Dollar General: Value or Value Trap?

I spent Labor Day weekend reading about this beaten down retailer. This article provides some initial thoughts on the company.

Introduction

I often engage in “rubbernecking” when I come upon the scene of a debacle causing a company’s stock price to plummet. Last week, Dollar General’s precipitous decline following its earnings release caught my attention. After falling 12.2% on Thursday, August 31, the stock declined an additional 5.9% on Friday, September 1. The stock, which closed at $130.27 on Friday, has been cut roughly in half since October 2022. The company’s market capitalization is $28.6 billion.

Dollar General is not a company that I have followed in the past. However, a quick look at the annual report led me to believe that I am capable of understanding the business. I noted that the company posted earnings per share in excess of $10 in each of the past three years and has an attractive long-term growth story. My interest increased when I looked at dataroma.com to see who owns the stock. I’m against blind coat tailing, but when investors I highly respect not only own the stock but were adding to their positions recently at much higher prices, I can’t help but take notice!

After spending an hour on the situation, it was obvious why the market punished the stock. The business has performed very poorly this year and management has cut its guidance for the rest of the year. If you’re trying to beat the S&P 500 this year, who wants to be in a company that’s likely to post ugly results three months from now? However, what if the company can get back on track? Management continues to open new stores and, if past profitability and unit economics can be restored, perhaps this is a company that could earn $15 per share in five years and again trade at twenty times earnings. That scenario could produce an annual compound return of ~18%.

I caution the reader that I am not making predictions that this rosy scenario will happen and my background with the business is literally just three days old. This article is not a comprehensive business profile comparable to the series I wrote last year which was discontinued in January. Each of those profiles was the product of several weeks of work. However, I thought that the information I have gathered so far on Dollar General might be useful for readers who are not yet familiar with the company and interested in a starting point for their own research.

Overview

The retail landscape in the United States is intensely competitive. Consumers are aware of the importance of seeking the best value for their money in all economic environments but this need becomes acute during economic downturns and times of high inflation. There are no one-size-fits-all retail strategies in a vast country of 330 million consumers with a diverse mix of urban, suburban, and rural communities that have unique needs and face very different economic pressures.

I spent a couple of years living in a rural community more than twenty years ago. At that time, the only local retail option was a convenience store next to a small restaurant and gas station. Those of us who commuted to the nearest city had access to all of the typical retail options on a daily basis, but people who worked locally would not necessarily want to drive long distances more than once a week. The local “mom and pop” store served their needs for purchases during the week.

Dollar General specializes in serving the needs of small towns and rural communities with over 80% of its 19,488 stores located near towns of 20,000 or fewer people. The company operates more stores than any other retailer in the United States and has locations within five miles of 75% of the U.S. population. Dollar General stores are typically bare-bones small-box formats which average 7,500 square feet. A typical grocery store has about four to five times as much space while the average size of a Wal-Mart Supercenter is a whopping 178,000 square feet.

