Daily Journal Faces an Uncertain Future

Charlie Munger's death raises many questions for Daily Journal that remain unanswered following the company's 10-K and proxy filings.

“I don’t think it was a mistake to buy the Daily Journal when we did, paying the price we did. We paid $2.5 million for it, we got a dividend of $2.5 million shortly thereafter. Everything you see is profit. I think we’ve coped pretty well so far.”1

— Charlie Munger, 2021 Daily Journal Annual Meeting

On March 28, 2022, Daily Journal announced a major leadership transition. Steven Myhill-Jones, a Canadian software executive, was named as Chairman and Interim Chief Executive Officer.2 He replaced Gerald Salzman who retired at the age of 83 after spending over four decades at Daily Journal as a Director, President, CEO, and CFO. Charlie Munger resigned as Chairman but remained on the board and continued to manage the company’s large portfolio of marketable securities.

The passing of the baton to a young executive with a technical background was an important moment for a company that first entered the software business in 1999. Charlie Munger’s continued presence as a director and manager of the investment portfolio created a sense of continuity despite his advanced age.

Unfortunately, Mr. Munger’s death on November 28, 2023 raises several questions that have not been fully addressed by the company’s recent 10-K and proxy filings.

In particular, it is unclear who will have authority over the securities portfolio. Valued at over $300 million at the end of the fiscal year, the portfolio is of great importance relative to Daily Journal’s $460 million market capitalization.3 In addition, it is not clear that the current three members of the board have adequate skin in the game in terms of ownership. Institutional knowledge might also be limited given that the longest serving board member joined the company less than five years ago.

Charlie Munger owned 46,280 shares and trusts benefiting the Munger family own 131,297 shares. In combination, this ownership interest is worth $59.3 million and accounts for 12.9% of shares outstanding. While this interest is not a large percentage of Mr. Munger’s estate, it is a large holding in absolute terms. More importantly, Mr. Munger quite clearly cared about the future of Daily Journal. As a result, I approach the situation by seeking to better understand how the current structure might make sense as opposed to assuming that proper planning did not take place.

I first analyzed Daily Journal twelve years ago in Daily Journal Corporation: Declining Publisher or Rising Hedge Fund? I passed on making an investment given that the traditional business was in decline, the software business was unproven, and Charlie Munger, at the age of 88, was not likely to remain involved for very long. When I revisited the company five years later, I could not justify the premium over book value.

Last year, I wrote a comprehensive analysis of Daily Journal for paid subscribers. This report is now freely available in full. Readers with a serious interest in the company should review the report before continuing with this article. I will not attempt to reproduce all historical information and narratives from my report in this article.

In this article, I present a brief update of business developments based on the recently released 10-K for the fiscal year that ended on September 30, 2023. I then turn my attention to the structure and management of the investment portfolio, both in terms of its concentrated nature and its leverage. Finally, I address corporate governance issues and the company’s proposed equity compensation plan that has been seeded by Charlie Munger’s gift of 3,720 shares of his stock which he donated in 2022.

