Henry Ford's Life and Work

In a biography published a century ago, Henry Ford reflected on the early days of the automobile industry. We have much to learn from Ford despite serious flaws in his judgment and character.

“Well, I would say that Charlie and I, we long have felt that the auto industry is just too tough. You know, the Ford Motor Company, I mean, Henry Ford, looked like he owned the world with the Model T. And he brought down the price dramatically, he took up wages dramatically. He might have been, with a different personality, or some different views, elected President of the United States.”

My first car was a 1965 Ford Mustang purchased when I was six months short of my sixteenth birthday. In the late 1980s, the early Mustangs were regarded as old cars that were fun to drive, not as classics to be coddled and displayed at car shows.

The Ford Motor Company sold nearly 1.2 million Mustangs between the 1964 1/2 and 1966 model years. The cars were affordable, abundant, simple to maintain, and fun to drive. Brand loyalty can be extremely powerful, especially when formed at an early age. I went on to purchase two new vehicles from Ford over the next two decades.

The 1964 1/2 Mustang was unveiled at the 1964 World’s Fair on April 17, 1964. By that time, Henry Ford had been dead for seventeen years, but there is no doubt that the Mustang was a car that Ford would have appreciated. The base sticker price was $2,368, the equivalent of $23,500 in today’s dollars. It was relatively affordable at a time when the median family income was $6,600. The Mustang was an immediate success and served millions of drivers very well for decades. It was exactly the type of value proposition that Henry Ford would have heartily approved of.

Henry Ford pioneered the moving assembly line which was a prerequisite for making automobiles cheap enough for a mass market. Modern factory production provided massive economies of scale for Ford that allowed him to routinely cut the price of vehicles while delivering more value for consumers. Rather than selling vehicles at the highest possible margin that the current market could bear, Ford reduced prices to vastly increase the size of the future market.

By 1922, Henry Ford was nearing his sixtieth year and had much to share about his approach to business. In 1922, he published an autobiography, My Life and Work. Like many entrepreneurs, Ford did not seem to fear that sharing his approach would create new competitors. To the contrary, his stated mission in life was to serve his community and the country by making reliable and affordable transportation available to the masses and providing well-paid jobs to his employees.

Although a capitalist to the core, Ford’s book actually refers to “living wages” multiple times which might strike modern readers as odd. Ford saw no inconsistency. In his mind, a company that could not provide well-paying jobs for its workers was failing to fulfill its overall mission. He repeats again and again that this is not charity but simply good business. In Ford’s mind, business exists to serve.

No account of Henry Ford’s life is complete without addressing lapses in his moral judgment and character. Ford’s antisemitism was known by the early 1920s. Ford makes only passing reference to “Studies in the Jewish Question” in the book. But no discussion of Ford’s life can omit the dark side of his personality as toxic antisemitism spread like metastatic cancer in the years leading up to the Second World War.

Can we learn from Ford’s career while also addressing his momentous moral failures? I respect the decision of anyone who does not wish to do so. However, I have made an attempt to learn as much as possible from Ford’s life and highlight three key insights in this article before returning to the great moral failure that tarnishes his legacy.

Consumer Surplus

The concept of consumer surplus measures the extra value received by consumers when the price they pay for a product is less than what they are willing to pay. Any market is made up of a group of potential customers, each of whom is willing to purchase a product at a certain price. If the price is low enough, the number of consumers drawn in will grow. In a competitive market, there will always be consumers who receive more value than they are paying for. In the following graph, consumer surplus is represented by the red region of the supply-demand curve:

Henry Ford was obsessed with cutting the price of his cars as quickly as possible to encourage development of the automobile industry and to serve as many customers as possible. In other words, he sought to deliver a massive amount of consumer surplus to customers. Ford’s approach was extreme standardization and high volume production and he made little attempt to segment the market with varying models designed to cater to consumers who were willing to pay a premium price.

“The public is wary. It thinks that the price-cut is a fake and it sits around waiting for a real cut. We saw much of that last year [1921]. If, on the contrary, the economies of making are transferred at once to the price and if it is well known that such is the policy of the manufacturer, the public will have confidence in him and will respond. They will trust him to give honest value.