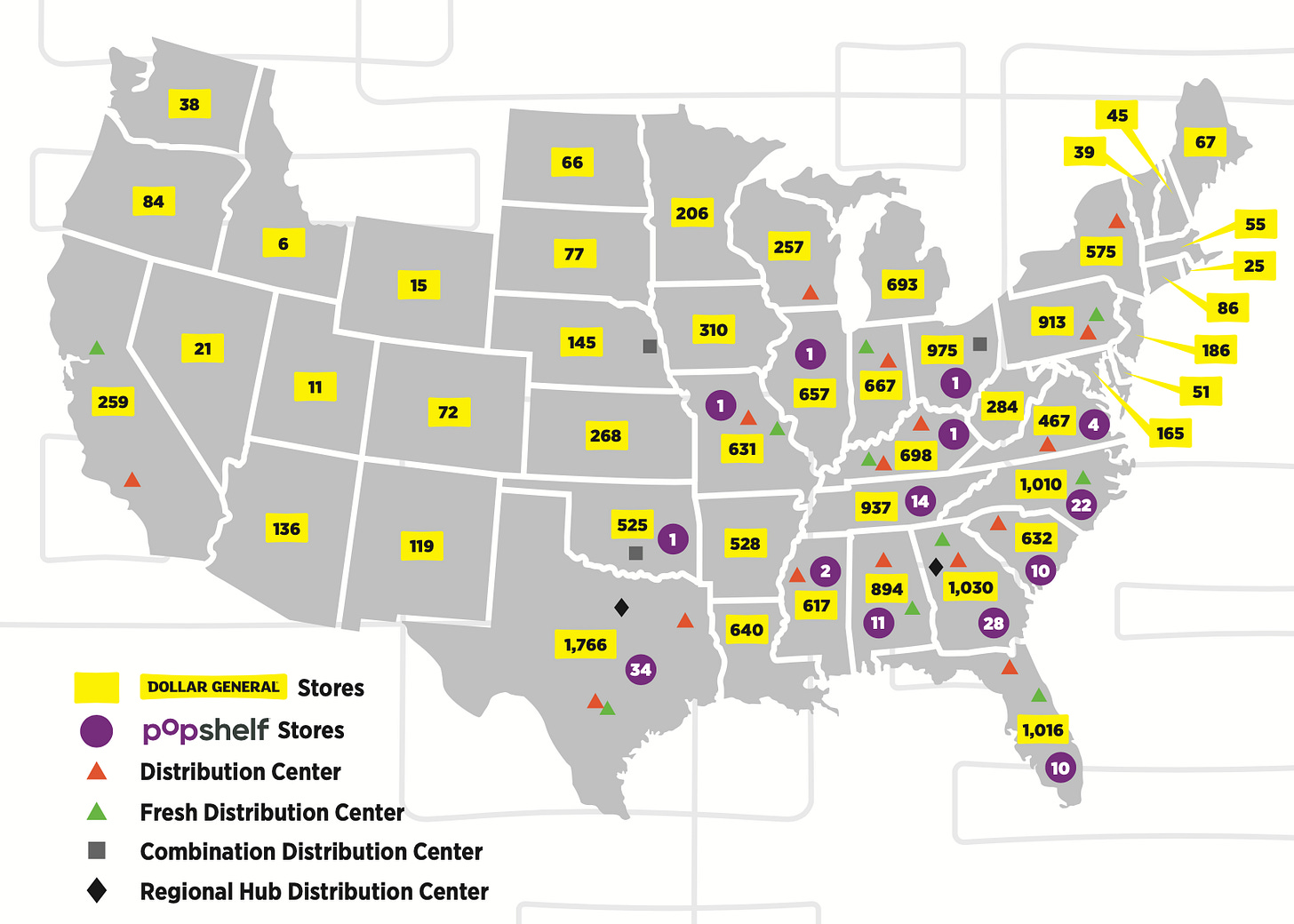

With its extensive store footprint, Dollar General benefits from economies of scale that allow for vertical integration. The company operates nineteen distribution centers for non-refrigerated products, ten cold storage distribution centers, and two distribution centers for both refrigerated products and general merchandise. The company more than doubled the size of its private tractor fleet in 2022 and anticipates having more than 2,000 tractors by the end of 2023. The distribution centers and transportation fleet provide significant control of the supply chain.

The following exhibit from Dollar General’s 2022 annual report shows the locations of the 19,104 stores in 47 states that it operated as of February 3, 2023 along with the location of its distribution centers. In addition to the Dollar General brand, the company operated 190 pOpshelf locations selling non-consumable products.

The store base is geographically concentrated in the south, southeastern, and midwestern United States and management has been adding locations rapidly over the past decade. The exhibit below shows the growth in store count since 2014:

Even during a challenging year, store growth has not stopped and it appears that there is room for many more store openings in the years to come. To understand why Dollar General has an opportunity to make headway in more rural locations, I recommend a Wall Street Journal article published in 2017 that describes the customer base.

Of course, the devil is in the details, so let’s take a closer look at some key metrics over the past decade with a focus on how the company has hit turbulence this year and whether management is likely to get back on track.

Sales Mix

Before delving into Dollar General’s key metrics in more detail, it is important to understand the sales mix. Stores sell a mix of consumable and non-consumable products. Consumable products include shelf-stable foods as well as a growing emphasis on refrigerated and frozen foods. In addition to selling branded consumer products, Dollar General also has a private label brand named Clover Valley that sells goods similar to branded products at a lower price point.

Non-consumable products include seasonal assortments along with home products and apparel. Dollar General’s business is somewhat seasonal with higher sales in the fourth quarter due to the Christmas season. Generally, non-consumable products carry a higher gross margin than consumables, although margins on a product line basis are not provided by management.