Traditional Business

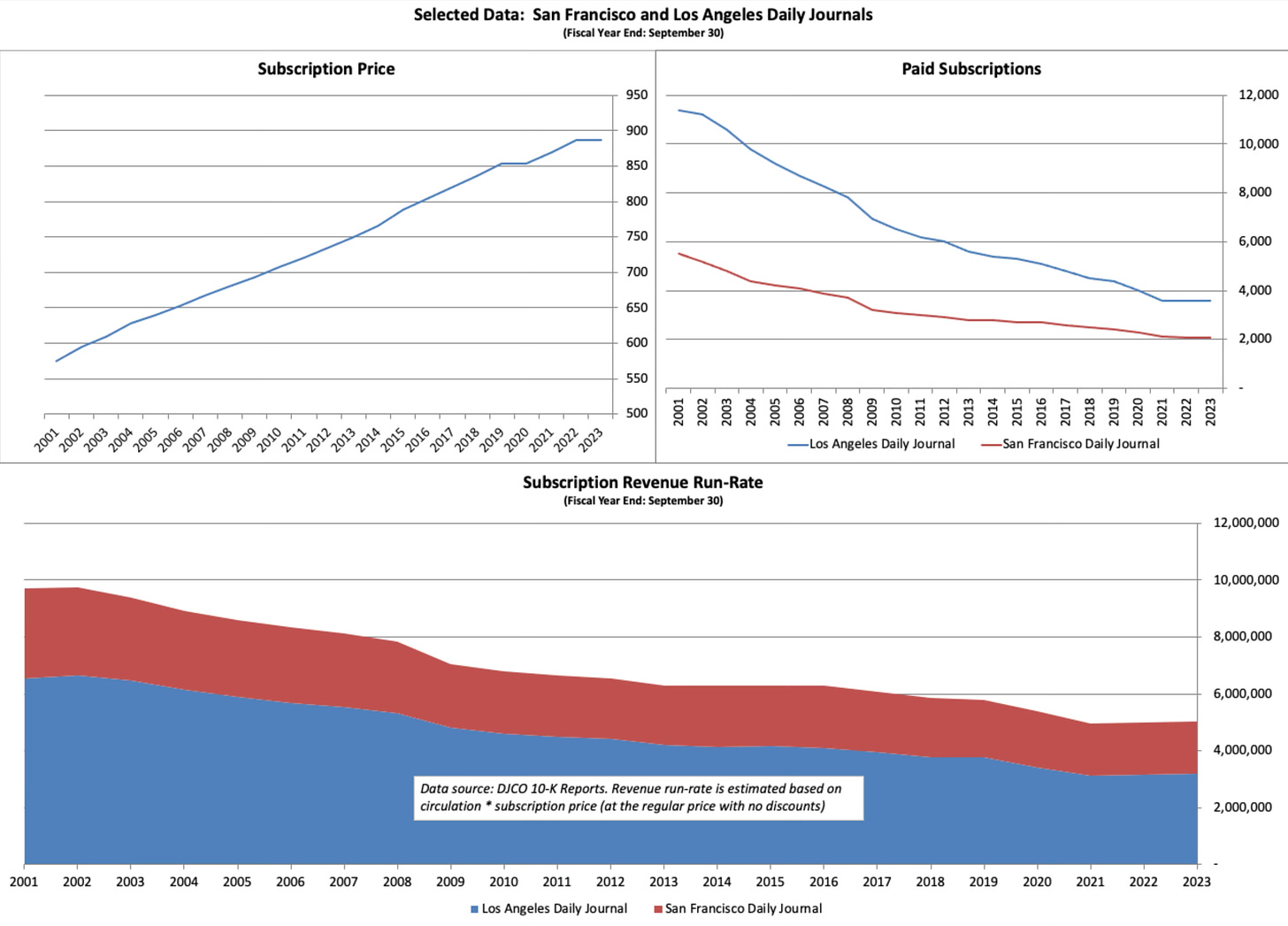

Daily Journal publishes nine newspapers in California and one newspaper in Arizona. The Los Angeles and San Francisco Daily Journals share a great deal of content. Both were founded in the late nineteenth century and have a distinguished history serving the legal profession. With a subscription rate of $887, these papers are not cheap but are highly valued by judges, lawyers, and others in the legal profession. The combined circulation of the Daily Journals posted a small increase in fiscal 2023 after years of constant decline. Although the papers have historically enjoyed significant pricing power, the subscription rate held steady for only the second time this century.

The following exhibit provides an illustration of the long-term decline of the Daily Journals. The impact of the decline in circulation has been mitigated by a steady increase in the subscription price. While imprecise due to apparent discounting, the “run-rate” of circulation revenue has still been on a clear downward trajectory.

The company’s eight smaller newspapers have specific areas of focus in real estate, law, or general business news and carry public notice advertising. As the company’s 10-K warns, public notice advertising is vulnerable to legislative changes. For example, legislation in California taking effect this year reduces the public advertising required by law for self-storage facility lien sales. The company estimates a negative impact of approximately $150,000 to $200,000 per year from this change alone.

