Berkshire Hathaway's 2023 Proxy Statement

Share repurchases, compensation, ownership, risk disclosures, and board diversity

Three weeks ago, Berkshire Hathaway shareholders and the financial news media quickly digested the contents of Berkshire Hathaway’s 2022 annual report which contained Warren Buffett’s letter to shareholders. I was certainly among those who eagerly awaited the early morning release of the annual report and spent much of the weekend analyzing the company’s results. While Mr. Buffett’s letter was less detailed than in years past, I thought that many important points were conveyed.

Like other public companies, Berkshire Hathaway is required to provide an annual proxy statement containing information on board and executive compensation along with matters that stockholders will be asked to vote on at the annual meeting. Berkshire released its 2023 proxy statement yesterday. It is likely that only a tiny fraction of the shareholders and journalists who read the annual report will bother to spend any time with the proxy statement. This is unfortunate because proxies provide a wealth of information that is absent from annual reports.

Perhaps one reason for the general lack of interest in proxies is that most large public companies bury important information within a massive and glossy piece of marketing material. This is not the case at Berkshire. This year’s proxy is just nineteen pages long, consists entirely of text, and doesn’t even have any photographs let alone glossy pages. Of the nineteen pages, six are related to shareholder proposals.

This article covers several aspects of the proxy. The proxy takes less than half an hour to read and I would encourage readers to review it for themselves. Some of my comments are subjective and potentially controversial, particularly related to proposals that threaten to politicize Berkshire’s culture and corporate governance. Even owners with a tiny number of shares can submit proposals, and rightfully so, but when I see politically motivated nonsense, I reserve the right to call it out.

Share Repurchases

Shareholders of record as of the close of business on March 8, 2023 are entitled to vote at the meeting and the company announced that there were 590,238 Class A shares and 1,298,190,161 Class B shares on that date. Class A stock has one vote per share while Class B stock has 1/10,000 of a vote per share. As I wrote last year, Berkshire’s future will depend on voting control, with Class A shares having a major advantage.

Based on this disclosure, we can calculate that Berkshire had 1,455,698 Class A equivalent shares outstanding on March 8. Each Class B share has economic rights equivalent to 1/1500 of a Class A share:

Class A shares + (Class B shares / 1500) = Class A Equivalents

590,238 + (1,298,190,161 / 1500) = 1,455,698 Class A EquivalentsBerkshire had 1,458,235 Class A equivalents outstanding on February 13, 2023, a figure disclosed in the annual report. This indicates that Berkshire retired 2,537 Class A equivalents between February 14 and March 8.

Berkshire had 1,459,733 Class A equivalents outstanding on December 31, 2022, a figure also disclosed in the annual report. This indicates that Berkshire repurchased 1,498 Class A equivalents between January 1 and February 13.

Adding up these figures, Berkshire has reduced its share count by 4,035 Class A equivalents this year. Eyeballing the stock chart, it seems like $470,000 per share might approximate an average cost. This implies a cost of around $1.9 billion.

We will know the precise number of shares and amount spent when the first quarter report is released in late April or early May. Class A shares closed at $442,765 on Friday, March 17, well below the cost of recent repurchases, so perhaps Warren Buffett will accelerate the pace between now and March 31. However, Mr. Buffett might prefer buying shares of Occidental Petroleum and perhaps he is finding other opportunities based on market dislocations caused by recent bank failures — either in banks or in other securities that have declined over the past week. Time will tell.