So standardization may seem bad business unless it carries with it the plan of constantly reducing the price at which the article is sold. And the price has to be reduced (this is very important) because of the manufacturing economies that have come about and not because the falling demand by the public indicates that it is not satisfied with the price. The public should always be wondering how it is possible to have so much for the money.”

Ford’s competitors typically sought to maximize short term profits rather than delivering consumer surplus in the way Ford advocated.

Why?

Because they had a relatively static view of the overall potential for the automobile industry. They did not grasp Ford’s key insight that delighting consumers with far more than they expect would greatly increase the overall market for automobiles. Competitors did not realize that this increased demand would make it possible to bring the unit cost of production down, thereby launching a feedback loop of greater efficiencies leading to even lower prices.

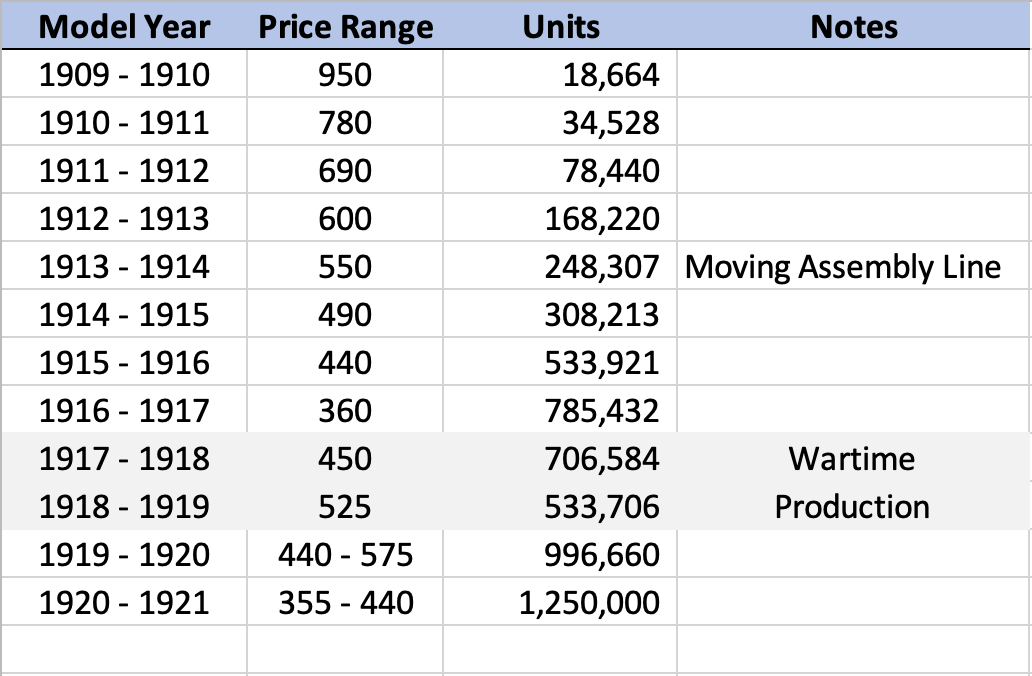

During the first year of production of the Model T (1908-1909), Ford sold 10,607 cars. Ford offered several variations of the Model T with the touring car priced at $850. Here is how pricing and production progressed over the next twelve model years:

In recent years, the concept of scale economies shared has gained much attention and is usually cited in the context of Amazon’s rise in recent decades. There are other contemporary examples including Costco. In both cases, consumers have come to trust that they would get low prices. This had led many consumers to not even bother checking prices at competitors. Costco delivers such massive consumer surplus that I recovered my membership fee during my first shopping trip.

Henry Ford, Jeff Bezos, and Jim Sinegal have much in common. They all left dollars on the table in the short run, generating massive consumer surplus, and this resulted in market share gains leading to economies of scale followed by further price reductions. As Henry Ford wrote, “all that has to be done to adopt it is to overcome the habit of grabbing at the nearest dollar as though it were the only dollar in the world.”

High Wages

Henry Ford is famous for instituting an eight hour workday and setting a minimum wage of $5 per day. These policies were introduced in 1914 when a six day workweek was the norm, so the minimum wage was $30 for a forty-eight hour workweek. This works out to the equivalent of $19 per hour in today’s dollars. The minimum wage was not actually delivered entirely through an hourly wage. There was a profit-sharing component, but the $5 minimum was maintained so long as the employee produced. Those who did not produce were soon no longer employed by Ford.

