Berkshire Hathaway’s 2024 Annual Report

My thoughts on Berkshire's annual report and Warren Buffett's letter to shareholders.

There was a time when I enthusiastically spent my weekends reading annual reports, but those days are now a distant memory. However, there is one big exception. Every year, I wake up on a Saturday morning in late February to eagerly await the release of Berkshire Hathaway’s annual report. Warren Buffett’s letter to shareholders is always the highlight, but I also enjoy slowly going through every word of the report and updating dozens of spreadsheets I have maintained for decades.

Last year, I wrote a series of articles covering the 2023 annual report, an effort that took several weeks which was undertaken as part of a paid subscription offering which has since been discontinued. I will not repeat that process this year, but I thought it would be helpful for some readers if I post a shorter article. This post is by no means a comprehensive summary of the report and only includes a few topics that I decided to write about. Readers are encouraged to review Berkshire’s press release and annual report.

Too Much Cash?

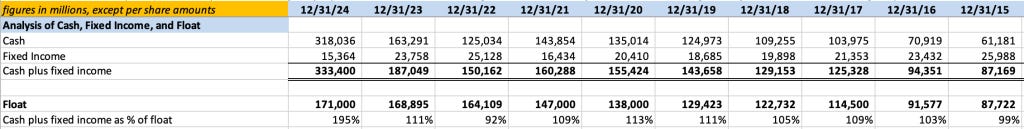

Berkshire has an enormous amount of cash on its balance sheet. However, news articles often provide inaccurate figures because they include cash held by the railroad and utility groups that Warren Buffett has typically not included in his discussions of cash in the past. In addition, many analysts and reporters neglect to subtract a liability reflecting amounts due for treasury bill purchases that had not settled at yearend. With these adjustments, Berkshire’s cash balance stood at $318 billion at the end of 2024.

It would be a mistake to regard the entire $318 billion as available for deployment. Berkshire has established a minimum level of $30 billion of cash in the context of its repurchase program. Additionally, Berkshire has a very small allocation to fixed-maturity investments. Historically, the sum of Berkshire’s cash and fixed-maturity investments has approximated insurance policyholder float, as we can see below:

Clearly, Berkshire has excess cash by historical standards and could deploy over $160 billion while still maintaining a 1:1 ratio between cash plus fixed-maturity investments and float. Is this “too much” cash? Mr. Buffett expressed a strong preference for owning equities, whether through shares in the stock of public companies or in wholly owned subsidiaries. He also noted that paper money can experience major erosion through inflation and that “fixed-coupon bonds provide no protection against runaway currency.”

My overall impression is that Berkshire’s cash balance will grow in the coming year unless there is a major market correction that provides attractive opportunities either in the stock market or acquisitions. As I type this article, such conditions seem quite unlikely, but sentiment can change quickly in financial markets and there is a significant amount of macroeconomic uncertainty regarding taxes, trade policy, and spending. Shareholders should take some solace in the fact that Berkshire continues to earn ~4.25% on its treasury bill portfolio while Mr. Buffett waits for a fat pitch.

Repurchase activity has ground to a halt and will likely remain suspended given the reaction of the market to Berkshire’s annual report. I would be surprised to see any repurchases unless the stock declines by at least 15% from current levels and we might need a 20% decline, to about $600,000 on the Class A shares, before Mr. Buffett regains his enthusiasm for large repurchases. Fortunately for shareholders who do not want a taxable event, there was no discussion of Berkshire declaring a dividend.