Compensation

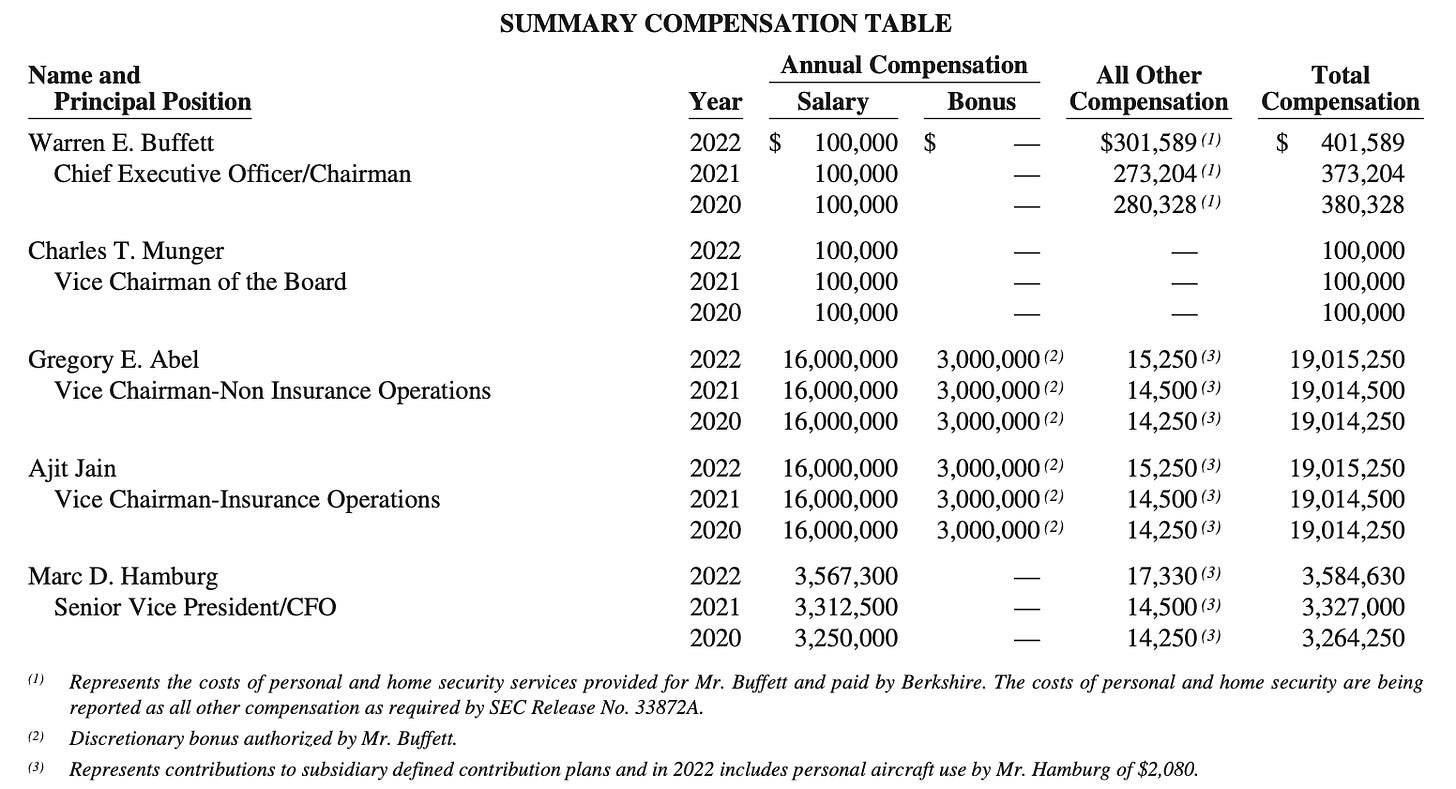

There is not much to report in terms of compensation changes over the past year. Non-management board members continue to earn only symbolic pay. Note that there are no zeros omitted in the table below:

Inflation over the past few years was not as transitory as Federal Reserve officials had hoped, and a reader of Berkshire Hathaway’s annual report can see the effects of inflation on the company’s operations. However, inflation has hardly been a factor when it comes to executive compensation. Warren Buffett and Charlie Munger continue to receive a token salary of $100,000 per year. Mr. Buffett’s “compensation” includes the cost of personal security. Greg Abel and Ajit Jain continue to receive total compensation of $19 million. Longtime CFO Marc Hamburg was the only executive whose salary approximately kept up with the rising cost of living in 2022.

Berkshire does not provide stock-based compensation to executives or board members. One of the reasons Berkshire’s proxy is so brief is because disclosures related to stock-based compensation typically consume many pages of tables and commentary that no doubt confuse most shareholders who have the fortitude to actually read such material. That is not an issue at Berkshire. As a result, I will still have time to go running in the daylight this afternoon after posting this article.