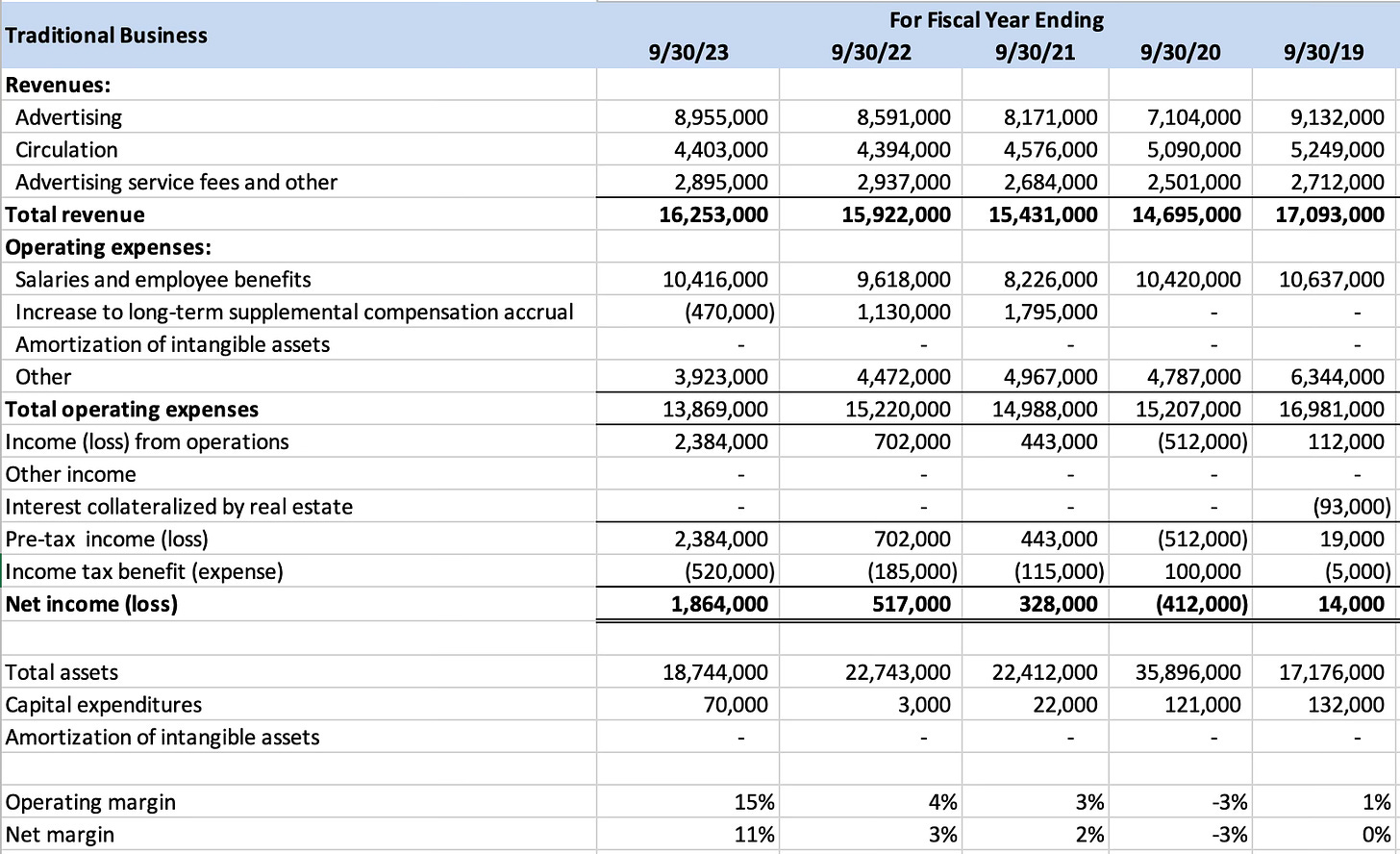

The exhibit below shows results for the newspaper segment for the past five years:

