Warren Buffett's Advice on Stocks vs. Bonds

In October 2010, Warren Buffett thought that stocks were far more attractive than bonds, a prediction that proved to be accurate.

"It's quite clear that stocks are cheaper than bonds. I can't imagine anybody having bonds in their portfolio when they can own equities, a diversified group of equities. But people do because they, the lack of confidence. But that's what makes for the attractive prices. If they had their confidence back, they wouldn't be selling at these prices. And believe me, it will come back over time."

— Warren Buffett, October 5, 2010

From our perspective in mid-2023, Warren Buffett’s advice in late 2010 seems obvious, but it was not self-evident at the time. The United States had recently emerged from a financial crisis and it took years for investors to regain confidence. In retrospect, most of the fluctuations that seemed meaningful to us on a day-to-day basis have receded into mere noise when we zoom out and look at markets over a period of many years.

With the benefit of hindsight, Mr. Buffett’s observations nearly thirteen years ago were exactly on target. From October 2010 to May 2023, the S&P 500 posted an annualized return of 10.7%. Those who reinvested dividends would have achieved a 12.7% annualized return over that timeframe. Berkshire Hathaway Class A shares have compounded at an annualized rate of 11.8% since October 4, 2010.

Stocks have done very well indeed, just as Mr. Buffett predicted. How does this compare to the experience of bond investors over the same timeframe?

When I listen to Mr. Buffett comment on bonds, I usually think of treasury securities because Berkshire Hathaway tends to concentrate its fixed maturity investments in treasuries rather than accept credit risk. The occasional drama over the debt ceiling notwithstanding, treasury securities are considered very safe when it comes to credit risk. This lack of credit risk usually comes at the cost of relatively low returns.

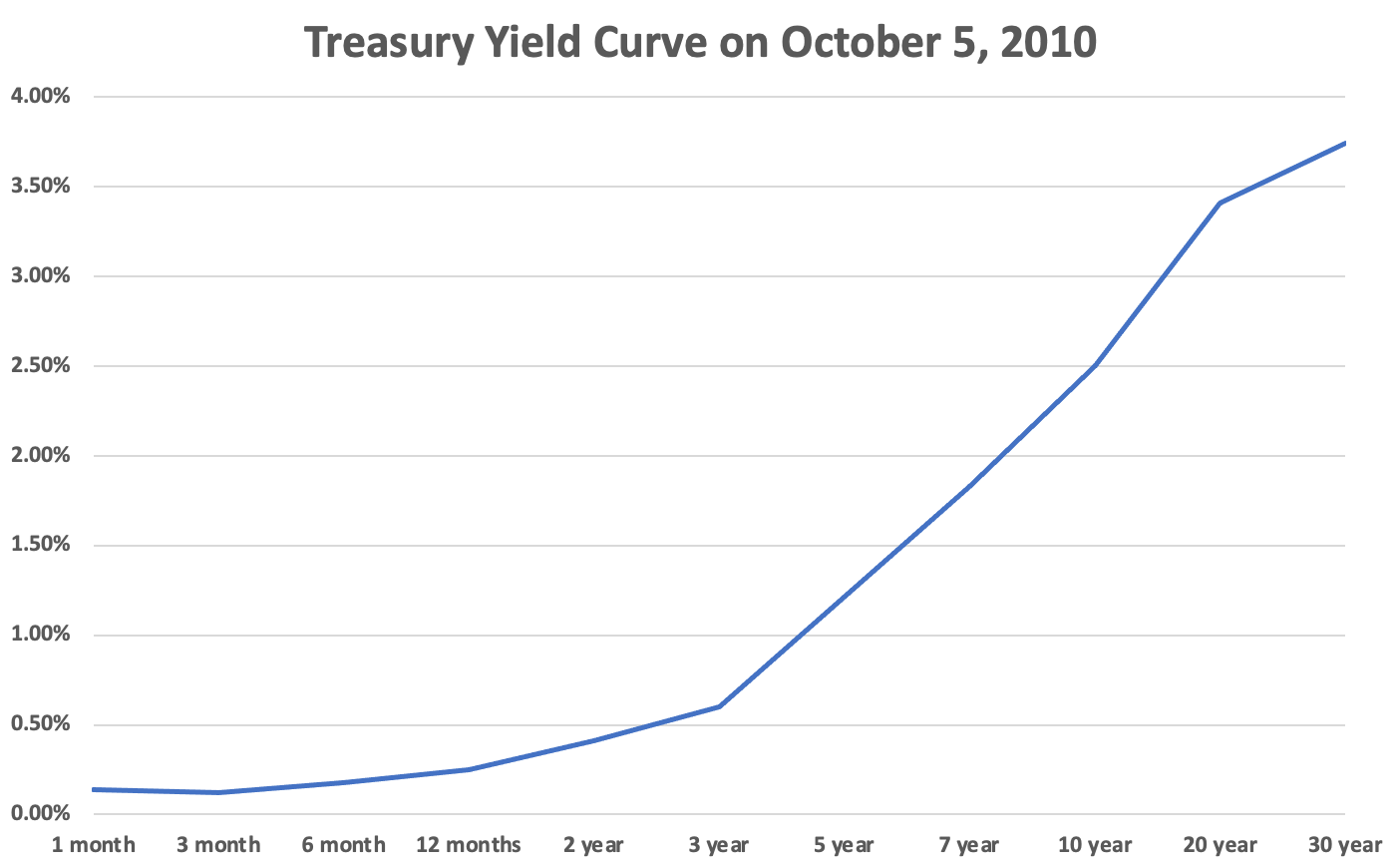

On October 5, 2010, the following yields were available on treasury securities:

