Markel's 2023 Omaha Brunch

Continuing a tradition dating back to 1991, Markel's management team answered questions for two hours on the day after the Berkshire Hathaway annual meeting.

“It really helps if you know which hunting ground to look in. In fact, we all do better hunting where the hunting is easy. I have a friend who’s a fisherman. He says, ‘I have a simple rule for success in fishing. Fish where the fish are.’”

Let’s imagine that you are running a small insurance company that was family owned and operated for many decades until it went public five years ago. As a newly public company, you are relatively unknown in the investing community. You hope to attract shareholders who have a long term mindset and will allow management to focus on years and decades rather than quarters. How can you attract such shareholders?

Many investors claim to have a long term mindset but few actually do. It might be an exaggeration to say it is like searching for a needle in a haystack, but perhaps not by much. What if you could look for such investors in a location where they are known to congregate? Your odds of attracting a solid shareholder base would be much higher. This is precisely what Markel Corporation has been doing since 1991 by hosting a brunch in Omaha on the day after the Berkshire Hathaway annual meeting.

This year, the Markel brunch took place on Sunday, May 7. CEO Tom Gayner and his management team answered questions covering a wide range of topics for two hours. I did not attend the Berkshire meeting and was not at the Markel event. However, Markel recently posted a video of the Q&A session which appears below. It is well worth taking the time to watch the entire video if you are interested in how a smaller company has taken the Berkshire playbook and emulated many aspects of it.

With shareholders’ equity of $505 billion and a market capitalization of just over $700 billion, Berkshire Hathaway’s immense size is an inherent constraint on its future growth. In contrast, Markel has shareholders’ equity of $13.7 billion and a market capitalization of $17.7 billion. There are a greater number of opportunities for Markel when it comes to allocating capital toward marketable securities or acquisitions.

It is interesting to note that Markel has allocated a large percentage of its equity portfolio to Berkshire Hathaway for many decades. As of March 31, 2023, Berkshire’s Class A and B shares accounted for 12.6% of Markel’s equity portfolio. Tom Gayner is not only a longtime admirer of Warren Buffett and Charlie Munger, but he has also chosen to make Berkshire the cornerstone of Markel’s equity portfolio.

What does Berkshire’s management think of Markel Corporation? Would Warren Buffett consider Markel to be a potential acquisition target?

Markel is not that much larger than Alleghany, an insurer that Berkshire acquired last year. Shortly after the Alleghany acquisition was announced, I wrote an article speculating that Markel might be Berkshire’s next acquisition. Has Mr. Buffett ever offered to acquire Markel? There has never been any public announcement, but we do know that Berkshire acquired 420,293 shares of Markel during the first quarter of 2022 and modestly increased the investment during the second quarter. Berkshire now owns approximately 3.5% of Markel’s outstanding shares.

There seems to be mutual admiration between the two companies, but my guess is that Markel will remain independent. If that is the case, Berkshire shareholders might consider whether they should also invest in Markel. The question is whether Markel offers higher expected returns compared to Berkshire sufficient to account for the greater level of risk involved in owning a smaller and less diversified company.

In this article, I have highlighted four points of discussion that came up during the Markel brunch Q&A session:

I have not attempted to transcribe the meeting or to cover every single topic that came up during the discussion. Instead, my focus is mostly on exploring how Markel might resemble Berkshire Hathaway at an earlier stage of development. How should Berkshire shareholders think about a potential investment in Markel?

For readers who are not familiar with Markel, I suggest reviewing my article posted in April 2022, Does it Make Sense for Berkshire Hathaway to acquire Markel Corporation?. This article provides background information on the “mini Berkshire” concept in general and how it might apply to Markel specifically. There are also several articles related to Markel that have been published on The Rational Walk in recent years. Also, readers may want to check out the Berkshire Hathaway Resources page.