Drivers of Operating Earnings

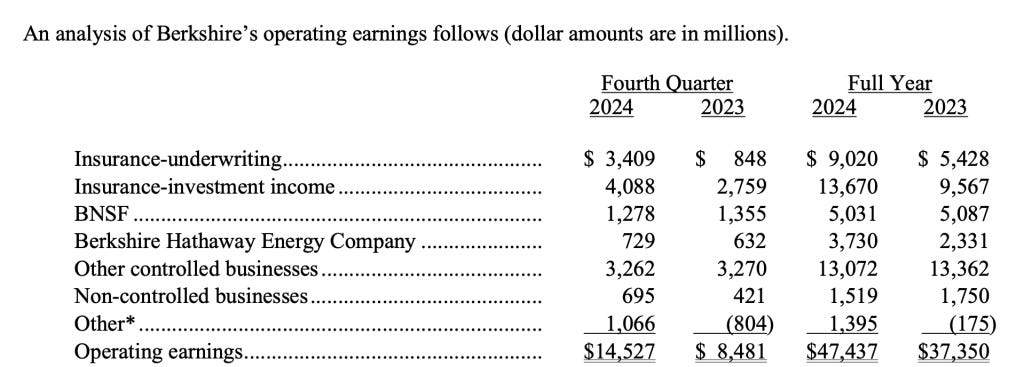

The press release presents a useful table of after-tax operating earnings:

By all accounts, Berkshire had a banner year with record operating earnings of $47.4 billion. This was driven by much better insurance underwriting results as well as higher investment income. However, we should note that the “Other” line item includes $1.1 billion of foreign currency exchange gains related to non-U.S. denominated debt in 2024 compared to $211 million of gains for 2023. Results were relatively flat for BNSF while BHE showed some improvement. The sprawling manufacturing, service, and retailing group, represented by the “Other controlled businesses” line, posted slightly lower profits.

If the goal is to look at the drivers of the increase in operating earnings, we should focus on underwriting performance and investment income. I have some comments on underwriting in the next section, but we can look at the simpler situation with investment income here. The table below tells the story of investment income over the past three years:

The increase in interest income is due primarily to large increases in Berkshire’s treasury bill portfolio which was partially offset by slightly lower treasury bill rates during the final quarter of the year. This should be no surprise at all given what we have seen develop with Berkshire’s cash balance over the past four quarters. Meanwhile, dividend income declined due to reductions in the equity security portfolio which was partially offset by higher dividends on certain holdings. Within the corporate structure, a certain percentage of dividend income is excluded from taxation, so as the proportion of Berkshire’s investment income tilts more toward treasury bill interest, we can expect the effective income tax rate to rise.

Berkshire does not provide “guidance” to analysts, but what if we wanted to forecast interest income for 2025? Obviously, this would depend on Berkshire’s average cash and treasury bill balance over the course of the year, which is not knowable, as well as the level of interest rates which, for short-dated treasuries, is tied closely to the Federal Funds rate which is determined by Federal Reserve policy actions. As a result, we cannot realistically forecast interest income for 2025, although I would note that the treasury yield curve currently implies that the Fed will cut rates by around a quarter to half of a percent this year.

Of course, if Berkshire deploys cash, the goal will be to earn returns materially higher than the yield on treasury bills. However, this may or may not show up immediately in other line items of Berkshire’s income statement. If Berkshire uses cash to purchase equity securities, the company will receive dividend income as well as potential capital gains over time, but these returns will be irregular and unpredictable. The acquisition of a new subsidiary would be expected to result in reported operating earnings in excess of treasury bill rates over time, but perhaps not immediately.

GEICO: The Star of the Show!