Consumables accounted for just over 75% of sales a decade ago. The mix has been shifting toward consumables for several years and breached the 80% level during the first half. As consumables account for a larger percentage of sales, gross margins will be under more pressure. The company has attempted to shift the mix toward non-consumables, both in Dollar General branded stores as well as the new pOpshelf concept, but so far the unfavorable mix situation has persisted.

As we can see from the exhibit below, apparel has been particularly weak, with seasonal and home product sales stagnating even as store count has increased. As the company’s core consumer has faced increasing pressure due to high inflation, it is natural to expect spending to gravitate toward basic necessities of daily life.

The effect of the pandemic stimulus programs is also clear when examining recent results. The company posted unusually strong sales across the board in 2020, but as the stimulus effect has waned and inflation has wreaked havoc among those with little disposable income, discretionary spending has stalled even as sales of consumable necessities have continued to grow.

Operating History: 2013 to 1H 2023

When I learn about a business, I find it useful to look at a minimum of ten years of data so I can spot long term trends. The exhibit below shows the operating results of the past decade along with the first half of fiscal 2023 (click to expand image):

Despite the unfavorable changes to product mix, gross margin has held up better than I would have expected. As a point of reference, I looked at my Costco research last year and noted that Wal-Mart ran at a gross margin of 24.4% in fiscal 2022 and Target ran at a gross margin of 28.3%. Obviously, Costco’s gross margin of 10-11% is in an entirely different league serving a totally different member-based demographic.

The fact is that the economics of big box stores is very different from Dollar General’s small box format. Rural consumers could access lower priced merchandise by shopping at Wal-Mart, but if the closest Wal-Mart is 40 miles away and gasoline costs almost $4 per gallon, such trips will be infrequent. Dollar General clearly provides a good value proposition for rural consumers compared to other convenient options.

The main source of Dollar General’s recent problems is apparent when we look at the operating margin. At 7.5% during the first half of 2023, this metric is, by far, the worst showing over the past decade. SG&A as a percentage of sales came in at 23.9% during the first half compared to 22.4% in 2022 and 22.2% in 2021. Looking back further, SG&A as a percentage of sales was 21.1% in 2013.

During the company’s earnings call, management provided several reasons for poor performance this year. In particular, inventory shrinkage has become a major problem. Management expects “$100 million of additional shrink headwind.” In addition, management refers to an “acceleration of investment in retail labor” of ~$150 million, which I take to refer to higher labor costs due to wage inflation.

Inventory turnover has been under pressure recently. Turnover was 3.7 times at the end of the second quarter on a trailing four-quarter basis. Turnover was 4.0 times in fiscal 2022 and ranged from 4.4 to 4.9 between fiscal 2013 and 2021.

Store Unit Economics

Dollar General’s rapid expansion in recent years makes it important to look at store unit economics which have been very attractive historically. Prior to 2021, the company boasted of a multi-decade record of growth in same-store sales. Here are some key metrics that I calculated on a per-store basis along with the company’s reported same-store sales and sales per square foot statistics:

It is typical in retail for new stores to post weaker results than established stores during the first few years, so it is impressive that Dollar General was able to post the record shown in the exhibit while nearly doubling the store count. As stores mature, their financial profile begins to resemble the company-wide average.

When we look at same-store sales growth, 2020 obviously appears as an aberration due to the pandemic. Dollar General’s customer demographic benefited from stimulus payments as well as other programs that have since phased out or ended. The 16.3% increase in same store sales in 2020 was bound to reverse to some degree, which resulted in the 2.8% decline in 2021 that broke a multi-decade record of same-store sales growth. Growth resumed in 2022 before showing a small decline in the first half of 2023. However, it is important to realize that these figures are in nominal dollars. The 4.3% growth of same-store sales in 2022 is nothing to write home about since this represents a decline in real terms given the elevated level of inflation.

Dollar General typically leases locations for its stores. In addition to the capital required to build out the store, the company must invest in inventory. I have not found reliable data on the capital expenditures required to open a Dollar General store, but we can determine the inventory per store. We can also see the operating profits, although new locations will lag the company-wide average for the first few years. Still, the figures seem encouraging regarding the unit economics of new store openings.

Balance Sheet

When we look at the balance sheet data over the past decade, it quickly becomes apparent that leverage has increased dramatically since the end of fiscal 2021. Debt has increased from $4.2 billion at the end of fiscal 2021 to $7.3 billion at the end of the first half of fiscal 2023. Debt as a percentage of total capital increased from 40% to 56% while the Debt to EBIT ratio increased from 1.36x to 2.88x.