Fixed Maturity Portfolio

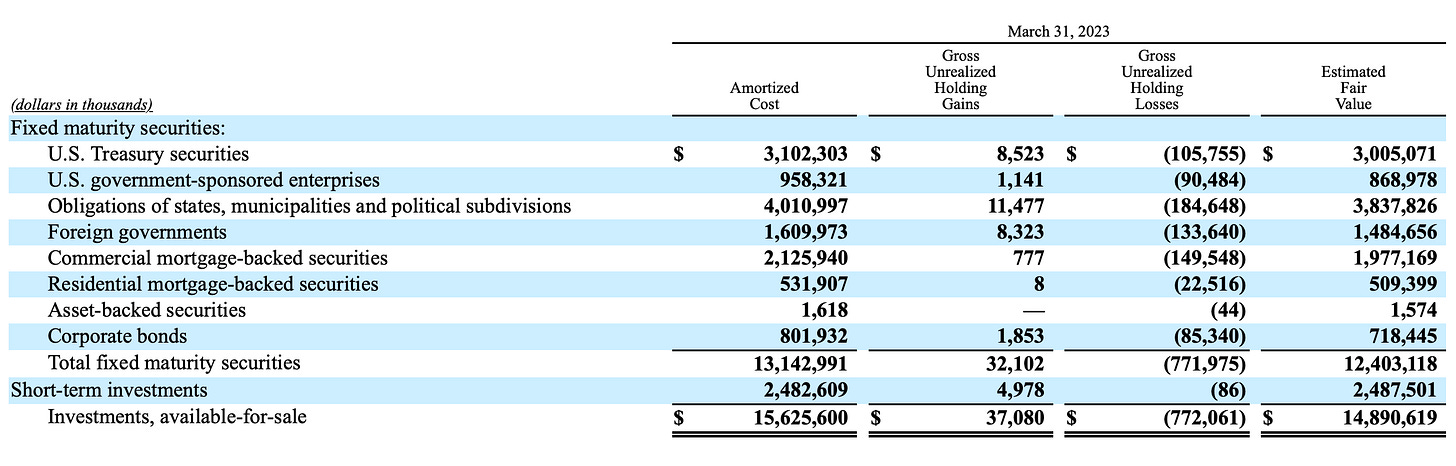

Markel has long maintained a large fixed maturity portfolio that is designed to match the projected amount and timing of insurance liabilities. Markel has a far higher allocation to bonds compared to Berkshire. As of March 31, 2023, Markel’s fixed maturity portfolio had an amortized cost of $13.1 billion and estimated market value of $12.4 billion. Markel carries its fixed maturity portfolio on its balance sheet at market value. The following exhibits show the composition of the portfolio:

Within the context of Markel’s invested assets of $23 billion, fixed maturity securities account for 53.9%, with equity securities at 35.3%, and short-term securities at 10.8%. In addition, Markel held $5 billion of cash and cash equivalents as of March 31.

Over the years, many investors have noted that Markel has a much higher allocation to fixed income compared to Berkshire Hathaway. The difference is dramatic. As of March 31, Berkshire held only $22.6 billion of fixed maturity securities compared to $328.2 billion of equity securities. To the extent that equity securities offer greater long-term returns than fixed income, this would be an advantage for Berkshire.

A couple of questions early in the Markel brunch Q&A addressed the question of the company’s fixed income allocation. Markel’s policy is to analyze expected insurance liabilities, both in terms of size and timing, and attempt to match the flows of fixed income maturities to claims liabilities. This approach of cash flow matching is conservative and Markel does not want to take credit risk. According to the latest 10-Q, the average credit rating of the portfolio is AAA with 99% of the portfolio rated A or better by at least one nationally recognized rating agency.

I found one aspect of the discussion particularly interesting. Tom Gayner spoke about how there is an accounting mismatch that could cause distortions when interest rates change. While the bonds in the portfolio are always marked to market, the same is not true for insurance liabilities. Loss reserves are not marked to market or discounted, except in cases required by law. As a result, in periods of rising rates, the value of the fixed maturity portfolio declines but insurance liabilities on the balance sheet do not decline even though the net present value of those liabilities is lower.

To the extent that insurance liabilities are accurately matched by bonds, Markel has a natural hedge in place when it comes to interest rate fluctuations. The declining value of bonds in the portfolio is offset by declining value of loss reserves even though the loss reserves are not marked down on the balance sheet.

Mr. Gayner also discussed Markel’s allocation to fixed maturity securities relative to Berkshire in response to a question from a shareholder. He stated that there will come a point in time when Markel is less constrained in its allocation between bonds and stocks. The key metric to track is whether equity capital is growing at a faster rate than insurance liabilities. This builds a margin of safety and provides leeway in terms of how capital can be invested, either toward equity securities or toward wholly owned subsidiaries via Markel Ventures.

