Berkshire Hathaway's Fixed Maturity Portfolio

Recent bank failures raise questions about how Berkshire Hathaway and other insurers account for fixed maturity investments.

“Banking is very good business if you don't do anything dumb."

— Warren Buffett

When Accounting Gets Exciting …

There’s a reason that Mad Men, the popular television series, featured an advertising agency rather than an accounting firm. Advertising might be less exciting today than it was during the 1960s, but chances are that the day-to-day life of a marketing executive provides more opportunities for excitement than would be the case in accounting. When accounting gets exciting enough to become a topic of conversation in the public consciousness, that’s a good sign that something has gone off the rails.

Banking has certainly gone off the rails over the past week.

The fall of Silicon Valley Bank on Friday was followed by a weekend of desperate pleas for government aid on social media by supposedly rugged "up-from-the-bootstrap capitalists.” This spectacle and the ensuing panic led to the government providing bailouts on Sunday evening. In addition to Silicon Valley Bank, the FDIC closed Signature Bank, a financial institution that former Congressman Barney Frank, of Dodd-Frank fame, had overseen as a director since 2015.

As I explained over the weekend, Silicon Valley Bank’s troubles related to its portfolio of fixed maturity securities that were carried on its balance sheet at cost rather than at fair market value. Management had designated the majority of the bank’s fixed-maturity securities as “held-to-maturity” (HTM) rather than “available-for-sale” (AFS).

Accounting rules permit HTM securities to be carried at cost while AFS securities must be carried at fair market value. The bank’s HTM securities were carried on the balance sheet at $91.3 billion as of December 31, 2022, but fair value was far lower at $76.2 billion. The decline in fair value was caused by rising interest rates. When interest rates rise, the market value of a fixed maturity security declines. When Silicon Valley Bank had to sell securities to meet demand for withdrawals, investors woke up to the fact that the bank would fail if it faced further deposit flight.

Over the past several days, I have been asked about how rising interest rates affect the fixed maturity portfolio of other companies, with several readers asking about Berkshire Hathaway in particular. In this article, I attempt to explain how the investment strategy of an insurer differs from a bank. This is followed by taking a brief look at Berkshire Hathaway’s fixed-maturity portfolio as of December 31, 2022.

Insurance vs. Banking

Before considering how insurers manage investments, it is necessary to consider the primary source of funding for companies in these industries. Banking and insurance are both highly regulated industries that are required to maintain certain levels of capital in order to operate. Discussing capital requirements is a complex subject beyond the scope of this article, but it is important to know that banks and insurers must have adequate shareholder capital. Maintaining sufficient capital provides resiliency for banks and insurers when faced with difficult business conditions.

Banks are in the business of accepting deposits from customers and using deposits to fund loans and investments. A customer deposit is a liability of the bank which may or may not require the bank to pay interest to the customer. The bank seeks to deploy these deposits in loans and investments that provide a rate of return greater than what must be paid on deposits. When most people think of bank deposits, they are thinking of demand deposits. Ordinary checking and savings accounts are called demand deposits because the customer can literally demand a return of the funds at any time. Banks also accept time deposits, also called certificates of deposit, which require the customer to leave the deposit with the bank for a certain period of time in order to earn a higher rate of interest. The return of a time deposit prior to maturity usually requires the customer to pay a penalty or fee to the bank.

Insurers are in the business of accepting premiums from customers in exchange for bearing risk in the event of specified losses suffered by the customer. In aggregate, part of the premiums received by a well-run insurer will represent underwriting profit while the majority of the premiums are used to fund customer losses. However, those losses do not occur immediately, so an insurance company benefits from the ability to invest premiums until customer losses occur. The term float is commonly used to refer to funds that represent a liability to the insurer but are available for investment until claims are received from customers who have suffered losses.

We can see some obvious similarities between banks and insurers. In both cases, a company is receiving funds from customers that represent liabilities but may be invested for a certain period of time.

In the case of banks, demand deposits can theoretically “walk out the door” at any time. Although unlikely except in the event of a panic, all of a bank’s demand deposits could be requested simultaneously. If that occurs, the bank will need to liquidate most of its loans and investments immediately in order to pay back depositors. This could be difficult enough if a bank only owns marketable securities and next to impossible if the bank primarily has loans to other customers, such as mortgages or auto loans.