In terms of revenue, the segment is showing some welcome signs of stability after a long period of decline. In fiscal 2023, advertising revenue benefited from increased trustee sale notices due to the lifting of pandemic-related foreclosure moratoriums imposed on lenders. This drove a 22% increase in foreclosure notices. At least part of this improvement should be non-recurring since the backlog of foreclosure activity is likely to abate in future years. The San Francisco and Los Angeles Daily Journals account for 93% of circulation revenue. The stabilization of circulation revenue is directly attributed to paid circulation holding steady, as shown in the previous exhibit.

Although net income increased in fiscal 2023, this was due to a reduced long-term supplemental compensation accrual of $1.6 million. It appears that this benefit has to do with halting the issuance of new certificates for the management incentive plan, pending shareholder approval of a new equity compensation plan. Absent this non-recurring tailwind, earnings would have declined despite higher revenue due to higher compensation costs. I interpret recent results as a temporary reprieve from a long-term secular decline that is likely to continue for the foreseeable future.

Journal Technologies

In 1999, Daily Journal entered the software business when it purchased Sustain. Over a decade later, New Dawn and ISD were acquired. These three businesses are now collectively referred to as Journal Technologies. A full history of these purchases is available in my January 2023 report so I will not repeat that information here.

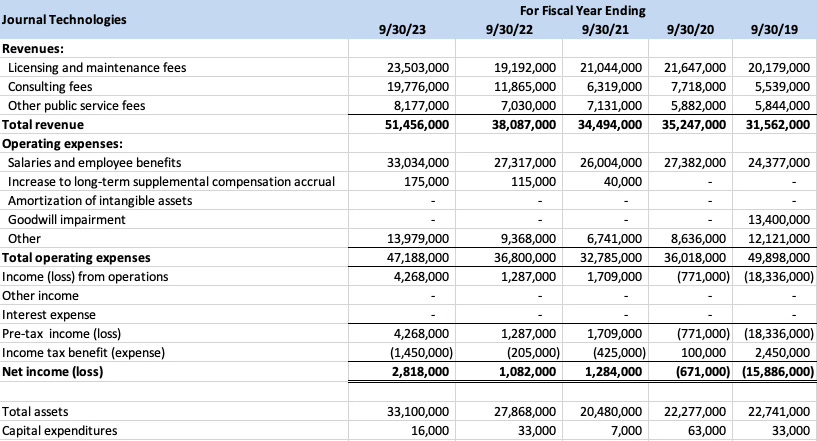

The exhibit below shows the results of the segment for the past five years:

Journal Technologies has conservative revenue recognition practices with respect to consulting revenue which is only considered earned when a client “goes live” and begins to use the software in production. Software implementations can take months or even years. Employee costs associated with implementations are expensed when incurred while revenue is deferred. As of September 30, 2023, the company had deferred consulting fee revenue of $5.8 million representing project advances made by clients that have yet to be recognized as income. Due to these factors, Journal Technologies experiences “lumpy” reported results.

In fiscal 2023, pre-tax income increased from $1.3 million to $4.3 million. The size of this increase has much to do with the timing of client go-lives during the fiscal year. The effect of a larger number of go-lives is to recognize revenues that were previously deferred, boosting results. Licensing and maintenance fee revenue also increased.

Management notes that competition for talent is intense in the software industry. Salary increases and the hiring of additional staff members boosted salary and employee benefits by 20.9% in fiscal 2023. Journal Technologies also expenses research and development costs as they are incurred. There are no capitalized R&D costs. Management cautions shareholders that expenses needed to upgrade software products and address “certain technical debt that exists within current generation offerings” will pressure earnings for the “foreseeable future.”

My previous report on Daily Journal includes much more information on the competitive landscape in the software business. The company’s product offerings are primarily case management solutions for courts and justice agencies. There are important competitors including Tyler Technologies which is also discussed in the report. I also included an appendix that discusses vertical market software in general drawing from my personal experience in a very similar vertical market.