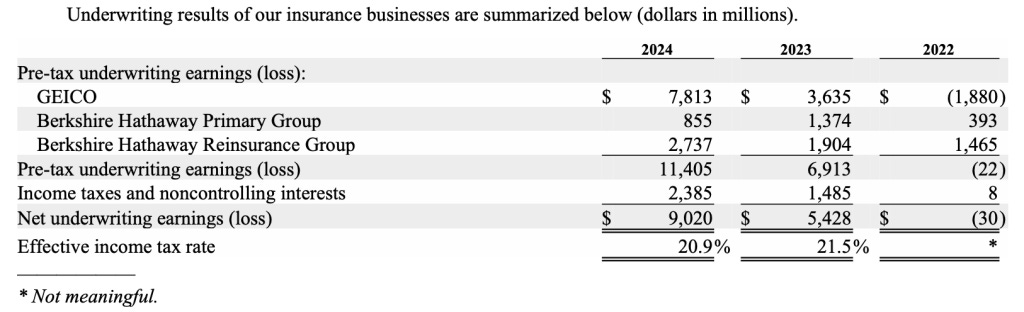

Insurance underwriting was the other big driver of operating earnings in 2024. Let’s take a look at the results of the overall group:

All of Berkshire’s insurance segments did well in 2024, but GEICO was clearly the star of the show with CEO Todd Combs earning praise from Warren Buffett in his letter to shareholders:

“Our insurance business also delivered a major increase in earnings, led by the performance of GEICO. In five years, Todd Combs has reshaped GEICO in a major way, increasing efficiency and bringing underwriting practices up to date. GEICO was a long-held gem that needed major repolishing, and Todd has worked tirelessly in getting the job done. Though not yet complete, the 2024 improvement was spectacular.”

GEICO has indeed shown major improvement over the past couple of years and $7.8 billion of underwriting profits in a single year is extremely impressive. Here are some high level figures for the past five years:

I’ve written about GEICO in detail several times over the past few years, with the most recent article appearing after the 2023 annual report. The story here is well known to many Berkshire Hathaway shareholders. This gem of a business performed strongly for decades but underinvested in technology which resulted in its main competitor, Progressive, achieving an advantage in underwriting appropriately for risks assumed. As a result, GEICO experienced significant underwriting losses between Q3 2021 and Q4 2022 and also lost market share to Progressive. Management took steps to raise premiums and cut costs which restored underwriting profitability starting in 2023.

The following table shows GEICO’s underwriting results on a quarterly basis since Q1 2020:

The table tells the story, but it is helpful to view the data in charts as well. The following charts show GEICO’s loss ratio and expense ratio since the first quarter of 2018:

In the third quarter of 2022, GEICO’s loss ratio was a catastrophically high 97%, indicating that management set rates at woefully inadequate levels. Fortunately, that was the high water mark for the loss ratio which has declined to under 70% in the latest quarter. GEICO has always had a significant cost advantage over its competitors and management applied this lever even more aggressively in recent quarters, with advertising spending and other expenses severely trimmed. This resulted in an ultra-low expense ratio of under 10% for the full year, although the expense ratio climbed up to 11.6% in the fourth quarter as management felt confident enough to increase advertising spending.

The combined ratio is the sum of the loss and expense ratios, with figures under 100% representing underwriting profit. We can see the trend that resulted in 2024’s exceptional performance in this graph:

Taking a much longer term view, we can see how exceptional 2024 results were compared to prior years. GEICO’s 81.5% combined ratio for the full year was way below the 93.8% average combined ratio for the figures in the following table, showing data since 2001:

It would be highly unrealistic for Berkshire shareholders to regard GEICO’s 2024 underwriting profits to be in any way “normal” given the historically low combined ratio. As we can clearly see from the table above, GEICO’s normal expense ratio is several points higher than it was in 2024, and we can expect the company to begin advertising in earnest to recover market share, assuming that management is confident that premiums are now at levels that will produce an acceptable loss ratio.

What would “normalized” underwriting profits look like for GEICO? Assuming premium volume of, say, $44 billion in 2025, GEICO would post underwriting profits of about $3 billion if it runs at a combined ratio of 93%. However, 93% might be optimistic given that Ajit Jain, at the 2023 annual meeting, disclosed that GEICO’s target combined ratio is 96%. This would imply “normal” underwriting profits of just $1.75 billion.