A modern reader might do a few double-takes reading Ford’s chapter on wages. He uses phrases such as “social justice” and “living wage” that are right out of the talking points of the twenty-first century progressive movement. However, Ford emphasized that no “charity” was involved. He stated that the minimum wage was an entirely voluntary act done in order to build goodwill. However, it seems like it was also done to stem extremely high employee turnover:

“In 1914, when the first plan went into effect, we had 14,000 employees and it had been necessary to hire at the rate of about 53,000 a year in order to keep a constant force of 14,000. In 1915 we had to hire only 6,508 men and the majority of these new men were taken on because of the growth in the business. With the old turnover of labor and our present force we should have had to hire at the rate of nearly 200,000 men a year — which would be pretty nearly an impossible proposition … The matter of labor turnover has not since bothered us.”

Henry Ford strongly believed that wages had to come out of production. Only through the application of wise management and productive labor could high wages be paid because ultimately the consumer is the one actually paying the wage. Ford sought to pay “better wages than any similar line of business, and it ought to be the workman’s ambition to make this possible.”

Despite Ford’s meritocratic ideals, he had a paternalistic side. He conducted investigations into the home life of employees and sought to observe whether they lived in morally upstanding ways. He would employ single women and married women whose husbands were unable to work, but he refused to hire married women who had working husbands. He paid black workers wages equal to white workers doing similar work. However, there was some de-facto segregation since black employees tended to be placed together in more hazardous lines of work.

Ford had another motive for paying his employees well:

“… Our own sales depend in a measure upon the wages we pay. If we can distribute high wages, then that money is going to be spent and it will serve to make storekeepers and distributors and manufacturers and workers in other lines more prosperous and their prosperity will be reflected in our sales. Country-wide high wages spell country-wide prosperity, provided, however, the higher wages are paid for higher production. Paying high wages and lowering production is starting down the incline toward dull business.”

Henry Ford was someone who Howard Marks might refer to as a “second level thinker”. Ford did not view the market for his automobiles as static. He understood that each action he took on pay would have feedback effects on the entire system. This extended beyond his view of Ford Motor Company to the country at large.

Ford refers to wages as “partnership distributions” and appears sincere in regarding employees as partners. He acknowledges that “there is a pleasure in feeling that you have made others happy — that you have lessened in some degree the burdens of your fellow-men — that you have provided a margin out of which may be had pleasure and saving.” He was demanding but provided rewards for employees who produced.

Debt as a Band Aid

“I cannot too greatly emphasize that the very worst time to borrow money is when the banking people think that you need money.”

— Henry Ford

Henry Ford disliked Wall Street and expressed negative sentiments regarding bankers several times in the book. In his view of the world, finance was at best a necessary evil and he sought to rely on reinvestment of earnings to grow the business. He recognized that only production creates value and reinvestment can compound value. After early episodes in which he sought partners and financing, Ford came to realize that he could only control his own destiny by staying in firm control of Ford Motor Company.

If this is all we can say about Henry Ford’s attitude toward debt, this would be a relatively unexciting topic to highlight. However, Ford had reasons for avoiding debt beyond what it implied for control. Ford firmly believed that the presence of debt, or the ability and willingness to habitually fall back on debt, only acted to mask operational problems in a business. In other words, he regarded the use of debt in hard times to be equivalent to applying a band aid or taking a pain reliving drug. It would not solve the underlying problem.

In the aftermath of the First World War, business conditions were difficult. In addition, Ford had borrowed money to buy the full stock interest of Ford Motor Company. It would have been possible for Ford to borrow additional funds during the early 1920s, but Ford loathed debt and decided to seek efficiency gains to make price cuts possible and spur consumer demand. His unwillingness to take on debt was a forcing factor leading the business to become far more efficient:

“We could have borrowed $40,000,000 — more had we wanted to. Suppose we had borrowed, what would have happened? Should we have been better fitted to go on with our business? Or worse fitted?

