down while the lack of liquidations from the taxable stock portfolio means that its real value is now on the upswing. Meanwhile, the traditional IRA continues to grow unimpeded by any withdrawals. Total financial assets are also on the upswing. The couple’s finances are in solid shape at they near age seventy-five and the start of Phase IV.

Phase IV: 2044 to ???

Note: All dollar figures in this article are expressed in 2024 dollars.

At age seventy-five, the days of tax-deferred compounding in the couple’s traditional IRA are drawing to a close. Uncle Sam now wants his share of Brenda and Eddie’s IRA, although he is considerate enough to spread the tax burden over the rest of the couple’s lifetime rather than asking for his take all at once.

Every year starting in 2044, Brenda and Eddie will calculate their RMD based on the value of the traditional IRA on January 1 divided by a life expectancy factor. For example, at age 75, the life expectancy factor is 24.6. This factor declines every year as the couple gets older in recognition of the assumption that they have fewer years left.

As the life expectancy factor declines, the RMD will increase assuming that the account size remains relatively constant with investment returns more or less covering the RMD during the initial years of withdrawals.

Our projection is that the value of the traditional IRA will be approximately $2.2 million on January 1, 2044 resulting in a RMD of approximately $89,000. Combined with social security of $36,000, the couple’s pre-tax income will be approximately $125,000. Unfortunately, the days of paying little or no income tax are now over. The entire IRA distribution is taxable along with most of the social security benefit. Although the couple’s income has increased to $125,000, it is likely that they will not see much of an after-tax increase in spending power due to taxes on the RMD.

The following exhibit shows the projected portfolio during Phase IV. The assumption of a 4% real return on stocks and a 0% real return on TIPS remains unchanged.

I chose to cut off this exhibit at age 85, but the same basic drawdown strategy will continue for the rest of the couple’s lives. I have applied the life expectancy factor for each year based on the couple’s age and the projected balance of the IRA. Over time, the RMD will increase due to declining life expectancy.

We can see that the couple remains in good shape in terms of total income, even after considering likely taxes due on the IRA distributions, although we cannot precisely guess what tax rates will look like in the 2040s. Since the taxable stock portfolio is no longer needed for the couple’s cash flow, its real value starts to increase nicely and total financial assets begin a slow upswing.6

Old Age Contingencies

As the couple reaches their mid-eighties, hopefully they will remain in good health. However, the reality is that eventually old age will impose limitations on their activities and potentially require assistance in tasks of everyday living. This reality is one reason for conservatism earlier in retirement. Due to Brenda and Eddie’s good planning, the real value of their financial assets has remained intact and even increased to a small extent during their first three decades of retirement.

It is common to read criticisms of financial plans that result in a large net worth late in life. After all, shouldn’t people enjoy their wealth while they are young rather than hoarding it for extreme old age or to leave to their heirs?

This is not an invalid question, but the premise is that Brenda and Eddie have deprived themselves of something important in order to remain multi-millionaires in their old age. Recall that the couple never spent more than $50,000 per year prior to retirement and they doubled their consumption to $100,000 per year when they retired. I doubt that they felt deprived of anything, but they certainly could have afforded to spend even more if they really wanted to or if unfortunate events compelled them to.

Although everyone has different priorities, my view is that most people would prefer to remain in their homes and avoid institutional settings. In-home nursing care is extremely expensive, especially if needed on a 24/7/365 basis. It is not unusual for such care to cost $30/hour or more in major urban areas. If serious debility requires constant care, the bill can add up to a quarter million dollars per year. A person requiring that level of care is also likely to have other large medical bills that must be paid for out of pocket. Long-term care insurance is a possibility not explored in this article that could potentially mitigate the need to pay for some costs out-of-pocket.

There are other complexities not discussed in this article and many simplifying assumptions that have been made. In particular, both Brenda and Eddie are the same age and I have not explored strategies related to spousal social security benefits or survivor benefits due to the second to die. As I mentioned at the outset, retirement is a complex topic and individual situations vary widely.