It is also important to compare GEICO’s performance to Progressive, as I have on numerous occasions in past years. Progressive has been performing admirably in recent years and has steadily picked up market share while avoiding underwriting losses. The following chart displaying earned premiums of GEICO and Progressive shows the result of the competitive battle of the post-pandemic period:

In April 2024, I wrote an article about Progressive “firing on all cylinders” in which I shared its recent results. Performance continued to be strong for the remainder of 2024. While GEICO’s policyholders-in-force count dropped by 0.5% in 2024 and 9.8% in 2023, Progressive has gone in the opposite direction. We have limited data on policies-in-force from GEICO, but very detailed data from Progressive:

It is useful to look at growth in policies-in-force both on a month-to-month sequential basis, as well as on a trailing twelve month basis, as shown in the following table:

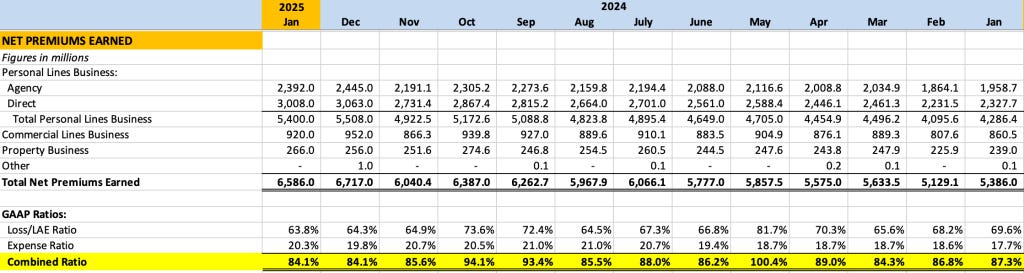

The data speaks for itself. Progressive has been shooting the lights out when it comes to market share gain. But what good are market share gains if you lose money? Fortunately for Progressive shareholders, management has not grown at the expense of losses. Quite the contrary, as we can see in the table below:

Progressive has not released its annual report for 2024, but we have monthly data releases from which the above table was derived. Progressive reported a full year combined ratio of 88.8%, which is higher than GEICO’s 81.5% combined ratio but still excellent and well below Progressive’s 96% combined ratio target.

Would we rather have GEICO post a combined ratio in the low 80s with market share stagnation, or a combined ratio in the high 80s or low 90s with robust growth? Historically, Berkshire has been aggressive in terms of seeking growth for GEICO, but with the caveat that inadequate pricing must be rejected.

Hopefully, GEICO’s recent investments in technology will help its underwriters price at a level that can achieve market share growth while still delivering underwriting profits. The problem in recent years was that GEICO’s confidence in its risk assessment declined due to six quarters of terrible results. Advertising spending was slashed and pricing increased. The success we saw in 2024 was welcome news, but it remains to be seen what GEICO’s normalized level of profitability will be and whether market share gains will occur. I think the jury is still out on GEICO’s turnaround.

Miscellaneous Thoughts

My original intent was to potentially cover a couple of other areas of interest, but the discussion of GEICO took more room than anticipated. I would just briefly note that the Manufacturing, Service, and Retailing group, which I covered in much detail last year, revealed some weakness in the service and retailing sectors, which is discussed on pages K-50 to K-53 of the annual report. We can see the weakness in quarterly margin trends, highlighted in yellow below:

The bright spot here is McLane which posted unusually high margins in 2024. Pilot was transferred to the MSR group in 2024 from the Railroad, Utility, and Energy group where it first appeared in 2023 after being consolidated on Berkshire’s balance sheet. Berkshire acquired full ownership of Pilot in early 2024 after a nasty legal dispute with the founding family. I wonder whether Pilot was in Warren Buffett’s mind when he wrote about Berkshire’s mistakes at the beginning of his annual letter.