In his 2021 letter to shareholders, Mr. Gayner explained how he thinks about Markel’s allocation of capital and how this interacts with regulatory requirements. The company must maintain sufficient capital to satisfy regulatory requirements. Treasury securities and other high quality fixed income investments are given “full credit” by regulators whereas equity securities receive only fifty percent credit. Investments in wholly owned subsidiaries through Markel Ventures receive no credit.

The bottom line is that as shareholders’ equity grows faster than insurance liabilities, management’s flexibility with respect to reducing bond investment allocations will increase. Since Tom Gayner has a strong record in equity investments, shareholders should benefit if the allocation to equities can increase in the future.

Interest Rates and Inflation

A shareholder asked Tom Gayner how he thinks about the appropriate discount rate when valuing investments and whether the discount rate changes over time. This was in the context of investments in marketable securities as well as the acquisition of wholly owned subsidiaries.

Mr. Gayner’s answer emphasized that he does not use academic formulas to arrive at an extremely precise discount rate. In finance courses, students are taught to calculate weighed average cost of capital in a precise manner, but practitioners typically come up with ballpark numbers. Currently, this is about 10%, but in the 1990s when bond yields were much higher, the discount rate might have been 14-16%.

What I found very interesting, and reassuring, is that Mr. Gayner refuses to lower the discount rate when he believes that interest rates are unusually low and unlikely to stay low for a long period of time. When interest rates fell to zero, he still held the line in his mind at a 10% discount rate. Of course, the implication is that this results in acting on fewer opportunities since most investors are willing to lower their discount rates in a search for returns in a zero interest rate world.

These comments echo similar statements made by Warren Buffett over the years. If interest rates are financial gravity, asset prices can get out of control when rates fall if investors are willing to accept lower returns, the implication of using a lower discount rate to value future cash flows. Refusing to play that game is a conservative posture that can hurt results in bull markets but preserve capital in a rising rate environment.

Regarding inflation, Mr. Gayner said that his fixed income strategy of matching the duration of bond investments to insurance liabilities remains unchanged and that he is not confident in his ability to predict inflation.

Later in the session, Mr. Gayner came up with an interesting analogy between interest rates and curfews for teenagers. When rates are high, investors are conservative when valuing equity investments because the opportunity cost is high. Why take major risks in equities when you can earn a double digit rate of return in fixed income securities? As interest rates fell over the past four decades, it was like the curfew going later and later, culminating in rates near zero. When rates are extremely low, that is like a teenager with a curfew past midnight. Bad things are likely to happen.

Use and Limitations of EBITDA

A shareholder mentioned that Warren Buffett and Charlie Munger have long referred to EBITDA (earnings before interest, taxes, depreciation, and amortization) as “bullshit earnings”. In light of this, why does Markel report on Markel Ventures results using EBITDA?

Mr. Gayner responded by explaining that he fully understands that the D in EBITDA — that is depreciation — is a very real expense and should not be glossed over. He stated that capital expenditures are disclosed in the financial statements and that replacement capex is often even greater than reported depreciation. Shareholders have the tools they need to estimate operating earnings from the figures supplied.

The question remains why management refers to EBITDA at all, and apparently this practice is to be in a position to communicate with people who automatically think in terms of EBITDA when it comes to business acquisitions. Since Markel is in competition with private equity and other potential acquirers, sellers often think in terms of EBITDA. While Berkshire has grown beyond having to cater to the communication preferences of others, Markel has not and must act in an ambassadorial manner when it comes to dealing with prospective sellers.

Loss Reserves and Trust in Management

Toward the end of the session, there were questions related to how shareholders should think about loss reserving adequacy and trust in management. This was in the context of a thought experiment of what type of event could torpedo Markel.

Mr. Gayner said that he and the management team think about this all the time since managing risk is what they do. Markel has a longstanding policy of preferring to have reserves that are redundant, or more than adequate, rather than to take the risk of reserves falling short. Over long periods of time, this has proven to be the case.