Although no one knew it at the time, treasuries were at the beginning of a very long period of extremely low returns. In 2010, the Federal Reserve did not yet have an explicit inflation target, but Chairman Ben Bernanke would soon announce a 2% target. Investing at the short end of the yield curve was a near guarantee of loss of purchasing power of time. A yield in excess of inflation expectations at the time could be obtained in treasuries, but only by purchasing a maturity of ten years or more which involves taking considerable duration risk.

In 2010, fixed income investors might have waited on the sidelines in short term treasury bills expecting that long term treasuries would eventually provide more attractive yields as the economy recovered. While the ten year treasury did offer better yields occasionally, the story of the past thirteen years has been one of consistently low long term yields, as we can see from the chart of the ten year treasury note:

According to the inflation calculator provided by the Bureau of Labor Statistics, the consumer price index compounded at approximately 2.7% from October 2010 to April 2023. Investors in the S&P 500 or Berkshire Hathaway have compounded their wealth far in excess of inflation while an investor in longer term treasury securities would have been lucky to achieve any real return after inflation and taxes.

What if a skittish investor worried about the risk of investing in stocks but found the yields offered on ordinary treasuries unappealing because of the risk of inflation?

Since 1997, the United States Treasury has offered Treasury Inflation Protected Securities (TIPS) which are meant to provide investors with a real return adjusted for inflation. Just as we have a yield curve for regular treasury securities, we also have a yield curve for TIPS. This is what TIPS yields looked like on October 5, 2010:

Unlike regular treasury securities, TIPS are only offered as longer term securities at auction, although one can purchase TIPS on the secondary market for shorter maturities. For purposes of this discussion, I have displayed TIPS yields for five to thirty year maturities in the chart above. Note that the yields are expressed in real terms. In addition to the real yield, investors receive an adjustment for inflation.

At the time, the yield curve was upward sloping for TIPS, with the five year offering a real yield of negative 0.19% and the thirty year security offering a real yield of 1.54%.

It is interesting to note the difference between the yield on the regular ten year treasury of 2.5% and the yield on the ten year TIPS of 0.65% which implies that the market expected the inflation rate to be approximately 1.85% over the ten year period. This means that the choice of investing in the regular ten year treasury or the ten year TIPS would depend on the investor’s expectation of inflation. The investor who expected inflation higher than 1.85% would opt for the TIPS over the regular treasury.

Just as the interest rate for regular treasury securities fluctuates over time, TIPS real yields also fluctuate. The following chart shows how the real yield on the ten year TIPS has varied over the past thirteen years:

We should note that the real yield on longer term TIPS can become negative, as we can see from the exhibit above. This happened early in the thirteen year period and, in a more extreme way, during the period following the pandemic. As of mid-2023, real yields on TIPS are back in positive territory again.

The other option for risk averse small investors in October 2010 would have been to buy I Series U.S. Savings Bonds, also known as I Bonds. However, at the time, the I Bond offered a real yield of 0%, lower than the yields available on TIPS.

The bottom line is that unless an investor in October 2010 was willing to take credit risk in bonds and had a high degree of skill, it is almost certain that stocks provided far higher returns. A long-term investor who took Warren Buffett’s advice to heart would have achieved returns well in excess of inflation. In the bond world, an investor would have struggled to keep his head above water in real purchasing power terms.

This raises the question of whether it ever makes sense to invest in bonds over long periods of time, especially during periods of inflation. The answer depends on the yields offered on bonds, the likely level of inflation in the future, and the current valuation of a broad-based index of U.S. stocks.

I recently wrote an article about the role of TIPS in a fixed income portfolio, but this was in the context of a five year cash flow ladder rather than a long term investment. However, the fact is that the majority of investors will want to allocate a portion of their assets to bonds, especially those who are approaching their retirement years. A bond allocation usually provides a baseline level of perceived stability which permits many investors to view stock price fluctuations with greater equanimity, avoiding panic during the inevitable periods when stocks are declining.

For U.S. based investors who are unwilling to take credit risk, it makes sense to focus on securities backed by the United States government. Both marketable treasury securities and savings bonds have no credit risk, although all marketable securities, including regular treasuries and TIPS, have duration risk if sold prior to maturity.

Anyone investing in bonds needs to be aware of the risk of inflation, the topic of an article published yesterday. TIPS and I Bonds are both viable options that can provide limited inflation protection. In my next article, I will provide a detailed comparison of how TIPS and I Bonds work along with my opinion on how they might be used for various investment goals based on the interest rates that currently prevail.

Note to readers: This is the second article in a three-part series about inflation, TIPS, and I Bonds. The first article in the series, Death, Taxes, and Inflation, was published yesterday. Early next week, I will publish an article about investing in TIPS and I Bonds in today’s economic environment.

If you would like to support my work and receive additional premium articles several times per month, please consider signing up for a paid subscription.

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.