Conclusion

The point of our fictional story is to present a simple scenario that reveals some of the opportunities available to early retirees and key pitfalls to avoid. Obviously, most people in their mid-fifties do not have a $3.5 million net worth and the early retirement plan presented in this article might appear wildly unrealistic. However, I do not believe that it is unrealistic for a couple to accumulate such a net worth provided that they have a decent income and live far below their means, saving a great deal of money and investing it well for many decades.

Several years ago, I wrote Fifteen Years to Financial Independence about a twenty-five year old married couple with a goal of retiring at forty. If that couple continued to work and save for another decade, they would have been in a position similar to Brenda and Eddie in this article. The reality is that few people will elect to make these choices, but that does not make early retirement impossible even if it is uncommon.

To bring our story to a close, if Brenda and Eddie live to be a hundred years old, they should have an estate worth in the neighborhood of $4 million in 2024 dollars based on a continuation of the scenario in Phase IV. Although estate tax law can change, it is highly unlikely that their estate will be subject to tax.7 The value of their stock portfolio will also receive a “step-up” in cost basis, leaving their heirs with a substantial inheritance, something that Brenda and Eddie are happy to provide for their children and grandchildren.

The End

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues or on social media.

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

The median home price in the Austin-Round Rock region was $92,000 in June 1993 and $465,000 in April 2023, representing an annualized increase of ~5.5%.

There are limited exceptions to early withdrawal penalties for tax deferred retirement accounts. If Brenda and Eddie’s retirement savings were held in a 401k plan set up appropriately, they could elect to take withdrawals starting at age 55 under the so-called “Rule of 55”. However, this provision does not extend to traditional individual retirement accounts. If Brenda and Eddie’s retirement savings were in a Roth IRA rather than a traditional IRA, they could potentially make withdrawals of their contributions (but not earnings) prior to 59 1/2 without paying penalties.

While most Medicare beneficiaries pay their premium through an automatic deduction from their Social Security check, one does not have to receive social security to enroll in Medicare. In such cases, retirees will receive a quarterly bill for Medicare Part B premiums.

In 2022, 93.97% of dividends paid by the Vanguard Total Stock Market Index Fund (Admiral shares) were “qualified dividends” for tax purposes.

While it is true that current government projections indicate that social security benefits may have to be severely cut sometime in the 2030s, my view is that politicians are unlikely to deal with the famous “third rail” of American politics by punishing seniors who already qualify for benefits. That being said, social security cuts are a risk, just like the risk of lower-than-expected investment returns, that must be considered in any retirement plan.

I should note that the couple may wish to establish a five year TIPS bond ladder within the IRA at this point, operating on the same principles as the taxable TIPS portfolio earlier in retirement. However, for the sake of brevity and because the mechanics would be identical to what I presented previously, I have not introduced that complexity in Phase IV. If the couple chooses to establish a TIPS portfolio, the overall real return of the IRA will probably fall from 4% (for an all stock portfolio) to something closer to 3%.

Under current law, the estate tax exemption is $12,920,000 per person, far in excess of Brenda and Eddie’s projected estate. However, the exemption is set to be reduced in 2026 unless new legislation is passed. Without new legislation, the exemption will revert to 2017 levels plus inflation adjustments between 2017 and 2025. Fidelity estimates that the exemption will be approximately $7 million per person in 2026 unless new legislation passes.

Very informative! Thank you.

Would this game plan differ substantially if an IRA Roth is utilized instead of a traditional IRA? What taxes are we talking about at 75?

My daughter and son in law are a perfect match to your fictional couple right down to Austin residence. They are considering same from big tech names. Sent them your informative missive to aid decision. Her parents (us) are still working and her father under contract till he’s 71. Big difference between Boomers and GenX. They can’t wait to quit working while we enjoy contributing and adding value. It’s gotten much harder and weirder since Covid but we will finish out.

Thank you for this great piece.