Deprival-Superreaction Tendency

It is intensely painful to lose something that we have acquired.

“‘Tis better to have loved and lost

Than never to have loved at all.”

The pursuit of worldly wisdom requires us to understand the human psychology that drives decision making and behavior. What may appear to be undeniably rational and optimal from a purely logical standpoint often fails to account for the fact that human beings do not view the world in the same way as a computer.

Thousands of years of evolution have left humanity with a set of psychological impulses that might have been necessary to ensure the perpetuation of the species centuries ago but can lead to miscalculations in the modern world.

While we should acknowledge that all of us are subject to the legacy of evolutionary psychology, by understanding common areas of misjudgment we may be able to give ourselves a slight edge.

Was Lord Tennyson correct?

It certainly seems like his poem contains a great deal of wisdom. Surely it is better if one has strong connections with other human beings even if circumstances change that later deprive us of those relationships. It is inevitable that anyone going through life will suffer loss, whether it might be due to a break-up of a relationship, the death of a romantic partner, or the loss of a friend or close relative.

Loss in a social context can also occur when economic dislocations cause us to lose contact with colleagues even when they might not be close personal friends. The only way to guarantee that one suffers no loss is to become a hermit and avoid interacting with anyone. Almost all human beings are social creatures and the cost of avoiding the risk of social loss — a lifetime of isolation — clearly exceeds the cost of dealing with the losses that will inevitably occur.

While Lord Tennyson’s perceptions regarding human relationships seems to match practical experience, his words cannot be applied when it comes to human emotions related to economics.

From a practical perspective, in the way a computer might regard well-being, it certainly seems like the happiness of an individual who experiences transient wealth might be greater than someone who never experienced wealth at all.

Consider two neighbors who both earn the median household income. One individual wins a $10 million lottery but, within a few years, manages to squander half of it through frivolous spending and loses the other half in bad investments. From an economic standpoint, the lottery winner enjoys higher lifetime consumption than the person who never won the lottery, but from a psychological standpoint, the lottery winner is far worse off. His higher lifetime consumption, boosted in a fleeting manner, is no consolation for losing what he became accustomed to.

The lottery winner, for a brief period of time, is relieved of any financial worries, has no need to work, and can finally acquire most of the possessions he has ever dreamed about. His lifestyle immediately ratchets up to the limits of his newfound wealth which provides temporary joy, but the hedonic treadmill soon causes him to regard all of this as the new baseline. Soon, half of his winnings have been consumed and the rest of it evaporates due to poor investments.

Does anyone intuitively think that this man will go back to his old neighborhood, get a job working at the median income, and be satisfied with his life? In contrast, his neighbor who never won the lottery has continued living his life — not necessarily satisfied with everything and perhaps always aspiring for more, but at least not having tasted what he can no longer have.

Starting in the 1990s, Charlie Munger began to give public talks about his framework of human misjudgment which was later significantly expanded in written form as a chapter in Poor Charlie’s Almanack. Deprival-Superreaction Tendency refers to the human reactions to the experience of loss — both the loss of something one already possesses as well as the loss of something that one has almost obtained. Munger likens the human reaction to loss to the reaction of his dog when someone tried to take food out of his mouth. The dog, normally tame and good natured, would bite his master. This was a totally irrational act but an instinctive and automatic reaction to loss.

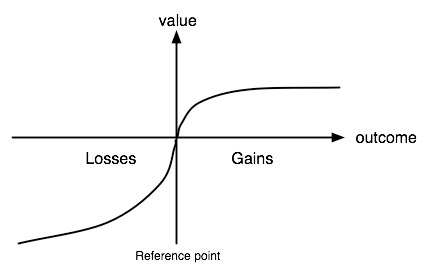

In 2011, Daniel Kahneman published Thinking, Fast and Slow, a book that describes prospect theory and many additional topics in a format intended for a non-academic audience. Through a series of experiments and surveys, Kahneman demonstrates that individuals feel the benefits of gains much less forcefully than the pain of losses. Consider the exhibit below:

Charlie Munger’s dog felt the pain of loss much more than the pleasure of gain in terms of a food reward just as the lottery winner feels the loss of his fortune much more intensely than the pleasure of his win.

There are many other contexts in which the deprival-superreaction tendency can influence decision making as well as government policy. One excellent example is the psychology behind payroll tax withholdings. In the United States, as well as in most developed countries, it is mandatory to have an estimate of a worker’s tax liability deducted from each paycheck before the worker ever sees the funds. If a worker’s gross pay is $10,000 per month, she might only see $7,000 deposited into her bank account at the end of the month because $3,000 has already been claimed for payroll taxes as well as federal and state income taxes. Additionally, many people voluntarily authorize deductions for retirement contributions.

What would happen if the gross amount of the worker’s pay of $10,000 was deposited in her account and she wrote checks totaling $3,000 to the various government agencies as well as to her retirement account provider? The answer, for almost everyone, is that she would feel worse off than if she had never seen the $3,000 hit her account to begin with. One might think that she feels worse off because of the hassle of having to write checks, but the same would be true if the payments were automated. Merely seeing her account balance go up by $10,000 and having $3,000 taken from the account makes her feel worse than if she simply had the $7,000 net pay deposited and never consciously thought about the withheld taxes.

Of course, the irrationality gets even worse when people willingly have excess funds withheld from their paychecks in order to get a tax refund the following April. However, from a psychological standpoint, the extra withholding doesn’t sting very much because it is not money the worker ever “had” to begin with, and the windfall refund is like manna from heaven. Almost everyone understands that this isn’t free money from an intellectual standpoint, but for some reason people still enjoy getting tax refunds so much that they willingly provide an interest free loan to the government through excessive payroll withholdings.

Charlie Munger also notes that deprival-superreaction has important implications for labor-relations. Whether in the form of union contracts or discussions with individuals regarding their pay package, it is nearly impossible for employers to reduce wages even when necessary and warranted. Even in cases where a business has an unsustainable cost structure and failure to reduce wages would result in an elimination of all jobs, and even in industries where employees may have trouble finding new work, it is not uncommon for unions to reject pay cuts. In such cases, a business failure would leave both the owners of the business and the employees in worse shape than if employees made a difficult decision to accept lower wages.

The difficulty of wages and prices to adjust downward due to the deprival-superreaction tendency is one reason the government policy seeks to leverage the concept of money illusion through inflation. Aside from economies suffering from hyperinflation, people think of wages and prices in nominal terms. An employer that needs to cut wages by two percent in real terms will have a much easier time implementing a pay freeze in a year when inflation is two percent than trying to impose a two percent pay cut in a year when there is no inflation. The need to allow real prices and wages to adjust downward, when warranted, is one of the more compelling arguments in favor of low levels of inflation (as opposed to zero inflation), although it is questionable whether it is ethical for government to harness money illusion as a policy tool in this manner.

It is tempting to consider issues like this and pretend that we have immunity because we understand the issues at an intellectual level. The reality is that no one is immune but we are capable of incrementally acting in a more rational manner by going through checklists and being aware of the biases that could be influencing our decisions. I still feel the pain of permanent losses of capital much more acutely than the pleasure of gains. But I have never sought to artificially receive tax refunds every April by overpaying during the prior year. I will take that as a small victory.

Note to readers: This article is part of a series on Charlie Munger’s Psychology of Human Misjudgment.

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.