In the case of an insurance company, float does not “walk out the door” at the same time. The amount of time an insurer can expect to retain float depends on the nature of the insurance. Float from automobile insurance is likely to be required to pay claims much sooner than float from a retroactive reinsurance policy that covers health claims related to asbestos exposure that will take decades to pay out. These are two extreme examples — but generally, float is a more stable source of funds than the demand deposits at a bank.

As going concerns, one can view both banks and insurers as having sources of funds that resemble revolving funds. Obviously, some deposits are going to leave a bank during any given period, but one can expect other deposits to arrive and, if the bank is serving its customers well, deposits should be expected to grow over time. The same is true with an insurer. An automobile insurer like GEICO is constantly receiving premiums for new policies and paying out claims for losses. Over time, float will grow or shrink based on how well GEICO serves its customer base.

Houston, We Have a Problem …

The purpose of the previous section is not to suggest that insurance is a better business than banking, only to illustrate the inherent differences between the source of funds available to banks and insurers. These differences have major implications when it comes to investments.

When bank customers lose confidence, deposits can leave in a hurry. This is precisely what happened at Silicon Valley Bank when depositors attempted to withdraw $42 billion on Thursday, March 9. They had every right to do so. These were demand deposits which comprised the vast majority of Silicon Valley Bank’s deposit base:

We can see that only a tiny percentage of Silicon Valley Bank’s deposits were time deposits with the remainder available to depositors immediately. We do not know what the bank’s balance sheet looked like on March 9, but if it looked anything like what it did at the end of 2022, there was no way to fulfill the withdrawal requests:

As of December 31, 2022, the bank had $13.8 billion in cash equivalents, $26.1 billion in AFS securities and $91.3 billion in HTM securities. In addition, the bank had a portfolio of $73.6 billion of loans which is not a source of funds to satisfy immediate requests for withdrawals.

I discussed the difference between the fair value and carrying value of Silicon Valley Bank’s HTM portfolio in detail over the weekend, so I will not repeat that discussion here. However, it is important to note that regardless of whether the securities were designated as AFS or HTM, they were not immediately liquid to satisfy $42 billion of withdrawals. Being unable to satisfy withdrawal requests is the death knell of any bank. Any remaining customer confidence will evaporate and this precipitates a classic run on the bank. The FDIC closed the bank on March 10.

It is possible for customers of an insurance company to lose confidence as well, and depending on the nature of the policy, a customer might have the ability to request a pro-rated refund. However, the customer is more likely to simply shift his business to another insurer when the policy comes up for renewal than to cancel. Even if the customer cancels and is due a pro-rated refund, there is no expectation that the funds will be refunded immediately. Nor does the customer view premiums placed with an insurance company as assets that they are depending on to make a mortgage payment or meet payroll. There is no parallel in insurance similar to a run on the bank.

Duration Matching

Most insurance companies invest float received from policyholders in fixed maturity investments that management believes will match the duration of the float. In other words, an insurer’s portfolio implicitly acknowledges the temporary nature of the float that is being held, knowing that it will eventually be required to pay losses to customers. With a diversified book of business, an insurer should be able to predict with reasonable accuracy when funds will be needed and can invest accordingly.

This is not to say that insurers cannot be surprised by unexpected claims. This can happen when insurers fail to adequately model all potential scenarios. For example, business interruption insurance is intended to cover losses that force a business to temporarily shut down. Before the pandemic, most insurers assumed that no single event was likely to shut down thousands of small businesses in hundreds of metro areas simultaneously. Well, surprise! While insurers can be blindsided by rare events, in most cases it is possible to duration match fairly well.

If an insurer is doing a good job of duration matching, securities in the fixed maturity portfolio are likely to be held to maturity. Such securities can depreciate in terms of market value prior to maturity but losses will reverse if held to maturity, assuming that the issuer of the security does not default. The fact that securities are likely to be held to maturity does not require management to use HTM accounting. The intention to hold a security to maturity provides management with the option, but not the requirement, to use HTM accounting. They can still designate the portfolio as AFS.