It is difficult to determine whether Journal Technologies will ultimately succeed in the software business. Charlie Munger called the process a “long, long slog” which so far seems appropriate given the heavy investments made by Daily Journal since 1999. Mr. Munger displayed unusual optimism when speaking about the software business and clearly viewed serving courts and justice agencies as a positive contribution to civilization. Particularly due to the software background of the company’s new CEO, I would expect heavy investment in this area to continue in the future.

Investment Portfolio

Daily Journal’s portfolio of marketable securities was valued at $303,128,000 as of September 30, 2023 and carried a deferred tax liability of $36,260,000, bringing the net value of the portfolio to $266,868,000 if it had been liquidated on that date. A margin loan secured by the portfolio had an outstanding balance of $75,000,000 with interest payable at the Fed Funds rate plus fifty basis points (currently 6%). Margin interest of $4,255,000 was paid during the fiscal year while the portfolio generated dividends and interest of $8,336,000. Cumulative unrealized gains stood at $137,716,000.

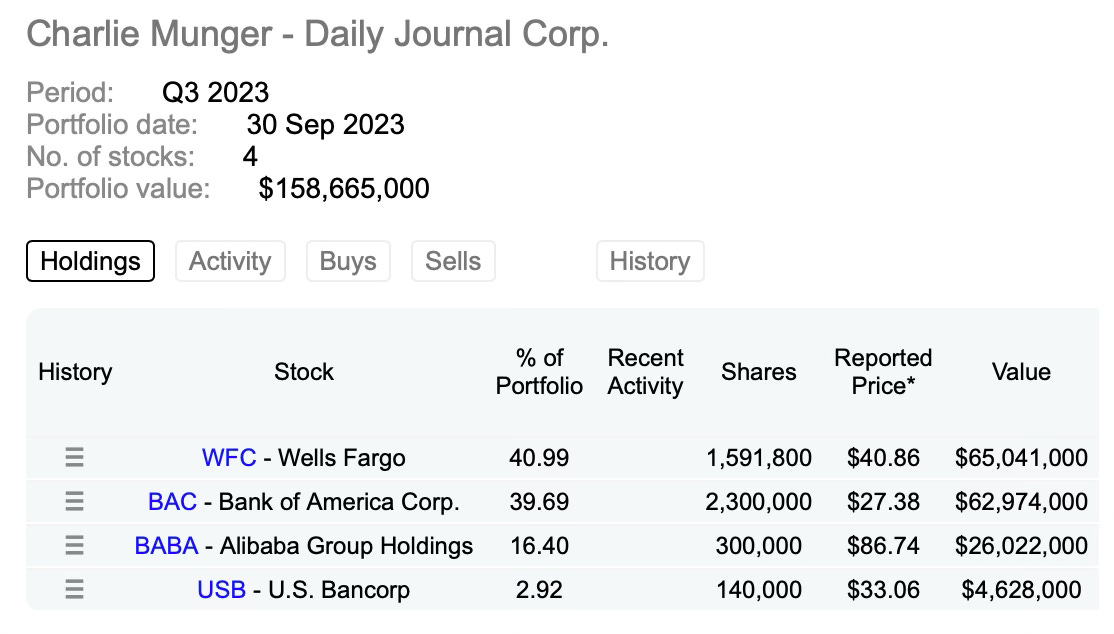

As discussed at length in my report last year, Daily Journal has a highly concentrated portfolio. At the end of fiscal 2023, the portfolio contained investments in just eight companies. As of September 30, 2023, securities traded on U.S. exchanges accounted for $158,665,000 and are shown in the exhibit below:

For much additional detail on the history of Daily Journal’s portfolio, readers should review my comprehensive report. Shareholders have long been comfortable with a high degree of concentration due to Charlie Munger’s decades-long record as an investor, and this comfort apparently extended to his use of leverage. Mr. Munger made the following statement about leverage at the 2022 annual meeting:

“Well, of course, if you invest in marketable securities, you have the risk that they’ll go down and you’ll lose money instead of make it. But if you hold a depreciating currency, that’s losing purchasing power. On balance, we prefer the risk we have to those we’re avoiding, and we don’t mind a tiny little bit of margin debt.”