Skin in the Game

When last year’s proxy was released, I wrote an article about board compensation and share ownership. I would recommend that article for background information on Berkshire’s overall philosophy regarding alignment of shareholder and director incentives. Agency problems can never be completely overcome, but at Berkshire ordinary shareholders can at least rest assured that directors serve because they have substantial assets at risk, not because they are receiving rich pay and benefits.

In last year’s article, I provided a table that I think gives readers a better picture of the true skin in the game of directors compared to the standard proxy disclosure. Standard disclosures are somewhat confusing because a director’s “beneficial ownership” includes shares that they oversee for charitable foundations. While I am sure that directors who control Berkshire shares for the benefit of charity care deeply about those charities, I think that it is useful to segregate such shares from true personal ownership and ownership via family related trusts.

Here is the table updated for this year’s proxy:

There are footnotes provided in the proxy that disclose whether shares related to a director are held in trusts, usually for family members, or for charitable foundations. I have changed the title of column F from “Family Holdings” to “Trust Holdings” since there are some cases where the trusts are not specified as family trusts. I suspect that such trusts are for family members, but the proxy does not say so explicitly. For example, here is the footnote for Greg Abel:

“Includes 173 Class A shares and 2,289 Class B shares held by a trust for which Mr. Abel is a trustee but with respect to which he disclaims any beneficial interest and 74 Class B shares held by Mr. Abel as custodian for members of his family but with respect to which he disclaims any beneficial interest.”

In Mr. Abel’s case, the trust holding 173 Class A shares is not explicitly called a family trust whereas the trust holding 74 Class B shares is referred to as a family trust. I strongly suspect that the ultimate beneficiaries of both trusts are family related rather than held for charity, because other directors who oversee charitable trusts are specified. So unless stated in the proxy footnotes, I have put trust shares in column F.

Berkshire’s board has substantial skin in the game. However, the departure of Tom Murphy Sr. from the board in February 2022 shortly before his death and the death of David S. Gottesman in September 2022 were blows to Berkshire Hathaway. In addition to the decades of experience both men brought to the table, they were also large shareholders of the company who knew Warren Buffett for decades and they were not only directors but Mr. Buffett’s personal friends.

Berkshire’s governance committee states that they seek directors who, among other attributes, “have had a significant investment in Berkshire shares relative to their resources for at least three years.” As we review the exhibit above, it is quite clear that all directors have substantial investments in Berkshire, although we are left to make inferences about each director’s total resources based on their resume.

Susan Decker has the smallest investment in Berkshire with 3,125 Class B shares worth $917,219 at the current stock price. As lead independent director, it would be a positive signal if Ms. Decker was willing to raise her stake in the company. Here is Ms. Decker’s biographical sketch from the proxy:

“SUSAN L. DECKER, age 60, has been a director of the Corporation since 2007. Ms. Decker also serves on the boards of directors of Costco Wholesale Corporation, Vail Resorts, Inc., Momentive, Chime, Automattic and Vox Media. She is CEO and Founder of Raftr, a community-building and insights platform. From June 2000 to April 2009, Ms. Decker held various executive management positions at Yahoo! Inc., a global Internet brand, including President (June 2007 to April 2009), head of the Advertiser and Publisher Group (December 2006 to June 2007) and Chief Financial Officer (June 2000 to June 2007). Before Yahoo!, Ms. Decker spent 14 years with Donaldson, Lufkin & Jenrette. She is a Chartered Financial Analyst and served on the Financial Accounting Standards Advisory Council for a four-year term, from 2000 to 2004.”

While I have no concerns about Ms. Decker’s qualifications to serve on the board based on her extensive background and sixteen years of service on Berkshire’s board, I question whether an investment of under $1 million represents a “significant investment” relative to her resources. I note that Ms. Decker serves on the Costco board with Charlie Munger and she would not be serving on Berkshire’s board if Mr. Munger did not have very high regard for her abilities. That being said, I believe that the role of lead independent director calls for a larger investment.

Are there other directors who could have more in Berkshire relative to their resources? My guess is that the answer is yes in a few cases, although I won’t single out any specific director. The reason for commenting on Ms. Decker is the apparent incongruity between the lead independent director role and having the smallest investment in Berkshire among all of the directors.

