“There is intelligent speculation as there is intelligent investing. But there are many ways in which speculation may be unintelligent. Of these the foremost are: (1) speculating when you think you are investing; (2) speculating seriously instead of as a pastime, when you lack proper knowledge and skill for it; and (3) risking more money in speculation than you can afford to lose.”

— Benjamin Graham

Intelligent investing is relatively straightforward but it can take a long time for small sums to grow into a meaningful nest egg. As Charlie Munger has observed, many of the questions that he is asked boil down to how one can become as rich as he is, but faster! Few people have the patience to forego consumption in the short run in order to be wealthy several decades from now.

Whether consciously or not, many investors engage in forms of speculation in an attempt to accelerate their progress by scoring quick wins. There is nothing inherently wrong with speculation provided that Benjamin Graham’s warnings are taken into account. If you are going to speculate, you should at least know that you are speculating rather than investing and attempt to be as smart about it as possible.

A minimum prerequisite for intelligent speculation is to at least have an understanding of what it is you are trading.

On January 7, Elon Musk sent the following tweet to his tens of millions of followers:

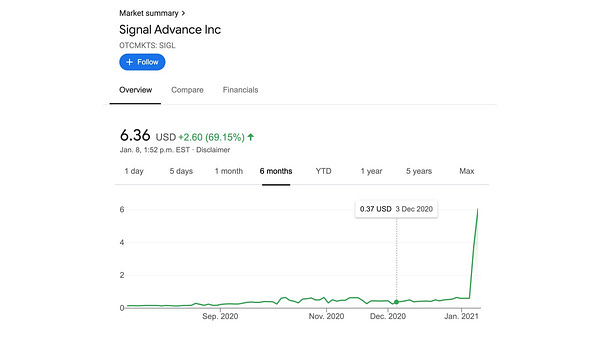

What did he mean? Apparently a significant number of speculators did not pause very long to think about the meaning of this two word tweet and instead rushed to purchase shares of Signal Advance (SIGL), a tiny micro-cap stock. The company engages in developing technology “which may significantly reduce signal detection delays associated with a variety of physical sensors” according to its latest 10-K filing.

A speculator operating with a hair-trigger could plausibly rationalize that Mr. Musk had found a use for Signal Advance’s technology in Tesla automobiles, but that was not the intent of the tweet. It quickly became clear that Mr. Musk was actually telling his followers that they should use the Signal platform which is a messaging application.

From a closing price of $0.60 on January 6, Signal Advance’s price increased by 527% on January 7 and another 91% on January 8, closing at $7.19.

On January 8, the Signal platform sent the following tweet:

By January 8, it should have been abundantly clear to speculators that the security they were buying had nothing whatsoever to do with Mr. Musk’s tweet.

On January 11, Signal Advance issued a press release stating that the company had nothing to do with Mr. Musk’s tweet. Speculators did not care. The price of Signal Advance rallied to close at $38.70 after reaching an intraday high of $70.85.

What started out as a case of mistaken identity became an exercise in the greater fool theory as speculators knowingly bought up shares of a stock that had nothing to do with Elon Musk’s tweet simply because they thought that someone else would show up to purchase their shares at an even higher price. While the frenzy of January 11 abated, the stock was still trading above $5 per share at the end of January and closed at $1.27 on July 13, more than twice its level prior to Mr. Musk’s tweet.

The story of Advance Signal is not unique. Similar speculative rallies have taken place in other stocks due to mistaken identity including Zoom Technologies (ZOOM) which has been mistaken for Zoom Communication (ZM).

Cases of mistaken identity are nothing new. In 1999, in the midst of the dot com bubble, a tiny penny stock soared 37,636% when it was mistaken for a company with a similar name that had filed to go public.

While many of these rather amusing stories seem to be innocent cases of mistaken identity, market manipulators have leveraged the gullibility of investors in the past to make a quick buck.

The Repeal of Prohibition

In 1933, Prohibition was repealed in the United States when the 21st Amendment was ratified. Congress proposed the amendment on February 20 but it was not ratified by a sufficient number of states until December 5 when it took effect. When the amendment was proposed by Congress, no one knew whether enough states would act or when. But businessmen and speculators were not going to wait for full clarity before acting.