Whether $75 million of margin debt against a ~$300 million portfolio qualifies as a “tiny bit” of leverage is an open question that shareholders must now evaluate in light of Mr. Munger’s death. It is reasonable to want to make this assessment based on information regarding who will take over responsibility for the portfolio, but the company has provided no details about succession for this function other than to caution shareholders that future results are unlikely to match historical performance:

“Charles T. Munger, the legendary investor of Berkshire Hathaway fame, has been a director of the Company for many decades, and has long managed the Company’s holdings of marketable securities. Mr. Munger passed away on November 28, 2023. Although the Board will work to ensure that the portfolio remains well-managed, it’s impossible to ever replace Mr. Munger. Given the loss of Mr. Munger, the Company does not expect the future financial performance of its marketable securities portfolio to rival its past performance.”

In my comprehensive report, I speculated that Daily Journal might turn to Li Lu if the portfolio is left intact. I also noted that the portfolio could be liquidated or diversified in some manner that does not require active management. I should also note that Mohnish Pabrai is a well-regarded manager and a longtime friend of Charlie Munger. It seems like Daily Journal should have access to expert investment counsel should they wish to continue running a concentrated strategy. Perhaps it is reasonable to give management some time to determine next steps, but if I was a shareholder I would be asking questions about portfolio management at the annual meeting on February 15.

I do not regard the portfolio as distributable to shareholders, at least not the bulk of it. Charlie Munger made it clear that he views the portfolio as a way to bolster the mission of the newspaper business and to back the software business. The portfolio has already helped Journal Technologies secure contracts by giving clients the confidence that the company is financially stable. In addition, competitive pressure for talent could very well require the company to spend heavily in the future.

Corporate Governance

Charlie Munger’s longstanding presence at Daily Journal should inspire quite a bit of confidence for shareholders given his history of business ethics and good judgment. However, shareholders have a right to be concerned about several aspects of the company’s corporate governance. I would expect several of the concerns outlined in this section to be addressed in a reasonable timeframe. Charlie Munger was not in denial about his age and must have discussed his vision for governance with the board.

As I discussed at length in my comprehensive report, Daily Journal has an unusual management incentive plan that provides “certificates” to key executives. Certificates provide compensation based on pre-tax earnings on a segment basis or, in the case of the CEO and CFO, for the company as a whole. The company has long referred to stock option plans as “capricious” and “undesirable.”

The problem with this approach is that it is outside mainstream practices of nearly every software company competing for talent. Stock-based compensation is a core expectation for highly skilled software engineers. Perhaps seeing the writing on the wall, but still wishing to prevent shareholder dilution, Charlie Munger donated 3,720 shares of his stock to the company in 2022 in order to seed a new management equity incentive plan. However, valued at under $1.3 million based on the current stock price, Mr. Munger’s gift is not likely to last for very long.

Shareholders are being asked to approve a new equity incentive plan at the upcoming annual meeting. The available pool will initially be capped at 3,720 shares which I expect will be depleted very quickly. The board intends to start slowly and determine how to proceed at a later date.