If a fixed maturity security designated as HTM suffers a decline in market value prior to maturity due to rising interest rates, this will not impact net income or equity. If a fixed maturity security designated as AFS suffers such a decline, this will not impact net income but will impact equity via other comprehensive income. Treating fixed maturity investments as AFS is more conservative and presents a better picture of the situation in terms of actual equity in the current economic environment.

Berkshire Hathaway’s Fixed Maturity Portfolio

At the outset, it is important to recognize the fact that Berkshire Hathaway is not a typical insurer. Aside from being a massive conglomerate with businesses spanning a wide array of industries outside insurance, Berkshire has a massive level of equity relative to float. As of December 31, 2022, Berkshire had total shareholders’ equity of $472.4 billion. The statutory surplus of Berkshire’s U.S. based insurers was $272 billion compared to float of $164 billion.

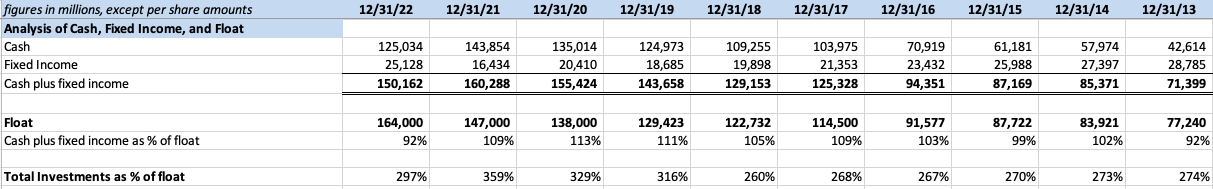

To put Berkshire’s fixed maturity portfolio in context, let’s take a look at Berkshire’s overall investment allocation over the past decade:

We can see that fixed maturity investments represent only 5.2% of invested assets as of December 31, 2022. Over the past decade, Warren Buffett has avoided investing in bonds due to the low interest rate environment and opted to keep very large balances of cash equivalents, including treasury bills. Berkshire also maintains a very large portfolio of equity securities, an allocation that is unusual in the insurance industry.

Aside from Berkshire’s investment portfolio shown in the exhibit, the company also owns subsidiaries in a wide array of industries. Readers who are interested in more information on Berkshire in general are invited to review the material on the Berkshire Hathaway resource page.

Many Berkshire analysts suggest that Mr. Buffett invests policyholder float in equity securities, but Berkshire’s combined cash and fixed maturity investments tend to approximate float over long periods of time. The exhibit below shows Berkshire’s cash and fixed maturity investments as a percentage of float over the past decade. In addition, we can see total investments as a percentage of float.

As noted previously, insurers do not face anything equivalent to runs on a bank, but it is interesting to note that even if a large percentage of Berkshire’s float suddenly disappeared, the company is run in such a way that no serious observer would claim that the funds could not be found to satisfy the claims. It is no exaggeration to say that Berkshire has a fortress balance sheet from the perspective of policyholders.

Unlike most insurance companies, Berkshire does not attempt to match the duration of its fixed maturity portfolio with expected claims. This is discussed in Berkshire’s latest annual report in some detail, an excerpt of which is presented below:

“Berkshire’s insurance subsidiaries hold significant levels of invested assets. Investment portfolios are managed by Berkshire’s Chief Executive Officer and Berkshire’s other investment managers. Investments include a very large portfolio of publicly traded equity securities, which is unusually concentrated in relatively few issuers, as well as fixed maturity securities and cash and short-term investments. Generally, there are no targeted allocations by investment type or attempts to match investment asset and insurance liability durations. However, investment portfolios have historically included a much greater proportion of equity securities than is customary in the insurance industry.”

Although Berkshire’s fixed maturity portfolio is very small, it is still worth taking a look at its composition and how it is accounted for. The following exhibit shows the category of securities in the portfolio at the end of 2022:

We can see that the portfolio is predominantly invested in government backed securities and that the amortized cost of the portfolio approximates fair market value. Berkshire’s balance sheet carries its fixed maturity portfolio at fair value.