Joseph P. Kennedy was one of the most successful speculators of the 1920s and one of the few who emerged unscathed from the 1929 stock market crash. In fact, Kennedy not only was unharmed by the crash but profited from it through well timed short positions. A wealthy man prior to the Great Depression, Kennedy became even more wealthy during the early 1930s.

In a world where information flowed at a much slower pace, opportunities for outright manipulation and fraud abounded. With the end of Prohibition on the horizon, investors were searching for “repeal stocks” — companies that would benefit from the boom in alcohol sales that was expected. Owens-Illinois was one of the popular stocks of 1933 because it made glass bottles needed to distribute alcoholic beverages.

In a syndicate that included Lehman Brothers among other well known firms and individuals, Kennedy purchased 65,000 shares of a company called Libbey-Owens-Ford which manufactured plate glass for automobiles. According to his biographer, Kennedy was knowingly engaging in stock manipulation:

“The syndicate, of which Kennedy was the largest individual investor, placed its Libbey-Owens-Ford stock orders in the hands of two pool managers, who divided them into several parcels and began trading them wildly on the New York Stock Exchange. As one of the pool managers later admitted under questioning by Ferdinand Pecora before the Senate Committee on Banking and Currency, the enterprise was constructed on the correct assumption that if the pool managers pumped up volume by buying and selling shares to one another, investors would take notice and start buying shares of Libbey-Owens-Ford on the mistaken belief that they were buying shares of Owens-Illinois, the bottle manufacturer.

Kennedy profited enormously from the stock pool and invested some of his profits in Owens-Illinois.”

— The Patriarch: The Remarkable Life and Turbulent Times of Joseph P. Kennedy, p. 192

The story of Libbey-Owens-Ford is a classic pump-and-dump scheme that worked marvelously well in the low-information world of 1933. Speculators of that era did not have easy access to information as we do today with the internet and, in the frenzy of trying to capitalize on a rising stock price, many obviously were fooled by the vaguely similar name. But other speculators, including Kennedy, clearly knew that the company being traded had nothing to do with the repeal of Prohibition.

The More Things Change …

The desire to get rich quickly will never change. It is simply human nature to want results that are quicker than waiting for the magic of compounding to show its results over decades. What is somewhat baffling is that cases of mistaken identity still persist in an era where one can verify a ticker symbol in a matter of seconds.

Although Elon Musk’s tweet about Signal was characteristically vague and cryptic, it would not have taken much digging to understand that the context of the tweet had nothing to do with Signal Advance. All the information was out there, accessible by anyone with an internet connection. Most of the speculation seems to have occurred once everyone knew that there was a case of mistaken identity.

Cases of outright stock manipulation are obviously more troubling. What Joseph P. Kennedy and his syndicate engaged in was outright manipulation and the victims did not have easy access to information. Obviously, any competent speculator would have taken the time to understand the nature of Libbey-Owens-Ford and the fact that it had nothing whatsoever to do with Owens-Illinois, but it would have taken some time to round up the information. Kennedy profited from deception of the sort that is still practiced today despite far better access to information.1

I’ll conclude with another quote from Ben Graham:

“Outright speculation is neither illegal, immoral, nor (for most people) fattening to the pocketbook. More than that, some speculation is necessary and unavoidable, for in many common-stock situations there are substantial possibilities of both profit and loss and the risks therein must be assumed by someone.”

— Benjamin Graham

It is important to note that speculation is not inherently immoral provided that deception and manipulation are not part of the strategy. Unfortunately, there are too many pump-and-dump schemes today and no shortage of naive victims who fail to take advantage of all the information that is available at their fingertips in seconds.

Copyright, Disclosures, and Privacy Information

Nothing in this newsletter constitutes investment advice and all content is subject to the copyright and disclaimer policy of The Rational Walk LLC.

Your privacy is taken very seriously. No email addresses or any other subscriber information is ever sold or provided to third parties. If you choose to unsubscribe at any time, you will no longer receive any further communications of any kind.

The Rational Walk is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Kennedy apparently did not suffer any legal consequences from his manipulation of Libbey-Owens-Ford in 1933. The following year, over the objections of many advisors, President Roosevelt named Kennedy as the first Chairman of the newly created Securities and Exchange Commission where Kennedy would be in charge of overseeing an agency responsible for curbing the excesses that he understood so well.