This exhibit shows the balance sheet data over the past decade (click to enlarge):

Although management has halted repurchases, a subject that I will discuss in the next section, the share count has been reduced by over 30% since the end of fiscal 2013.

Capital Allocation

Dollar General has historically generated significant cash flow. I prefer to look at cash flow and capital allocation over a long period of time and I gathered data for the past ten fiscal years plus the first half of fiscal 2023.

Over this period, Dollar General generated $21.2 billion of operating cash flow and spent $8.3 billion on capital expenditures. If you subtract capex from operating cash flow, you end up with $12.9 billion of “free cash flow” although with the store count nearly doubling, it is obvious that a significant amount of capex is expansionary in nature. Additionally, much of the inventory buildup over the past decade, which depressed operating cash flow by $5.9 billion, was needed to support new stores.

Dollar General has been an enthusiastic buyer of the company’s stock, as noted in the previous section. Over the past ten and a half years, management allocated $14.3 billion toward repurchases. A dividend was introduced in 2015 which returned $3 billion to shareholders. The return of capital over this period was in excess of free cash flow with the difference made up by an increase of $4.3 billion of debt.

The entire cash flow statement is too large to display here so I have condensed the data into the following exhibit that shows selected sources and uses of cash over the period. We can see that the sum of free cash flow and net issuance of debt is a nearly perfect match against cash returned to shareholders.

Readers will also note that repurchases halted entirely in the first half of fiscal 2023. According to management’s comments during the earnings call, there are no plans to resume repurchases despite the precipitous decline in the stock price.

Management stated that the need to maintain an investment grade credit rating precludes the possibility of repurchases in the near term, yet the dividend remains intact. The impulse of management to treat a dividend as sacrosanct while halting repurchases in times of trouble is disturbingly familiar.

Drilling down to the past few years, we can see that management became aggressive and took on considerable debt to fund repurchases of stock at much higher prices. Over the past three and a half years, free cash flow was $5 billion but management chose to return $9.3 billion to shareholders with the vast majority returned via repurchases. Simple math makes it unsurprising that debt increased by over $4 billion.

Hindsight is 20/20, but I can understand if shareholders are annoyed by management taking on debt to fund repurchases at much higher prices only to halt the repurchase program when shares are depressed. Of course, this type of behavior is not unique to Dollar General. Taking on leverage to fund repurchases at high valuations is common.

Conclusion

I can claim no special expertise or insight into Dollar General at this point given that I have spent less than thirty hours on the company over just a few days. However, I am intrigued by the strong history of store growth and the attractive unit economics even as I shake my head in frustration at management’s capital allocation record.

Will management succeed in restoring operating margins to prior levels or will the dismal 7.5% operating margin of the first half of 2023 become the new normal? It seems highly unlikely that management will totally fail to restore operating margins. In the long run, the economic fundamentals that produced a strong record over a decade have not suddenly evaporated. Inventory and wage pressures are likely to eventually abate although it is hard to predict the timing of a turnaround.

Store growth continues even in the current difficult environment and it seems clear that there is more room to grow. The vast geography of the United States and the company’s current geographic footprint makes it clear that there are still growth opportunities to displace less competitive small retailers in locations where there is insufficient population density to support big box Wal-Mart Supercenters.

I am not sure what to think of the pOpshelf initiative or the company’s nascent entry into Mexico that began this year. Given that I am unimpressed with management’s capital allocation, I would prefer to see a laser focus on margins and growing the Dollar General format rather than taking on the potential distractions of an international expansion. However, I cannot rule out Mexico as a growth opportunity.

While Dollar General’s cash generation record makes the current debt load manageable, I would prefer to see management deleverage to ratios that prevailed prior to 2022. I would also halt the dividend and redirect those funds toward repurchases if the stock remains depressed in the coming months. Management is guiding for earnings per share of $7.10 to $8.30 for the current fiscal year and it is likely that third quarter results will be ugly.

Hopefully this article has been useful for readers interested in Dollar General. I am intrigued by the company at the current price but have not done sufficient work to make an investment. I am not familiar with Dollar Tree/Family Dollar, nor have I visited any Dollar General locations. Comments are welcome!

If you found this article interesting, please click on the ❤️️ button and consider referring a friend to The Rational Walk.

Thanks for reading!

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

No position in Dollar General.