Mr. Buffett and Mr. Munger will not be on the board forever and it is prudent to look at director ownership excluding their holdings. Obviously, Mr. Buffett’s absence will be a major blow to Berkshire from a business standpoint but we will also lose a director with massive skin in the game. In his place, the administrator of Mr. Buffett’s estate will control his shares as they are distributed to charities over a period spanning about a decade. Howard Buffett, who has been on the board for three decades, is likely to take over as Chairman. Mr. Munger has been less specific about how his shares will be distributed upon his death, but his absence will also be felt both in terms of wise guidance for the firm and as a very large owner.

Risk Oversight

In September 2022, the SEC sent Berkshire Hathaway a letter requesting a greater level of detail regarding risk disclosures and the responsibilities of Berkshire’s lead independent director. CFO Marc Hamburg responded a few days later indicating that the company would enhance the disclosure in the 2023 proxy.

Berkshire’s proxy has this to say about Ms. Decker’s role:

“Susan A. Decker is the Board’s lead independent director. Berkshire’s lead independent director does not represent the Board in communications with shareholders and other stakeholders. It is Berkshire’s policy to generally limit such communications to a six-hour question and answer (“Q&A”) session with Berkshire shareholders and stakeholders held each year prior to Berkshire’s annual shareholders meeting. At this session Berkshire’s shareholders and stakeholders have the opportunity to ask questions to Berkshire’s Chairman and its three Vice Chairmen (Warren Buffett, Charlie Munger, Greg Abel and Ajit Jain). …

As lead independent director, Ms. Decker along with the Board’s Governance, Compensation and Nominating Committee provide recommendations to Warren Buffett regarding potential director candidates. In addition, Ms. Decker provides suggestions to Mr. Buffett and other members of the Board regarding the Board size and composition if Warren Buffett is no longer able to serve as Berkshire’s CEO and Chairman of the Board.”

I would note that Berkshire’s directors are normally present at the annual meeting and I believe certain directors have been asked questions by shareholders in the past. I suspect that if a shareholder wanted to ask questions directly of Ms. Decker at the upcoming meeting, they would be able to do so. My understanding of the situation is that the lead independent director at Berkshire has a fairly limited role, but does have a real role, nonetheless. Almost all Berkshire shareholders understand that Mr. Buffett controls the company and is the dominant personality in the boardroom.

Regarding risk control, the proxy clearly states that the buck stops with Mr. Buffett:

“The full Board of Directors has responsibility for general oversight of risks. It receives reports from Mr. Buffett and other members of senior management at least twice a year on areas of risk facing the Corporation. In addition, as part of its charter, the Audit Committee discusses Berkshire’s policies with respect to risk assessment and risk management. Berkshire’s chief risk officer is its Chairman and CEO, Warren Buffett. Mr. Buffett and the members of the Audit Committee believe it is important that the full Board have overall responsibility for risk oversight. Berkshire rarely utilizes outside advisors and experts to anticipate future threats and trends. Mr. Buffett along with Berkshire’s three Vice Chairmen are continually assessing risks.” [Emphasis added]

As long as Mr. Buffett is able to serve as Chairman of Berkshire Hathaway, he is going to be a dominant force in the boardroom, both because of his extremely long tenure and track record and because he is the largest shareholder of the company. In addition, he is always going to be the main risk officer as long as he’s serving as CEO.

The main purpose of greater definition of roles and responsibilities with respect to risk oversight is to ensure that the eventual transition from Mr. Buffett to his successor will go smoothly. Greg Abel’s eventual role in the boardroom will differ substantially from Mr. Buffett’s since the CEO and Chairman roles will be separated. It will be interesting to see how Berkshire’s board evolves over time.

Board Diversity

Rather than insulting the reader’s intelligence with meaningless self-congratulatory verbiage and virtue signaling hypocrisy related to various trendy political and social issues, Berkshire’s proxy focuses on matters that are actually relevant to shareholders. The company refuses to engage in typical corporate “diversity” initiatives and rightfully focuses on merit and skin in the game rather than the color of one’s skin:

“Berkshire does not have a policy regarding the consideration of diversity in identifying nominees for director. In identifying director nominees, the Governance Committee does not seek diversity, however defined. Instead, as previously discussed, the Governance Committee looks for individuals who have very high integrity, business savvy, an owner-oriented attitude, a deep genuine interest in the Company and have had a significant investment in Berkshire shares relative to their resources for at least three years.