Mr. Market seems to like Berkshire’s results and the stock has been hitting record highs early this week, with the Class A shares reaching $750,000 for the first time. It seems like only yesterday that I wrote an article when the Class A shares hit $600,000 a little over a year ago. Priced at ~1.65x book value, Berkshire shares are trading at a high price-to-book ratio relative to its typical level in the post-financial crisis period, but the stock traded at such levels for long periods in the 2000s:

Warren Buffett stopped focusing on book value several years ago after reporting on that figure for decades. He did so not because he viewed book value as a representation of Berkshire’s intrinsic value, but because he felt that rates of change in book value roughly approximated rates of change in intrinsic value, which he has always said far exceeds book value. For many longtime shareholders, this metric is still worth tracking.

A year ago, Berkshire’s stock rose after the release of the annual report and I wrote Too Clever by Half! to criticize the idea of “trading” the stock. But after a subsequent spike in the stock price in late summer, I failed to take my own advice and sold shares in my retirement accounts, thinking that I would owe no taxes on the sale and shares were getting too expensive. A few weeks later, I reversed my decision and wrote a mea culpa, Just Hold the Goddamn Stock! I was fortunate enough to replace my sold shares at a slightly lower price, but I rediscovered that “trading” is not for me.

Why not trade the stock? Time is the friend of the owner of an excellent business. We should not forget that Berkshire reinvests all of its earnings and has historically compounded book value per share (and intrinsic value per share) at very attractive rates:

There is no law that says that Berkshire will continue to compound at such rates, but in any given year, we can be sure that Berkshire will deliver tens of billions of dollars in after-tax operating income alone, in addition to posting gains on securities on a normalized basis. If Berkshire seems “expensive” today at 1.65x book value, that problem will most likely work itself out in short order as value continues to accrete to owners and management retains all earnings.

As an example, let’s say that you believe that Berkshire’s intrinsic value is $690,000 per Class A share when the stock price is $750,000. This would indicate a modest overvaluation of 8.7%. You could sell your share today, hoping to buy it back at a lower level in the future. But within a year, it is highly likely that Berkshire’s intrinsic value will have “caught up” to today’s “overvaluation” and you could very well never have an opportunity to buy back your position at a lower price.

Some people have a trading mentality while others do not. Personally, I find trading unappealing even when it works out well, as it did for me last summer. It is too mentally taxing to try to jump in and out of a stock simply because its value seems a bit on the high side. The situation would be different if a stock is trading at a level that could plausibly result in no return for five or ten years, but that has never really been the case for Berkshire Hathaway. As a result, it seems better to just hold the stock unless there is a need to raise cash or some clearly superior opportunity comes along that carries reasonable levels of risk.

Conclusion

I should mention that I have received some pushback on my concerns about Berkshire’s culture in the long run, which was the subject of an article last week. I’ll reiterate that I have no short-term or medium-term concerns, but as I discussed at length in the article, Berkshire’s ownership will eventually resemble a “typical” mega-cap company once Warren Buffett’s family foundation eventually ceases operations, which will probably occur 10-15 years after his death.

My “base case” is that a company with a “typical” ownership profile is likely to have a “typical” culture eventually. I hope to be wrong, but we will not know for quite a long time. It seems certain that the small number of remaining Class A shares in existence after the Buffett Foundation winds down will be held almost exclusively by large institutions unless the shares are split at some point in the coming years.

I am very grateful that Warren Buffett remains at the helm of Berkshire at the age of ninety-four. When I purchased my first shares of Berkshire a quarter century ago, I never imagined that Mr. Buffett would still be running the company in 2025 and I still have trouble wrapping my mind around the life-changing compounding that my early investments in Berkshire have delivered. The modest quarterly bonus payments that I regularly invested in Berkshire from 2000-05 could have each bought a very nice vacation or perhaps a living room furniture set at the time. Today, many of those positions could pay for a down payment on a median priced single family home.

The compounding snowball that is Berkshire Hathaway never ceases to amaze me.

Copyright, Disclosures, and Privacy Information

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC. The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Individuals associated with The Rational Walk own shares of Berkshire Hathaway.