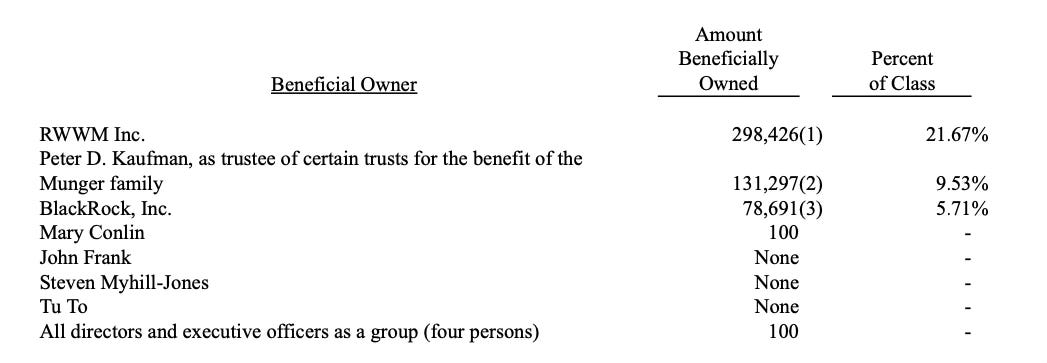

The current board is comprised of just three members. Mary Conlin joined the board in 2019 and John B. Frank joined in February 2022. It is likely that Mr. Frank and Mr. Munger knew each other quite well given that Mr. Frank served as a partner at Munger, Tolles & Olson in the past. Steven Myhill-Jones has served as Chairman since March 2022 when he joined the company as interim CEO. He was named permanent CEO in October 2023. The bylaws of the company permit a board size of three to seven, but no additional directors have been nominated in the proxy statement.

Unfortunately, board and executive ownership is minimal. Mary Conlin is the only board member who owns any shares and her stake is only worth $33,400. Mr. Myhill-Jones, while no doubt a capable CEO, has yet to purchase any shares. The company’s long-serving CFO, Tu To, has no ownership interest.

Non-executive board members are paid $5,000 per year for their service. While this token sum is admirable, I view it as strange when the directors involved own no shares or only a small number of shares. Perhaps they were serving out of a sense of loyalty to Charlie Munger and will continue to serve to honor him, but I would feel better about the board if it was larger and had substantially more skin in the game. I think that these questions are certainly legitimate to bring up at the annual meeting.

Conclusion

Daily Journal finds itself at an inflection point in its history. With the death of Charlie Munger, the company has lost not only a revered leader but the manager of its highly concentrated investment portfolio and no clear succession plan has been presented for this function. In addition, Mr. Munger’s absence leaves the company’s board with only three members, only one of whom has even a small stake in the company.

With the legacy newspaper business in long-term secular decline despite relative stability in recent results and competitive pressures in the software business, management will have its hands full in the coming years. On a positive note, Mr. Munger’s investments have provided the company with a great deal of flexibility. There is clearly room for management to invest substantially in the software business in terms of funding product improvements and competing for talent.

I have not discussed the possibility that the company could be acquired in the future. Perhaps the company might be a target for Constellation Software which has a long history of acquiring vertical market software companies and allowing them to be run independently. A competitor such as Tyler Technologies might also have an interest.

I have followed Daily Journal for over a decade due to my interest in anything that Charlie Munger was involved in as well as due to my professional background in software. Although I have never been a shareholder and probably will not purchase shares in the future, I definitely plan to continue monitoring the company’s progress in the years ahead. I am particularly interested to see how the board approaches the equity incentive plan and how much it dilutes existing shareholders.

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Daily Journal was purchased for $2.5 million in 1977 by the New America Fund which was controlled by Charlie Munger and Rick Guerin. When the New America Fund liquidated in 1986, Daily Journal became a publicly traded company.

According to the company’s recent filings, Mr. Myhill-Jones became the permanent CEO of Daily Journal Corporation in October 2023.

As of September 30, 2023, the securities portfolio had a fair market value of $303,128,000. There was a margin loan balance of $75,000,000 secured by the securities portfolio. The margin loan interest rate is variable based on the Fed Funds rate plus fifty basis points.

Hi, Ravi, Thanks for this. Coincidentally, I just sold my very few shares, this morning. Gained 33+%. I'm too busy to learn more about and to continue to monitor this company. I have no expertise in this area. Just Charlie, who I wanted to keep track of.

I also bought WFC when it was $22.00, since Charlie kept his shares. I am a copycat, sometimes. When there are certain other variables that line up, like Mr. Market and valuation levels going below rationality.

Best wishes, and Happy New Year!

Dang, over 40% of the stock portfolio in WFC? I thought WB and CM had given up on that bank after all the scandals.