Berkshire does have women and minorities on the board, but rather than insult them by treating these highly accomplished individuals as props to generate a checkmark on some diversity grid, the proxy emphasizes that they were selected due to what they bring to the table in terms of experience and ownership. In response to a shareholder proposal that is intended to force Berkshire into the practices of most other large companies, the proxy responds with the following statement:

“Berkshire’s commitment to diversity, equity and inclusion and the effectiveness of our companies’ related programs starts with our leaders, including our Board of Directors, of which four members are female and two members are racially or ethnically diverse. However, it should be noted that these directors were not selected for diversity purposes. To ensure long-term success for our shareholders, Berkshire encourages its leaders to execute diversity, equity and inclusion strategies that are tailored to the unique aspects of their businesses.” [Emphasis added]

Readers of the biographies covering Mr. Buffett’s life know that he was an advocate for civil rights from the earliest days of the civil rights movement of the 1960s. He has also made numerous comments over the years about the loss to individual businesses and to society as a whole when women are discriminated against in employment markets. None of this seems to matter to politically driven pressure campaigns intended to intimidate businesses to elevate skin color, gender, and sexual orientation over ownership and business acumen when it comes to corporate governance.

Hopefully, Berkshire will continue to resist politically driven pressure campaigns in the decades to come. As a longtime shareholder with a great deal of skin in the game, I care not a bit about “diversity” on the board as a goal in and of itself. I care about business acumen and ownership when it comes to selecting the men and women responsible for representing my interests and overseeing management charged with maximizing my long-term wealth. I care about skin in the game, not skin color.

It will be a sad day if Berkshire’s proxy consists of a hundred pages of glossy virtue signaling verbiage twenty years from now. At least for now, I am pleased with a proxy that took thirty minutes to read while giving me all the relevant facts rather than one that required an entire weekend to parse through needless verbiage.

If you found this article interesting, please click on the ❤️️ button and consider sharing this issue with your friends and colleagues. The Rational Walk no longer uses social media. Readers who use social media are encouraged to post links.

Thanks for reading!

Copyright and Disclaimer

Nothing in this article constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Long Berkshire Hathaway.

CALPers filed the following with the SEC in support of proxy measures 4, 5, 6, and 7 and they also oppose the re-election of Christopher Davis, Susan Decker and Meryl Witmer:

https://www.sec.gov/Archives/edgar/data/919079/000114036123016992/brhc10051155_px14a6g.htm

The Illinois State Treasurer filed the following with the SEC in support of proxy measure 5:

https://www.sec.gov/Archives/edgar/data/1067983/000121465923005016/x46230px14a6g.htm

As I have written on numerous occasions, Berkshire will continue to be pressured by institutions acting with clearly political motives that wish to bully the board into adopting various vapid "ESG" measures. The CALPers statement is particularly vapid, as their management seems oblivious to the extensive disclosures offered by Berkshire subsidiaries, most notably Berkshire Hathaway Energy which regularly posts such information in its SEC filings as well as investor presentations, such as this one from March:

https://www.brkenergy.com/assets/pdf/fiic-presentations/2023-fiic-presentation.pdf

Institutions with political motives will eventually succeed in making Berkshire act as all other mega-caps unless sufficient support exists among remaining Class A shareholders in the decades to come. Unfortunately, I am not optimistic about the chances of Berkshire avoiding the ESG nonsense in the long run given the dynamics of Class A to Class B conversion and the very high price of Class A stock that will force individual investors to convert to B or realize very large capital gains. As I wrote last year, Berkshire could elect to split the Class A shares to reduce the need of individual investors to convert to B:

https://rationalwalk.com/the-case-for-splitting-berkshires-class-a-shares/

Greg Abel purchased 55 shares of $BRKA on Friday, March 17 at an average cost of $447,259.99. This transaction is worth more than his entire gross pay for 2022. Of course, he does have more money he can invest from last year's sale of his 1% stake in BHE, but I find it hard to criticize a man who now has built a nine figure stake in Berkshire is just a few months. He will likely buy more in the future. A huge vote of confidence from Berkshire's next CEO.

https://www.sec.gov/Archives/edgar/data/1067983/000108131623000009/xslF345X04/wf-form4_167942916524621.xml