While reserve development can vary widely from quarter to quarter, you can start to see some patterns emerge over years and decades. Mr. Gayner noted that if management has a mindset of being a principal rather than an agent, the focus is on the balance sheet and ensuring adequate reserves. On the other hand, if the mindset is that of an agent, the income statement will reign supreme. From his perspective, the balance sheet is kept conservative and the income statement is like a residual from changes in the balance sheet.

Trust is critical when it comes to investing in an insurance company. Investors who do not trust management should not invest in the stock. Mr. Gayner noted that there are ways to verify whether management is trustworthy, and this should be measured over long periods of time. Reserves that are more than adequate year after year are not there by accident — this indicates conservatism and warrants trust in management.

Conclusion

When asked whether Berkshire Hathaway or Markel represents the better investment, Tom Gayner responded by saying that the answer would be different based on what an investor is looking for. Mr. Gayner spoke about how Berkshire has been a role model for Markel and has provided a “spectacular playbook” that has helped Markel run its business differently. This was a somewhat unfair question to ask the CEO of a public company, but there is no doubt the question was on the minds of many attendees.

How should a shareholder of Berkshire Hathaway think about investing in Markel? These are clearly very different companies. Berkshire is a massive conglomerate with highly diversified operations while Markel is far more dependent on its insurance operations. Berkshire has been buying non-insurance subsidiaries for over a half century while Markel purchased its first Markel Ventures business in 2005. Markel has a far higher allocation to fixed maturity investments compared to Berkshire.

Perhaps the most compelling reason to consider Markel is that it is a far smaller company with more flexibility. Markel can consider investments in publicly traded stocks that are too small for Berkshire. The same is true when it comes to acquisitions. The universe of potential investments is far greater at Markel than it is at Berkshire Hathaway. Management also has a far longer runway. Tom Gayner is 61 years old and indicated that he plans to run Markel indefinitely, even alluding to the possibility of attending a Markel brunch a quarter century from now.

Assume that you are an investor who would have to sell Berkshire shares in order to buy Markel. Logically, you would have to expect a higher return from Markel than from Berkshire because Markel is smaller, less diversified, and therefore riskier than Berkshire. For example, if you expect Berkshire’s intrinsic value to grow by high single digits over the next two decades, you would probably want at least low double digit growth from Markel to consider an investment.

I do not make investment recommendations, but I do disclose whether I own the companies that I write about. I have owned Berkshire Hathaway shares on a continuous basis since February 2000, although I have bought and sold shares of Berkshire several times over the years. I first purchased Markel in March 2011 and held shares continuously until March 2022 when I sold my personal holdings. I still hold Markel in a custodial account that I manage for the benefit of family members.

While it is arguably more likely than not that Markel will outperform Berkshire over the next decade, I do not necessarily think that the outperformance will be dramatic from where the shares traded in March 2022 or from today’s prices. I continue to follow Markel closely and could own it again in the future if the relative valuation of Berkshire and Markel change materially.

Management of both companies deserve our trust and it will be interesting to see how the situation develops in the years and decades to come. I doubt that shareholders of either company will experience unsatisfactory results with shares held for many years.

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues or on social media.

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Ravi, you wrote, “As interest rates rose over the past four decades,..” Didn’t you mean ‘declined’?

You make an important point: Tom Gayner, and Steve Markel, have been serious students of Buffett for over 3 decades. They have carefully sought to model Markel after Berkshire--to the extent they are allowed. Markel is not authorized by its insurance commissioner to hold concentrated equity positions in its insurance capital, as Berkshire has since the mid-80s; it must hold much higher levels of fixed income securities. This hurt them at zero interest rates.

Tom once told me that he and Steve decided after Markel went public not to set up an investor relations office: it would only produce the kind of short-term investor they didn’t want, and they would be forced to hold regular presentations. In the early days, if you called the IR phone number, you got Tom’s office, if his secretary recognized you, she or he would put you through. They started the Omaha brunches when they realized that Berkshire’s shareholders were the kind of shareholders they wanted to attract. My guess is that a very large percentage of Markel shareholders were represented at the latest brunch. As an aside, Warren once said to me that he measured his performance as CEO by how few shares traded; to which he added, with a chuckle: that is not how his fellow CEOs think, nor on Wall Street. My guess is that Markel experiences low turnover, which of course mirrors Berkshire for the same reason. And that explains why both have resisted splitting their shares.

Thanks for writing thoughtful pieces!