If we had borrowed we should not have been under the necessity of finding methods to cheapen production. Had we been able to obtain the money at 6 percent flat — and we should in commissions and the like have had to pay more than that — the interest charge alone on a yearly production of 500,000 cars would have amounted to about four dollars a car. Therefore we should now be without the benefit of better production and loaded with a heavy debt. Our cars would probably cost about one hundred dollars more than they do; hence we should have a smaller production, for we could not have so many buyers; we should employ fewer men, and in short not be able to serve to the utmost.”

Ford’s insight is equally applicable today, and perhaps even more applicable. When a business, as a matter of survival, must find ways to improve its efficiency, ideas and experiments will be made that would otherwise not even be contemplated if the easy option of taking on debt is on the table. The same is true for raising new equity. Raising outside funding to address operational problems in a business acts as a pressure relief valve and reduces urgency, at least for a while.

Of course, there are times when debt is necessary. Ford borrowed for the purpose of buying full control of Ford Motor Company. I am sure that he did so because he thought that the long term benefits of not being answerable to those with shorter term mindsets would increase the value of the business. The main thing to keep in mind is that debt should not be used to patch over operational problems in a business.

The Dark Side of Henry Ford

Toward the end of the book, Henry Ford turns his attention toward politics and philosophy. In a rambling chapter entitled “Things in General”, Ford pontificates on topics ranging from his friendship with Thomas Edison and John Burroughs to his hobby of birdwatching. He then delves into thoughts about war in general and World War I in particular. At the end of the chapter, he writes briefly about the “Jewish Question”. Ford’s prejudice is apparent in numerous conspiratorial sentiments about Jewish abuses of “American hospitality” and “warfare upon Christian society”.

In 1918, Ford purchased The Dearborn Independent, a small newspaper that became known as The Ford International Weekly. From 1918 to 1927, Ford published antisemitic screeds in this newspaper that were also published as booklets with the title of The International Jew: The World’s Problem. Ford also republished The Protocols of the Elders of Zion, a fabricated text that was used as proof of an international Jewish conspiracy to dominate the world.

Henry Ford was a famous and respected man and his opinions mattered to millions of people. He used Ford Motor Company to distribute his newspapers and pamphlets to dealerships across the United States. When customers purchased a car, they would find copies of Ford’s publications inside the car when they drove off the dealership lot. Ford used his reputation in business to promote virulently antisemitic views.

It gets worse. Henry Ford was admired by Adolf Hitler who arranged to have Ford presented with the Grand Cross of the Supreme Order of the German Eagle in April 1938 to coincide with Ford’s seventy-fifth birthday. By the late 1930s, the Nazi persecution of Jews in Germany was widely known. There is no way that Henry Ford could have been ignorant of the evils of Hitler’s Germany when he accepted the award. The horrors of Kristallnacht took place just a few months later.

Henry Ford provided a legitimacy to antisemitism by lending his name and reputation to a repugnant movement that culminated in the Holocaust. To try to understand how an industrialist as brilliant as Henry Ford could hold such disgusting views and allow his name to be associated with Adolf Hitler is to embark upon a psychological study going to the root of how evil exists in this world.

Conclusion

Is it possible to gain insights from Henry Ford’s business career given what we know about his antisemitic views? Can we compartmentalize the man sufficiently to trust what he might say about moving assembly lines, debt, wages, and providing a vast consumer surplus? Or must we discount everything he did or said in a business context because of his grave character flaws and sins?

As I wrote in the introduction, I do not blame anyone who does not wish to study Henry Ford’s life. That is perfectly understandable particularly for those who have ancestors who were victims of the Second World War. Since I have family members who were direct victims of Nazi Germany, I can appreciate this point of view.

However, I do believe that we can gain important business insights from studying Ford’s life. More than that, we are presented with an important lesson. The fact that an individual might be respected and known for achievement in one area does not imply that he is an exemplar in other areas of his life. In fact, quite the opposite can be true. This is a lesson that applies in our times just as it did a century ago.

If you found this article interesting, please click on the ❤️️ button and consider sharing it with your friends and colleagues or on social media.

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

A fantastic write-up.

I want to highlight the fact that you didn't skip or ignore Ford's anti-Semitic chapter, as it is so easy to often do. For everything, the business side can be fascinating on its own - but remembering what life is all about at the end of the day is important.

Fascinating. Thank you.