How did Berkshire’s fixed maturity portfolio escape the type of carnage that afflicted Silicon Valley Bank’s portfolio in the rising interest rate environment of 2022? Warren Buffett has long had a strategy of avoiding long duration securities in a low interest rate environment. Let’s take a look at the maturity profile of Berkshire’s portfolio:

Mr. Buffett’s conservatism has resulted in a short duration portfolio resilient to a rising rate environment. How would Berkshire’s portfolio fare if rates were to rise further in the near term? Berkshire is not immune from losses, but the damage would be almost totally immaterial compared to the company’s overall level of invested assets, as the following exhibit illustrates:

If interest rates rise by 300 basis points, or 3%, Berkshire’s fixed maturity portfolio would fall by $1.3 billion which represents a decline of just 5.3%. Of course, Berkshire’s must larger position in cash equivalents would not be impaired. In fact, rising interest rates improve the return that Berkshire can generate on ultra-short duration assets such as treasury bills.

Conclusion

Berkshire Hathaway is a very unusual company and not representative of other insurers. Intelligent investors should carefully review how insurance companies allocate their portfolios and consider whether the duration of the fixed maturity securities is likely to match the duration of policyholder liabilities. In Berkshire’s case, duration matching is not necessary and would be meaningless given the company’s large holdings of cash equivalents. There is no doubt that Berkshire can pay claims as they occur, but this isn’t necessarily the case for all insurers.

In general, insurance companies have a more stable source of funds compared to banks because float cannot just walk out the door tomorrow even if policyholders start to lose confidence in an insurer, nor is it likely that claims will be made so suddenly that securities cannot be liquidated in an orderly manner to make payments.

An insurance company can certainly suffer impairments of its business model if customers lose confidence, but most likely this will result in a loss of renewals over time rather than immediately. When it comes to bank runs, management might have just hours to react. This is not the case in the insurance industry.

None of this is to excuse complacency. Investors should read notes to financial statements to determine whether figures shown on a balance sheet for fixed maturity investments reflect fair market value or amortized cost and if there are significant losses that are not reflected on the balance sheet. It is easy enough to adjust shareholders equity to reflect fair market value if the analyst deems it to be necessary.

The events of the past week obviously make it necessary to exercise great vigilance when it comes to analyzing banks. I am not an expert in bank analysis and have not owned bank stocks since well before the financial crisis. In retrospect, I had no idea what I was doing when I invested in a couple of banks in the early to mid 2000s and it is fortunate that I realized my ignorance before the financial crisis hit.

I feel conversant enough in banking at a high level, at least enough to write articles such as those published over the past week, but I can offer no advice to those who are searching through the regional bank carnage this week for investment opportunities in specific banks. Of course, nothing I publish is ever investment advice, but is even more true when it comes to bank stocks! Don’t take this article as advice!

It is easy enough to look at balance sheets and determine if there is a big gap between the carrying value and market value of fixed maturity portfolios, at least as of December 31, 2022. However, there is no mathematical formula that will tell you whether a bank’s customers are on the verge of pulling deposits. Mass psychology is not something you can predict based on financial statements. Very few banks can survive a loss of confidence that results in massive withdrawals all at once.

While it looks like the government might be on the verge of protecting more regional bank depositors, that does not mean that equity holders of banks are safe from being wiped out. My recommendation, from a vantage point on the sidelines, is to be careful.

If you found this article interesting, please click on the ❤️️ button and consider sharing this issue with your friends and colleagues. The Rational Walk no longer uses social media. Readers who use social media are encouraged to post links.

Thanks for reading!

Copyright and Disclaimer

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Long Berkshire Hathaway.

Well thought out article, as usual. 1-Keep in mind that life insurers differ from what you described as products are designed for assets and liabilities to interact. This is true for traditional managers but PE firms manage life companies more like a P/C firm. A life insurer would not use the term float. 2-annuities and universal life products could theoretically have a run on the bank but it would be unlikely since distributors are incented to reissue the policy once the surrender charges have graded off. 3-For the insurers you describe future premiums can be viewed as an asset with cash flows that are predictable. If the cost of float is less than 1 premiums are all you need except for conservatism. This is why property insurers are able to invest so broadly. 4 - property insurers do interact with economic variables, eg, when inflation is high cars cost more to fix and cost of float exceeds 1.

Excellent write-up. While I own BRKB shares and model my equity investing on many of WB's principles, I have always shared his reticence to buy fixed income securities. The unusual element in the SVB matter, unlike with most banks and insurance companies, is that bank management not only mismanaged durations of assets and liabilities but also the singular nature of its customers in their dependence on one kind of funding.